Fixed rent provides tenants with predictable monthly payments, ensuring consistent cash flow for landlords regardless of business performance. Revenue-sharing models align landlord income with tenant success, fostering partnership but introducing variability in rental earnings. Choosing between these depends on risk tolerance, business stability, and long-term financial goals for both parties.

Table of Comparison

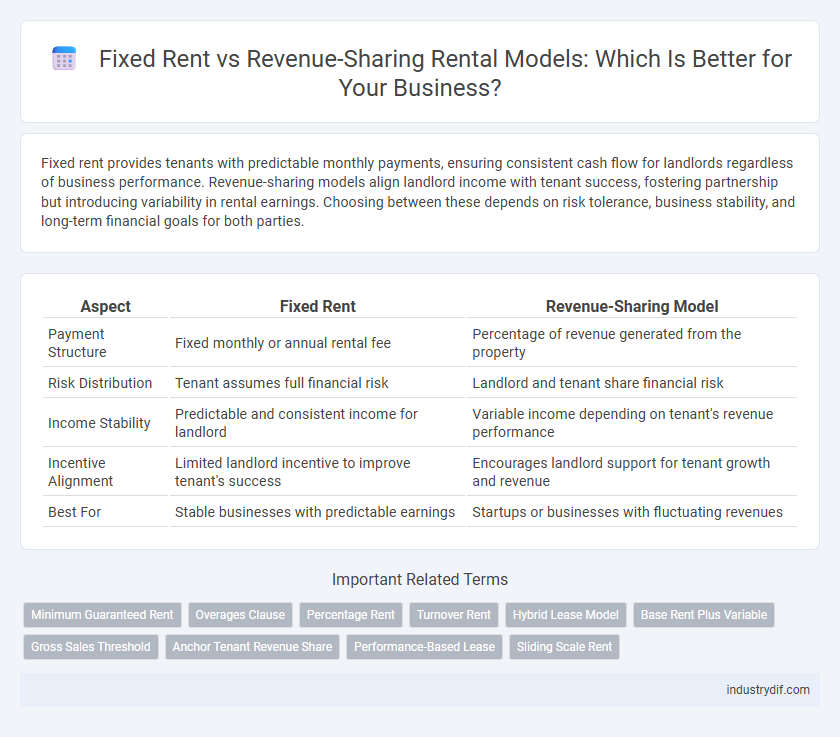

| Aspect | Fixed Rent | Revenue-Sharing Model |

|---|---|---|

| Payment Structure | Fixed monthly or annual rental fee | Percentage of revenue generated from the property |

| Risk Distribution | Tenant assumes full financial risk | Landlord and tenant share financial risk |

| Income Stability | Predictable and consistent income for landlord | Variable income depending on tenant's revenue performance |

| Incentive Alignment | Limited landlord incentive to improve tenant's success | Encourages landlord support for tenant growth and revenue |

| Best For | Stable businesses with predictable earnings | Startups or businesses with fluctuating revenues |

Introduction to Fixed Rent and Revenue-Sharing Models

Fixed rent models involve tenants paying a predetermined, consistent amount regardless of business performance, providing predictability for both landlords and tenants. Revenue-sharing models require tenants to pay rent based on a percentage of their gross or net sales, aligning rent costs with actual business success. These contrasting approaches cater to different business risk tolerances and cash flow structures in rental agreements.

Defining Fixed Rent in Rental Agreements

Fixed rent in rental agreements refers to a predetermined, consistent payment amount that tenants are obligated to pay landlords regardless of the property's performance or income generated. This model provides stability and predictability in cash flow for landlords, eliminating fluctuations tied to tenant revenue. Fixed rent is commonly favored in commercial leases where budgeting certainty and simplified accounting processes are essential.

Understanding Revenue-Sharing Rental Models

Revenue-sharing rental models allocate a percentage of the tenant's revenue to the landlord instead of a fixed rent amount, aligning landlord income with business performance. This model offers flexibility for startups and seasonal businesses by reducing upfront costs and creating a partnership-based incentive structure. Proper contract terms must define revenue calculation methods, reporting frequency, and audit rights to ensure transparency and mitigate disputes.

Key Differences Between Fixed Rent and Revenue-Sharing

Fixed rent requires tenants to pay a predetermined, constant amount regardless of business performance, providing predictable income for landlords but less flexibility for tenants. Revenue-sharing models link rent to a percentage of the tenant's sales, aligning landlord and tenant interests while introducing variable income and potential financial risk. Key differences lie in payment stability, tenant risk exposure, and the correlation between rent and business success.

Advantages of Fixed Rent for Landlords and Tenants

Fixed rent provides landlords with predictable and stable income, simplifying financial planning and reducing the risk of variable cash flow. Tenants benefit from clearly defined rental costs, allowing for straightforward budgeting without the uncertainty of fluctuating payments. This model fosters long-term agreements, promoting security and consistent occupancy for landlords while offering tenants fixed expenses that support financial stability.

Benefits of Revenue-Sharing Models in Rental Agreements

Revenue-sharing models in rental agreements align landlord and tenant incentives by linking rent payments to actual business performance, reducing financial risk during low-revenue periods. This flexible approach often leads to higher tenant retention and improved partnership dynamics, fostering long-term collaboration. Property owners benefit from potential upside during high-revenue months without sacrificing steady baseline income.

