Pre-construction real estate offers buyers the opportunity to invest in properties before they are built, often at lower prices and with customizable options. Tokenized real estate breaks down ownership into digital tokens, enabling fractional investment and enhanced liquidity compared to traditional real estate transactions. This modern approach increases accessibility and allows investors to diversify portfolios without the need for large capital commitments.

Table of Comparison

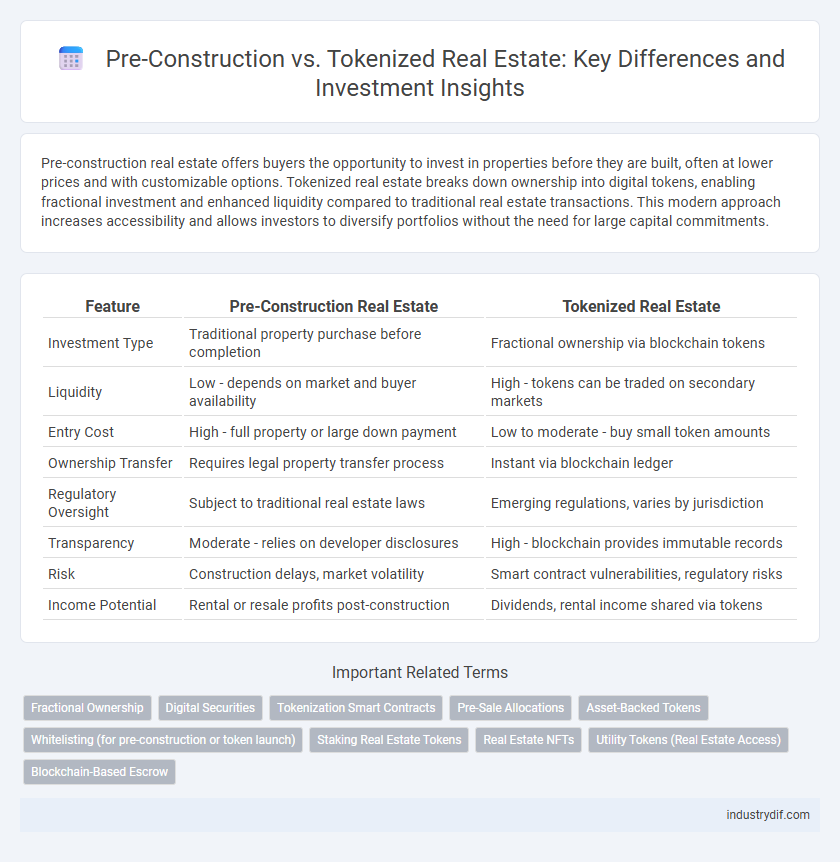

| Feature | Pre-Construction Real Estate | Tokenized Real Estate |

|---|---|---|

| Investment Type | Traditional property purchase before completion | Fractional ownership via blockchain tokens |

| Liquidity | Low - depends on market and buyer availability | High - tokens can be traded on secondary markets |

| Entry Cost | High - full property or large down payment | Low to moderate - buy small token amounts |

| Ownership Transfer | Requires legal property transfer process | Instant via blockchain ledger |

| Regulatory Oversight | Subject to traditional real estate laws | Emerging regulations, varies by jurisdiction |

| Transparency | Moderate - relies on developer disclosures | High - blockchain provides immutable records |

| Risk | Construction delays, market volatility | Smart contract vulnerabilities, regulatory risks |

| Income Potential | Rental or resale profits post-construction | Dividends, rental income shared via tokens |

Understanding Pre-Construction Real Estate

Pre-construction real estate involves purchasing properties before they are built, often at lower prices with potential for capital appreciation. This method requires thorough market analysis, developer credibility assessment, and understanding of contractual terms to mitigate risks such as project delays or cancellations. Buyers benefit from customization options and scheduled payments, making it a traditional yet strategic investment approach in real estate.

