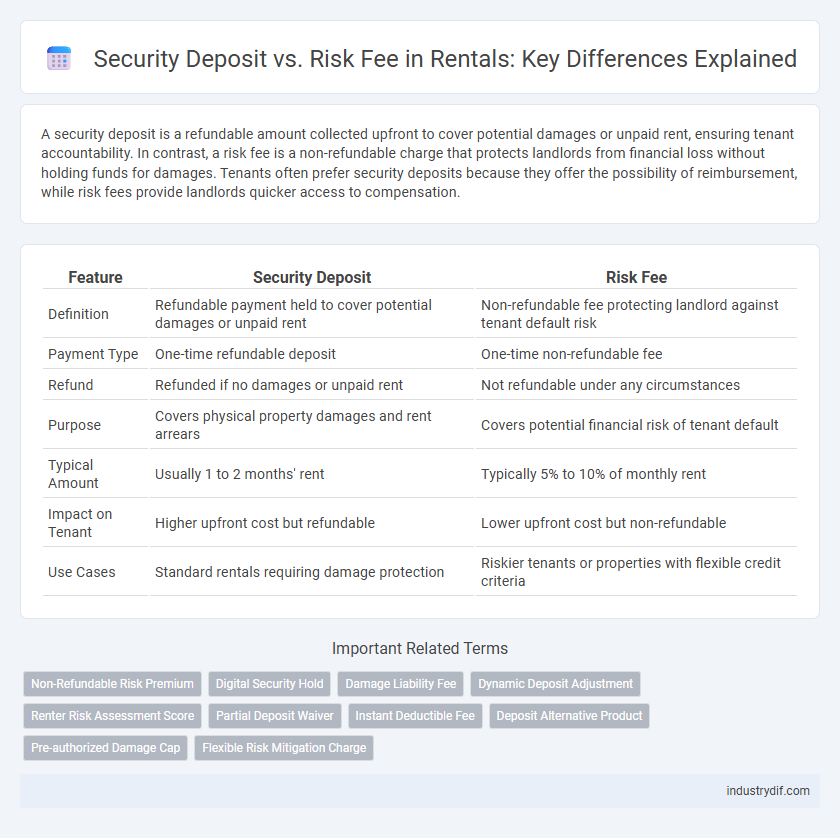

A security deposit is a refundable amount collected upfront to cover potential damages or unpaid rent, ensuring tenant accountability. In contrast, a risk fee is a non-refundable charge that protects landlords from financial loss without holding funds for damages. Tenants often prefer security deposits because they offer the possibility of reimbursement, while risk fees provide landlords quicker access to compensation.

Table of Comparison

| Feature | Security Deposit | Risk Fee |

|---|---|---|

| Definition | Refundable payment held to cover potential damages or unpaid rent | Non-refundable fee protecting landlord against tenant default risk |

| Payment Type | One-time refundable deposit | One-time non-refundable fee |

| Refund | Refunded if no damages or unpaid rent | Not refundable under any circumstances |

| Purpose | Covers physical property damages and rent arrears | Covers potential financial risk of tenant default |

| Typical Amount | Usually 1 to 2 months' rent | Typically 5% to 10% of monthly rent |

| Impact on Tenant | Higher upfront cost but refundable | Lower upfront cost but non-refundable |

| Use Cases | Standard rentals requiring damage protection | Riskier tenants or properties with flexible credit criteria |

Understanding Security Deposits in the Rental Industry

Security deposits serve as a financial safeguard for landlords, typically amounting to one or two months' rent, held to cover potential damages or unpaid rent during the lease term. Risk fees, in contrast, are non-refundable charges designed to mitigate the landlord's exposure to tenant default or property damage without the return potential of a deposit. Understanding the distinction between security deposits and risk fees helps tenants and landlords navigate rental agreements effectively, ensuring clarity on financial responsibilities and protections.

What is a Risk Fee?

A risk fee is a non-refundable charge paid by tenants that acts as an alternative to a traditional security deposit, providing landlords with financial protection against potential damages or missed rent. Unlike a security deposit, which is refundable if no damages occur, a risk fee covers landlords upfront for tenants deemed higher risk due to credit history or rental background. This fee helps renters with limited funds secure housing without the burden of a large deposit, while landlords mitigate financial exposure efficiently.

Key Differences Between Security Deposit and Risk Fee

A security deposit is a refundable amount paid upfront to cover potential damages or unpaid rent, while a risk fee is a non-refundable charge that mitigates the landlord's financial exposure without reimbursement. Security deposits are typically regulated by state laws setting maximum amounts and return timelines, whereas risk fees are less commonly regulated and serve as an additional upfront buffer. Understanding these distinctions helps tenants and landlords navigate financial responsibilities and legal protections during rental agreements.

Legal Implications: Security Deposit vs Risk Fee

Security deposits are regulated by state laws, requiring landlords to hold funds in separate accounts and provide itemized deductions, ensuring tenant protection and legal recourse for improper withholding. Risk fees, often categorized as non-refundable charges, lack the same legal protections and transparency, potentially exposing tenants to financial loss without statutory guidelines. Understanding these legal distinctions is crucial for both landlords and tenants to avoid disputes and ensure compliance with rental regulations.

Refundability: Comparing Security Deposits and Risk Fees

Security deposits are refundable funds held to cover potential damages or unpaid rent, returned to tenants after lease termination if no issues arise. Risk fees are typically non-refundable charges paid upfront to reduce landlord liability, offering protection without reimbursement regardless of property condition. Understanding the refundability difference helps tenants weigh upfront costs against potential financial recovery.

