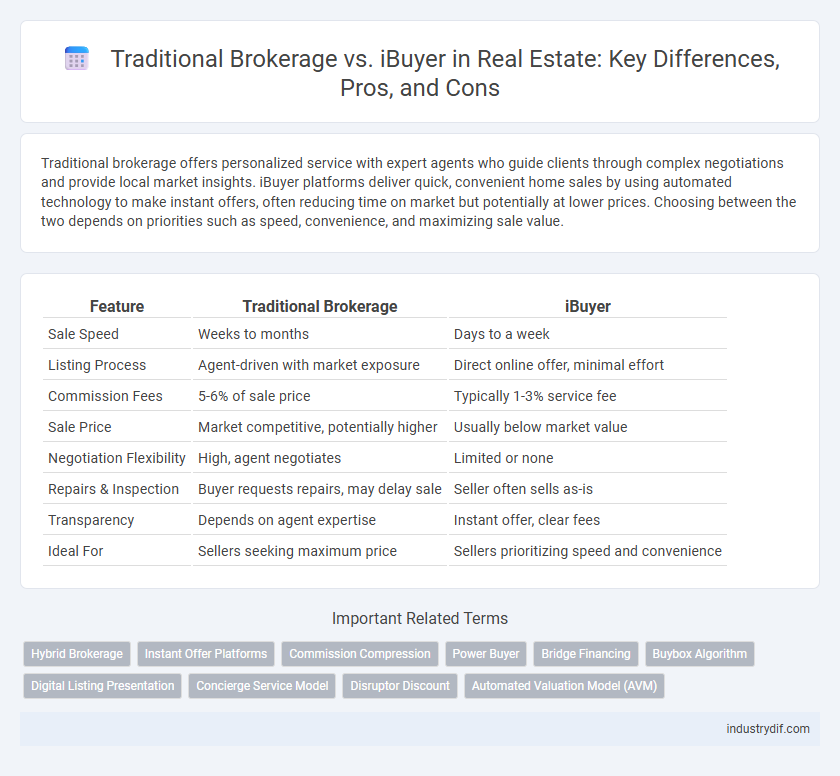

Traditional brokerage offers personalized service with expert agents who guide clients through complex negotiations and provide local market insights. iBuyer platforms deliver quick, convenient home sales by using automated technology to make instant offers, often reducing time on market but potentially at lower prices. Choosing between the two depends on priorities such as speed, convenience, and maximizing sale value.

Table of Comparison

| Feature | Traditional Brokerage | iBuyer |

|---|---|---|

| Sale Speed | Weeks to months | Days to a week |

| Listing Process | Agent-driven with market exposure | Direct online offer, minimal effort |

| Commission Fees | 5-6% of sale price | Typically 1-3% service fee |

| Sale Price | Market competitive, potentially higher | Usually below market value |

| Negotiation Flexibility | High, agent negotiates | Limited or none |

| Repairs & Inspection | Buyer requests repairs, may delay sale | Seller often sells as-is |

| Transparency | Depends on agent expertise | Instant offer, clear fees |

| Ideal For | Sellers seeking maximum price | Sellers prioritizing speed and convenience |

Defining Traditional Brokerage and iBuyer Models

Traditional brokerage involves real estate agents representing buyers or sellers in property transactions, relying on personal expertise, market knowledge, and negotiation skills to facilitate sales. The iBuyer model uses technology and algorithms to provide instant cash offers to sellers, streamlining the process by eliminating the need for showings and lengthy negotiations. While traditional brokerage offers a personalized approach with human interaction, iBuyers prioritize speed, convenience, and digital efficiency in real estate sales.

How Traditional Agents and iBuyers Operate

Traditional real estate agents operate through personalized client interactions, leveraging local market expertise and negotiation skills to list, market, and sell properties, often involving showings and open houses. iBuyers use technology-driven platforms to provide instant cash offers by algorithmically assessing property values, enabling quick transactions without extensive marketing or showings. The traditional brokerage model emphasizes human relationships and tailored services, whereas iBuyers prioritize speed and convenience through automation and streamlined processes.

Speed of Transaction: Comparing the Processes

Traditional brokerage transactions typically take 30 to 60 days, involving property showings, negotiations, inspections, and mortgage approvals. iBuyer platforms streamline the process by using automated valuation models and reducing contingencies, enabling sellers to close within 7 to 14 days. This speed advantage appeals to homeowners seeking quick sales but may involve lower offers compared to traditional methods.

Fees and Costs: Traditional Brokers vs iBuyers

Traditional brokerage fees typically range from 5% to 6% of the home's sale price, covering marketing, negotiation, and closing services, whereas iBuyers charge service fees usually between 1% and 7%, often deducting these directly from the offer price. Traditional brokers may incur additional costs for inspections, staging, and repairs, while iBuyers streamline the process by purchasing homes directly, minimizing extra expenses but sometimes offering lower sale prices. Homeowners should weigh the higher certainty and convenience of iBuyers against the potentially higher net proceeds achieved through traditional brokerage services.

Home Valuation: CMA vs Automated Algorithms

Traditional brokerage relies on Comparative Market Analysis (CMA), leveraging local market expertise and recent sales data to deliver tailored home valuations that reflect neighborhood trends and property specifics. In contrast, iBuyers use automated algorithms powered by vast datasets and machine learning to provide instant online valuations, prioritizing speed and convenience over nuanced assessment. While CMAs offer accuracy through human judgment, algorithm-based valuations can lack context but excel in efficiency and scalability.

