Rent collection through traditional methods often involves time-consuming processes, manual tracking, and delayed payments, leading to inefficiencies for landlords and tenants. Digital wallet rent solutions streamline transactions by enabling instant, secure payments directly from tenants' smartphones, reducing the risk of late fees and enhancing financial transparency. This technological shift in rent collection improves cash flow consistency and simplifies record-keeping for property managers.

Table of Comparison

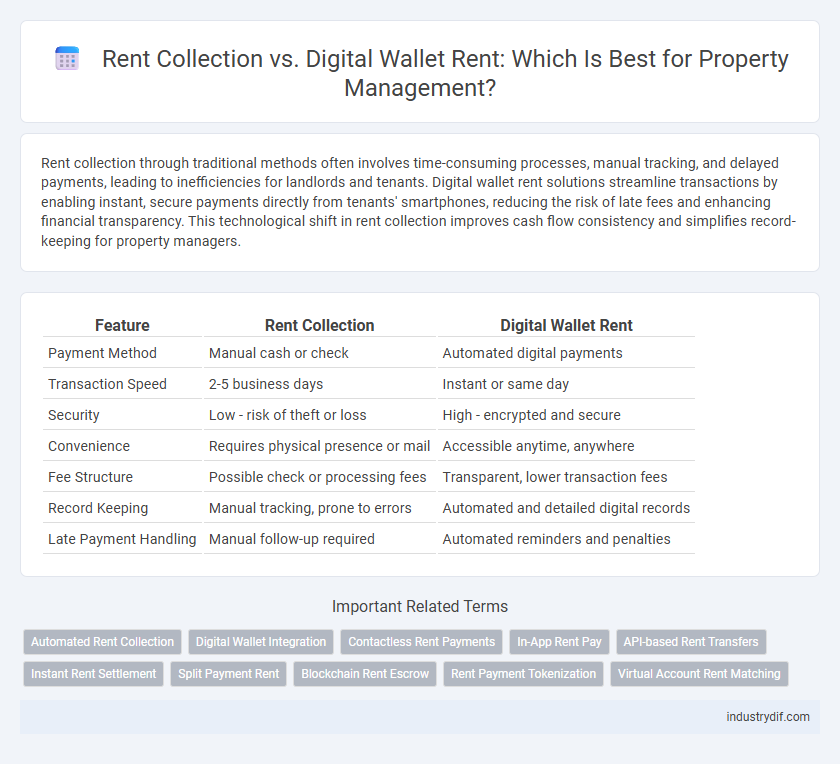

| Feature | Rent Collection | Digital Wallet Rent |

|---|---|---|

| Payment Method | Manual cash or check | Automated digital payments |

| Transaction Speed | 2-5 business days | Instant or same day |

| Security | Low - risk of theft or loss | High - encrypted and secure |

| Convenience | Requires physical presence or mail | Accessible anytime, anywhere |

| Fee Structure | Possible check or processing fees | Transparent, lower transaction fees |

| Record Keeping | Manual tracking, prone to errors | Automated and detailed digital records |

| Late Payment Handling | Manual follow-up required | Automated reminders and penalties |

Understanding Traditional Rent Collection Methods

Traditional rent collection methods primarily involve cash payments, checks, and money orders exchanged in person or mailed to landlords. These approaches often lead to delayed payments, increased administrative workload, and security risks such as lost or stolen payments. Understanding these limitations highlights the need for more efficient alternatives like digital wallet rent systems that streamline transactions and improve accountability.

What Is a Digital Wallet for Rent Payments?

A digital wallet for rent payments is an online platform that securely stores tenants' payment information, enabling quick and convenient rent transactions directly from their smartphone or computer. Unlike traditional rent collection methods involving checks or cash, digital wallets streamline rent processing through encrypted, contactless payments, reducing late fees and administrative overhead. This technology integrates with property management software to automate reminders, receipts, and transaction tracking, enhancing transparency for both landlords and tenants.

Key Differences: Rent Collection vs Digital Wallet Rent

Rent collection traditionally involves landlords manually collecting payments through checks, cash, or bank transfers, which can be time-consuming and prone to delays. Digital wallet rent leverages mobile payment platforms like Apple Pay, Google Wallet, or PayPal, enabling tenants to pay rent instantly and securely from their smartphones. This shift enhances payment tracking, reduces administrative overhead, and improves cash flow management for property owners.

Efficiency and Speed of Payment Processing

Rent collection through traditional methods often involves manual processes that can delay payment verification and fund availability. Digital wallet rent payments streamline transaction speed by enabling instant fund transfers and real-time tracking, significantly enhancing efficiency for landlords and tenants. The integration of automated notifications and secure digital ledgers further reduces administrative burdens and accelerates cash flow management.

