A fixed-rate mortgage offers borrowers predictable monthly payments with a consistent interest rate over the loan term, providing financial stability for homeowners. Green mortgages incentivize energy-efficient home improvements by offering lower interest rates or additional credit, supporting sustainable living while potentially increasing property value. Choosing between these options depends on whether you prioritize payment consistency or investing in eco-friendly upgrades that reduce long-term utility costs.

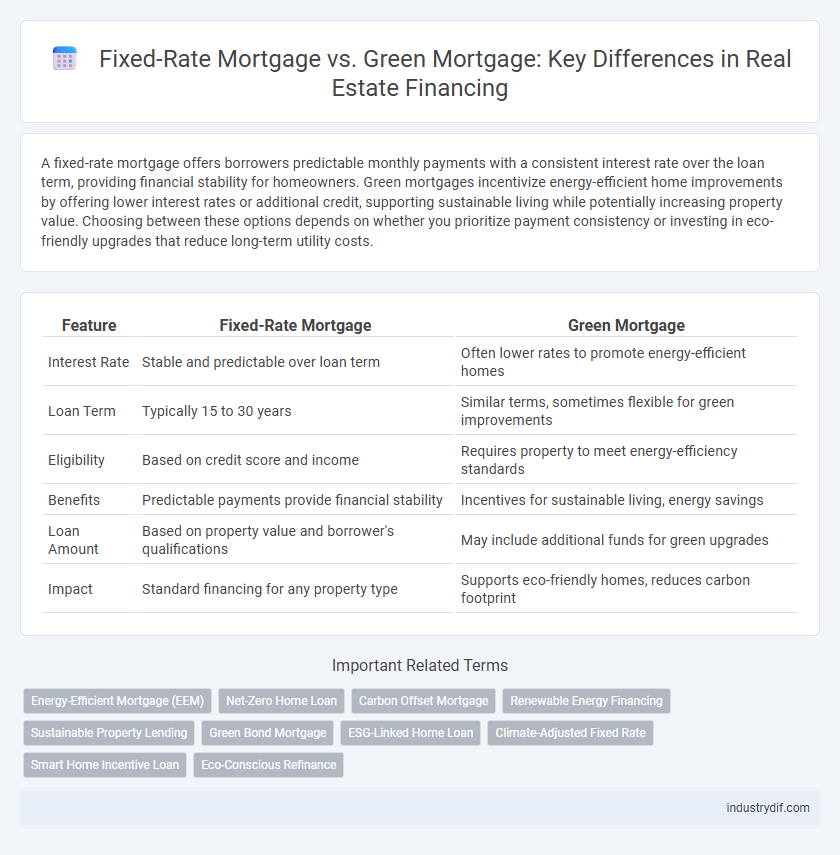

Table of Comparison

| Feature | Fixed-Rate Mortgage | Green Mortgage |

|---|---|---|

| Interest Rate | Stable and predictable over loan term | Often lower rates to promote energy-efficient homes |

| Loan Term | Typically 15 to 30 years | Similar terms, sometimes flexible for green improvements |

| Eligibility | Based on credit score and income | Requires property to meet energy-efficiency standards |

| Benefits | Predictable payments provide financial stability | Incentives for sustainable living, energy savings |

| Loan Amount | Based on property value and borrower's qualifications | May include additional funds for green upgrades |

| Impact | Standard financing for any property type | Supports eco-friendly homes, reduces carbon footprint |

Understanding Fixed-Rate Mortgages

A fixed-rate mortgage offers borrowers a stable interest rate and consistent monthly payments throughout the loan term, typically ranging from 15 to 30 years. This predictability helps homeowners budget effectively without worrying about fluctuating market rates. In contrast to green mortgages, which incentivize energy-efficient property improvements, fixed-rate loans prioritize financial stability over environmental benefits.

What is a Green Mortgage?

