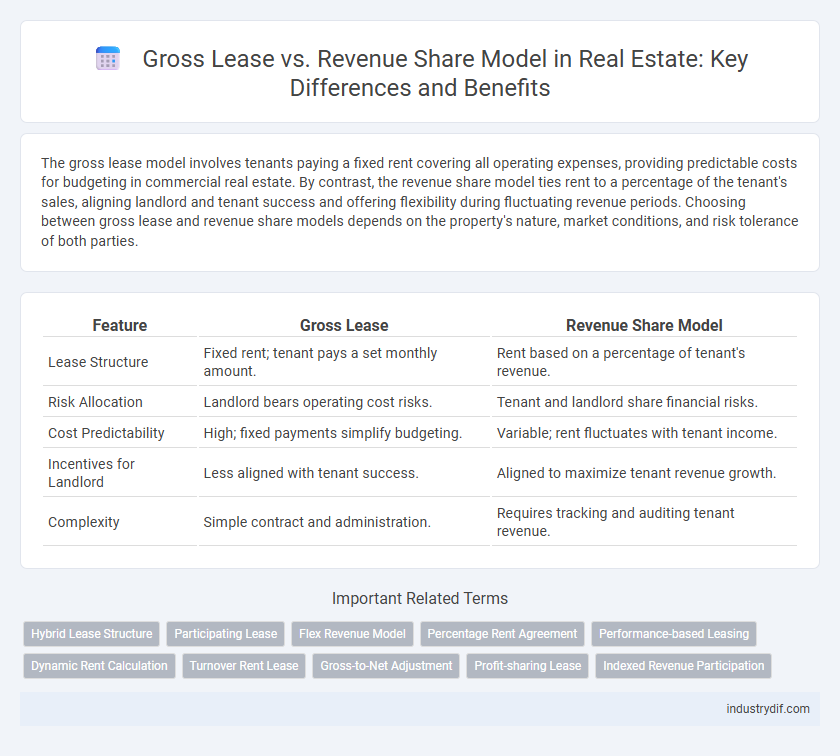

The gross lease model involves tenants paying a fixed rent covering all operating expenses, providing predictable costs for budgeting in commercial real estate. By contrast, the revenue share model ties rent to a percentage of the tenant's sales, aligning landlord and tenant success and offering flexibility during fluctuating revenue periods. Choosing between gross lease and revenue share models depends on the property's nature, market conditions, and risk tolerance of both parties.

Table of Comparison

| Feature | Gross Lease | Revenue Share Model |

|---|---|---|

| Lease Structure | Fixed rent; tenant pays a set monthly amount. | Rent based on a percentage of tenant's revenue. |

| Risk Allocation | Landlord bears operating cost risks. | Tenant and landlord share financial risks. |

| Cost Predictability | High; fixed payments simplify budgeting. | Variable; rent fluctuates with tenant income. |

| Incentives for Landlord | Less aligned with tenant success. | Aligned to maximize tenant revenue growth. |

| Complexity | Simple contract and administration. | Requires tracking and auditing tenant revenue. |

Understanding Gross Lease in Real Estate

Gross lease in real estate is a rental agreement where the tenant pays a fixed rent amount, and the landlord covers all property expenses such as taxes, insurance, and maintenance. This model provides predictable costs for tenants, making budgeting straightforward while landlords manage variable expenses. Gross leases are commonly used in commercial properties where simplicity and cost certainty are prioritized.

What is a Revenue Share Model?

A Revenue Share Model in real estate is an agreement where tenants pay landlords a percentage of their gross sales instead of a fixed rent. This model aligns landlord and tenant interests by linking rent to business performance, often used in retail and commercial properties. It provides landlords with upside potential when tenant revenue grows, while offering tenants reduced fixed costs during slower sales periods.

Key Differences: Gross Lease vs Revenue Share

A gross lease requires tenants to pay a fixed rent amount, with the landlord covering property expenses such as maintenance, taxes, and insurance, ensuring predictable costs for tenants. In contrast, a revenue share model links rent payments to the tenant's revenue, allowing rent to fluctuate based on business performance and aligning landlord-tenant incentives. The gross lease offers stability, while the revenue share model provides flexibility and risk-sharing, particularly beneficial in retail or hospitality real estate.

Advantages of Gross Lease Agreements

Gross lease agreements provide tenants with predictable monthly expenses by including rent, taxes, insurance, and maintenance costs in a single fixed payment, minimizing financial uncertainty. Landlords benefit from stable, consistent income streams without fluctuating operational costs or unexpected expenditures. This model simplifies budgeting for both parties and reduces administrative complexities compared to revenue share models in commercial real estate.

Benefits of the Revenue Share Model

The Revenue Share Model aligns landlord and tenant interests by tying rent payments directly to business performance, promoting mutual growth and reducing vacancy risks. Tenants benefit from lower initial fixed costs and greater cash flow flexibility, enabling them to invest more in their operations. Landlords gain potential for higher total income during strong tenant performance periods, creating a dynamic and sustainable leasing environment.

Financial Implications for Landlords

In a gross lease, landlords receive a fixed rental income covering property expenses, offering predictable cash flow but limiting potential upside from property performance. The revenue share model ties rental income to tenant sales, potentially increasing landlord profits during high tenant revenue periods while exposing landlords to income variability and market risks. Landlords must weigh the stability of fixed gross lease payments against the growth potential and financial uncertainty inherent in revenue share agreements.