Risk Factors in Fixed Rent vs Revenue-Sharing

Fixed rent presents a predictable expense with low financial risk for landlords but transfers revenue variability risk entirely to tenants, potentially causing payment defaults during low-income periods. Revenue-sharing models align landlord and tenant interests by linking payments to actual business performance, mitigating tenant risk but introducing income unpredictability for landlords. Understanding these risk trade-offs is crucial for effective lease structuring and long-term financial stability in commercial rental agreements.

Industry Applications: Choosing the Right Rental Model

Fixed rent models provide predictable costs, ideal for industries with stable revenue streams such as manufacturing and retail, where budgeting accuracy is critical. Revenue-sharing models align payment with business performance, benefiting sectors like entertainment, hospitality, and startups that experience fluctuating income. Selecting the optimal rental model depends on cash flow variability, risk tolerance, and long-term growth projections within the specific industry.

Financial Implications for Property Owners and Operators

Fixed rent offers property owners predictable monthly income, simplifying financial planning and reducing risk from market fluctuations. The revenue-sharing model aligns landlords' earnings with tenant success, potentially generating higher returns during peak business periods but increasing income volatility. Owners must weigh financial stability against growth opportunities when choosing between fixed rent and revenue-sharing agreements.

Future Trends in Rental Payment Structures

Emerging rental payment structures increasingly favor hybrid models combining fixed rent with revenue-sharing elements to align landlord-tenant interests and adapt to fluctuating market conditions. Data from commercial real estate markets indicate a growing preference for flexible agreements, particularly in retail and coworking spaces, enhancing risk-sharing and potential upside for property owners. Advanced analytics and blockchain technology are driving transparency and efficiency in payment tracking, signaling a shift towards more dynamic, data-driven rental contracts.

Related Important Terms

Minimum Guaranteed Rent

Minimum Guaranteed Rent ensures a stable income for landlords by setting a fixed baseline payment regardless of the tenant's actual revenue, contrasting with the Revenue-Sharing Model where rent fluctuates based on business performance. This approach minimizes financial risk for property owners while providing tenants the flexibility to grow without immediate pressure to meet high fixed costs.

Overages Clause

The overages clause in a fixed rent versus revenue-sharing model defines how excess revenue beyond a set threshold is split, protecting landlords from underpayment while allowing tenants to benefit from business growth. This clause ensures transparency and fairness by specifying percentage shares or caps on additional income, balancing risk and reward within rental agreements.

Percentage Rent

Percentage rent in a revenue-sharing model charges tenants a variable rent based on a predetermined percentage of their gross sales, aligning landlord earnings with tenant performance. Fixed rent offers predictable income through a constant monthly payment, while percentage rent provides flexibility and potential upside during high-revenue periods.

Turnover Rent

Turnover rent, a type of revenue-sharing model, adjusts rental payments based on the tenant's sales performance, aligning landlord income with business success and reducing fixed cost burdens for retailers. This contrasts with fixed rent models, where tenants pay a predetermined amount regardless of turnover, often resulting in higher risk for tenants during low sales periods.

Hybrid Lease Model

The hybrid lease model combines fixed rent and revenue-sharing components, allowing landlords to receive a stable base payment while benefiting from tenant business performance, optimizing income potential. This approach balances risk and reward by aligning landlord and tenant interests, enhancing flexibility and fostering long-term leasing partnerships.

Base Rent Plus Variable

The Base Rent Plus Variable model combines a fixed base rent with a percentage of revenue, aligning landlord income with tenant performance and reducing risk. This hybrid approach incentivizes growth while ensuring minimum guaranteed income, making it favorable for commercial leases in fluctuating markets.

Gross Sales Threshold

Fixed rent offers predictable monthly payments regardless of business performance, while revenue-sharing models adjust rent based on a predetermined gross sales threshold, ensuring flexibility for tenants during varying sales periods. Setting an optimal gross sales threshold balances landlord income stability with tenant cash flow variability, incentivizing both parties toward mutual financial success.

Anchor Tenant Revenue Share

Anchor tenant revenue share in a rental agreement aligns landlord income with the tenant's business performance, typically involving a base fixed rent plus a percentage of the tenant's gross revenue. This model mitigates risk by providing landlords with potentially higher returns during peak sales periods while offering tenants lower fixed costs compared to traditional fixed rent agreements.

Performance-Based Lease

Performance-based lease models align tenant and landlord interests by linking rent payments to business revenue, reducing fixed-cost risks for tenants while incentivizing landlords to support tenant success. Unlike traditional fixed rent agreements, revenue-sharing leases adjust monthly payments based on a percentage of sales, promoting partnership and adaptability in commercial rental arrangements.

Sliding Scale Rent

Sliding scale rent in rental agreements adjusts rent payments based on tenant revenue, combining benefits of fixed rent stability and revenue-sharing flexibility. This model aligns landlord income with business performance, reducing risk for tenants while potentially increasing returns during high-revenue periods.

Fixed Rent vs Revenue-Sharing Model Infographic

industrydif.com

industrydif.com