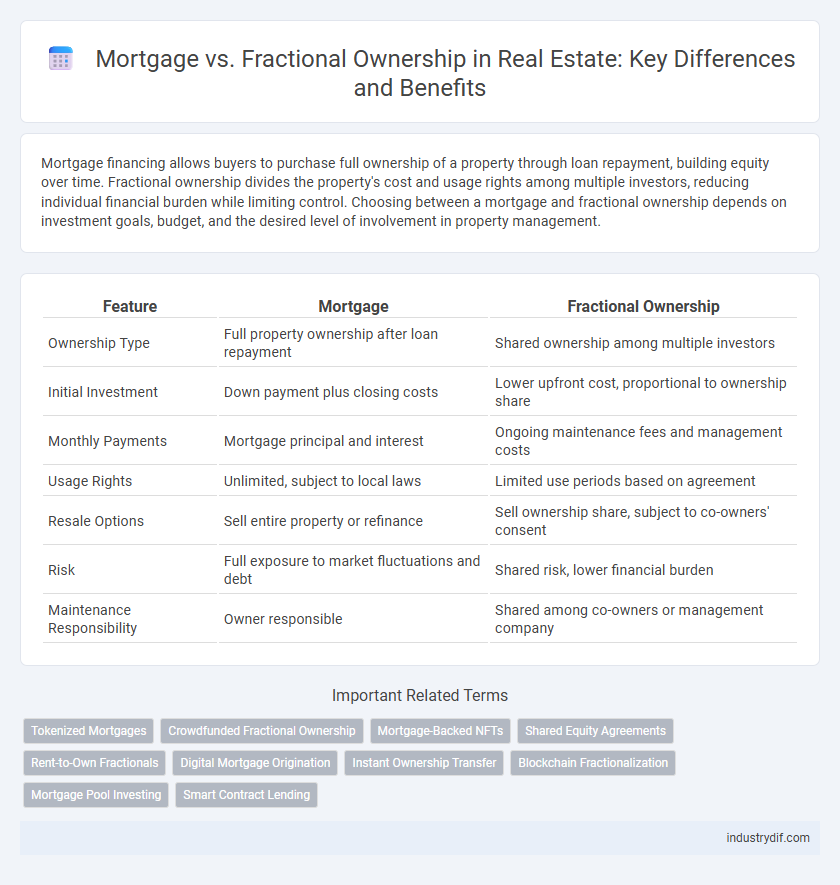

Mortgage financing allows buyers to purchase full ownership of a property through loan repayment, building equity over time. Fractional ownership divides the property's cost and usage rights among multiple investors, reducing individual financial burden while limiting control. Choosing between a mortgage and fractional ownership depends on investment goals, budget, and the desired level of involvement in property management.

Table of Comparison

| Feature | Mortgage | Fractional Ownership |

|---|---|---|

| Ownership Type | Full property ownership after loan repayment | Shared ownership among multiple investors |

| Initial Investment | Down payment plus closing costs | Lower upfront cost, proportional to ownership share |

| Monthly Payments | Mortgage principal and interest | Ongoing maintenance fees and management costs |

| Usage Rights | Unlimited, subject to local laws | Limited use periods based on agreement |

| Resale Options | Sell entire property or refinance | Sell ownership share, subject to co-owners' consent |

| Risk | Full exposure to market fluctuations and debt | Shared risk, lower financial burden |

| Maintenance Responsibility | Owner responsible | Shared among co-owners or management company |

Understanding Traditional Mortgages in Real Estate

Traditional mortgages in real estate involve borrowing a fixed or variable loan amount secured by the property, with monthly payments covering principal and interest over a term typically ranging from 15 to 30 years. Interest rates can vary based on credit scores, loan type, and market conditions, affecting overall affordability and total repayment cost. Understanding loan-to-value ratios, down payment requirements, and amortization schedules is essential for comparing traditional mortgages with alternative ownership models like fractional ownership.

What is Fractional Ownership?

Fractional ownership is a real estate investment model where multiple individuals share ownership of a property, each holding a percentage interest and rights to use the asset. This arrangement reduces the financial burden of purchasing a full property, offering cost-effective access to high-value real estate like vacation homes or luxury estates. Unlike traditional mortgages, fractional ownership combines shared equity with joint decision-making, allowing investors to benefit from property appreciation without full responsibility for maintenance or management.

Key Differences: Mortgage vs Fractional Ownership

Mortgage involves securing a loan to purchase an entire property, with the borrower responsible for full repayment and ownership. Fractional ownership allows multiple investors to share ownership and expenses of a property, reducing individual financial burden but limiting control. Key differences include financing structure, legal ownership rights, and the extent of individual use or occupancy rights.

Pros and Cons of Mortgage Financing

Mortgage financing offers the advantage of full property ownership, allowing buyers to build equity over time and benefit from potential property appreciation. However, it requires significant financial commitment with monthly payments, interest costs, and risk of foreclosure if obligations are unmet. Compared to fractional ownership, mortgages provide more control but less flexibility in terms of usage and resale options.

Advantages and Disadvantages of Fractional Ownership

Fractional ownership allows multiple investors to share the cost and benefits of a property, reducing individual financial burden while providing access to high-value real estate. It offers flexibility in usage and potential appreciation, but limitations include complex scheduling, shared maintenance responsibilities, and less liquidity compared to traditional mortgages. Unlike mortgage-financed sole ownership, fractional ownership may pose challenges in resale and decision-making among co-owners.

