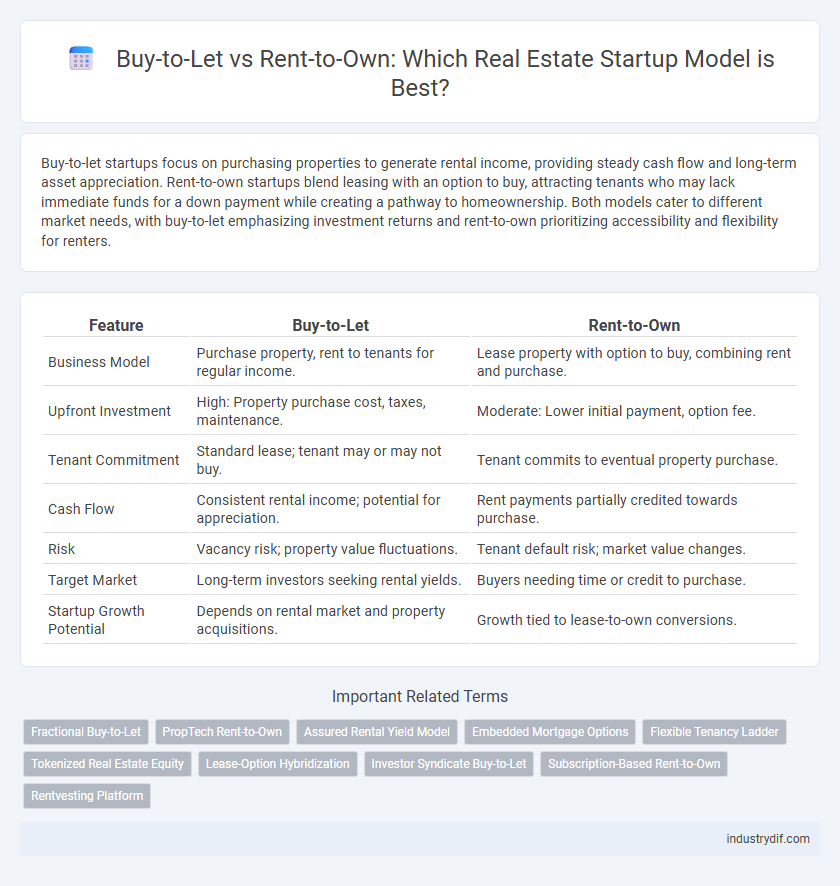

Buy-to-let startups focus on purchasing properties to generate rental income, providing steady cash flow and long-term asset appreciation. Rent-to-own startups blend leasing with an option to buy, attracting tenants who may lack immediate funds for a down payment while creating a pathway to homeownership. Both models cater to different market needs, with buy-to-let emphasizing investment returns and rent-to-own prioritizing accessibility and flexibility for renters.

Table of Comparison

| Feature | Buy-to-Let | Rent-to-Own |

|---|---|---|

| Business Model | Purchase property, rent to tenants for regular income. | Lease property with option to buy, combining rent and purchase. |

| Upfront Investment | High: Property purchase cost, taxes, maintenance. | Moderate: Lower initial payment, option fee. |

| Tenant Commitment | Standard lease; tenant may or may not buy. | Tenant commits to eventual property purchase. |

| Cash Flow | Consistent rental income; potential for appreciation. | Rent payments partially credited towards purchase. |

| Risk | Vacancy risk; property value fluctuations. | Tenant default risk; market value changes. |

| Target Market | Long-term investors seeking rental yields. | Buyers needing time or credit to purchase. |

| Startup Growth Potential | Depends on rental market and property acquisitions. | Growth tied to lease-to-own conversions. |

Buy-to-Let vs Rent-to-Own: Key Definitions

Buy-to-let involves purchasing a property specifically to lease it out to tenants, generating rental income and potential capital appreciation. Rent-to-own is a hybrid model where tenants rent with the option to purchase the property later, combining rental payments with equity buildup. Understanding the distinctions in cash flow, tenant commitment, and property ownership timelines is crucial for startups deciding between these real estate investment strategies.