Convenience and Experience for Sellers

Traditional brokerage offers personalized service through experienced agents who guide sellers with tailored market insights and negotiation expertise. iBuyer platforms provide unmatched convenience by enabling quick, streamlined sales with instant offers and minimal home preparation. Sellers prioritizing convenience benefit from iBuyers' speed, while those valuing expert guidance and tailored strategies often prefer traditional brokerage.

Flexibility and Negotiation Power

Traditional brokerage offers greater flexibility and negotiation power by enabling personalized interactions and tailored deal structures between buyers and sellers. Agents leverage market expertise to negotiate terms and contingencies that suit individual needs, often resulting in higher sale prices. In contrast, iBuyers provide fast, convenience-driven transactions with fixed offers, limiting sellers' ability to negotiate price or conditions.

Risks and Protections for Homeowners

Traditional brokerage offers homeowners personalized guidance and legal protections through licensed agents, reducing risks such as undervaluation and contract disputes. iBuyer platforms provide convenience and faster sales but carry risks including lower sale prices and limited negotiation options, often requiring homeowners to accept as-is offers without traditional home inspections. Understanding these differences helps homeowners balance speed against potential financial and legal exposures in real estate transactions.

Market Reach and Exposure

Traditional brokerages leverage extensive networks and multiple listing services (MLS) to maximize market reach and exposure, attracting a wide range of potential buyers. iBuyers utilize technology-driven platforms to offer instant cash offers and streamlined sales but typically have a more limited buyer audience due to direct-from-company transactions. The broad visibility provided by traditional agents often results in higher sale prices, while iBuyers prioritize convenience and speed over extensive market exposure.

Future Outlook: Evolving Real Estate Models

Traditional brokerage models maintain personal agent relationships and local market expertise, which continue to appeal to buyers and sellers seeking tailored services. iBuyer platforms leverage technology and data analytics to offer instant cash offers and streamlined transactions, increasingly appealing to tech-savvy consumers prioritizing speed and convenience. The future outlook suggests a hybrid approach, integrating personalized service with digital innovation, reshaping real estate by balancing human expertise and AI-driven efficiency.

Related Important Terms

Hybrid Brokerage

Hybrid brokerage combines the personalized service and local market expertise of traditional brokerage with the convenience and speed of iBuyer technology, offering sellers flexible options and competitive pricing. This model leverages data-driven algorithms and human agents to optimize home valuation and streamline transactions, enhancing efficiency while maintaining professional guidance.

Instant Offer Platforms

Instant offer platforms streamline the home selling process by providing sellers with quick, cash-based offers, contrasting traditional brokerage's longer timelines that involve listing, showings, and negotiations. These platforms leverage algorithms and market data to deliver near-instant valuations, reducing seller uncertainty and transaction duration significantly.

Commission Compression

Traditional brokerage commissions typically range from 5% to 6% of the home's sale price, while iBuyers often charge lower, flat-fee commissions around 1% to 3%. This commission compression drives competitive pricing but may impact the level of personalized service and negotiation expertise offered by traditional agents.

Power Buyer

Power buyers benefit from traditional brokerage through expert negotiation and personalized market insights, ensuring optimized property value and tailored transaction strategies. In contrast, iBuyers provide rapid offers and streamlined processes but often sacrifice price competitiveness and comprehensive market expertise.

Bridge Financing

Bridge financing offers traditional brokerage clients a flexible short-term loan to cover the gap between purchasing a new home and selling the existing property, enabling smoother transactions without immediate sale pressure. iBuyer platforms typically avoid bridge financing by providing near-instant cash offers, allowing homeowners to sell quickly but often at a lower price than market value.

Buybox Algorithm

The Buybox algorithm enables iBuyers to provide instant, data-driven home offers by analyzing market trends, property conditions, and pricing dynamics, streamlining the selling process compared to traditional brokerage models. While traditional brokerages rely on agent expertise and negotiation, the Buybox algorithm offers precision and speed, reducing time on market and enhancing transaction efficiency.

Digital Listing Presentation

Traditional brokerage relies on personalized, in-person listing presentations that emphasize agent expertise and local market knowledge, often supported by printed materials and face-to-face interactions. iBuyers leverage digital listing presentations featuring instant online offers, virtual home tours, and data-driven pricing algorithms to streamline the seller experience and reduce time on market.

Concierge Service Model

The traditional brokerage concierge service model offers personalized, hands-on support through experienced agents who manage every step of the home buying or selling process, ensuring tailored marketing strategies and negotiation expertise. In contrast, iBuyer concierge services provide streamlined, tech-driven transactions with faster offers and simplified processes, but may lack the in-depth market insight and customization found in traditional brokerage.

Disruptor Discount

Traditional brokerage typically involves commission fees ranging from 5% to 6%, while iBuyers offer a disruptor discount by purchasing homes directly and charging service fees often between 1% and 3%. This streamlined process enables faster sales and reduced costs, appealing to sellers seeking convenience and greater net proceeds.

Automated Valuation Model (AVM)

Traditional brokerage relies on human expertise and market knowledge for property valuation, whereas iBuyers utilize Automated Valuation Models (AVMs) that analyze vast datasets and algorithms to provide instant, data-driven home price estimates. AVMs enhance the iBuyer model by delivering faster transactions and reducing subjective biases often present in traditional appraisals.

Traditional Brokerage vs iBuyer Infographic

industrydif.com

industrydif.com