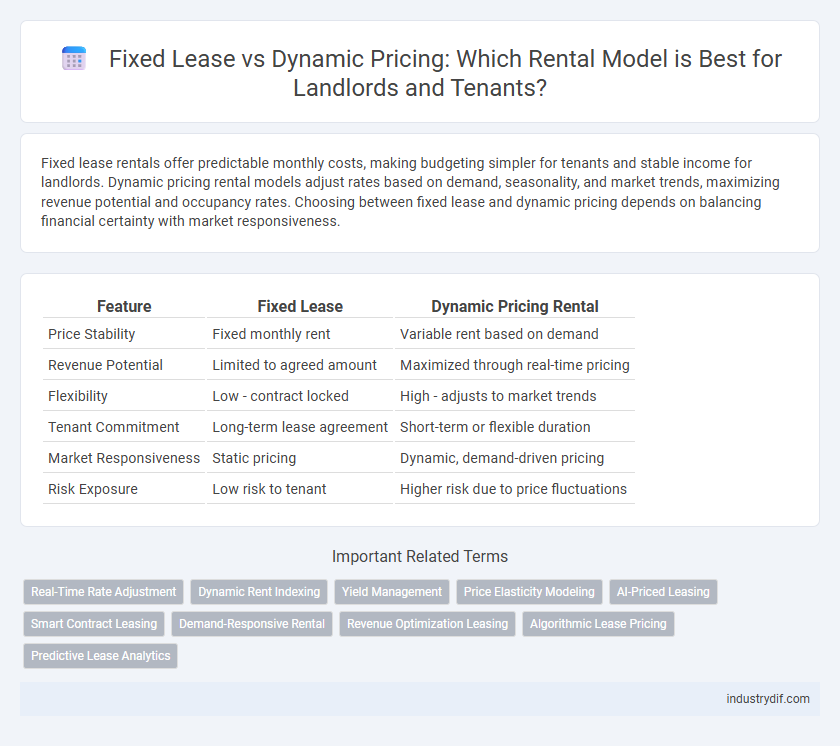

Fixed lease rentals offer predictable monthly costs, making budgeting simpler for tenants and stable income for landlords. Dynamic pricing rental models adjust rates based on demand, seasonality, and market trends, maximizing revenue potential and occupancy rates. Choosing between fixed lease and dynamic pricing depends on balancing financial certainty with market responsiveness.

Table of Comparison

| Feature | Fixed Lease | Dynamic Pricing Rental |

|---|---|---|

| Price Stability | Fixed monthly rent | Variable rent based on demand |

| Revenue Potential | Limited to agreed amount | Maximized through real-time pricing |

| Flexibility | Low - contract locked | High - adjusts to market trends |

| Tenant Commitment | Long-term lease agreement | Short-term or flexible duration |

| Market Responsiveness | Static pricing | Dynamic, demand-driven pricing |

| Risk Exposure | Low risk to tenant | Higher risk due to price fluctuations |

Understanding Fixed Lease in Rental Agreements

Fixed lease rental agreements establish a set rental amount for a defined period, providing tenants with predictable monthly payments and budget stability. This type of lease clearly outlines the rental rate, duration, and terms, minimizing disputes related to price changes during the lease term. Fixed lease agreements are ideal for renters seeking consistency and landlords wanting assured income over the contract period.

What is Dynamic Pricing in Rental Industry?

Dynamic pricing in the rental industry refers to a flexible pricing strategy where rental rates fluctuate based on real-time market demand, seasonality, local events, and occupancy levels. This approach maximizes revenue by adjusting prices dynamically rather than maintaining a fixed lease rate, allowing property owners to optimize earnings during peak times and fill vacancies during slower periods. Advanced algorithms and data analytics are commonly used to implement dynamic pricing, ensuring competitive rates aligned with market trends.

Key Differences Between Fixed Lease and Dynamic Pricing

Fixed lease rental agreements establish a predetermined, consistent rental rate for a specified term, providing predictable monthly expenses and financial stability for tenants. Dynamic pricing rental models adjust rates based on real-time market demand, seasonality, and occupancy trends, allowing landlords to maximize revenue during high-demand periods. The key differences lie in pricing flexibility and predictability, with fixed leases offering stability and dynamic pricing enabling responsive rate optimization.

Pros and Cons of Fixed Lease Rental

Fixed lease rentals provide predictable monthly costs, making budgeting straightforward for tenants and landlords alike. However, this pricing model may lead to missed opportunities for higher revenue during periods of increased demand and lacks flexibility in adjusting rent based on market fluctuations. Fixed leases also offer stability but can limit responsiveness to maintenance cost changes or local economic shifts.

Advantages and Disadvantages of Dynamic Pricing Rental

Dynamic pricing rental optimizes revenue by adjusting rates based on demand, seasonality, and market trends, allowing property owners to maximize profits during peak periods. However, this model can lead to price volatility, potentially deterring long-term tenants who prefer predictable, stable rental costs. Implementing dynamic pricing requires sophisticated data analysis and real-time market monitoring, increasing operational complexity compared to fixed lease agreements.

Impact of Market Trends on Rental Pricing Models

Fixed lease agreements provide predictable rental income by locking in rates for a set period, but they may lag behind current market demand fluctuations. Dynamic pricing rental models adjust rates in real-time based on supply, demand, and local market trends, maximizing revenue during high-demand periods. Market data, such as occupancy rates and competitor pricing, directly influence dynamic pricing, enabling property owners to respond swiftly to economic shifts and seasonal trends.