A green mortgage is a home loan designed to encourage energy-efficient improvements or the purchase of environmentally friendly properties. It often offers lower interest rates or incentives for homes with sustainable features such as solar panels, improved insulation, or energy-efficient appliances. This type of mortgage supports reduced utility costs and a smaller carbon footprint compared to traditional fixed-rate mortgages.

Key Differences Between Fixed-Rate and Green Mortgages

Fixed-rate mortgages provide a consistent interest rate and monthly payment over the loan term, offering financial stability and predictability for homeowners. Green mortgages often include incentives such as lower interest rates or additional loan amounts for energy-efficient home improvements, promoting sustainability and cost savings on utilities. The key difference lies in fixed-rate mortgages' emphasis on payment consistency, while green mortgages prioritize environmental benefits and long-term energy efficiency.

Interest Rates: Fixed vs Energy-Efficient Options

Fixed-rate mortgages offer consistent, predictable interest rates throughout the loan term, providing stability and easier budgeting for homeowners. Green mortgages often feature lower interest rates or incentives to encourage energy-efficient home improvements, potentially reducing long-term costs. Comparing the fixed interest rate's reliability with green mortgage benefits helps buyers balance financial security against energy savings.

Eligibility Requirements for Each Mortgage Type

Fixed-rate mortgages require a stable credit score typically above 620, steady income proof, and a debt-to-income ratio under 43% to qualify. Green mortgages demand similar credit standards but also mandate property eligibility criteria, such as energy-efficient certifications or compliance with environmental standards. Borrowers seeking green loans must provide documentation like Energy Star ratings or home energy audits for approval.

Environmental Impact and Sustainability

Fixed-rate mortgages offer predictable payments over time without directly influencing environmental outcomes, while green mortgages provide incentives for energy-efficient home improvements that reduce carbon footprints and promote sustainability. Borrowers choosing green mortgages often benefit from lower interest rates or down payment assistance when investing in solar panels, energy-efficient appliances, or sustainable building materials. The environmental impact of green mortgages aligns with global efforts to reduce greenhouse gas emissions and foster eco-friendly housing developments.

Long-Term Cost Benefits Comparison

Fixed-rate mortgages offer predictable monthly payments, shielding homeowners from interest rate fluctuations and ensuring stable budgeting over the loan term. Green mortgages provide incentives such as lower interest rates or higher loan limits for energy-efficient home improvements, potentially reducing utility costs and increasing property value over time. Comparing long-term cost benefits, green mortgages may offer greater overall savings by combining financing advantages with energy efficiency gains, while fixed-rate mortgages excel in payment stability and financial certainty.

Borrower Profiles: Who Should Choose Which?

Borrowers with stable incomes and long-term homeownership plans benefit most from fixed-rate mortgages due to predictable monthly payments and protection against interest rate fluctuations. Environmentally conscious buyers or those seeking energy-efficient homes should consider green mortgages, which often offer lower interest rates or incentives for purchasing or upgrading to sustainable properties. First-time buyers focused on budget certainty gravitate towards fixed rates, while eco-friendly homeowners prioritize green financing to support energy savings and environmental impact.

Incentives and Government Programs

Fixed-rate mortgages offer predictable monthly payments and stability over the loan term, while green mortgages provide incentives such as lower interest rates or reduced down payments for energy-efficient homes. Government programs like the Federal Housing Administration's Energy Efficient Mortgage (EEM) and VA's Energy Efficient Mortgage offer financial benefits to borrowers who purchase or improve environmentally friendly properties. These incentives aim to promote sustainable building practices by lowering borrowing costs and encouraging investment in energy-saving improvements.

Making the Right Mortgage Choice for Your Property

Choosing between a fixed-rate mortgage and a green mortgage depends on your long-term financial goals and property features. Fixed-rate mortgages offer predictable monthly payments and stability, ideal for buyers seeking consistent budgeting over the loan term. Green mortgages provide lower interest rates or incentives for energy-efficient homes, making them optimal for properties with sustainable upgrades and buyers prioritizing eco-friendly investments.

