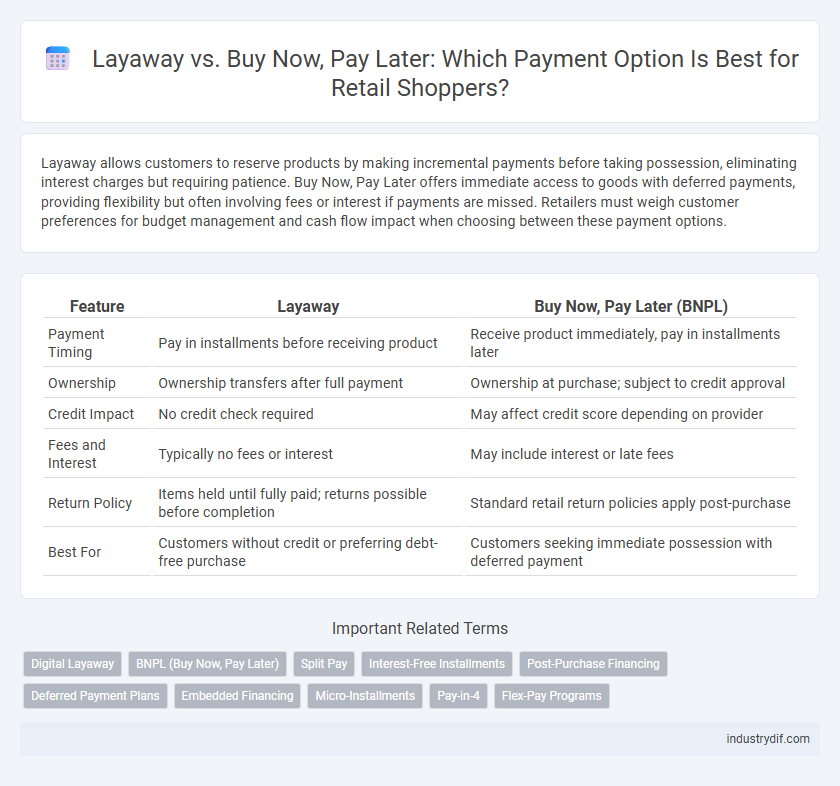

Layaway allows customers to reserve products by making incremental payments before taking possession, eliminating interest charges but requiring patience. Buy Now, Pay Later offers immediate access to goods with deferred payments, providing flexibility but often involving fees or interest if payments are missed. Retailers must weigh customer preferences for budget management and cash flow impact when choosing between these payment options.

Table of Comparison

| Feature | Layaway | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Payment Timing | Pay in installments before receiving product | Receive product immediately, pay in installments later |

| Ownership | Ownership transfers after full payment | Ownership at purchase; subject to credit approval |

| Credit Impact | No credit check required | May affect credit score depending on provider |

| Fees and Interest | Typically no fees or interest | May include interest or late fees |

| Return Policy | Items held until fully paid; returns possible before completion | Standard retail return policies apply post-purchase |

| Best For | Customers without credit or preferring debt-free purchase | Customers seeking immediate possession with deferred payment |

Understanding Layaway in Retail

Layaway in retail involves reserving a product by making a series of scheduled payments before taking possession, offering a budget-friendly alternative without incurring interest charges. Unlike Buy Now, Pay Later (BNPL), layaway requires full payment prior to product release, minimizing retailer risk and avoiding consumer debt accumulation. This payment method appeals to shoppers seeking disciplined spending while retailers can enhance cash flow stability and reduce returns.

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a flexible payment option in retail that allows consumers to purchase products immediately and spread the cost over multiple interest-free installments. Unlike layaway, BNPL enables instant product possession without full upfront payment, leveraging digital platforms and credit assessments for approval. This payment solution enhances affordability and boosts conversion rates by providing consumers with manageable, scheduled payments.

Key Differences Between Layaway and BNPL

Layaway requires customers to pay in full before receiving the product, while Buy Now, Pay Later (BNPL) allows immediate possession with deferred payments. Layaway typically involves no interest or fees if payments are completed on time, whereas BNPL options often include interest or late fees depending on the provider's terms. Consumer credit risk is higher with BNPL since the product is delivered upfront, unlike layaway where goods are held until the balance is paid.

Pros and Cons of Layaway Programs

Layaway programs allow customers to reserve products by paying in installments before taking possession, minimizing debt risks compared to Buy Now, Pay Later (BNPL) options that often involve credit and interest fees. The pros of layaway include no credit checks, reduced impulse buying, and guaranteed product availability, while cons involve limited immediate ownership, potential non-refundable fees, and the need for disciplined payment schedules. Retailers benefit from increased customer commitment and reduced returns but face challenges with inventory management and delayed revenue recognition.

Advantages and Disadvantages of BNPL Services

Buy Now, Pay Later (BNPL) services provide shoppers with flexible payment options, allowing them to split purchases into interest-free installments, which increases affordability and driving higher conversion rates for retailers. However, BNPL usage can lead to increased consumer debt risk and potential late payment fees, which may negatively impact credit scores. Retailers benefit from higher average order values but face challenges with payment delays and potential fraud, requiring robust risk management systems.

Impact on Consumer Spending Behavior

Layaway programs encourage disciplined saving by requiring full payment before possession, reducing impulse purchases and promoting budget-conscious spending among consumers. Conversely, Buy Now, Pay Later (BNPL) options increase purchasing power by allowing immediate possession with deferred payments, often leading to higher average order values and increased consumer debt levels. Retailers leveraging BNPL observe boosted sales volumes but must manage potential risks associated with consumer overextension and credit defaults.

