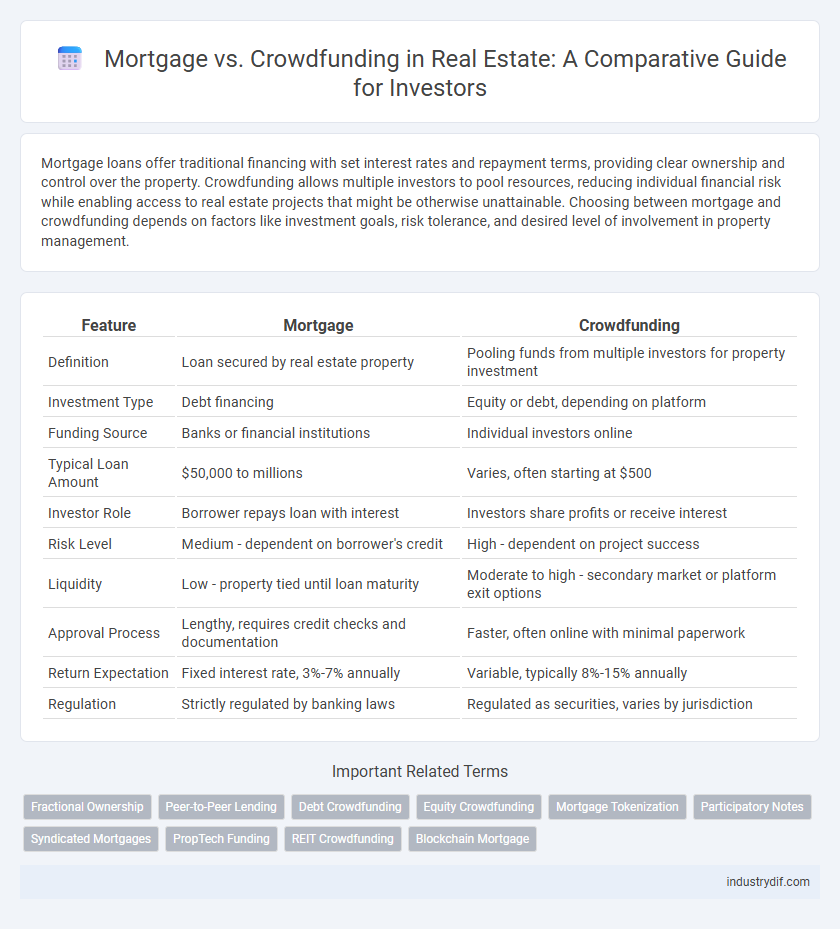

Mortgage loans offer traditional financing with set interest rates and repayment terms, providing clear ownership and control over the property. Crowdfunding allows multiple investors to pool resources, reducing individual financial risk while enabling access to real estate projects that might be otherwise unattainable. Choosing between mortgage and crowdfunding depends on factors like investment goals, risk tolerance, and desired level of involvement in property management.

Table of Comparison

| Feature | Mortgage | Crowdfunding |

|---|---|---|

| Definition | Loan secured by real estate property | Pooling funds from multiple investors for property investment |

| Investment Type | Debt financing | Equity or debt, depending on platform |

| Funding Source | Banks or financial institutions | Individual investors online |

| Typical Loan Amount | $50,000 to millions | Varies, often starting at $500 |

| Investor Role | Borrower repays loan with interest | Investors share profits or receive interest |

| Risk Level | Medium - dependent on borrower's credit | High - dependent on project success |

| Liquidity | Low - property tied until loan maturity | Moderate to high - secondary market or platform exit options |

| Approval Process | Lengthy, requires credit checks and documentation | Faster, often online with minimal paperwork |

| Return Expectation | Fixed interest rate, 3%-7% annually | Variable, typically 8%-15% annually |

| Regulation | Strictly regulated by banking laws | Regulated as securities, varies by jurisdiction |

Understanding Traditional Mortgages in Real Estate

Traditional mortgages in real estate involve a loan provided by banks or financial institutions, requiring a down payment and fixed or adjustable interest rates over a set term. Borrowers must meet credit score criteria, income verification, and collateral requirements to secure financing. This conventional lending method offers structured repayment schedules and legal protections, distinguishing it from emerging alternatives like real estate crowdfunding.

