Traditional security deposits require tenants to pay a significant upfront sum that landlords hold as collateral against damages or unpaid rent, often tying up essential funds. Deposit-free renting eliminates this upfront cost by using insurance or guarantee services, allowing tenants to move in with more flexible financial options while landlords receive protection. This modern approach enhances affordability and accessibility in the rental market without compromising rental security.

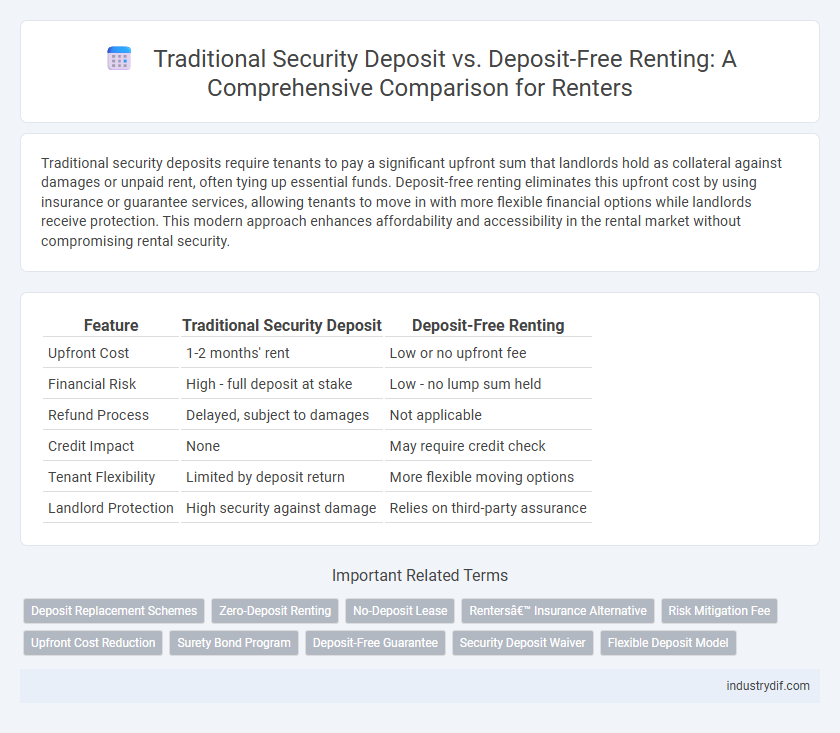

Table of Comparison

| Feature | Traditional Security Deposit | Deposit-Free Renting |

|---|---|---|

| Upfront Cost | 1-2 months' rent | Low or no upfront fee |

| Financial Risk | High - full deposit at stake | Low - no lump sum held |

| Refund Process | Delayed, subject to damages | Not applicable |

| Credit Impact | None | May require credit check |

| Tenant Flexibility | Limited by deposit return | More flexible moving options |

| Landlord Protection | High security against damage | Relies on third-party assurance |

Understanding Traditional Security Deposits

Traditional security deposits typically amount to one to two months' rent and are held by landlords as financial protection against tenant damages or unpaid rent. These deposits are refundable after the lease ends, minus any deductions for repairs or cleaning fees, but tenants often experience delays or disputes during the return process. Understanding the rules governing security deposits, including maximum allowable amounts and legal timelines for return, is essential for renters navigating traditional leasing agreements.

What is Deposit-Free Renting?

Deposit-free renting eliminates the need for upfront cash security deposits by using third-party insurance or payment plans to protect landlords against potential damages or unpaid rent. This innovative approach increases affordability and accessibility for tenants by reducing initial move-in costs while maintaining financial security for property owners. Deposit-free options often require a small non-refundable fee, offering a flexible alternative to traditional security deposits in the rental market.

Key Differences: Traditional vs Deposit-Free Models

Traditional security deposits require tenants to pay a substantial upfront sum, often equivalent to one or two months' rent, which landlords hold as collateral against damages or unpaid rent. Deposit-free renting replaces this lump sum with insurance or guarantee products, allowing tenants to avoid tying up large amounts of cash while providing landlords with financial protection. The deposit-free model enhances tenant affordability and flexibility, reducing move-in costs and streamlining the rental process.

Pros and Cons of Traditional Security Deposits

Traditional security deposits provide landlords with a financial safety net to cover damages or unpaid rent, typically amounting to one to two months' rent, which can reassure property owners. However, high upfront costs can pose a significant barrier for tenants, making rental properties less accessible and potentially delaying move-in dates. While refundable, these deposits often generate disputes over deductions and may take weeks to return, limiting tenants' liquidity and causing frustration.

Advantages and Drawbacks of Deposit-Free Renting

Deposit-free renting eliminates the upfront financial burden of traditional security deposits, making it more accessible for tenants with limited savings. This option often involves paying a non-refundable fee or subscribing to an insurance policy, which can be more cost-effective for short-term leases but might result in higher overall long-term expenses. However, deposit-free renting may offer less financial protection for landlords, potentially leading to increased disputes over property damages or unpaid rent.

Cost Comparison: Security Deposits vs Deposit-Free Options

Traditional security deposits typically require tenants to pay an upfront sum equal to one or more months' rent, which can strain initial moving budgets. Deposit-free renting options offer a cost-effective alternative by replacing lump-sum deposits with smaller, manageable fees or insurance policies, freeing up cash flow. Comparing overall expenses, deposit-free solutions often result in lower immediate financial burdens and greater liquidity for renters.

