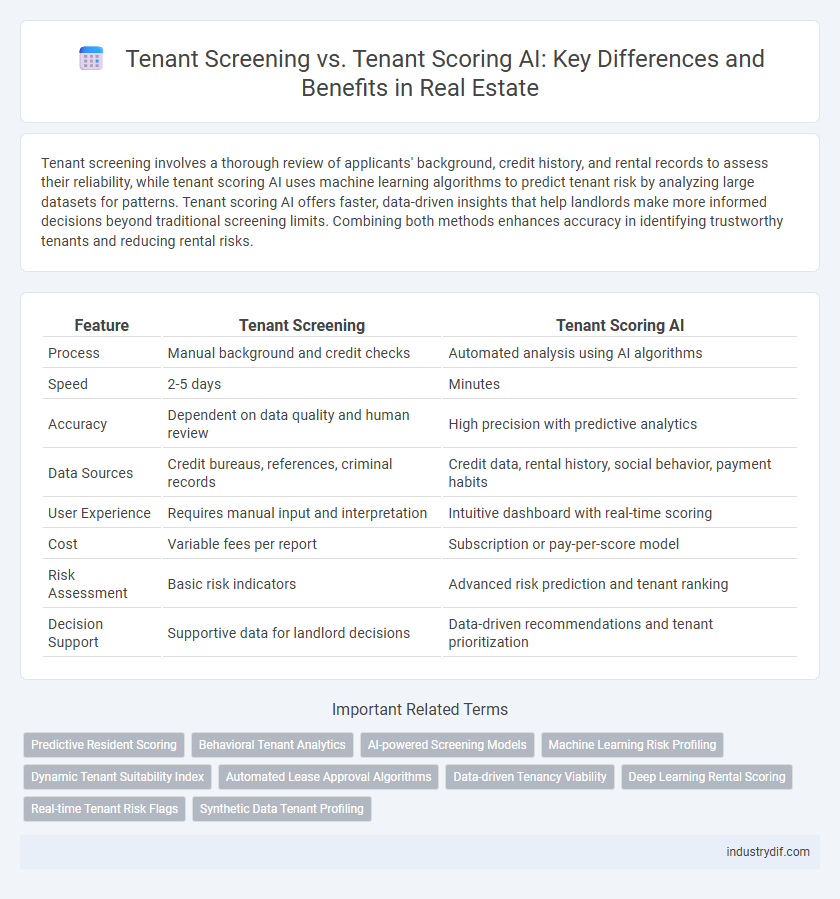

Tenant screening involves a thorough review of applicants' background, credit history, and rental records to assess their reliability, while tenant scoring AI uses machine learning algorithms to predict tenant risk by analyzing large datasets for patterns. Tenant scoring AI offers faster, data-driven insights that help landlords make more informed decisions beyond traditional screening limits. Combining both methods enhances accuracy in identifying trustworthy tenants and reducing rental risks.

Table of Comparison

| Feature | Tenant Screening | Tenant Scoring AI |

|---|---|---|

| Process | Manual background and credit checks | Automated analysis using AI algorithms |

| Speed | 2-5 days | Minutes |

| Accuracy | Dependent on data quality and human review | High precision with predictive analytics |

| Data Sources | Credit bureaus, references, criminal records | Credit data, rental history, social behavior, payment habits |

| User Experience | Requires manual input and interpretation | Intuitive dashboard with real-time scoring |

| Cost | Variable fees per report | Subscription or pay-per-score model |

| Risk Assessment | Basic risk indicators | Advanced risk prediction and tenant ranking |

| Decision Support | Supportive data for landlord decisions | Data-driven recommendations and tenant prioritization |

Understanding Tenant Screening: Traditional Approaches

Traditional tenant screening relies on manual background checks, credit reports, and rental histories to evaluate rental applicants. This process involves verifying income, employment status, and assessing past landlord references to reduce financial risk and avoid problematic tenants. While effective, manual screening can be time-consuming and subjective compared to automated AI-driven tenant scoring systems.

What is Tenant Scoring AI?