Market Trends in Buy-to-Let and Rent-to-Own

The buy-to-let market continues to expand, driven by increasing rental demand and favorable tax incentives for property investors, while rent-to-own startups capitalize on rising homeownership barriers and shifting consumer preferences toward flexible purchasing options. Technological advancements in proptech streamline tenant-landlord interactions in buy-to-let, whereas rent-to-own platforms emphasize credit accessibility and personalized payment plans to attract underserved markets. Rising urbanization and economic uncertainties reinforce the appeal of both models, but rent-to-own demonstrates faster growth potential by addressing affordability challenges in competitive housing markets.

Investment Strategies: Buy-to-Let vs Rent-to-Own

Buy-to-let investments generate steady rental income and long-term capital appreciation by purchasing properties to lease to tenants, requiring significant initial capital and management efforts. Rent-to-own strategies attract tenants seeking eventual homeownership, offering higher monthly payments that combine rent with option fees, potentially reducing vacancy rates and enhancing cash flow stability. Evaluating market demand, tenant profiles, and financial goals is crucial for choosing between immediate rental income from buy-to-let and the potential equity buildup in rent-to-own models.

Financial Implications for Investors

Buy-to-let investments typically require substantial upfront capital for property purchase and ongoing maintenance costs, generating rental income subject to tax liabilities and market fluctuations. Rent-to-own models often involve lower initial investment and provide steady cash flow through option fees and monthly payments, potentially increasing returns if tenants convert to buyers. Investors must assess risk tolerance, liquidity needs, and long-term financial projections to determine the optimal strategy for maximizing ROI in dynamic real estate markets.

Pros and Cons for Tenants and Buyers

Buy-to-let properties offer tenants stable rental agreements with fewer financial commitments, while buyers benefit from predictable rental income and property appreciation, though landlords face risks like property maintenance and vacancy periods. Rent-to-own schemes enable tenants to accumulate equity and eventually own the home, providing a pathway to ownership despite credit challenges, but these agreements often come with higher monthly payments and complex contract terms that can pose risks to buyers. Tenants in rent-to-own arrangements may find increased flexibility and contractual rights compared to traditional leases, whereas buy-to-let tenants typically experience less flexibility but more straightforward rental conditions.

Regulatory Landscape for Each Model

Buy-to-let startups operate within established landlord-tenant regulations, requiring compliance with property safety standards, rental licensing, and tax obligations, such as income declaration on rental earnings. Rent-to-own models face additional regulatory scrutiny involving contract transparency, consumer protection laws, and often more complex legal frameworks governing option fees and purchase agreements. Navigating these regulatory landscapes is critical for startups to mitigate legal risks and ensure operational legitimacy in their respective real estate markets.

Risk Assessment: Buy-to-Let vs Rent-to-Own

Buy-to-let investments carry risks such as tenant default, property maintenance costs, and market volatility impacting rental income. Rent-to-own startups face challenges including buyer creditworthiness, contract enforcement complexity, and property value fluctuations during the lease period. An effective risk assessment involves analyzing tenant reliability, legal frameworks, and local real estate market trends to mitigate potential financial losses in both models.

Tenant Experience and Ownership Pathways

Buy-to-let models offer tenants straightforward rental agreements but limit opportunities for ownership, often leading to long-term occupancy without equity gains. Rent-to-own startups enhance tenant experience by combining rental payments with a pathway to ownership, fostering financial commitment and gradual equity accumulation. This approach improves tenant satisfaction and builds wealth by aligning rental costs with future property ownership goals.

Emerging Startups in Buy-to-Let and Rent-to-Own

Emerging startups in the buy-to-let sector leverage technology to provide data-driven property management and tenant screening solutions, enhancing rental income stability for investors. Rent-to-own startups focus on alternative homeownership pathways by integrating flexible payment plans and digital marketplaces that attract underserved tenants seeking eventual ownership. Both models utilize AI and blockchain technology to increase transparency, reduce transaction costs, and improve user experience in the evolving real estate market.