Tenant Considerations: Choosing the Right Model

Tenants evaluating a Gross Lease versus a Revenue Share Model must consider financial predictability and risk exposure, where Gross Leases offer fixed rent payments simplifying budgeting, while Revenue Share Models align rent with business performance, potentially reducing costs during low sales periods. The choice depends on the tenant's confidence in revenue stability and desire for flexibility; established businesses may prefer fixed costs, whereas startups might benefit from the variable rent tied to actual income. Understanding the long-term financial implications and operational control in each model is crucial for tenants to select a lease structure that supports sustainable growth and cash flow management.

Market Trends: Gross Lease vs Revenue Share

Market trends reveal a growing preference for revenue share models in commercial real estate, driven by tenants' desire for flexible cost structures aligned with business performance. Gross leases remain popular in traditional markets due to their predictable expenses and ease of budgeting, especially for long-term tenants seeking stability. Emerging urban centers and retail sectors increasingly adopt revenue share models, leveraging market volatility to balance landlord risks and tenant opportunities.

Risk Analysis for Both Leasing Models

Gross lease shifts most operating expense risks to the landlord, allowing tenants to pay a fixed rent regardless of property costs fluctuations, which provides predictable income but exposes landlords to variable expenses such as maintenance and taxes. Revenue share models allocate risk between landlord and tenant by tying rent to tenant sales performance, reducing landlord exposure to fixed income loss but introducing variability based on tenant business success. Both models require careful evaluation of tenant stability and market conditions to balance financial risk and ensure sustainable cash flow in commercial real estate investments.

Selecting the Best Lease Structure for Your Business

Selecting the best lease structure for your business involves evaluating the financial predictability of a gross lease against the variable costs and potential revenue benefits of a revenue share model. Gross leases offer fixed monthly expenses, simplifying budgeting and reducing financial risk, while revenue share models align landlord and tenant interests by basing rent on sales performance, promoting growth opportunities. Analyzing your business's cash flow stability, growth projections, and market conditions will help determine if a predictable lease cost or a performance-linked lease best supports your long-term success.

Related Important Terms

Hybrid Lease Structure

The hybrid lease structure combines elements of gross lease and revenue share models, providing landlords with a base rent plus a percentage of tenant sales to align interests and optimize revenue. This approach balances fixed income stability with performance-based upside, making it suitable for retail and commercial properties where tenant sales fluctuate.

Participating Lease

Participating Lease, a hybrid of Gross Lease and Revenue Share Model, requires tenants to pay a base rent plus a percentage of gross sales, aligning landlord income with tenant performance. This lease type incentivizes landlords to support tenant business success while providing tenants lower fixed rent costs compared to traditional gross leases.

Flex Revenue Model

The Flex Revenue Model in real estate blends elements of gross leases and revenue share agreements by allowing landlords to receive a fixed base rent plus a percentage of the tenant's revenue, optimizing income potential in flexible commercial spaces. This model aligns landlord and tenant interests, as lease payments fluctuate with business performance, often enhancing occupancy rates and tenant retention compared to traditional gross lease structures.

Percentage Rent Agreement

A Percentage Rent Agreement under a Gross Lease combines a fixed base rent with a variable component tied to a percentage of the tenant's gross sales, aligning landlord income with tenant performance. This revenue share model incentivizes landlords to support tenant success, making it prevalent in retail real estate where sales fluctuations directly impact rental income.

Performance-based Leasing

Performance-based leasing in real estate leverages the Revenue Share Model by aligning tenant rent obligations with the business's actual revenue, promoting shared risk and incentivizing property performance. Unlike the traditional Gross Lease where a fixed rent is paid regardless of income fluctuations, the Revenue Share Model dynamically adjusts rent, benefiting landlords during high revenue periods and providing tenants flexibility during downturns.

Dynamic Rent Calculation

The gross lease model features a fixed rent payment that remains constant regardless of property income fluctuations, providing predictable cash flow but limited flexibility for tenants and landlords. In contrast, the revenue share model utilizes dynamic rent calculation based on a percentage of the tenant's gross revenue, aligning landlord income with business performance and allowing for adaptable rent adjustments in response to market conditions.

Turnover Rent Lease

Turnover rent lease, a common form of gross lease in retail real estate, ties rent payments to a tenant's sales revenue, aligning landlord and tenant interests through variable rent based on turnover. This revenue share model mitigates fixed costs for tenants while offering landlords potential income growth linked to business performance, enhancing financial flexibility within commercial leases.

Gross-to-Net Adjustment

Gross lease agreements require tenants to pay a fixed rent without accounting for property operating expenses, resulting in a straightforward gross-to-net adjustment based primarily on fixed costs. Revenue share models incorporate variable rent tied to tenant sales, necessitating complex gross-to-net adjustments that factor in fluctuating revenues and negotiated percentages, aligning landlord income with tenant performance.

Profit-sharing Lease

Profit-sharing leases align landlord and tenant interests by allocating a portion of the tenant's revenue, creating a variable rent structure sensitive to business performance. This model reduces fixed costs for tenants while enabling landlords to benefit directly from the tenant's profitability, contrasting with the fixed payments in gross leases.

Indexed Revenue Participation

Gross lease agreements require tenants to pay a fixed rent regardless of property revenue, while the revenue share model with indexed revenue participation ties rent payments to a percentage of tenant sales, adjusted based on predefined revenue indices. This indexed approach aligns landlord income with business performance fluctuations, providing potential for increased lease revenue during periods of higher tenant earnings.

Gross Lease vs Revenue Share Model Infographic

industrydif.com

industrydif.com