Eligibility Criteria for Mortgage Loans

Mortgage loans require applicants to meet specific eligibility criteria such as a stable income, a good credit score typically above 620, and a low debt-to-income ratio under 43%. Lenders also demand proof of employment, sufficient down payment--usually 20% of the property value--and documentation of assets and liabilities. Fractional ownership, by contrast, often has less stringent financial requirements since the investment is shared, reducing individual financial burden.

Legal Frameworks: Mortgage vs Fractional Ownership

Mortgage agreements establish a lien on the property title, granting lenders legal rights to foreclose in case of default, governed by property and contract law. Fractional ownership involves shared legal title among multiple parties, typically managed through tailored agreements or trusts that outline each co-owner's rights and responsibilities. Understanding these distinct legal frameworks is crucial for investors considering secure property interests or collaborative real estate ventures.

Cost Comparison: Mortgage Payments vs Fractional Shares

Mortgage payments typically involve fixed monthly costs that cover principal and interest, often spanning 15 to 30 years, whereas fractional ownership requires an initial investment for a share of the property plus ongoing fees proportional to that share. Fractional ownership can reduce upfront financial burden compared to traditional mortgages but may include variable costs such as maintenance, management fees, and less control over the property. Assessing total expenditure demands analyzing mortgage interest rates, loan terms, and the percentage of ownership costs to determine the most cost-effective option.

Exit Strategies: Selling Mortgaged Property vs Fractional Shares

Selling a mortgaged property typically involves paying off the outstanding loan balance before transferring ownership, which can complicate and lengthen the exit process. Fractional ownership allows investors to sell their shares independently without affecting the entire property, offering greater flexibility and potentially faster liquidity. Understanding these exit strategies is crucial for investors seeking efficient asset liquidation and minimized financial risk.

Which Real Estate Investment Model Suits You?

Mortgage financing offers full property ownership with the obligation of monthly payments and interest over the loan term, ideal for long-term investors seeking complete control and potential appreciation. Fractional ownership divides property costs and usage among multiple investors, lowering entry barriers while sharing expenses and risks. Assess your financial capacity, investment goals, and risk tolerance to determine whether traditional mortgage or fractional ownership better matches your real estate strategy.

Related Important Terms

Tokenized Mortgages

Tokenized mortgages leverage blockchain technology to transform traditional mortgage lending by dividing loan ownership into digital tokens, enabling fractional investors to participate with lower capital. This innovation enhances liquidity and transparency compared to conventional fractional ownership models, streamlining property financing and expanding access to real estate investment.

Crowdfunded Fractional Ownership

Crowdfunded fractional ownership in real estate allows multiple investors to collectively purchase and hold equity in a property, reducing the individual capital required compared to traditional mortgages. This model offers increased liquidity and lower entry barriers, contrasting with mortgages that involve full ownership and long-term debt obligations.

Mortgage-Backed NFTs

Mortgage-backed NFTs revolutionize real estate investment by tokenizing mortgage assets, enabling fractional ownership with enhanced liquidity and transparency on blockchain platforms. This innovation offers investors direct exposure to mortgage cash flows while reducing traditional barriers associated with property financing and management.

Shared Equity Agreements

Shared Equity Agreements offer a flexible alternative to traditional mortgages by allowing homeowners to share property appreciation with investors in exchange for reduced upfront costs. This model enables easier access to real estate ownership without the full debt burden of a mortgage, making it ideal for buyers seeking cooperative investment options.

Rent-to-Own Fractionals

Rent-to-own fractional ownership offers a flexible pathway to real estate investment by allowing buyers to gradually build equity through rent payments while sharing property costs with other owners. This model reduces upfront financial barriers compared to traditional mortgages, making homeownership more accessible and affordable in high-value markets.

Digital Mortgage Origination

Digital mortgage origination streamlines the approval process for both traditional mortgages and fractional ownership investments by utilizing automated data verification and electronic document submission. This technology accelerates access to real estate financing, reduces underwriting errors, and enhances transparency for investors participating in fractional ownership models.

Instant Ownership Transfer

Instant ownership transfer in fractional ownership allows multiple investors to acquire and trade real estate shares without lengthy approval processes, unlike traditional mortgage transactions that require full ownership transfer through legal and financial scrutiny. This streamlined process enhances liquidity and flexibility for investors seeking swift entry or exit in real estate markets.

Blockchain Fractionalization

Blockchain fractionalization transforms property investment by dividing real estate assets into digital tokens, enabling affordable partial ownership and increased liquidity compared to traditional mortgages that require full loan commitments. This decentralized approach enhances transparency, reduces transaction costs, and democratizes access to high-value real estate markets.

Mortgage Pool Investing

Mortgage pool investing offers diversified exposure to real estate debt by combining multiple mortgages into a single investment vehicle, reducing risk compared to individual mortgage loans. Fractional ownership divides property equity among investors but lacks the cash flow potential and risk mitigation inherent in mortgage pool investments.

Smart Contract Lending

Smart contract lending in mortgage and fractional ownership streamlines transactions by automating loan agreements and payments through blockchain technology, enhancing transparency and reducing reliance on intermediaries. This innovation lowers costs, expedites process timelines, and increases security for real estate investors leveraging decentralized finance solutions.

Mortgage vs Fractional Ownership Infographic

industrydif.com

industrydif.com