Traditional leasing requires tenants to commit to fixed-term contracts with limited flexibility, often involving stringent credit checks and a security deposit. Rent-to-own agreements allow renters to apply a portion of their monthly payments toward eventual homeownership, providing a pathway to build equity while living in the property. This model combines the benefits of renting with the potential for long-term investment and ownership.

Table of Comparison

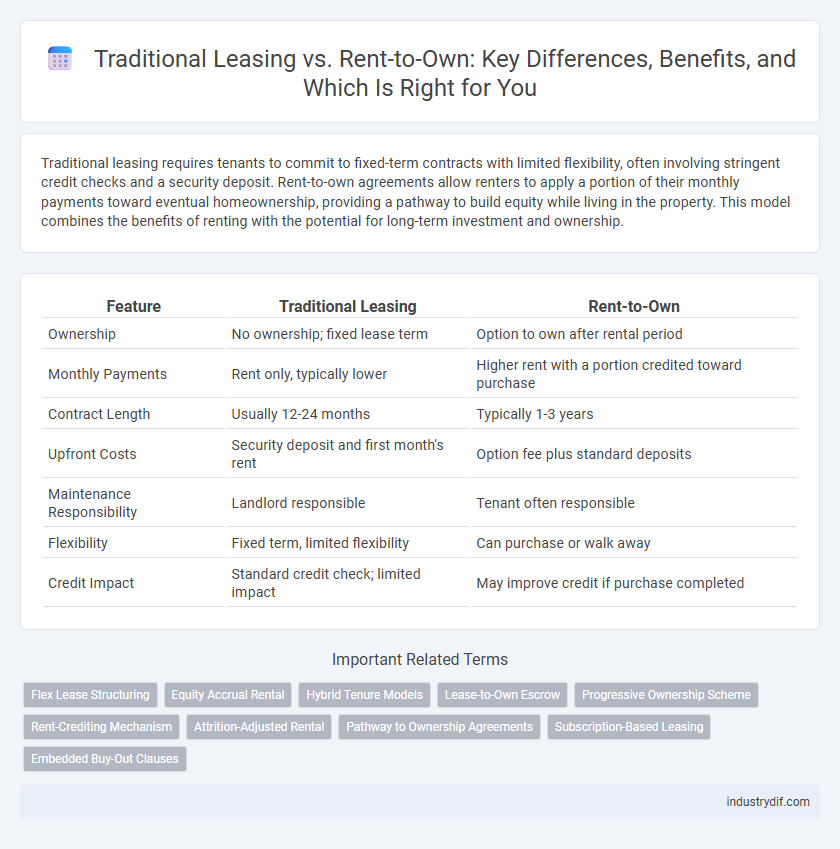

| Feature | Traditional Leasing | Rent-to-Own |

|---|---|---|

| Ownership | No ownership; fixed lease term | Option to own after rental period |

| Monthly Payments | Rent only, typically lower | Higher rent with a portion credited toward purchase |

| Contract Length | Usually 12-24 months | Typically 1-3 years |

| Upfront Costs | Security deposit and first month's rent | Option fee plus standard deposits |

| Maintenance Responsibility | Landlord responsible | Tenant often responsible |

| Flexibility | Fixed term, limited flexibility | Can purchase or walk away |

| Credit Impact | Standard credit check; limited impact | May improve credit if purchase completed |

Understanding Traditional Leasing in the Rental Industry

Traditional leasing in the rental industry involves a fixed-term agreement between the landlord and tenant, typically ranging from six months to a year, where the tenant pays a set monthly rent without gaining ownership rights. This model emphasizes predictable rent payments and clear contractual obligations but does not build equity for the tenant. Traditional leases often require upfront deposits and credit checks, reflecting standard property management practices in residential and commercial rentals.

What Is Rent-to-Own?

Rent-to-own is a rental agreement allowing tenants to lease a property with the option to purchase it later, often applying a portion of rent payments toward the down payment. This model provides flexibility for renters who may not have immediate funds for a full purchase or need time to improve credit. Unlike traditional leasing, rent-to-own combines rental use with the potential for homeownership, blending short-term occupancy with long-term investment.

Key Differences Between Traditional Leasing and Rent-to-Own

Traditional leasing involves fixed-term contracts with monthly payments granting temporary property use without ownership rights, while rent-to-own agreements combine rental payments with an option to purchase the property later, often applying a portion of rent towards the purchase. Lease terms in traditional leasing are typically shorter and less flexible compared to rent-to-own contracts, which offer tenants the opportunity to build equity over time. Rent-to-own can be beneficial for renters with limited credit, providing a pathway to homeownership, whereas traditional leasing suits those seeking short-term housing without ownership obligations.

Benefits of Traditional Leasing for Renters

Traditional leasing offers renters predictable monthly payments and clear contract terms, ensuring financial stability and straightforward budgeting. Renters benefit from fewer upfront costs compared to purchase options, with maintenance and repairs typically handled by landlords. This leasing model provides flexibility for those seeking short- to medium-term housing without the commitment of ownership.

Advantages of Rent-to-Own Agreements

Rent-to-own agreements offer flexible payment options that allow tenants to apply a portion of their rent toward home ownership, making it easier for individuals with limited credit to eventually buy property. These contracts provide an opportunity to build equity while living in the home, reducing the need for a large down payment upfront. Rent-to-own arrangements also enable tenants to lock in a purchase price, potentially benefiting from property appreciation over the rental period.