Security Features: Manual vs Digital Rent Transactions

Manual rent collection typically involves physical cash handling, increasing the risk of theft, loss, and human error, with limited tracking and audit capabilities. Digital wallet rent transactions use encrypted payment systems, biometric authentication, and two-factor verification to enhance security and provide transparent transaction records. The shift to digital rent payments reduces fraud risks and ensures faster, more secure fund transfers compared to traditional manual methods.

Tenant Experience: Convenience and Accessibility

Rent collection through traditional methods often involves delays and inconvenience due to manual payments and limited hours of operation. Digital wallet rent payments offer tenants seamless, 24/7 accessibility with instant transaction confirmation, enhancing convenience and user satisfaction. Integration with mobile apps further simplifies rent management, enabling tenants to automate payments and track history effortlessly.

Cost Comparison: Traditional vs Digital Rent Collection

Traditional rent collection methods often involve higher costs due to processing fees, physical paperwork, and manual labor expenses. Digital wallet rent payment solutions reduce these costs by minimizing transaction fees, eliminating paper usage, and automating rent processing workflows. Landlords and property managers benefit from the cost efficiency and faster payment cycles offered by digital wallet systems compared to conventional rent collection.

Record Keeping and Financial Tracking

Rent collection through traditional methods often involves manual record keeping, which can lead to errors and delays in financial tracking. Digital wallet rent payments automate transaction recording, providing real-time updates and accurate financial data accessible for both landlords and tenants. Enhanced transparency and efficiency in digital wallets streamline rent management and simplify expense reconciliation processes.

Challenges in Adopting Digital Wallet Rent Payments

Challenges in adopting digital wallet rent payments include issues with security risks, limited tenant access to compatible technology, and a lack of universal acceptance among landlords. Many tenants face difficulties related to digital literacy and the need for reliable internet access, hindering widespread use. Furthermore, integration with existing property management systems remains complex, creating barriers to seamless rent collection through digital wallets.

Future Trends in Rent Collection Technologies

Future trends in rent collection technologies emphasize seamless integration of digital wallets, enabling instant and secure transactions between tenants and landlords. Enhanced automation powered by AI streamlines payment tracking and reminders, reducing late payments and administrative burdens. Blockchain-based platforms promise transparent, tamper-proof records, revolutionizing trust and efficiency in rent management systems.

Related Important Terms

Automated Rent Collection

Automated rent collection systems streamline the payment process by securely processing transactions through digital wallets, reducing late payments and administrative errors. Integrating digital wallet rent payments enhances tenant convenience and improves cash flow management for property managers.

Digital Wallet Integration

Digital wallet integration simplifies rent collection by enabling tenants to make secure, instant payments directly through mobile apps or online platforms, reducing delays and administrative overhead. This technology enhances transparency and financial tracking for property managers by automatically recording transactions and facilitating seamless reconciliation.

Contactless Rent Payments

Contactless rent payments through digital wallets streamline rent collection by enabling secure, instantaneous transactions without physical cash or checks. This method reduces payment delays and enhances convenience for both landlords and tenants, promoting efficient rent management.

In-App Rent Pay

In-app rent pay streamlines rent collection by enabling tenants to securely pay rent directly within the rental platform, reducing delays and manual processing errors. Digital wallet rent options enhance convenience by offering instant transactions and integrated payment tracking, improving landlord-tenant financial interactions and record-keeping efficiency.

API-based Rent Transfers

API-based rent transfers streamline rent collection by enabling seamless integration between property management platforms and digital wallets, reducing manual processing errors and accelerating transaction times. This method enhances financial transparency and convenience for both landlords and tenants by automating payment tracking and enabling instant fund availability.

Instant Rent Settlement

Instant rent settlement through digital wallets accelerates the rent collection process by enabling real-time transactions and reducing delays caused by traditional payment methods. This technology enhances cash flow for landlords and provides tenants with a convenient, secure platform for prompt rent payments.

Split Payment Rent

Split payment rent enables tenants to divide their monthly rent across multiple sources, providing flexibility beyond traditional rent collection methods. Digital wallet rent platforms streamline these transactions by securely managing partial payments, reducing late fees, and enhancing transparency for both landlords and tenants.

Blockchain Rent Escrow

Blockchain rent escrow enhances rent collection security by automating payment verification and holding funds until lease conditions are met, reducing fraud and disputes. Digital wallet rent transactions integrated with blockchain enable transparent, immutable records and faster processing compared to traditional rent collection methods.

Rent Payment Tokenization

Rent collection through digital wallet integration leverages rent payment tokenization to enhance security and streamline transactions by converting traditional payment data into encrypted tokens. This tokenization minimizes fraud risks, facilitates faster processing, and ensures tenant payment data privacy within rental platforms.

Virtual Account Rent Matching

Virtual account rent matching enhances rent collection by automating payment reconciliation, reducing errors, and accelerating cash flow management in rental businesses. Integrating digital wallet rent payments with virtual accounts streamlines transaction tracking and ensures accurate tenant balance updates.

Rent Collection vs Digital Wallet Rent Infographic

industrydif.com

industrydif.com