Escrow closings involve a trusted third party who holds funds and documents until all contract conditions are met, ensuring security for both buyers and sellers. Smart contract closings automate the transaction process using blockchain technology, reducing the need for intermediaries and minimizing the risk of fraud. Choosing between escrow and smart contract closings depends on priorities such as transparency, speed, and the desire for a traditional or technology-driven approach.

Table of Comparison

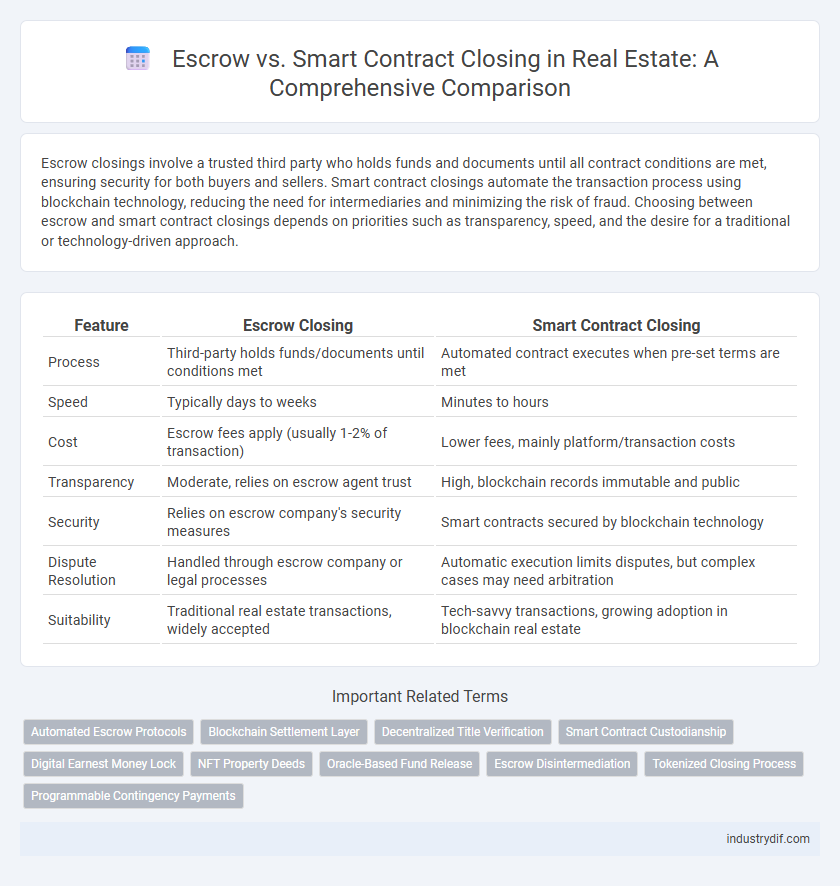

| Feature | Escrow Closing | Smart Contract Closing |

|---|---|---|

| Process | Third-party holds funds/documents until conditions met | Automated contract executes when pre-set terms are met |

| Speed | Typically days to weeks | Minutes to hours |

| Cost | Escrow fees apply (usually 1-2% of transaction) | Lower fees, mainly platform/transaction costs |

| Transparency | Moderate, relies on escrow agent trust | High, blockchain records immutable and public |

| Security | Relies on escrow company's security measures | Smart contracts secured by blockchain technology |

| Dispute Resolution | Handled through escrow company or legal processes | Automatic execution limits disputes, but complex cases may need arbitration |

| Suitability | Traditional real estate transactions, widely accepted | Tech-savvy transactions, growing adoption in blockchain real estate |

Introduction to Escrow and Smart Contract Closings

Escrow closings in real estate involve a neutral third party holding funds and documents until all contractual conditions are met, ensuring secure and compliant transactions. Smart contract closings leverage blockchain technology to automate contract enforcement and fund transfers without intermediaries, reducing errors and increasing efficiency. Both methods aim to safeguard buyer and seller interests, but smart contracts offer enhanced transparency and speed through decentralized verification.

Key Differences Between Escrow and Smart Contracts

Escrow involves a trusted third party holding funds and documents until contract conditions are met, ensuring secure, neutral transaction completion in real estate deals. Smart contracts automate transaction execution using blockchain technology, eliminating intermediaries by self-enforcing terms upon predefined conditions. Key differences include escrow's reliance on human oversight and legal frameworks versus smart contracts' algorithm-driven, transparent, and faster process reducing costs and risks of fraud.

How Traditional Escrow Works in Real Estate

Traditional escrow in real estate involves a neutral third party holding funds and documents until all contractual conditions are met, ensuring a secure and transparent transaction. The escrow agent verifies title searches, processes earnest money deposits, and coordinates with lenders, buyers, and sellers to finalize paperwork. This method mitigates risk by safeguarding assets until the agreed-upon terms are fully satisfied before closing the sale.

The Role of Smart Contracts in Real Estate Transactions

Smart contracts streamline real estate transactions by automating escrow processes, ensuring funds and property titles transfer securely only when predefined conditions are met. These blockchain-based contracts eliminate the need for intermediaries, reducing the risk of fraud and accelerating closing times. By recording each step immutably on the blockchain, smart contracts enhance transparency and trust between buyers, sellers, and agents.

Security and Transparency: Escrow vs Smart Contracts

Escrow services provide a secure third-party hold on funds during real estate transactions, ensuring trust by verifying conditions before release, but can be time-consuming and susceptible to human error. Smart contracts automate closing by executing predefined terms on a blockchain, enhancing transparency with immutable records and reducing fraud risks through decentralized verification. While escrow relies on traditional oversight, smart contracts offer increased security and efficiency by minimizing intermediaries and enabling real-time tracking of contract fulfillment.