What is Tokenized Real Estate?

Tokenized real estate refers to the process of converting ownership rights in a property into digital tokens on a blockchain, allowing fractional ownership and increased liquidity. This innovative approach enables investors to buy, sell, and trade real estate assets more efficiently, lowering barriers to entry and enhancing transparency. Unlike traditional pre-construction investments, tokenization offers greater accessibility and real-time market participation in real estate opportunities.

Investment Process: Pre-Construction vs Tokenization

Pre-construction investment requires purchasing properties before completion, involving lengthy approvals, contractual commitments, and delayed liquidity as investors wait for project delivery. Tokenized real estate offers fractional ownership through blockchain-based tokens, enabling faster transactions, enhanced liquidity, and lower entry barriers compared to traditional pre-construction methods. Tokenization also provides transparent, real-time asset management and reduces reliance on intermediaries, streamlining the overall investment process.

Access and Liquidity in Both Real Estate Models

Pre-construction real estate typically requires substantial upfront capital and involves longer holding periods, limiting liquidity and access to only accredited investors or those with significant financial resources. Tokenized real estate leverages blockchain technology to fractionalize ownership, enabling smaller investments and enhanced liquidity through secondary markets where tokens can be traded instantly. This democratization of access and improved liquidity makes tokenized real estate an attractive alternative for a broader range of investors seeking flexibility and quicker entry or exit options.

Risk Factors: Comparing Pre-Construction and Tokenized Assets

Pre-construction real estate carries risks such as project delays, market fluctuations, and developer insolvency, impacting investment returns. Tokenized real estate offers liquidity and fractional ownership but faces regulatory uncertainties, cybersecurity threats, and potential platform failures. Understanding these distinct risk profiles helps investors balance potential rewards against exposure in emerging versus traditional real estate markets.

Legal and Regulatory Considerations

Pre-construction real estate transactions typically comply with established local property laws and building regulations, requiring developers to secure permits and adhere to zoning ordinances before project approval. Tokenized real estate introduces complex legal challenges including securities regulations, digital asset compliance, and jurisdictional variability, necessitating thorough legal frameworks and transparent smart contracts to protect investor rights. Regulatory bodies are evolving to address these innovations, emphasizing anti-money laundering (AML) policies and investor disclosures to ensure market integrity and consumer protection.

Profit Potential and ROI Differences

Pre-construction real estate offers profit potential through property appreciation and resale after project completion, with ROI influenced by market trends and development timelines. Tokenized real estate enables fractional ownership on blockchain platforms, allowing for diversified investments with liquidity and faster ROI due to easier trading of tokens. While pre-construction investments typically require higher capital and longer commitment, tokenized assets present lower entry barriers and potentially quicker, more flexible returns.

Accessibility for Global Investors

Tokenized real estate significantly increases accessibility for global investors by enabling fractional ownership through blockchain technology, eliminating traditional geographical and financial barriers. Pre-construction investments typically require large capital and are limited to local markets, restricting global participation. Blockchain-based tokenization democratizes real estate investment, allowing diversified portfolios with lower entry costs and 24/7 trading on secondary markets worldwide.

Technology’s Role in Modern Real Estate Investments

Technology revolutionizes modern real estate investments by enabling pre-construction projects to leverage advanced data analytics for accurate market forecasting and risk assessment. Tokenized real estate introduces blockchain technology, facilitating fractional ownership, enhanced liquidity, and secure, transparent transactions. These innovations streamline investment processes, reduce barriers to entry, and expand access to diversified real estate portfolios globally.

Future Trends: Pre-Construction and Tokenized Real Estate

Pre-construction real estate offers investors the opportunity to secure properties at lower prices before completion, benefiting from potential appreciation as development progresses. Tokenized real estate leverages blockchain technology to fractionalize property ownership, enabling increased liquidity and accessibility for smaller investors. Future trends indicate a convergence where traditional pre-construction sales integrate with tokenization platforms, enhancing transparency, reducing entry barriers, and accelerating investment cycles in the real estate market.