Tenant Scoring AI leverages advanced machine learning algorithms to evaluate and predict tenant reliability based on comprehensive data such as rental history, credit scores, employment records, and behavioral patterns. Unlike traditional tenant screening, which relies on manual checks and static data, Tenant Scoring AI provides dynamic risk assessments and predictive analytics to identify high-quality tenants more accurately. This technology enhances decision-making efficiency by offering scalable, data-driven insights that reduce vacancy rates and improve overall property management performance.

Key Differences Between Screening and Scoring

Tenant screening involves verifying applicant backgrounds through credit checks, criminal history, and rental records to assess eligibility, while tenant scoring AI uses machine learning algorithms to predict tenant reliability by analyzing multiple data points and behavioral patterns. Screening focuses on filtering applicants based on predefined criteria and past records, whereas scoring provides a predictive risk assessment that quantifies the likelihood of timely rent payments and lease compliance. The key difference lies in screening's reliance on static data evaluation versus scoring's dynamic, data-driven risk prediction models for informed decision-making in tenant selection.

Benefits of AI-Driven Tenant Scoring

AI-driven tenant scoring enhances property management by providing accurate, data-backed evaluations that reduce the risk of default and costly evictions. Automated algorithms analyze multiple factors like credit history, rental behavior, and income stability, enabling faster, unbiased decisions. This approach increases efficiency, improves tenant quality, and boosts overall return on investment for landlords.

Accuracy and Fairness: Human vs. AI

Tenant screening traditionally relies on manual review of credit reports, rental histories, and background checks, which can introduce human bias and inconsistency in decision-making. AI-driven tenant scoring leverages machine learning algorithms to analyze large datasets objectively, improving accuracy by identifying patterns beyond human capabilities while reducing subjective errors. However, ensuring fairness remains critical as AI models must be carefully trained to avoid perpetuating systemic biases present in historical data.

Compliance and Legal Considerations

Tenant screening involves verifying applicant backgrounds to ensure compliance with federal and state fair housing laws, reducing the risk of discrimination claims. Tenant scoring AI leverages machine learning algorithms to predict tenant reliability but must adhere to data privacy regulations such as the Fair Credit Reporting Act (FCRA) and avoid biased decision-making practices. Maintaining transparent documentation and using compliant tools protects landlords from legal liabilities while promoting equitable tenant selection.

Data Privacy in Tenant Scoring AI

Tenant Screening relies on manual review and verification of applicant information, often limited by human bias and inconsistent data handling. Tenant Scoring AI automates the evaluation process with algorithms, enhancing accuracy but raising significant data privacy concerns due to extensive collection and analysis of personal information. Ensuring compliance with GDPR and CCPA regulations, along with implementing robust encryption and anonymization techniques, is crucial to protect tenant data in AI-driven scoring systems.

Impact on Rental Property Management

Tenant Screening AI enhances rental property management by automating background checks, credit reports, and eviction history verification, significantly reducing risk and streamlining applicant evaluation. Tenant Scoring AI offers predictive insights based on rental payment behavior, income stability, and lease adherence, enabling landlords to forecast tenant reliability and mitigate potential defaults. Integrating both technologies improves decision accuracy and operational efficiency, leading to higher occupancy rates and reduced tenant turnover.

Adopting AI Tools: Challenges and Best Practices

Adopting AI tools for tenant screening and tenant scoring requires addressing data privacy concerns and ensuring compliance with housing regulations such as the Fair Housing Act. Best practices include integrating machine learning algorithms that utilize comprehensive rental history, credit scores, and behavioral patterns while continuously validating the AI models to minimize bias and enhance predictive accuracy. Real estate professionals should invest in transparent AI platforms that provide clear decision-making criteria to foster trust and streamline tenant selection processes.

Future Trends in Tenant Evaluation Technologies

Emerging tenant evaluation technologies leverage advanced AI algorithms to enhance accuracy and efficiency beyond traditional tenant screening by incorporating tenant scoring models that analyze behavioral data, payment patterns, and social factors. Future trends emphasize predictive analytics to forecast tenant reliability and rental payment consistency, reducing landlord risk through data-driven decisions. Integration of machine learning with real-time data sources will enable continuous tenant profile updates, revolutionizing property management and lease agreement processes.

