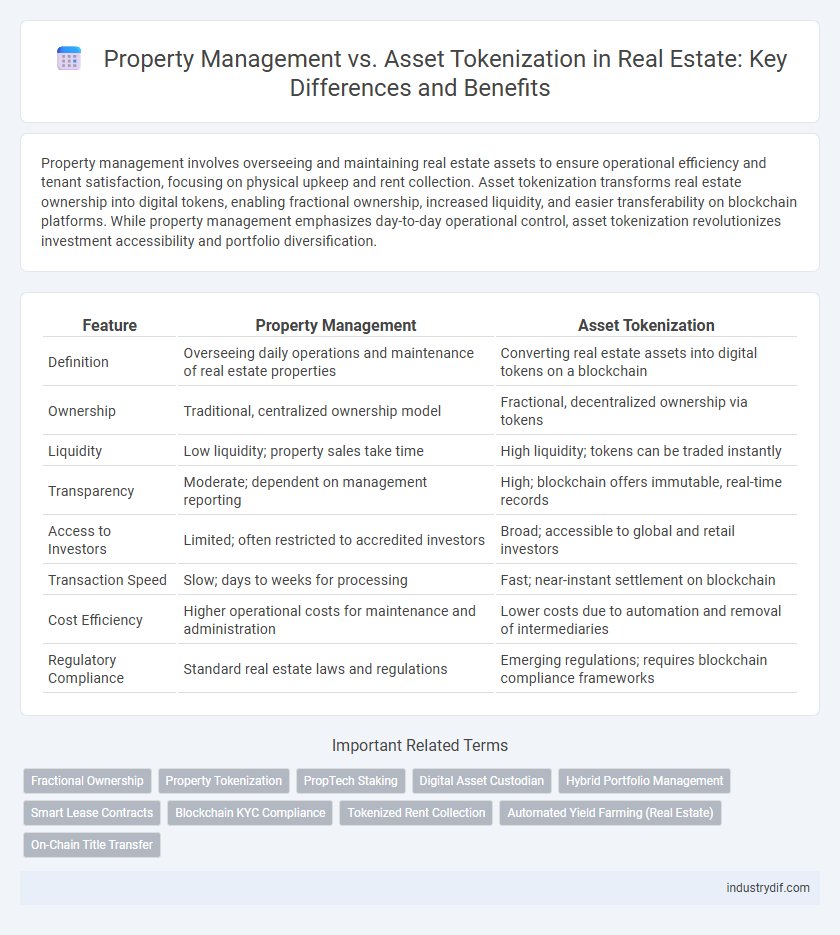

Property management involves overseeing and maintaining real estate assets to ensure operational efficiency and tenant satisfaction, focusing on physical upkeep and rent collection. Asset tokenization transforms real estate ownership into digital tokens, enabling fractional ownership, increased liquidity, and easier transferability on blockchain platforms. While property management emphasizes day-to-day operational control, asset tokenization revolutionizes investment accessibility and portfolio diversification.

Table of Comparison

| Feature | Property Management | Asset Tokenization |

|---|---|---|

| Definition | Overseeing daily operations and maintenance of real estate properties | Converting real estate assets into digital tokens on a blockchain |

| Ownership | Traditional, centralized ownership model | Fractional, decentralized ownership via tokens |

| Liquidity | Low liquidity; property sales take time | High liquidity; tokens can be traded instantly |

| Transparency | Moderate; dependent on management reporting | High; blockchain offers immutable, real-time records |

| Access to Investors | Limited; often restricted to accredited investors | Broad; accessible to global and retail investors |

| Transaction Speed | Slow; days to weeks for processing | Fast; near-instant settlement on blockchain |

| Cost Efficiency | Higher operational costs for maintenance and administration | Lower costs due to automation and removal of intermediaries |

| Regulatory Compliance | Standard real estate laws and regulations | Emerging regulations; requires blockchain compliance frameworks |

Property Management: Definition and Core Functions

Property management involves overseeing and handling the day-to-day operations of real estate assets, including tenant relations, rent collection, maintenance, and compliance with local regulations. Core functions also encompass property marketing, lease administration, and financial reporting to ensure optimal occupancy and income generation. Effective property management enhances asset value by maintaining property conditions and improving tenant satisfaction.

Asset Tokenization: Understanding the Concept

Asset tokenization in real estate transforms physical properties into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. This process facilitates seamless trading, transparent transactions, and reduced entry barriers for investors. Unlike traditional property management, asset tokenization leverages decentralized technology to enhance accessibility and efficiency in real estate investments.

Key Differences Between Property Management and Tokenization

Property management involves the day-to-day operations, maintenance, and tenant relations of real estate assets, ensuring physical property upkeep and income generation. Asset tokenization converts real estate ownership into digital tokens on a blockchain, enabling fractional ownership, enhanced liquidity, and easier transferability. Key differences include the operational focus of property management versus the financial and technological innovation driven by tokenization in real estate investment.

Benefits of Traditional Property Management

Traditional property management offers hands-on oversight that ensures consistent maintenance, tenant relations, and regulatory compliance, which are critical for preserving property value. Direct interaction with tenants allows for immediate resolution of issues, fostering tenant satisfaction and retention. Established management processes provide clear accountability and risk mitigation, which are essential for long-term investment stability.

Advantages of Real Estate Asset Tokenization

Real estate asset tokenization enables fractional ownership, increasing liquidity and allowing smaller investors to participate in high-value properties. It facilitates faster, cost-efficient transactions through blockchain technology, reducing intermediaries and enhancing transparency. Tokenization also supports global access to real estate markets, broadening investment opportunities beyond traditional geographic limitations.