Future Outlook: Which Model Is Set to Grow?

The buy-to-let market is projected to experience steady growth driven by high rental demand and investor confidence in long-term property appreciation. Rent-to-own schemes show potential in expanding affordability and attracting underserved renters seeking homeownership pathways, especially in regions with rising housing prices. Innovations in fintech and regulatory support are likely to influence the scalability and sustainability of both models in the evolving real estate landscape.

Related Important Terms

Fractional Buy-to-Let

Fractional Buy-to-Let allows multiple investors to share ownership of rental properties, reducing individual capital requirements and diversifying risk, making it a scalable alternative to traditional Buy-to-Let models. Rent-to-own startups focus on tenant pathways to ownership but fractional Buy-to-Let leverages technology to optimize rental income distribution and asset management for investors.

PropTech Rent-to-Own

PropTech Rent-to-Own startups revolutionize real estate by enabling tenants to build equity while renting, bridging the gap between traditional buy-to-let investments and homeownership. This model attracts investors seeking steady rental income with potential asset appreciation and provides renters a pathway to ownership without immediate mortgage commitments.

Assured Rental Yield Model

The Assured Rental Yield Model in buy-to-let startups guarantees landlords a fixed rental income, reducing investment risk and providing predictable cash flow. Rent-to-own startups leverage this model to attract tenants by offering future ownership options while ensuring steady payments, enhancing tenant retention and investor confidence.

Embedded Mortgage Options

Buy-to-let startups typically offer investors embedded mortgage options that streamline property financing, enhancing cash flow management and optimizing rental yields. Rent-to-own models integrate embedded mortgage solutions to facilitate gradual homeownership, reducing entry barriers and fostering long-term tenant commitment.

Flexible Tenancy Ladder

The Flexible Tenancy Ladder model offers a seamless transition between renting and ownership, enabling tenants to gradually build equity while maintaining rental flexibility. This approach combines the stability of buy-to-let investments with the accessibility of rent-to-own schemes, appealing to both landlords seeking steady income and tenants aiming for eventual homeownership.

Tokenized Real Estate Equity

Tokenized real estate equity enables buy-to-let and rent-to-own startups to fractionalize property ownership, increasing liquidity and accessibility for investors. This blockchain-based approach streamlines property transactions, enhances transparency, and allows stakeholders to trade equity tokens representing real estate assets efficiently.

Lease-Option Hybridization

Lease-option hybridization merges buy-to-let investment benefits with rent-to-own flexibility, allowing investors to secure steady rental income while offering tenants a path to homeownership through option contracts. This innovative model enhances cash flow stability and tenant retention by integrating lease agreements with potential purchase options, optimizing real estate portfolio performance.

Investor Syndicate Buy-to-Let

Investor syndicate buy-to-let offers pooled capital investment in rental properties, maximizing returns through economies of scale and risk diversification. Compared to rent-to-own startups, this model provides investors with consistent rental income and long-term asset appreciation without tenant management complexities.

Subscription-Based Rent-to-Own

Subscription-based rent-to-own startups offer a flexible alternative to traditional buy-to-let investments by enabling tenants to build equity through monthly payments while landlords receive steady income without the typical risks of property vacancies. This model leverages digital platforms to streamline tenant onboarding, automate payments, and provide real-time equity tracking, attracting both tech-savvy renters and investors seeking innovative real estate opportunities.

Rentvesting Platform

Rentvesting platforms enable investors to build property portfolios while renting their primary residence, offering flexibility and market entry with lower upfront costs compared to traditional buy-to-let models. These platforms leverage technology to match renters with investment properties, optimizing cash flow and long-term asset growth in competitive real estate markets.

Buy-to-let vs Rent-to-own startup Infographic

industrydif.com

industrydif.com