Which Rental Model Suits Landlords: Fixed Lease or Dynamic Pricing?

Landlords seeking stable, predictable income often prefer fixed lease agreements, securing consistent rental payments regardless of market fluctuations. Dynamic pricing models enable landlords to maximize revenue by adjusting rents based on demand, seasonality, and local events, but introduce variability and require active management. Choosing between fixed lease and dynamic pricing depends on a landlord's risk tolerance, market knowledge, and capacity to monitor and respond to rental market trends.

Tenant Perspective: Fixed Lease vs Dynamic Pricing

Tenants benefit from fixed lease agreements by enjoying predictable monthly rent payments, which simplifies budgeting and financial planning. Dynamic pricing rental models offer flexibility and potential cost savings during low-demand periods but can lead to unexpected rent fluctuations, increasing financial uncertainty. Choosing between fixed lease and dynamic pricing depends on a tenant's preference for stability versus adaptability in rental expenses.

Technology’s Role in Dynamic Pricing Rentals

Dynamic pricing in rental markets leverages advanced algorithms and real-time data analytics to adjust rates based on demand, seasonality, and market trends. Machine learning models optimize pricing strategies by continuously analyzing competitor rates, booking patterns, and customer behavior, enhancing revenue management. Cloud computing and IoT devices facilitate instantaneous updates and personalized offers, making dynamic pricing a technology-driven solution that outperforms traditional fixed lease models.

Future Trends in Rental Pricing Strategies

Fixed lease agreements provide predictable rental income and stability for landlords, while dynamic pricing leverages real-time market data and demand fluctuations to optimize rental rates. Future trends indicate a growing shift towards AI-powered algorithms that enable personalized pricing models, maximizing occupancy and profitability in competitive rental markets. Integration of smart home technology and IoT data will further refine these dynamic strategies by enabling more responsive and flexible lease terms.

Related Important Terms

Real-Time Rate Adjustment

Fixed lease rental agreements maintain a constant rate throughout the contract period, offering predictable costs but limiting the ability to capitalize on market fluctuations. Dynamic pricing rental models utilize real-time rate adjustment algorithms driven by supply, demand, and competitor pricing, maximizing revenue potential and occupancy rates through flexible pricing strategies.

Dynamic Rent Indexing

Dynamic rent indexing allows rental prices to adjust in real-time based on market demand, local vacancy rates, and economic indicators, ensuring landlords maximize revenue while maintaining competitive pricing. Unlike fixed lease agreements, this pricing model leverages data-driven algorithms to optimize rental income and respond rapidly to fluctuations in the housing market.

Yield Management

Fixed lease agreements provide predictable cash flow by setting a consistent rental rate over the lease term, which simplifies budgeting for property owners. Dynamic pricing in rental yield management leverages real-time market data and demand fluctuations to optimize rental income, enabling property managers to maximize occupancy and revenue.

Price Elasticity Modeling

Fixed lease pricing offers predictable revenue streams but often fails to capitalize on demand fluctuations, whereas dynamic pricing leverages price elasticity modeling to adjust rental rates in real-time, maximizing occupancy and profitability. Understanding tenant price sensitivity through elasticity metrics enables landlords to optimize pricing strategies, balancing market competitiveness with revenue optimization.

AI-Priced Leasing

AI-priced leasing leverages machine learning algorithms to analyze market demand, seasonal trends, and competitor rates, enabling dynamic pricing that maximizes rental income and occupancy. Fixed lease pricing offers predictable revenue but often misses revenue opportunities that adaptive AI models capture through real-time adjustment to fluctuations in the rental market.

Smart Contract Leasing

Smart contract leasing automates fixed lease agreements by codifying rental terms on blockchain, ensuring transparent, immutable contracts and timely payments without intermediaries. Dynamic pricing rental leverages real-time data integration within smart contracts to adjust rates based on demand fluctuations, optimizing revenue and occupancy rates efficiently.

Demand-Responsive Rental

Demand-responsive rental leverages dynamic pricing models that adjust rates based on real-time demand fluctuations, maximizing revenue and occupancy for rental properties. Fixed lease agreements offer stable, predictable income but lack the flexibility to capitalize on peak demand periods prevalent in short-term rental markets.

Revenue Optimization Leasing

Fixed lease agreements provide predictable monthly income but may limit revenue potential during high-demand periods, whereas dynamic pricing rental models adjust rates based on real-time market conditions, maximizing revenue optimization by capturing higher returns during peak seasons. Leveraging data analytics and demand forecasting in dynamic pricing enhances leasing strategies, driving greater profitability and occupancy efficiency compared to static fixed leases.

Algorithmic Lease Pricing

Algorithmic lease pricing leverages machine learning models to adjust rental rates dynamically based on real-time market demand, seasonality, and competitor pricing, contrasting with fixed lease agreements that set static prices for the lease term. This approach maximizes revenue potential and occupancy rates by continuously optimizing rental prices using data-driven algorithms.

Predictive Lease Analytics

Predictive lease analytics leverages historical rental data and market trends to optimize fixed lease terms by forecasting demand and pricing fluctuations, ensuring competitive yet stable rental income. In contrast, dynamic pricing rental utilizes real-time data analytics to adjust prices continuously based on occupancy rates, seasonal patterns, and competitor pricing, maximizing revenue through flexibility and responsiveness.

Fixed Lease vs Dynamic Pricing Rental Infographic

industrydif.com

industrydif.com