Challenges in Property Management

Property management faces challenges such as high operational costs, tenant disputes, and maintenance inefficiencies that hinder profitability and scalability. Managing physical assets requires constant oversight and manual coordination, leading to delays and increased risks of property depreciation. Asset tokenization offers a digital alternative by enabling fractional ownership and streamlined transactions, addressing many traditional management inefficiencies.

Security and Compliance in Asset Tokenization

Asset tokenization enhances security and compliance in real estate by leveraging blockchain technology to create immutable records and automate regulatory adherence through smart contracts. Unlike traditional property management, asset tokenization ensures transparent ownership transfers and real-time auditing capabilities, reducing fraud risks and improving investor confidence. Regulatory frameworks for tokenized assets require rigorous KYC/AML procedures and adherence to securities laws, promoting a secure and compliant investment environment.

Impact on Real Estate Liquidity

Property management maintains real estate liquidity through efficient operations, tenant retention, and timely maintenance, ensuring steady cash flow and asset value. Asset tokenization enhances liquidity by converting property ownership into digital tokens, enabling fractional ownership and easy transferability on blockchain platforms. This modernization significantly lowers barriers to entry and accelerates market transactions in real estate.

Future Trends: Property Management vs Tokenization

Future trends in real estate indicate a shift from traditional property management to asset tokenization, offering enhanced liquidity and fractional ownership through blockchain technology. Tokenization enables seamless transfer and diversification of real estate assets, reducing entry barriers for investors. Property management continues to evolve with smart contracts automating lease agreements and maintenance tasks, integrating with tokenized asset platforms for efficient, transparent operations.

Choosing the Right Strategy for Real Estate Investors

Property management involves hands-on oversight of real estate assets, including tenant relations, maintenance, and rent collection, ensuring steady income and asset preservation. Asset tokenization transforms property ownership into digital tokens on a blockchain, offering enhanced liquidity, fractional ownership, and access to a broader investor pool. Real estate investors must evaluate their goals for control, liquidity, and scale to choose between traditional management and innovative asset tokenization strategies.

Related Important Terms

Fractional Ownership

Property management involves the operational oversight of real estate assets, including tenant relations, maintenance, and rental income optimization, whereas asset tokenization leverages blockchain technology to enable fractional ownership, allowing multiple investors to hold and trade digital shares of a property. Fractional ownership through asset tokenization increases liquidity, broadens investor access, and facilitates transparent, efficient transactions compared to traditional property management models.

Property Tokenization

Property tokenization transforms real estate assets into tradable digital tokens on a blockchain, enhancing liquidity and broadening investor access compared to traditional property management. This method enables fractional ownership and automated transactions, reducing barriers and operational costs associated with managing physical properties.

PropTech Staking

Property management centers on the operational oversight of real estate assets, including tenant relations, maintenance, and leasing activities, while asset tokenization leverages blockchain technology to fractionalize ownership and enable liquidity through digital tokens. PropTech staking introduces a novel paradigm where investors lock tokens representing real estate assets, earning passive income and enhancing transparency, efficiency, and access within the property investment ecosystem.

Digital Asset Custodian

Digital asset custodians provide secure storage and management services for tokenized real estate assets, ensuring regulatory compliance and safeguarding investor interests in property management. By integrating blockchain technology, these custodians enable transparent, efficient asset tokenization, transforming traditional property management into a digitized ecosystem with increased liquidity and accessibility.

Hybrid Portfolio Management

Hybrid portfolio management integrates traditional property management with asset tokenization, enabling real estate investors to optimize liquidity while maintaining control over physical assets. This approach leverages blockchain technology to fractionalize ownership, enhance transparency, and streamline asset transfers, driving efficiency in diverse real estate portfolios.

Smart Lease Contracts

Property management leverages Smart Lease Contracts to automate rent collection, maintenance requests, and tenant communications, enhancing operational efficiency. Asset tokenization transforms ownership into digital tokens, enabling fractional investment and increased liquidity but relies heavily on smart contracts to execute lease terms securely and transparently.

Blockchain KYC Compliance

Property management leverages blockchain KYC compliance to securely verify tenant identities and streamline lease processes, enhancing transparency and reducing fraud risks. Asset tokenization uses blockchain-based KYC protocols to ensure regulatory compliance while enabling fractional ownership and liquidity in real estate investments.

Tokenized Rent Collection

Tokenized rent collection streamlines property management by enabling secure, transparent transactions through blockchain technology, reducing administrative costs and increasing payment efficiency. This innovative method enhances asset liquidity and investor engagement by allowing fractional ownership and real-time revenue distribution in tokenized real estate portfolios.

Automated Yield Farming (Real Estate)

Automated yield farming in real estate leverages asset tokenization to transform traditional property management by enabling fractional ownership and seamless liquidity through blockchain technology. This approach maximizes returns by automating rental income distribution and reinvestment, optimizing cash flow and enhancing portfolio efficiency.

On-Chain Title Transfer

On-chain title transfer in property management streamlines ownership verification by securely recording transactions on a blockchain, reducing fraud and enhancing transparency. Asset tokenization further enables fractional ownership and liquidity, allowing investors to trade digital tokens representing real estate assets seamlessly within decentralized platforms.

Property management vs Asset tokenization Infographic

industrydif.com

industrydif.com