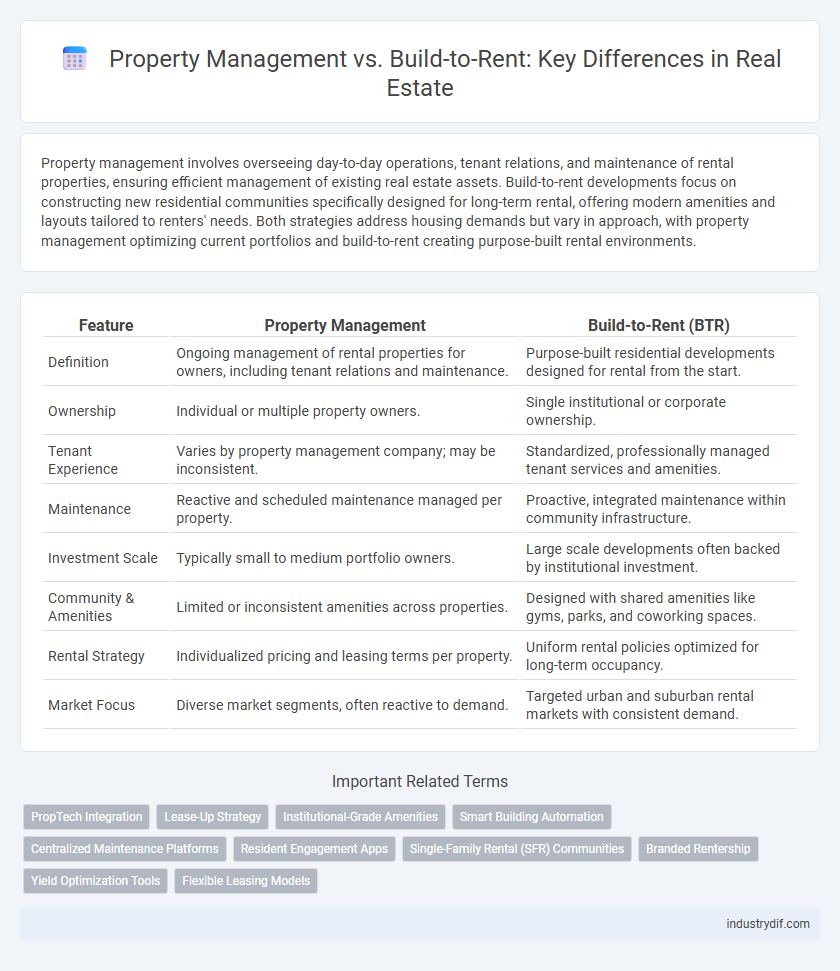

Property management involves overseeing day-to-day operations, tenant relations, and maintenance of rental properties, ensuring efficient management of existing real estate assets. Build-to-rent developments focus on constructing new residential communities specifically designed for long-term rental, offering modern amenities and layouts tailored to renters' needs. Both strategies address housing demands but vary in approach, with property management optimizing current portfolios and build-to-rent creating purpose-built rental environments.

Table of Comparison

| Feature | Property Management | Build-to-Rent (BTR) |

|---|---|---|

| Definition | Ongoing management of rental properties for owners, including tenant relations and maintenance. | Purpose-built residential developments designed for rental from the start. |

| Ownership | Individual or multiple property owners. | Single institutional or corporate ownership. |

| Tenant Experience | Varies by property management company; may be inconsistent. | Standardized, professionally managed tenant services and amenities. |

| Maintenance | Reactive and scheduled maintenance managed per property. | Proactive, integrated maintenance within community infrastructure. |

| Investment Scale | Typically small to medium portfolio owners. | Large scale developments often backed by institutional investment. |

| Community & Amenities | Limited or inconsistent amenities across properties. | Designed with shared amenities like gyms, parks, and coworking spaces. |

| Rental Strategy | Individualized pricing and leasing terms per property. | Uniform rental policies optimized for long-term occupancy. |

| Market Focus | Diverse market segments, often reactive to demand. | Targeted urban and suburban rental markets with consistent demand. |

Definition of Property Management

Property management involves the operation, control, and oversight of real estate assets on behalf of the owner, including tenant relations, maintenance, rent collection, and compliance with regulations. It encompasses both residential and commercial properties, ensuring optimal functionality and value retention through day-to-day management tasks. This contrasts with build-to-rent models that focus on the development and ownership of new rental housing specifically designed for long-term leasing.

