Buy-and-hold real estate offers long-term wealth accumulation through property appreciation and rental income, requiring significant capital and management effort. Tokenized real estate enables fractional ownership via blockchain technology, providing liquidity, lower entry barriers, and faster transactions. Investors can diversify portfolios more efficiently by combining traditional buy-and-hold strategies with tokenized real estate opportunities.

Table of Comparison

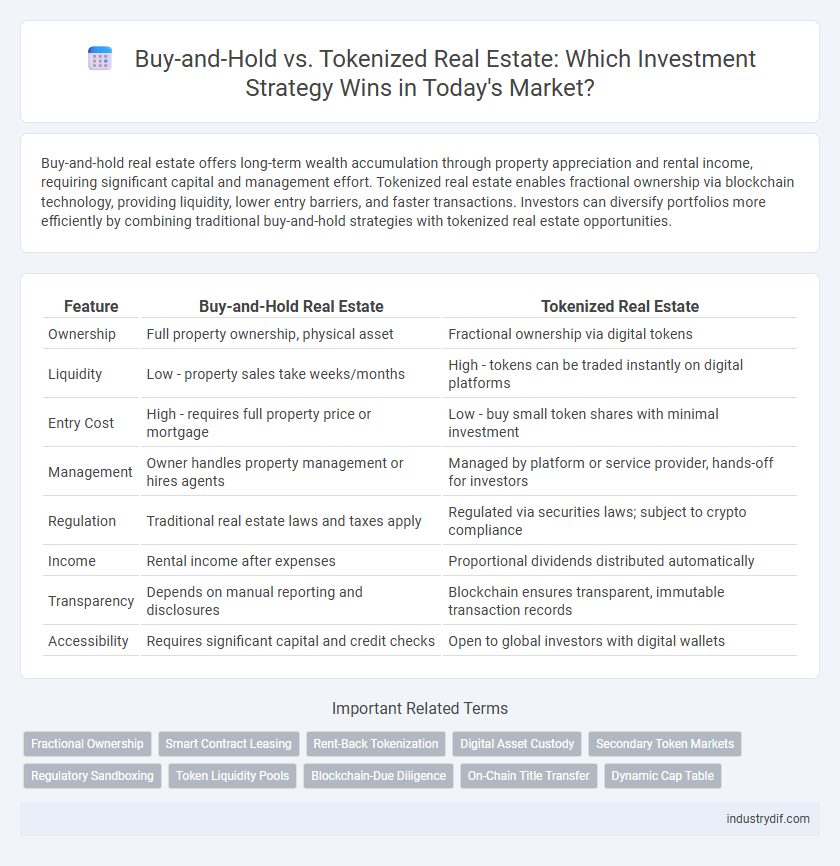

| Feature | Buy-and-Hold Real Estate | Tokenized Real Estate |

|---|---|---|

| Ownership | Full property ownership, physical asset | Fractional ownership via digital tokens |

| Liquidity | Low - property sales take weeks/months | High - tokens can be traded instantly on digital platforms |

| Entry Cost | High - requires full property price or mortgage | Low - buy small token shares with minimal investment |

| Management | Owner handles property management or hires agents | Managed by platform or service provider, hands-off for investors |

| Regulation | Traditional real estate laws and taxes apply | Regulated via securities laws; subject to crypto compliance |

| Income | Rental income after expenses | Proportional dividends distributed automatically |

| Transparency | Depends on manual reporting and disclosures | Blockchain ensures transparent, immutable transaction records |

| Accessibility | Requires significant capital and credit checks | Open to global investors with digital wallets |

Defining Buy-and-Hold Real Estate Strategy

Buy-and-hold real estate strategy involves purchasing properties to rent out or hold for long-term appreciation, generating steady passive income and potential capital gains. Investors rely on market appreciation, rental cash flow, and tax benefits such as depreciation deductions and mortgage interest write-offs. This traditional approach contrasts with tokenized real estate, which enables fractional ownership and increased liquidity through blockchain technology.

What Is Tokenized Real Estate?

Tokenized real estate refers to the process of converting ownership rights of a property into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. This innovation allows investors to buy, sell, or trade stakes in real estate assets with reduced barriers compared to traditional buy-and-hold strategies. By democratizing access and streamlining transactions, tokenized real estate transforms investment dynamics in the property market.

Key Differences: Traditional vs Tokenized Assets

Buy-and-hold real estate involves acquiring physical properties and holding them long-term to generate rental income and capital appreciation. Tokenized real estate converts property ownership into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and easier transferability. Traditional assets demand higher entry costs and longer transaction times, while tokenized assets offer enhanced accessibility, faster settlement, and lower barriers for investors.

Ownership Structures Compared

Traditional buy-and-hold real estate involves direct ownership of physical property, granting full control, rental income, and appreciation benefits, but requires significant capital and management effort. Tokenized real estate divides property ownership into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and lower entry barriers for investors. Both structures affect legal rights, transferability, and regulatory compliance, with tokenization offering enhanced flexibility and democratization of real estate investment.

Liquidity: Buy-and-Hold vs Tokenization

Buy-and-hold real estate investments typically involve low liquidity, as selling physical properties can take months due to transaction complexities and market conditions. Tokenized real estate offers enhanced liquidity by enabling fractional ownership and faster trades on blockchain platforms, allowing investors to buy or sell asset tokens quickly. This digital approach reduces barriers to entry and exit, improving market accessibility compared to traditional buy-and-hold strategies.

Accessibility and Minimum Investment

Buy-and-hold real estate typically requires substantial capital, often limiting accessibility to affluent investors due to high minimum investment thresholds. Tokenized real estate platforms reduce entry barriers by allowing fractional ownership, enabling investors to participate with significantly lower minimum investments often starting at a few hundred dollars. This innovation democratizes access to real estate markets, expanding opportunities for diversified portfolio growth across broader investor demographics.

