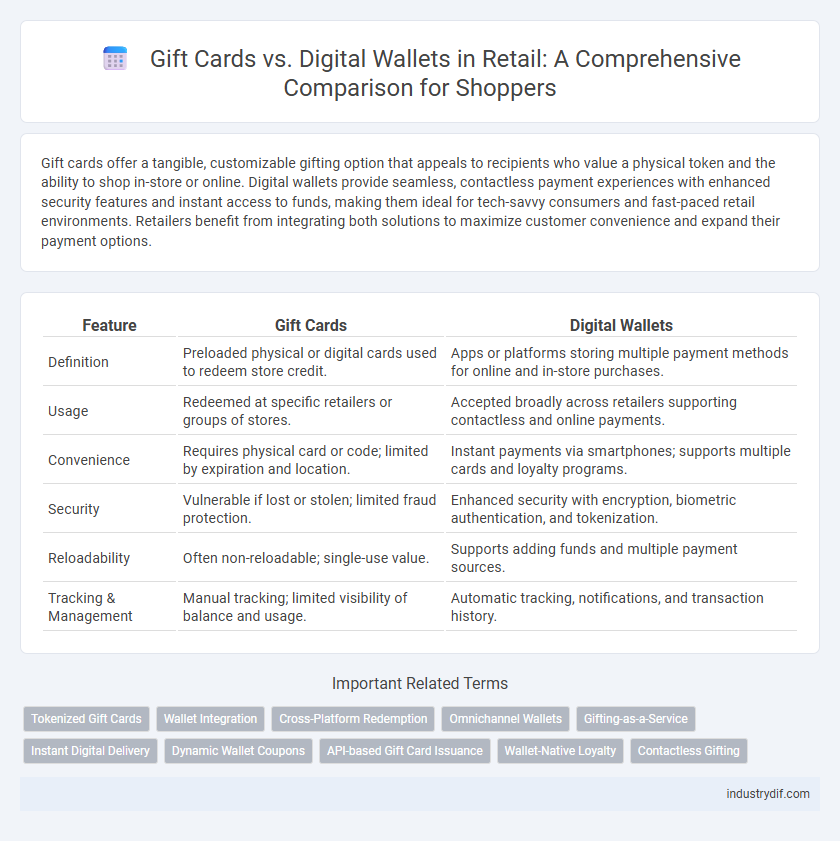

Gift cards offer a tangible, customizable gifting option that appeals to recipients who value a physical token and the ability to shop in-store or online. Digital wallets provide seamless, contactless payment experiences with enhanced security features and instant access to funds, making them ideal for tech-savvy consumers and fast-paced retail environments. Retailers benefit from integrating both solutions to maximize customer convenience and expand their payment options.

Table of Comparison

| Feature | Gift Cards | Digital Wallets |

|---|---|---|

| Definition | Preloaded physical or digital cards used to redeem store credit. | Apps or platforms storing multiple payment methods for online and in-store purchases. |

| Usage | Redeemed at specific retailers or groups of stores. | Accepted broadly across retailers supporting contactless and online payments. |

| Convenience | Requires physical card or code; limited by expiration and location. | Instant payments via smartphones; supports multiple cards and loyalty programs. |

| Security | Vulnerable if lost or stolen; limited fraud protection. | Enhanced security with encryption, biometric authentication, and tokenization. |

| Reloadability | Often non-reloadable; single-use value. | Supports adding funds and multiple payment sources. |

| Tracking & Management | Manual tracking; limited visibility of balance and usage. | Automatic tracking, notifications, and transaction history. |

Understanding Gift Cards in Retail

Gift cards in retail serve as prepaid stored-value cards issued by retailers, allowing customers to make purchases up to the card's balance, which encourages consumer spending and brand loyalty. These physical or digital cards provide a tangible gifting option with fixed denominations, simplifying budgeting for recipients and reducing cart abandonment rates. Retailers benefit from increased upfront cash flow and opportunities for repeat visits as gift card balances are redeemed over time.

The Rise of Digital Wallets

Digital wallets have transformed retail by offering consumers faster, contactless payment options and seamless integration with loyalty programs. Statistics show a significant rise in digital wallet adoption, with platforms like Apple Pay and Google Wallet driving convenience and security for both shoppers and retailers. Gift cards remain popular for gifting but lack the instant usability and multi-functionality that digital wallets provide in modern retail environments.

Key Features of Gift Cards

Gift cards offer a tangible, prepaid payment method that can be redeemed in-store or online, providing a secure and straightforward shopping experience. They often feature customizable designs and denominations, making them ideal for personalized gifting. Unlike digital wallets, gift cards do not require smartphone compatibility or internet access, ensuring accessibility for all customer segments.

Digital Wallets: Functions and Benefits

Digital wallets enable seamless, contactless payments by securely storing credit, debit, and loyalty card information, enhancing convenience for retail customers. They support instant transactions, personalized offers, and easy access to transaction history, driving customer engagement and retention. Retailers benefit from reduced checkout times, improved security through tokenization, and the ability to integrate with loyalty programs and mobile marketing campaigns.

Security Comparison: Gift Cards vs Digital Wallets

Gift cards offer limited security as they can be easily lost, stolen, or copied without real-time transaction monitoring, making unauthorized use difficult to prevent. Digital wallets enhance security through encryption, multi-factor authentication, and tokenization, reducing fraud risks and enabling instant transaction tracking. Retailers benefit from digital wallets by minimizing chargebacks and improving fraud detection compared to traditional physical gift cards.