Related Important Terms

Fractional Ownership

Fractional ownership in pre-construction real estate typically involves purchasing a share of a property during the development phase, offering potential appreciation but limited liquidity and higher entry costs. Tokenized real estate leverages blockchain technology to enable seamless, low-cost fractional ownership with enhanced liquidity, transparency, and accessibility for diverse investors.

Digital Securities

Pre-construction real estate involves buying properties before they are built, often requiring significant capital and bearing market risks, whereas tokenized real estate leverages blockchain technology to issue digital securities that represent fractional ownership, increasing liquidity and accessibility for investors. Digital securities in tokenized real estate enhance transparency and compliance through smart contracts, enabling seamless secondary market trading unlike traditional pre-construction investments.

Tokenization Smart Contracts

Tokenized real estate leverages blockchain technology and smart contracts to enable fractional ownership, transparent transactions, and automated compliance, significantly reducing intermediary costs and improving liquidity compared to traditional pre-construction investments. Smart contracts facilitate real-time execution of property transfers, dividend distributions, and regulatory adherence, enhancing trust and efficiency in the real estate market.

Pre-Sale Allocations

Pre-sale allocations in pre-construction real estate typically involve securing a unit before project completion, providing early access and potentially lower prices but with risks tied to construction delays or market fluctuations. Tokenized real estate offers fractional ownership through blockchain, allowing investors to purchase and trade real estate-backed tokens, enhancing liquidity and democratizing access beyond traditional pre-sale constraints.

Asset-Backed Tokens

Pre-construction real estate investments typically involve buying properties before completion, offering potential price appreciation but limited liquidity, while tokenized real estate uses asset-backed tokens to represent fractional ownership, enhancing liquidity and accessibility for investors. Asset-backed tokens ensure each digital token is directly linked to a tangible real estate asset, enabling secure, transparent transactions on blockchain platforms and facilitating smaller investment minimums.

Whitelisting (for pre-construction or token launch)

Whitelisting in pre-construction real estate ensures vetted investors gain early access to property launches, enhancing trust and regulatory compliance. In tokenized real estate, whitelisting validates participants during token issuance, streamlining KYC/AML processes and securing the digital asset ecosystem.

Staking Real Estate Tokens

Staking real estate tokens allows investors to earn passive income by locking their digital assets representing fractional ownership in tokenized real estate projects, offering higher liquidity and transparency compared to traditional pre-construction investments. This innovative approach leverages blockchain technology to facilitate real-time rewards and portfolio diversification while minimizing barriers associated with physical property ownership.

Real Estate NFTs

Real estate NFTs revolutionize property investment by offering tokenized ownership that enhances liquidity, transparency, and fractional access compared to traditional pre-construction deals, which typically involve longer timelines and higher entry barriers. By leveraging blockchain technology, Real Estate NFTs enable seamless trading and secure title management, transforming how investors participate in real estate markets.

Utility Tokens (Real Estate Access)

Pre-construction real estate investments offer early access to tangible properties often requiring significant capital and lengthy development timelines, while tokenized real estate through utility tokens provides fractional ownership and streamlined access to real estate assets via blockchain technology, enhancing liquidity and transparency. Utility tokens specifically enable holders to gain real estate access rights, participate in property management decisions, and receive rental income distributions, optimizing investor engagement and market accessibility.

Blockchain-Based Escrow

Blockchain-based escrow in tokenized real estate ensures secure, transparent transactions by automating fund transfers and title verification through smart contracts, reducing reliance on intermediaries. In contrast, traditional pre-construction escrow processes depend on manual oversight and third-party trust, often leading to longer timelines and increased risk of disputes.

Pre-construction vs Tokenized real estate Infographic

industrydif.com

industrydif.com