Risk Profiles and Investor Protection

Buy-and-hold real estate typically involves long-term market risks, property management challenges, and liquidity constraints, while tokenized real estate offers enhanced liquidity and fractional ownership but carries regulatory uncertainties and cybersecurity risks. Investor protection in buy-and-hold is rooted in tangible asset control and conventional legal frameworks, whereas tokenized real estate relies on smart contracts, blockchain transparency, and compliance with evolving securities regulations. Balancing risk profiles requires assessing traditional real estate's stability against the innovative yet complex nature of tokenized platforms.

Legal and Regulatory Considerations

Buy-and-hold real estate investments typically involve well-established legal frameworks, including property deeds, landlord-tenant laws, and local zoning regulations that investors must navigate. Tokenized real estate operates under emerging regulatory environments, often subject to securities laws and compliance requirements enforced by bodies like the SEC, demanding thorough due diligence on token offerings and smart contract legality. Understanding the differences in jurisdiction-specific property rights and digital asset regulations is essential for mitigating legal risks in both investment models.

Income Potential and Exit Strategies

Buy-and-hold real estate offers steady rental income and long-term property appreciation, appealing to investors seeking consistent cash flow and eventual asset liquidation. Tokenized real estate provides enhanced liquidity through fractional ownership and simplified exit strategies, enabling investors to trade shares on digital platforms with potentially quicker returns. Income potential in tokenized assets may vary based on platform fees and market liquidity, while traditional buy-and-hold investments benefit from established rental economies and depreciation tax advantages.

Future Trends in Property Investment

Buy-and-hold real estate remains a foundational investment strategy with long-term appreciation and rental income stability. Tokenized real estate introduces liquidity and fractional ownership, enabling diverse portfolios and lower entry barriers. Future trends point to increased integration of blockchain technology in property investment, enhancing transparency and access for global investors.

Related Important Terms

Fractional Ownership

Buy-and-hold real estate investment involves acquiring entire properties to generate long-term rental income and capital appreciation, often requiring significant capital and management responsibilities. Tokenized real estate offers fractional ownership by dividing properties into digital tokens, enabling investors to buy smaller stakes, increase liquidity, and diversify portfolios with lower entry costs.

Smart Contract Leasing

Smart contract leasing in tokenized real estate automates rental agreements, ensuring transparent, secure, and instantaneous execution of terms without intermediaries, significantly reducing administrative costs and disputes. Unlike traditional buy-and-hold strategies, this technology enables fractional ownership and seamless lease management, enhancing liquidity and accessibility for investors.

Rent-Back Tokenization

Rent-back tokenization combines traditional buy-and-hold real estate benefits with blockchain technology by enabling property owners to generate rental income while fractionalizing ownership through tokens, increasing liquidity and accessibility. This innovative model allows investors to earn steady cash flow and participate in real estate appreciation without full property management responsibilities, revolutionizing passive income strategies.

Digital Asset Custody

Buy-and-hold real estate requires physical property management and traditional custody solutions involving title deeds and escrow services, whereas tokenized real estate leverages blockchain technology for digital asset custody, enabling secure, transparent, and programmable ownership through smart contracts. Digital wallets and custodial services safeguard tokenized real estate assets by providing encryption, multi-signature authentication, and compliance with regulatory standards, enhancing liquidity and accessibility compared to conventional methods.

Secondary Token Markets

Secondary token markets enhance liquidity in tokenized real estate by enabling investors to buy and sell fractional property shares more efficiently compared to traditional buy-and-hold strategies, which often involve long-term illiquid assets. These markets facilitate real-time price discovery and lower entry barriers, attracting a broader investor base and potentially increasing asset accessibility and diversification.

Regulatory Sandboxing

Buy-and-hold real estate investments rely on traditional ownership models governed by well-established regulations, while tokenized real estate leverages blockchain technology subject to emerging regulatory sandbox frameworks that facilitate innovation by allowing temporary exemptions for compliance testing. Regulatory sandboxing enables tokenized real estate platforms to experiment with digital asset offerings under close supervision, promoting transparency and investor protection during the transition to more decentralized property investment structures.

Token Liquidity Pools

Token liquidity pools in tokenized real estate enable fractional ownership by aggregating multiple property tokens, enhancing market liquidity and allowing investors to buy or sell shares without the traditional constraints of buy-and-hold strategies. These pools facilitate instant trade execution and price discovery, significantly improving asset accessibility and portfolio diversification compared to conventional real estate investment models.

Blockchain-Due Diligence

Buy-and-hold real estate requires thorough traditional due diligence including property inspections, title verification, and market analysis, while tokenized real estate leverages blockchain technology for transparent, immutable records and streamlined investor verification. Blockchain due diligence enhances trust through smart contracts, automated compliance checks, and real-time transaction auditing, reducing risks associated with ownership and transfer.

On-Chain Title Transfer

On-chain title transfer in tokenized real estate enables instantaneous, transparent ownership changes recorded on a blockchain, reducing fraud risks and transaction costs compared to traditional buy-and-hold methods that rely on offline, paper-based title deeds. This digital approach enhances liquidity and offers fractional ownership opportunities, making real estate investment more accessible and efficient.

Dynamic Cap Table

Buy-and-hold real estate maintains a static cap table reflecting traditional ownership percentages, while tokenized real estate leverages blockchain technology to enable a dynamic cap table that adjusts in real-time based on fractionalized token transactions. This dynamic system enhances liquidity, transparency, and investor flexibility by allowing seamless transfer of ownership stakes without the need for conventional legal processes.

Buy-and-Hold vs Tokenized Real Estate Infographic

industrydif.com

industrydif.com