Financial Comparison: Cost Implications

Traditional leasing typically involves lower monthly payments but requires a substantial upfront deposit and offers no equity buildup. Rent-to-own agreements often come with higher monthly costs that include a portion applied toward eventual ownership, potentially offsetting long-term expenses. Evaluating total financial impact requires analyzing initial fees, monthly payments, and the value of accumulated equity over the lease period.

Flexibility and Commitment in Both Models

Traditional leasing often requires fixed-term contracts with limited flexibility, typically spanning one year and enforcing strict penalties for early termination. Rent-to-own agreements provide greater flexibility by allowing tenants to apply a portion of their rent toward ownership, which can reduce long-term commitment while offering a path to property acquisition. The balance between upfront flexibility and eventual ownership distinguishes rent-to-own from traditional leases, appealing to renters seeking gradual investment without immediate purchase obligations.

Risk Factors in Leasing vs. Rent-to-Own

Traditional leasing involves fixed monthly payments with limited flexibility, exposing tenants to the risk of financial loss if the property's value declines or if early termination fees apply. Rent-to-own agreements transfer some risk to tenants by allowing a portion of rent to build equity, but they face higher overall costs and the risk of forfeiting payments if they fail to purchase. Understanding specific contract terms and market conditions is crucial to mitigate financial risks in both leasing and rent-to-own models.

Suitability: Which Model Is Right for You?

Traditional leasing suits tenants seeking short-term commitment with predictable monthly payments and minimal responsibilities for property maintenance. Rent-to-own appeals to individuals aiming for homeownership but lacking immediate funds for a down payment, offering the chance to build equity over time while renting. Selecting the right model depends on financial readiness, long-term plans, and preference for flexibility versus eventual ownership.

Future Trends in Rental Agreements and Leasing Options

Future trends in rental agreements emphasize increased flexibility, with rent-to-own options gaining traction as they offer a pathway to ownership while maintaining affordable monthly payments. Traditional leasing remains popular for its straightforward terms and short commitment periods, but evolving consumer preferences drive demand for customizable contracts and integrated digital platforms. Advancements in AI and blockchain technologies are streamlining lease management and enhancing transparency, shaping the next generation of rental and leasing solutions.

Related Important Terms

Flex Lease Structuring

Traditional leasing offers fixed-term agreements with set monthly payments and limited flexibility, while rent-to-own plans provide adaptable lease structuring allowing tenants to apply a portion of rent towards eventual ownership, enhancing financial flexibility and long-term investment appeal. Flex lease structuring in rent-to-own arrangements accommodates variable payment schedules and contract adjustments, catering to diverse financial situations and fostering gradual equity building.

Equity Accrual Rental

Traditional leasing typically involves fixed monthly payments without equity accrual, as renters do not build ownership in the property. Rent-to-own agreements enable tenants to apply a portion of their rent toward eventual home equity, providing a pathway to ownership while living in the property.

Hybrid Tenure Models

Hybrid tenure models blend traditional leasing's fixed-term agreements with rent-to-own options, offering tenants flexibility to build equity while maintaining predictable rental payments. This approach caters to renters seeking long-term investment in property without immediate full purchase commitment, enhancing accessibility and financial planning in rental markets.

Lease-to-Own Escrow

Lease-to-own escrow offers a secure financial arrangement where rental payments contribute towards the eventual purchase of the property, ensuring funds are held in trust until ownership transfer is finalized. This contrasts with traditional leasing, where monthly payments are purely rental fees without equity accumulation or purchase options embedded in the contract.

Progressive Ownership Scheme

Traditional leasing requires fixed monthly payments with no ownership buildup, while the progressive ownership scheme in rent-to-own allows tenants to apply a portion of their rent towards eventual property ownership. This model benefits renters by gradually increasing equity and providing a clear path to homeownership without immediate large down payments.

Rent-Crediting Mechanism

Rent-to-own agreements incorporate a rent-crediting mechanism that applies a portion of each rental payment toward the eventual purchase price, accelerating equity buildup compared to traditional leasing where payments are solely for temporary use. This structured crediting enables tenants to invest in homeownership over time while enjoying the flexibility of rental occupancy.

Attrition-Adjusted Rental

Attrition-adjusted rental models in traditional leasing focus on fixed-term agreements with predictable tenant turnover rates, optimizing revenue through lease renewals and retention strategies. Rent-to-own schemes incorporate attrition adjustments by accounting for potential early buyouts and tenant default risks, balancing rental income with eventual property ownership transitions.

Pathway to Ownership Agreements

Traditional leasing provides renters with short-term usage rights without equity buildup, whereas rent-to-own agreements create a structured pathway to ownership by applying a portion of monthly payments toward the eventual purchase price. This pathway to ownership enables tenants to gradually accumulate equity while living in the property, bridging the gap between renting and full homeownership.

Subscription-Based Leasing

Subscription-based leasing offers flexible, short-term rental agreements with included maintenance and upgrades, contrasting traditional leasing's long-term fixed contracts and rent-to-own's incremental ownership model. This modern approach reduces upfront costs and provides easy access to the latest products, appealing to consumers seeking adaptability without commitment.

Embedded Buy-Out Clauses

Embedded buy-out clauses in traditional leasing agreements often require upfront negotiations and fixed terms, limiting flexibility for tenants to purchase the asset mid-lease. Rent-to-own contracts integrate buy-out options seamlessly, allowing renters to apply rental payments toward ownership, enhancing affordability and long-term asset acquisition.

Traditional Leasing vs Rent-to-Own Infographic

industrydif.com

industrydif.com