Impact on Renters: Flexibility and Financial Burden

Traditional security deposits require renters to pay a large upfront sum, creating a significant financial burden and limiting flexibility in moving or budgeting. Deposit-free renting eliminates this upfront cost, enabling renters to allocate funds toward other expenses and make housing changes more easily. This shift enhances financial freedom and reduces barriers to entry for individuals seeking rental accommodations.

Landlord Perspectives: Risk Management and Protection

Landlords managing traditional security deposits benefit from a direct financial safeguard against tenant damages or unpaid rent, providing immediate access to funds for repairs or losses. Deposit-free renting solutions often rely on third-party insurance or guarantees, shifting risk management away from landlords while potentially reducing upfront costs for tenants. Evaluating these options requires landlords to balance risk exposure with tenant accessibility, ensuring adequate protection without deterring prospective renters.

Legal Considerations in Security Deposits and Deposit-Free Renting

Legal considerations in security deposits require landlords to comply with state-specific regulations regarding maximum deposit amounts, mandatory interest payments, and timelines for return after tenancy ends. Deposit-free renting solutions often involve third-party insurance policies or bonds that shift financial risk without holding tenant funds, necessitating clear contractual agreements to define responsibilities and remedies. Both traditional and deposit-free models must ensure transparent disclosure to protect tenant rights and avoid disputes over damages or unpaid rent.

Choosing the Right Solution: Factors for Renters and Landlords

Traditional security deposits provide landlords with upfront financial protection against damages or unpaid rent but can pose a financial burden for renters due to large initial payments. Deposit-free renting offers an alternative by eliminating hefty deposits, increasing affordability and accessibility for tenants, while landlords receive protection through insurance-backed guarantees or third-party services. Renters should assess their financial flexibility and risk tolerance, while landlords must weigh security needs against market competitiveness to select the optimal solution.

Related Important Terms

Deposit Replacement Schemes

Deposit replacement schemes offer a cost-effective alternative to traditional security deposits by allowing tenants to pay a small non-refundable fee instead of locking away a large sum of money, improving affordability and cash flow. These schemes provide landlords with insurance coverage against damages or unpaid rent, maintaining financial protection while enhancing tenant accessibility and reducing upfront moving costs.

Zero-Deposit Renting

Zero-deposit renting eliminates the upfront financial burden by replacing traditional security deposits with affordable insurance or guarantee products, streamlining the rental process for tenants. This model enhances affordability and accessibility, reducing move-in costs while ensuring landlords remain protected against damages or unpaid rent.

No-Deposit Lease

No-deposit leases offer renters the advantage of moving in without upfront security deposit payments, reducing initial financial barriers. This alternative rental model often increases accessibility and flexibility while landlords mitigate risk through insurance policies or credit checks.

Renters’ Insurance Alternative

Traditional security deposits often require upfront cash that can strain renters' finances, while deposit-free renting options typically incorporate renters' insurance as a cost-effective alternative, providing financial protection against damages or unpaid rent. Renters' insurance coverage usually includes liability and personal property protection, offering greater flexibility and security without the burden of a large initial deposit.

Risk Mitigation Fee

Traditional security deposits typically require tenants to pay a substantial upfront sum, often equivalent to one or two months' rent, acting as a financial safeguard for landlords against potential damages or unpaid rent. Deposit-free renting introduces a risk mitigation fee, usually a smaller non-refundable payment, which reduces tenants' initial costs while providing landlords with some coverage for potential losses without holding large sums of tenant money.

Upfront Cost Reduction

Traditional security deposits often require tenants to pay an upfront sum equal to one or two months' rent, creating a significant financial barrier. Deposit-free renting eliminates this initial cost by replacing the deposit with a small, non-refundable fee or insurance, resulting in immediate upfront cost reduction for tenants.

Surety Bond Program

Traditional security deposits typically require tenants to pay upfront sums equal to one or more months' rent, which landlords hold as collateral against damages or unpaid rent. Deposit-free renting through surety bond programs allows tenants to secure rental agreements by paying a non-refundable fee that guarantees the landlord compensation up to a predetermined amount, reducing the initial financial burden while maintaining landlord protection.

Deposit-Free Guarantee

Deposit-free renting offers a Deposit-Free Guarantee that eliminates upfront cash requirements, enhancing affordability and accessibility for tenants by replacing traditional security deposits with a simple, low-cost insurance model. This innovative approach reduces financial barriers, speeds up rental agreements, and protects landlords against damages or unpaid rent through third-party coverage.

Security Deposit Waiver

Security deposit waivers eliminate the upfront cost of traditional security deposits by providing tenants with a low-cost insurance alternative that covers potential damages and unpaid rent. This deposit-free renting option increases affordability and accessibility for renters while ensuring landlords receive financial protection without holding large sums of money.

Flexible Deposit Model

The Flexible Deposit Model in rental agreements allows tenants to pay a reduced or segmented security deposit, improving affordability and cash flow compared to traditional lump-sum deposits. This approach enhances tenant flexibility while providing landlords with more consistent financial protection, promoting a balanced rental market.

Traditional Security Deposit vs Deposit-free Renting Infographic

industrydif.com

industrydif.com