What is Build-to-Rent (BTR)?

Build-to-Rent (BTR) refers to residential developments specifically designed and constructed for the rental market, offering professionally managed properties with amenities tailored to long-term tenants. Unlike traditional property management, which oversees leasing and maintenance of existing homes, BTR projects provide purpose-built rental communities that enhance tenant experience and investor returns. These developments often include features such as communal spaces, on-site management, and integrated technology to meet the demands of modern renters.

Key Differences Between Property Management and BTR

Property management involves overseeing rental properties on behalf of owners, including tenant relations, maintenance, and rent collection, whereas build-to-rent (BTR) refers to purpose-built residential communities designed specifically for rental living. Key differences include ownership and scale, with property management applicable to individual or portfolio properties, while BTR operates on a large scale with integrated community amenities and long-term rental strategies. BTR developments often offer higher design standards, professional management, and consistent rental income, contrasting with the varied quality and management styles in traditional property management.

Investment Models: Traditional vs Build-to-Rent

Traditional property management investment models rely on acquiring and managing individual rental units or portfolios, generating income through tenant leases and ongoing maintenance. Build-to-Rent (BTR) developments focus on purpose-built residential communities designed for long-term rental, offering scalable returns and higher operational efficiencies. BTR models attract institutional investors seeking stable cash flow, reduced vacancy risk, and enhanced control over property quality and tenant experience.

Ownership Structure in Property Management vs BTR

Property management typically involves multiple ownership structures, including individual landlords, real estate investment trusts (REITs), and third-party management firms overseeing rental properties owned by various investors. Build-to-rent (BTR) developments are often owned by institutional investors or large-scale firms that maintain full ownership and operational control, creating purpose-built rental communities designed for long-term tenancy. The centralized ownership in BTR contrasts with the fragmented ownership in traditional property management, enabling streamlined decision-making and consistent tenant experiences.

Operational Efficiencies: Comparing Property Management and BTR

Operational efficiencies in property management revolve around maintenance coordination, tenant communication, and rent collection processes, leveraging technology to streamline workflows and reduce costs. Build-to-Rent (BTR) models enhance operational efficiency by integrating design, construction, and management under one entity, enabling standardized maintenance, bulk procurement, and consistent tenant services across multiple units. BTR communities benefit from centralized management platforms and predictive maintenance strategies that lower downtime and optimize resource allocation compared to traditional property management.

Tenant Experience in Property Management vs BTR

Property management emphasizes personalized tenant services, including timely maintenance responses and community engagement, enhancing resident satisfaction and retention. Build-to-rent (BTR) developments integrate modern amenities and technology-driven conveniences designed for long-term tenant comfort and lifestyle needs. Tenant experience in property management relies on active landlord-tenant communication, while BTR focuses on seamless, integrated living environments that promote convenience and social connectivity.

Revenue Streams and Profitability

Property management generates steady income through rent collection, maintenance fees, and tenant services, ensuring consistent cash flow and tenant retention. Build-to-rent developments often provide higher long-term profitability by leveraging scale, brand consistency, and premium rents on purpose-built communities. Both models optimize revenue streams differently, with property management focusing on operational efficiency and build-to-rent on asset appreciation and large-scale occupancy.

Market Trends: Growth of Build-to-Rent

The build-to-rent sector is experiencing significant growth, driven by rising demand for professionally managed rental homes that offer modern amenities and stable tenancy. Market trends indicate a shift towards institutional investment in purpose-built rental communities, differentiating from traditional property management by focusing on long-term rental assets rather than single-unit portfolios. This evolution reflects changing consumer preferences and a broader industry move toward scalable, investor-backed rental housing solutions.