Cost Comparison: Escrow Fees vs Smart Contract Savings

Escrow fees typically range from 1% to 2% of the property's purchase price, significantly increasing closing costs, while smart contract closings can reduce or eliminate these fees through automated, trustless execution. By leveraging blockchain technology, smart contracts cut out intermediaries and minimize administrative expenses, leading to potential savings of thousands of dollars on high-value real estate transactions. This cost efficiency makes smart contract closings an attractive alternative compared to traditional escrow services.

Speed and Efficiency in Closing Processes

Smart contract closings significantly reduce transaction times by automating the verification and transfer of assets, eliminating the need for manual intervention common in traditional escrow processes. Escrow closings often involve multiple parties and paperwork, causing delays and inefficiencies. Implementing blockchain-based smart contracts enhances speed and accuracy, streamlining real estate closings and minimizing errors.

Legal and Regulatory Considerations

Escrow closings rely on legally recognized third-party intermediaries who ensure compliance with state real estate laws, providing a secure transaction framework governed by established regulations and fiduciary duties. Smart contract closings automate the execution of contractual terms via blockchain technology, raising novel legal and regulatory questions regarding enforceability, jurisdiction, and compliance with traditional property laws. Regulatory bodies are actively assessing smart contracts' implications to integrate digital transactions within existing real estate legal frameworks while safeguarding consumer protection and data privacy.

Challenges and Limitations of Each Method

Escrow closings face challenges such as dependency on third-party intermediaries, which can lead to delays and increased costs. Smart contract closings encounter limitations including technological complexity, regulatory uncertainties, and the requirement for widespread adoption of blockchain protocols. Both methods must address security concerns and integration with existing legal frameworks to ensure smooth real estate transactions.

Future Trends in Real Estate Closings

Future trends in real estate closings emphasize the integration of smart contract technology to automate and secure transactions, reducing reliance on traditional escrow services. Blockchain-powered smart contracts offer transparent, tamper-proof records that streamline title transfers and fund releases, enhancing efficiency and decreasing closing times. Adoption of these digital solutions is accelerating as the industry seeks to minimize fraud risks and optimize the buyer-seller experience with real-time verification and automated compliance.

Related Important Terms

Automated Escrow Protocols

Automated escrow protocols in real estate leverage blockchain technology to streamline closing processes by securely holding and releasing funds based on pre-defined conditions, reducing the need for traditional intermediaries. Smart contract closings enhance transparency and efficiency, minimizing risks of fraud and delays compared to conventional escrow methods.

Blockchain Settlement Layer

Blockchain settlement layers enable real estate transactions to bypass traditional escrow by automating fund release and title transfer through smart contracts, enhancing transparency and reducing closing time. Smart contract closings utilize a decentralized ledger to securely record property ownership and transaction history, minimizing fraud and settlement risks inherent in conventional escrow processes.

Decentralized Title Verification

Decentralized title verification in real estate closing enhances transparency and security by leveraging blockchain technology, eliminating the need for traditional escrow intermediaries. Smart contract closings automate title transfers and fund disbursements based on predefined conditions, reducing fraud risks and expediting transaction finality.

Smart Contract Custodianship

Smart contract custodianship in real estate closing automates escrow functions by securely holding and releasing funds through blockchain technology, reducing reliance on traditional third-party escrow agents. This decentralized approach enhances transaction transparency, minimizes settlement time, and mitigates risks associated with manual errors or fraud during property transfers.

Digital Earnest Money Lock

Digital earnest money lock through smart contract closing ensures automated, transparent, and secure release of funds upon meeting predefined conditions, eliminating intermediaries and reducing the risk of fraud. Traditional escrow systems rely on third-party custodians to hold and manage earnest money, often leading to slower processes and higher fees compared to blockchain-enabled smart contracts.

NFT Property Deeds

NFT property deeds revolutionize real estate closings by leveraging smart contracts to automate transactions, reduce fraud, and enhance transparency compared to traditional escrow methods that rely on third-party intermediaries. Smart contract closings enable secure, immutable transfer of ownership on blockchain platforms, streamlining the process and lowering costs associated with manual escrow services.

Oracle-Based Fund Release

Oracle-based fund release in smart contract closings automates payments by integrating real-world data directly into blockchain transactions, ensuring transparent and immediate fund disbursement upon fulfillment of contractual conditions. Unlike traditional escrow, this technology minimizes human error and reduces delays by eliminating intermediaries and enabling real-time verification of transaction milestones.

Escrow Disintermediation

Escrow disintermediation in real estate closing eliminates the need for traditional third-party escrow agents by utilizing blockchain-enabled smart contracts to automate transaction verification and fund release. This shift reduces closing times, lowers costs, and enhances transparency, providing a direct and secure transaction experience between buyers and sellers.

Tokenized Closing Process

Tokenized closing process in real estate replaces traditional escrow services with blockchain-based smart contracts, enabling secure, transparent, and automated property transactions. This method reduces closing time, minimizes fraud risk, and ensures real-time tracking of funds and document exchanges.

Programmable Contingency Payments

Programmable contingency payments in smart contract closings automate the release of funds based on predefined conditions, reducing delays and minimizing human error compared to traditional escrow methods. This technology enhances transparency and security by ensuring that payments are executed only when all contractual contingencies are met, streamlining real estate transaction processes.

Escrow vs Smart Contract Closing Infographic

industrydif.com

industrydif.com