Introduction to Real Estate Crowdfunding

Real estate crowdfunding allows multiple investors to pool capital online, enabling access to property investments with lower entry costs compared to traditional mortgages. This funding method leverages digital platforms to offer diversified portfolios, reduced barriers, and potential passive income without the need for direct property ownership. Unlike conventional mortgage loans that require individual credit evaluations and long-term debt commitments, crowdfunding democratizes real estate opportunities for both small and large investors.

Key Differences Between Mortgages and Crowdfunding

Mortgages involve borrowing a fixed amount from a lender with scheduled repayments and interest rates, typically secured by the property itself, ensuring legal ownership transfer upon completion. Crowdfunding in real estate pools funds from multiple investors to finance a property or project, offering shared ownership or profit participation without traditional loan obligations. The primary differences lie in risk distribution, investment control, and repayment structure, with mortgages providing predictable terms and crowdfunding offering collective investment opportunities and potential for higher returns but increased variability.

Eligibility Criteria: Mortgages vs Crowdfunding

Mortgage eligibility criteria typically require a strong credit score, stable income, and a low debt-to-income ratio to qualify for traditional bank loans. Crowdfunding platforms often have more flexible requirements, allowing a broader range of investors to participate with smaller capital contributions and fewer credit checks. While mortgages demand personal financial stability, crowdfunding eligibility emphasizes collective investment and project credibility.

Investment Process Comparison

Mortgage investment involves securing loans through banks or financial institutions, requiring credit evaluation and fixed repayment terms, while crowdfunding pools capital from multiple investors via online platforms, allowing fractional ownership with variable contributions. Mortgage investors typically experience a more structured and traditional process with predictable cash flows, whereas crowdfunding offers greater accessibility and diversification opportunities but with higher variability in returns and regulatory oversight. Both methods demand due diligence, but crowdfunding often involves evaluating numerous smaller projects, contrasting with the singular, large-scale commitment seen in mortgage financing.

Risk and Return Profiles

Mortgage investments typically offer lower risk due to secured debt and predictable interest payments, resulting in steady but modest returns. Crowdfunding real estate projects present higher risk through equity exposure and project variability, which can yield significantly higher returns if the development succeeds. Investors must weigh the stability of mortgage-backed securities against the potential for amplified gains and losses inherent in crowdfunding ventures.

Regulatory Considerations

Mortgage financing is heavily regulated by federal and state laws such as the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), ensuring borrower transparency and consumer protections. Crowdfunding platforms for real estate investments must comply with securities regulations enforced by the SEC, including the JOBS Act provisions, which govern investor eligibility and disclosure requirements. Understanding regulatory frameworks is critical for investors to navigate risks, compliance obligations, and legal protections in both mortgage and crowdfunding real estate transactions.

Accessibility for Investors and Buyers

Mortgage financing offers traditional accessibility for individual buyers with established credit and income, while real estate crowdfunding platforms democratize investment by allowing smaller contributions from a broader range of investors. Crowdfunding lowers entry barriers, enabling access to diverse property portfolios without the need for full ownership or large capital outlays. This shift enhances market participation, especially for first-time investors and buyers seeking alternative funding sources in the real estate sector.

Scalability in Real Estate Financing

Mortgage financing offers scalability through traditional bank loans and fixed interest rates, allowing individual investors to leverage significant capital for property acquisition. Crowdfunding platforms enhance scalability by pooling resources from numerous investors, enabling access to larger real estate projects with diversified risk. Both methods provide distinct scalability advantages, with mortgages favoring individual leverage and crowdfunding promoting collective investment growth.