Choosing the Right Approach: Property Management or BTR

Choosing between property management and build-to-rent (BTR) depends on investment goals and operational preferences. Property management suits investors seeking flexibility in tenant selection and property types, providing ongoing oversight and maintenance services. BTR offers a scalable, purpose-built rental solution designed for long-term income stability and streamlined management within dedicated communities.

Related Important Terms

PropTech Integration

Property management leverages advanced PropTech platforms to streamline tenant communication, automate maintenance scheduling, and optimize rent collection, enhancing operational efficiency and resident satisfaction. Build-to-rent developments integrate smart technologies from design to occupancy, embedding IoT devices and data analytics to improve asset performance and enable predictive maintenance throughout the property lifecycle.

Lease-Up Strategy

Lease-up strategy in Property Management emphasizes maximizing tenant retention and optimizing rental income through targeted marketing and efficient turnover processes, whereas Build-to-Rent lease-up focuses on rapid occupancy by leveraging new construction appeal and tailored tenant incentives to establish market presence quickly. Data-driven analytics in Build-to-Rent accelerate lease-up velocity by forecasting demand and customizing lease terms, contrasting with traditional property management's reliance on established tenant databases and incremental lease renewals.

Institutional-Grade Amenities

Institutional-grade amenities in property management often include robust maintenance services, advanced security systems, and professionally managed community spaces designed to enhance resident experience. Build-to-rent developments emphasize these high-quality amenities by integrating purpose-built features such as smart home technology, fitness centers, and communal areas, appealing to long-term renters seeking convenience and comfort.

Smart Building Automation

Smart building automation enhances property management by optimizing energy efficiency, predictive maintenance, and tenant comfort, leading to reduced operational costs and increased asset value. In build-to-rent developments, integrating IoT-enabled smart systems from the design phase ensures seamless control over lighting, HVAC, and security, attracting tech-savvy renters and improving long-term investment returns.

Centralized Maintenance Platforms

Centralized maintenance platforms streamline property management by integrating service requests, vendor coordination, and real-time tracking into a single system, enhancing efficiency and tenant satisfaction. In build-to-rent developments, these platforms enable proactive maintenance scheduling and scalable operations, reducing downtime and operational costs across multiple rental units.

Resident Engagement Apps

Resident engagement apps in property management streamline communication, maintenance requests, and community events, enhancing tenant satisfaction and retention in multifamily housing. Build-to-rent developments leverage these apps to create tailored experiences that foster long-term residency and simplify property operations through integrated digital tools.

Single-Family Rental (SFR) Communities

Single-family rental (SFR) communities in build-to-rent developments offer purpose-built homes designed for long-term tenancy, enhancing tenant quality and community consistency. Property management in SFR communities focuses on maintenance, tenant relations, and maximizing rental income, making it essential for operational efficiency and asset value preservation.

Branded Rentership

Branded rentership in property management offers standardized services and amenities that enhance tenant experience, contrasting traditional build-to-rent developments by emphasizing community branding and operational excellence. Integrating branded rentership strategies drives higher tenant retention and rental yields through consistent quality and lifestyle-focused offerings.

Yield Optimization Tools

Yield optimization tools in property management leverage market analytics, dynamic pricing algorithms, and tenant behavior data to enhance rental income and minimize vacancies efficiently. Build-to-rent developments integrate these advanced tools with long-term asset strategies, maximizing yield through tailored amenities and scalable operational technologies that adapt to evolving renter demands.

Flexible Leasing Models

Property management offers flexible leasing models tailored to diverse tenant needs, including short-term, month-to-month, and customizable lease agreements that enhance occupancy rates and tenant satisfaction. Build-to-rent developments emphasize standardized, long-term leases designed to stabilize cash flow and foster community, balancing flexibility with consistency in rental income.

Property Management vs Build-to-Rent Infographic

industrydif.com

industrydif.com