Related Important Terms

Predictive Resident Scoring

Tenant Screening evaluates applicants based on background checks, credit history, and rental records, while Tenant Scoring AI utilizes predictive resident scoring to analyze behavioral patterns and forecast lease compliance and payment reliability. Predictive resident scoring leverages machine learning algorithms and big data to identify high-risk tenants, enhancing landlord decision-making and reducing vacancy rates.

Behavioral Tenant Analytics

Behavioral tenant analytics enhances tenant screening by leveraging AI to assess patterns such as payment reliability, communication habits, and lifestyle consistency, providing a deeper insight into tenant behavior beyond traditional credit checks. Tenant scoring AI quantifies these behavioral metrics into predictive risk scores, enabling landlords to make data-driven leasing decisions based on comprehensive behavioral profiles and reducing the likelihood of defaults or evictions.

AI-powered Screening Models

AI-powered tenant screening models leverage machine learning algorithms to analyze extensive datasets including credit history, rental records, and background checks, enabling landlords to make informed decisions quickly and accurately. Unlike traditional scoring methods, these AI models continuously learn and adapt to new patterns, reducing bias and improving the prediction of tenant reliability and risk.

Machine Learning Risk Profiling

Machine Learning Risk Profiling enhances tenant screening by analyzing vast datasets to predict rental payment behavior and default risk more accurately than traditional methods. Tenant scoring AI leverages algorithms to assign risk scores based on factors like credit history, employment stability, and past rental performance, optimizing landlord decision-making and reducing vacancy rates.

Dynamic Tenant Suitability Index

Dynamic Tenant Suitability Index leverages advanced AI algorithms to provide a comprehensive and real-time evaluation of tenant reliability by analyzing financial history, rental behavior, and socioeconomic factors. This approach surpasses traditional tenant screening by continuously updating tenant scores based on evolving data, enabling landlords to make more informed leasing decisions with predictive accuracy.

Automated Lease Approval Algorithms

Automated lease approval algorithms leverage tenant scoring AI to analyze credit history, rental payment behavior, and background checks, enabling landlords to make faster, data-driven decisions. Unlike traditional tenant screening, these AI-driven models increase accuracy by quantifying risk factors, reducing human bias, and streamlining lease approvals through predictive analytics.

Data-driven Tenancy Viability

Tenant Screening leverages comprehensive background checks and credit reports to assess rental applicants, while Tenant Scoring AI uses machine learning algorithms to analyze large datasets for predictive insights into tenancy behavior and risk. Data-driven tenancy viability improves through Tenant Scoring AI by providing landlords with quantifiable, real-time risk assessments that enhance decision-making beyond traditional screening methods.

Deep Learning Rental Scoring

Deep learning rental scoring leverages neural networks to analyze vast datasets, providing more accurate tenant risk assessments compared to traditional tenant screening methods. This AI-driven approach enhances predictive accuracy by evaluating complex patterns in rental history, credit scores, and behavioral data, leading to improved tenant selection and reduced default rates.

Real-time Tenant Risk Flags

Tenant Screening identifies potential renters by analyzing background checks, credit history, and eviction records, while Tenant Scoring AI evaluates real-time tenant risk flags such as recent changes in financial behavior and social signals to provide dynamic risk assessments. Real-time tenant risk flags enable landlords to make proactive decisions by detecting emerging issues like payment delays or sudden income drops instantly.

Synthetic Data Tenant Profiling

Tenant Screening relies on traditional methods such as credit reports and background checks, while Tenant Scoring AI enhances accuracy using synthetic data to create comprehensive tenant profiles by simulating various financial and behavioral scenarios. Synthetic Data Tenant Profiling improves predictive analytics, reduces bias, and enables real estate professionals to make more informed leasing decisions by evaluating potential tenants beyond historical data limitations.

Tenant Screening vs Tenant Scoring AI Infographic

industrydif.com

industrydif.com