Future Trends in Real Estate Funding Models

Emerging real estate funding models are shifting from traditional mortgages toward crowdfunding platforms, which democratize investment and offer increased capital access to diverse investors. Crowdfunding leverages technology to streamline the funding process, reduce entry barriers, and enable fractional ownership, driving higher liquidity in the real estate market. As digital innovation continues, hybrid models integrating blockchain and smart contracts are expected to enhance transparency, security, and efficiency in future real estate financing.

Related Important Terms

Fractional Ownership

Fractional ownership through real estate crowdfunding allows investors to acquire a percentage of a property without the need for traditional mortgage financing or large capital outlays. This model diversifies risk and increases accessibility, contrasting with mortgages that require full property loans and credit qualifications.

Peer-to-Peer Lending

Peer-to-peer lending in real estate offers a decentralized alternative to traditional mortgages by connecting borrowers directly with individual investors, often resulting in faster approvals and competitive interest rates. This model enhances access to capital for homebuyers and real estate developers while providing investors with diversified opportunities and potential returns linked to property values.

Debt Crowdfunding

Debt crowdfunding in real estate offers investors fixed-income opportunities by directly lending to property developers or buyers, often yielding higher returns compared to traditional mortgages. This financing model mitigates risks through diversified loan portfolios and streamlined approval processes, making it an attractive alternative to conventional mortgage lending.

Equity Crowdfunding

Equity crowdfunding in real estate allows investors to acquire partial ownership stakes in properties, offering potential for rental income and capital appreciation, unlike traditional mortgages that require significant upfront capital and debt obligations. This innovative financing method democratizes access to high-value real estate investments by pooling smaller contributions from multiple investors, enhancing portfolio diversification and risk spread.

Mortgage Tokenization

Mortgage tokenization transforms traditional mortgage assets into digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity compared to conventional mortgage lending. This innovation bridges the gap between mortgage financing and crowdfunding by allowing a broader range of investors to participate in real estate debt markets with enhanced transparency and reduced transaction costs.

Participatory Notes

Mortgage financing typically involves borrowing directly from lenders with fixed interest rates and set repayment schedules, while crowdfunding leverages participatory notes, allowing investors to buy shares in real estate projects without full property ownership. Participatory notes in crowdfunding offer liquidity and portfolio diversification opportunities, often attracting smaller investors seeking access to large-scale real estate ventures.

Syndicated Mortgages

Syndicated mortgages pool funds from multiple investors to finance real estate projects, offering higher returns and shared risk compared to traditional single-lender mortgages. This method contrasts with crowdfunding by involving fewer investors with larger capital contributions and often more direct control over property management.

PropTech Funding

Mortgage financing remains a traditional cornerstone in real estate, offering structured loans secured by property to facilitate ownership transfer; crowdfunding, energized by PropTech innovations, democratizes investment opportunities by pooling capital from numerous investors, enhancing accessibility and diversification. The integration of blockchain and AI in PropTech platforms streamlines due diligence and transaction transparency, positioning crowdfunding as a competitive alternative to conventional mortgage models for property acquisition and development funding.

REIT Crowdfunding

REIT crowdfunding enables investors to pool funds for diversified real estate portfolios without the hefty capital required for traditional mortgages, offering fractional ownership and liquidity through publicly traded shares. Unlike mortgages that involve debt financing and monthly payments, REIT crowdfunding focuses on equity investment, providing potential dividends and capital appreciation tied to the real estate market performance.

Blockchain Mortgage

Blockchain mortgage platforms leverage decentralized ledger technology to enhance transparency, reduce processing time, and lower costs compared to traditional mortgages and real estate crowdfunding. These platforms enable secure, peer-to-peer lending and streamline property transactions by utilizing smart contracts, providing borrowers and investors with greater trust and efficiency in real estate financing.

Mortgage vs Crowdfunding Infographic

industrydif.com

industrydif.com