Impact on Tenants: Financial Considerations

Security deposits require tenants to provide a lump sum upfront, often equivalent to one or two months' rent, which is refundable upon lease termination if no damages occur. Risk fees, however, are non-refundable payments that reduce immediate financial burdens but increase overall renting costs since tenants don't recover this amount. Tenants must weigh the impact on cash flow and long-term expenses when choosing between security deposits and risk fees for rental agreements.

How Landlords Benefit from Security Deposits and Risk Fees

Security deposits provide landlords with a financial guarantee to cover damages or unpaid rent, reducing the risk of loss and ensuring property maintenance. Risk fees offer landlords non-refundable payments that mitigate potential tenant risks while increasing immediate cash flow. Both methods enhance landlord protection but differ in refundability and long-term security measures.

Common Misconceptions About Security Deposits and Risk Fees

Security deposits and risk fees are often confused but serve distinct purposes in rental agreements; security deposits are refundable funds held to cover potential damage or unpaid rent, while risk fees are non-refundable payments that protect landlords against tenant default. Many renters mistakenly believe risk fees can be reclaimed like deposits, leading to disputes during lease termination. Understanding these differences helps tenants make informed decisions and avoid unforeseen financial losses in rental agreements.

Industry Trends: Shift from Security Deposit to Risk Fee

The rental industry is increasingly shifting from traditional security deposits to risk fees as a standard practice, aiming to reduce upfront costs for tenants while mitigating landlords' financial exposure. Recent data shows that risk fees, typically non-refundable, provide landlords with quicker access to funds for potential damages and unpaid rent, reflecting evolving preferences toward flexibility and financial efficiency. This trend aligns with broader moves in property management to streamline tenant onboarding and minimize barriers to rental access.

Choosing the Right Option: Security Deposit or Risk Fee

Choosing between a security deposit and a risk fee depends on your financial flexibility and credit profile; a security deposit typically requires upfront payment equal to one or more months' rent and offers full or partial refund upon lease completion if no damages occur. Risk fees are non-refundable charges that reduce the upfront cash needed and often appeal to renters with limited savings or lower credit scores, but they increase overall rental costs. Evaluate landlord policies, state regulations, and your budget to decide whether the refundable security deposit or the non-refundable risk fee provides better financial protection and affordability for your rental agreement.

Related Important Terms

Non-Refundable Risk Premium

Non-refundable risk fees differ from security deposits by serving as upfront payments that protect landlords against potential tenant-related losses without the obligation of return, even if no damages occur. This risk premium provides landlords enhanced financial security compared to traditional refundable deposits, facilitating better risk management in rental agreements.

Digital Security Hold

Digital security hold offers a flexible alternative to traditional security deposits by temporarily freezing funds on a renter's credit or debit card, reducing upfront cash requirements and enhancing liquidity. Unlike risk fees that are non-refundable charges, digital security holds ensure funds remain accessible yet secure, minimizing financial risk for landlords while providing renters a seamless, technology-driven reservation of obligations.

Damage Liability Fee

Damage Liability Fee functions as a non-refundable charge that covers potential property damages without requiring a large upfront security deposit, shifting financial risk management to the renter. Unlike a traditional security deposit held to cover repairs, this fee streamlines the rental process by providing landlords immediate protection against damages while limiting tenant financial exposure.

Dynamic Deposit Adjustment

Dynamic deposit adjustment allows landlords to tailor security deposits or risk fees based on tenant history and market trends, reducing financial barriers while managing potential risks effectively. This flexible approach optimizes rental income protection by aligning fees with real-time risk assessments and tenant reliability data.

Renter Risk Assessment Score

Security Deposit and Risk Fee differ primarily in their approach to mitigating financial risk based on a Renter Risk Assessment Score; a higher score may reduce or eliminate traditional deposits by substituting with a non-refundable Risk Fee tailored to the renter's creditworthiness and rental history. This score-driven model enables landlords to customize financial requirements, balancing tenant affordability with protection against potential defaults or damages.

Partial Deposit Waiver

Partial deposit waiver options reduce upfront costs for renters by minimizing the security deposit required, while risk fees serve as a non-refundable alternative that covers potential damages and tenant defaults. This balance allows landlords to mitigate financial risks without demanding full deposits at signing, enhancing tenant affordability and flexibility.

Instant Deductible Fee

Security deposits traditionally secure landlords against tenant damages but require full upfront payment and return processes, whereas risk fees, including instant deductible fees, offer flexible, non-refundable insurance covering minor damages without large upfront costs. Instant deductible fees streamline claims by allowing immediate fee deduction from tenants' payments, minimizing disputes and accelerating damage compensation.

Deposit Alternative Product

Security deposit alternatives, such as risk fees, provide landlords with upfront non-refundable payments reducing financial exposure without traditional held deposits, often appealing to tenants lacking substantial savings. These deposit alternative products enhance tenant accessibility while maintaining property protection, leveraging market solutions like insurance-based guarantees or one-time risk fees tailored to mitigate potential damages or defaults.

Pre-authorized Damage Cap

A Pre-authorized Damage Cap in rental agreements limits the maximum amount a landlord can hold from a security deposit or risk fee for potential damages, offering tenants financial protection while ensuring landlords cover repair costs. This cap streamlines dispute resolution and clarifies liability boundaries, minimizing conflicts over damage claims during tenancy.

Flexible Risk Mitigation Charge

Flexible Risk Mitigation Charge offers renters an alternative to traditional security deposits by spreading the financial risk over manageable payments, enhancing cash flow and reducing upfront costs. This charge adapts to various tenant profiles while providing landlords with consistent risk coverage, improving rental accessibility and operational efficiency.

Security Deposit vs Risk Fee Infographic

industrydif.com

industrydif.com