Related Important Terms

Energy-Efficient Mortgage (EEM)

A Fixed-Rate Mortgage offers consistent monthly payments with a stable interest rate over the loan term, providing financial predictability for homebuyers. An Energy-Efficient Mortgage (EEM) enables buyers to finance energy-saving improvements by incorporating additional funds into their mortgage, reducing utility costs and enhancing property value through increased energy efficiency.

Net-Zero Home Loan

Net-zero home loans, a subset of green mortgages, offer fixed-rate mortgage stability while incentivizing energy-efficient home purchases with lower interest rates and potential tax credits. Borrowers benefit from predictable monthly payments and reduced environmental impact by financing homes that meet stringent energy-saving standards, lowering long-term utility costs.

Carbon Offset Mortgage

Carbon offset mortgages, a subset of green mortgages, incentivize homebuyers to invest in energy-efficient properties by offering reduced interest rates tied to lower carbon footprints. Fixed-rate mortgages provide predictable payments unaffected by market fluctuations but lack specific environmental impact benefits associated with carbon offset financing.

Renewable Energy Financing

Fixed-rate mortgages offer stable interest rates over the loan term, ensuring predictable payments, while green mortgages provide specialized financing incentives for energy-efficient home upgrades and renewable energy installations. Renewable energy financing through green mortgages lowers utility costs and increases property value by supporting solar panels, geothermal systems, and other sustainable technologies.

Sustainable Property Lending

Fixed-rate mortgages offer borrowers predictable monthly payments with stable interest rates over the loan term, while green mortgages provide incentives such as lower interest rates or reduced fees for financing energy-efficient and environmentally sustainable properties. Sustainable property lending promotes eco-friendly home improvements and energy savings, aligning mortgage options with environmental goals and increasing the value of green real estate investments.

Green Bond Mortgage

Green Bond Mortgages offer environmentally focused financing, leveraging funds raised through green bonds to support energy-efficient home purchases with fixed interest rates, often lower than traditional fixed-rate mortgages due to incentives targeting sustainable properties. Unlike conventional fixed-rate mortgages, Green Bond Mortgages prioritize carbon footprint reduction and sustainable construction, appealing to eco-conscious buyers seeking long-term savings and environmental impact benefits.

ESG-Linked Home Loan

ESG-linked home loans integrate environmental, social, and governance criteria, offering borrowers lower fixed-rate mortgage interest rates when purchasing energy-efficient or sustainable properties. This innovative financing option encourages green building practices while providing the stability of a fixed-rate mortgage, optimizing long-term savings and supporting responsible real estate investments.

Climate-Adjusted Fixed Rate

Climate-adjusted fixed-rate mortgages integrate environmental risk factors into traditional fixed-rate terms, offering borrowers stable interest rates while incentivizing energy-efficient property investments. These loans leverage climate data to adjust rates based on a home's sustainability features, promoting greener real estate choices and long-term financial resilience amid shifting environmental regulations.

Smart Home Incentive Loan

A Fixed-Rate Mortgage offers predictable monthly payments with a stable interest rate over the loan term, while a Green Mortgage, such as the Smart Home Incentive Loan, provides financial benefits specifically for energy-efficient home improvements and sustainable upgrades. The Smart Home Incentive Loan often includes lower interest rates or rebates to encourage eco-friendly investments, making it ideal for buyers seeking long-term savings and environmental impact reduction.

Eco-Conscious Refinance

Opting for a green mortgage during an eco-conscious refinance not only locks in competitive fixed-rate mortgage terms but also promotes energy-efficient home improvements, reducing long-term utility costs and carbon footprint. Homeowners benefit from lower interest rates and potential tax incentives that encourage sustainable upgrades, balancing financial stability with environmental responsibility.

Fixed-Rate Mortgage vs Green Mortgage Infographic

industrydif.com

industrydif.com