Consumer Preferences in Payment Methods

Consumers increasingly favor digital wallets over traditional gift cards due to the convenience, security features, and instant transaction capabilities offered by platforms like Apple Pay and Google Wallet. Data from a 2024 survey indicates that 68% of shoppers prefer digital wallets for in-store and online payments, compared to 37% who still use gift cards as a gifting method. Retailers optimizing for digital wallet compatibility often experience higher redemption rates and customer satisfaction, reflecting a shift towards seamless, contactless payment solutions.

Impact on Retailer Loyalty Programs

Gift cards enhance retailer loyalty programs by providing tangible value and encouraging repeat visits, often increasing average transaction size. Digital wallets streamline the redemption process, enabling seamless integration with personalized offers and real-time loyalty tracking. Combining both tools maximizes customer engagement and data collection, driving long-term loyalty and higher sales.

Transaction Speed and Convenience

Gift cards offer straightforward transaction speed by allowing instant in-store purchases without the need for additional apps or devices. Digital wallets enhance convenience by enabling contactless payments, automatic transaction recording, and quick access through smartphones or wearables. Both methods streamline checkout processes, but digital wallets provide added flexibility for multi-store use and seamless online checkout integration.

Cost Implications for Retailers

Gift cards often incur higher costs for retailers due to production, distribution, and breakage liabilities, while digital wallets reduce expenses by leveraging existing smartphone technology and minimizing physical goods. Digital wallets streamline transaction processing fees and offer real-time analytics, enabling retailers to optimize marketing strategies and reduce operational overhead. Retailers benefit from lower fraud risks and enhanced customer engagement with digital wallets, driving better cost efficiency compared to traditional gift card programs.

Future Trends: Gift Cards and Digital Wallets in Retail

Gift cards continue to dominate retail gift-giving with personalized designs and expanded redemption options, while digital wallets gain traction through seamless integration with loyalty programs and contactless payments. Emerging trends indicate a convergence where gift cards are increasingly issued in digital wallet formats, enhancing convenience and security for both retailers and consumers. Retailers leveraging blockchain technology and AI-driven personalization expect to further streamline gift card management and digital wallet experiences, driving customer engagement in the evolving retail landscape.

Related Important Terms

Tokenized Gift Cards

Tokenized gift cards enhance retail security by using encrypted digital tokens instead of traditional codes, reducing fraud risks and enabling seamless integration with digital wallets. These tokenized solutions offer retailers improved tracking, personalized promotions, and a frictionless customer experience across multiple platforms.

Wallet Integration

Wallet integration enhances retail experiences by allowing seamless gift card storage and redemption within digital wallets such as Apple Pay and Google Wallet. This integration streamlines transactions, boosts customer convenience, and encourages repeat purchases through efficient management of both gift cards and digital payment methods.

Cross-Platform Redemption

Gift cards offer versatile cross-platform redemption, allowing consumers to use their value both in physical stores and online, enhancing flexibility in retail purchases. Digital wallets streamline seamless payments across multiple devices and platforms, enabling instant transactions and integrated loyalty programs for a cohesive shopping experience.

Omnichannel Wallets

Omnichannel wallets integrate gift cards and digital payment methods into a seamless platform, enabling retailers to enhance customer experience through unified balance management and instant redemption across in-store and online channels. Leveraging omnichannel wallets increases customer retention by offering flexible payment options, simplified checkout processes, and personalized promotions linked to stored gift card values and loyalty rewards.

Gifting-as-a-Service

Gift cards provide a tangible gifting solution with predefined values that enhance brand loyalty and in-store sales, while digital wallets offer seamless, personalized transactions and instant delivery, driving higher engagement through convenience and integration with mobile commerce. Gifting-as-a-Service leverages both by enabling retailers to embed gifting options directly into online platforms, optimizing customer experience and increasing repeat purchases through versatile payment and redemption methods.

Instant Digital Delivery

Gift cards offer instant digital delivery, enabling immediate use for online and in-store purchases, while digital wallets provide seamless integration with multiple payment methods and loyalty programs for swift transactions. Both solutions prioritize speed and convenience, but digital wallets enhance customer experience through real-time updates and secure storage of multiple payment options.

Dynamic Wallet Coupons

Dynamic wallet coupons integrated into digital wallets offer retailers a powerful tool to personalize promotions and enhance customer engagement by delivering real-time, location-based discounts. Unlike traditional gift cards, these dynamic coupons enable seamless mobile redemption and data-driven targeting, increasing conversion rates and fostering brand loyalty in the competitive retail landscape.

API-based Gift Card Issuance

API-based gift card issuance streamlines the integration of customized gift card solutions directly into retail platforms, enabling real-time activation, balance tracking, and seamless redemption across multiple sales channels. Unlike digital wallets, which aggregate existing payment methods, API-driven gift cards offer retailers precise control over branding, promotional campaigns, and detailed customer transaction analytics.

Wallet-Native Loyalty

Wallet-native loyalty programs enhance customer retention by integrating gift cards directly within digital wallets, offering seamless redemption and real-time rewards tracking. Unlike standalone gift cards, digital wallets enable personalized promotions and instant transaction updates, driving higher engagement and repeat purchases in retail environments.

Contactless Gifting

Gift cards provide a tangible, prepaid option for contactless gifting, allowing recipients to redeem in-store or online, while digital wallets enable seamless, instant transfers and redemption through mobile devices, enhancing convenience and security in retail transactions. The rise of NFC-enabled smartphones and QR code scanning technology accelerates the adoption of digital wallets, making contactless gifting more interactive and personalized.

Gift cards vs Digital wallets Infographic

industrydif.com

industrydif.com