Retailer Considerations: Layaway vs BNPL

Retailers must evaluate the cash flow impact when choosing between layaway and Buy Now, Pay Later (BNPL) options, as layaway requires upfront payment before product release, while BNPL delays payment yet involves third-party financing fees. Customer purchase behavior and risk management influence this decision, with BNPL potentially increasing average order value but raising the risk of defaults or chargebacks. Inventory turnover rates and operational complexity also factor into retailer considerations, as layaway demands inventory holding until full payment, whereas BNPL accelerates product delivery with deferred payment.

Credit Implications and Customer Experience

Layaway plans require customers to pay in full before receiving the product, eliminating credit risk but often causing delayed gratification and potential cart abandonment. Buy Now, Pay Later (BNPL) services impact credit differently depending on the provider; some report to credit bureaus, affecting credit scores, while others do not, encouraging higher purchase volumes and ease of access. The customer experience with BNPL tends to be more seamless and flexible, enhancing conversion rates, whereas layaway may deter shoppers seeking immediate ownership despite no direct credit implication.

Popular Retailers Offering Layaway and BNPL

Major retailers like Walmart, Target, and Best Buy prominently feature layaway programs, allowing customers to reserve items through installment payments before purchase. In contrast, popular BNPL providers such as Affirm, Afterpay, and Klarna partner with retailers like Amazon, Sephora, and Nike to offer flexible payment options at checkout. Both payment methods cater to different consumer preferences, with layaway emphasizing gradual saving and BNPL focusing on immediate ownership with deferred payments.

Future Trends in Retail Payment Solutions

Layaway plans, which require customers to pay in installments before receiving products, are evolving with digital integration to enhance convenience and accessibility. Buy Now, Pay Later (BNPL) services are rapidly expanding, leveraging mobile technology and AI-driven credit assessments to offer flexible, instant financing options. Future retail payment solutions will prioritize seamless, personalized experiences, combining traditional methods with innovative digital financing to meet diverse consumer demands.

Related Important Terms

Digital Layaway

Digital layaway offers a secure, interest-free installment plan allowing customers to reserve products online by paying in increments before delivery, combining traditional layaway benefits with modern convenience. Unlike Buy Now, Pay Later services that charge interest and fees, digital layaway enhances shopper confidence and reduces debt risk, driving higher conversion rates and customer loyalty in retail.

BNPL (Buy Now, Pay Later)

Buy Now, Pay Later (BNPL) offers consumers flexible, interest-free installment payments that enhance purchasing power and improve cash flow management compared to traditional layaway plans, which require full payment before product release. Retailers benefit from increased conversion rates and average order values through BNPL integration, driving higher sales and customer satisfaction.

Split Pay

Split pay in retail offers a flexible alternative to layaway and buy now, pay later (BNPL) by allowing customers to divide payments into interest-free installments without delaying product possession. Unlike layaway, where items are held until full payment, split pay ensures immediate delivery, enhancing customer satisfaction and driving higher conversion rates.

Interest-Free Installments

Layaway allows customers to reserve products by paying over time without interest, eliminating credit checks and financial risk, while Buy Now, Pay Later (BNPL) enables immediate possession with interest-free installment plans often limited to short-term periods. Retailers leveraging interest-free BNPL options boost conversion rates and average order values by offering flexible payment choices that appeal to budget-conscious shoppers.

Post-Purchase Financing

Layaway requires customers to pay in installments before receiving the product, ensuring full payment upfront but delaying possession, whereas Buy Now, Pay Later (BNPL) allows immediate access with post-purchase financing through deferred payments or installments. Retailers leveraging BNPL often see increased average order values and conversion rates due to flexible payment options and reduced purchase friction.

Deferred Payment Plans

Deferred payment plans in retail, such as Layaway and Buy Now, Pay Later (BNPL), offer consumers flexible purchasing options, with Layaway requiring full payment before receiving the product and BNPL allowing immediate possession with installment payments post-purchase. Retailers benefit from increased sales and customer loyalty by integrating these plans, while consumers gain financial convenience and budget management through structured, interest-free or low-interest payments.

Embedded Financing

Embedded financing in retail merges Layaway and Buy Now, Pay Later by integrating payment options directly within the shopping experience, enabling customers to reserve products or buy immediately with flexible installment plans. Retailers benefit from increased conversion rates and customer loyalty as embedded financing simplifies checkout and offers personalized credit solutions without third-party interruptions.

Micro-Installments

Layaway requires customers to pay small, regular micro-installments before receiving the product, making it a budget-friendly option without interest charges. Buy Now, Pay Later offers immediate product access with deferred payments often split into interest-free micro-installments, boosting purchasing power and convenience in retail transactions.

Pay-in-4

Layaway requires customers to pay the full purchase price in installments before receiving the product, while Pay-in-4 allows shoppers to split payments into four interest-free installments, providing immediate access to items. Pay-in-4 services like Afterpay and Klarna enhance retail conversion rates by offering flexible, interest-free financing that appeals to budget-conscious consumers.

Flex-Pay Programs

Layaway programs allow customers to reserve products by making incremental payments over time before receiving the item, ensuring affordability without immediate financial burden. Buy Now, Pay Later (BNPL) options offer flexible payment plans post-purchase, often with no interest if paid within the agreed period, enhancing customer convenience and boosting retail sales conversions.

Layaway vs Buy Now, Pay Later Infographic

industrydif.com

industrydif.com