Real Estate Investment Trusts (REITs) offer investors liquidity and diversification by pooling funds to invest in large-scale properties, while fractional ownership allows individuals to directly own a percentage of a specific property, providing more control and potential tax benefits. REITs trade on major stock exchanges, making them accessible and easy to buy or sell, whereas fractional ownership typically involves longer holding periods and less liquidity. Understanding these differences helps investors balance risk, control, and accessibility in their real estate portfolios.

Table of Comparison

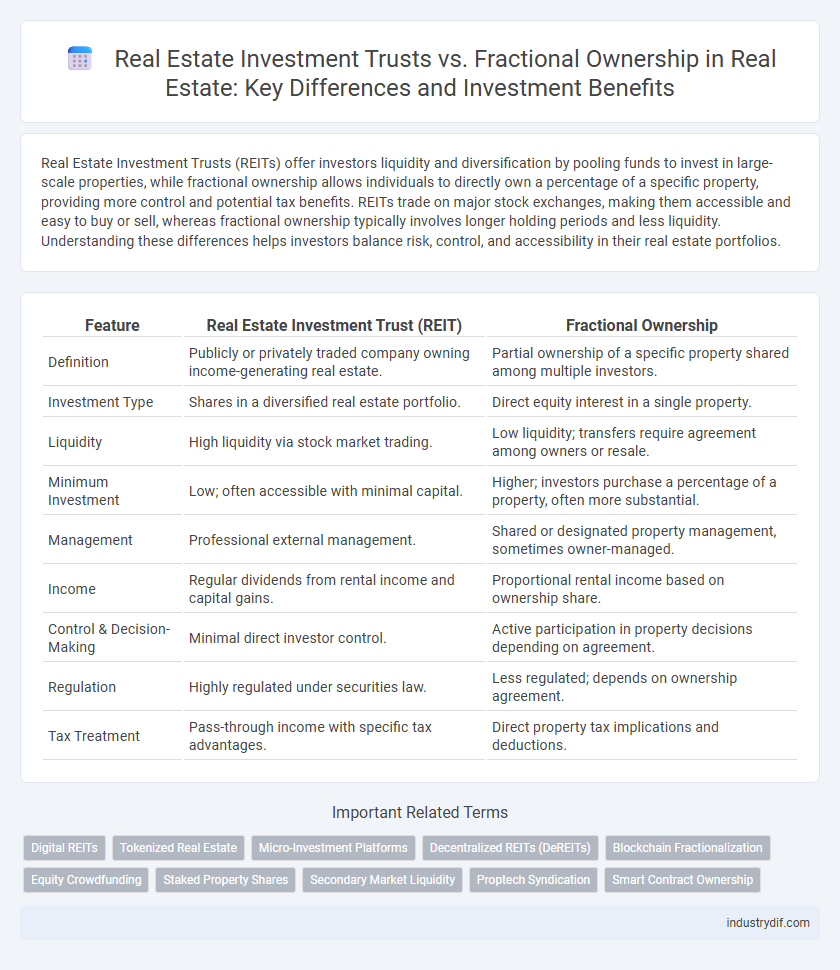

| Feature | Real Estate Investment Trust (REIT) | Fractional Ownership |

|---|---|---|

| Definition | Publicly or privately traded company owning income-generating real estate. | Partial ownership of a specific property shared among multiple investors. |

| Investment Type | Shares in a diversified real estate portfolio. | Direct equity interest in a single property. |

| Liquidity | High liquidity via stock market trading. | Low liquidity; transfers require agreement among owners or resale. |

| Minimum Investment | Low; often accessible with minimal capital. | Higher; investors purchase a percentage of a property, often more substantial. |

| Management | Professional external management. | Shared or designated property management, sometimes owner-managed. |

| Income | Regular dividends from rental income and capital gains. | Proportional rental income based on ownership share. |

| Control & Decision-Making | Minimal direct investor control. | Active participation in property decisions depending on agreement. |

| Regulation | Highly regulated under securities law. | Less regulated; depends on ownership agreement. |

| Tax Treatment | Pass-through income with specific tax advantages. | Direct property tax implications and deductions. |

Understanding Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate across various sectors, allowing investors to buy shares and earn dividends without directly managing properties. REITs provide liquidity and diversification, trading on major stock exchanges, which contrasts with fractional ownership where investors own a percentage of a specific property. Understanding REITs involves recognizing their regulatory requirement to distribute at least 90% of taxable income as dividends, making them attractive for income-focused real estate investors.

What is Fractional Ownership in Real Estate?

Fractional ownership in real estate allows multiple investors to purchase shares of a property, dividing acquisition and maintenance costs proportionally. This model provides partial property rights and usage privileges based on each investor's share, offering a more accessible way to invest in high-value real estate. Unlike Real Estate Investment Trusts (REITs), fractional ownership grants direct equity and the potential for personal use or rental income from the asset.

Key Differences Between REITs and Fractional Ownership

Real Estate Investment Trusts (REITs) allow investors to purchase shares in a professionally managed portfolio of income-generating properties, offering liquidity and diversification without direct property management responsibilities. Fractional ownership involves buying a specific share of a single property, granting investors partial legal title and potential use rights, but with limited liquidity and higher management involvement. The key differences between REITs and fractional ownership include liquidity, management responsibility, and the type of ownership interest--REITs provide passive, diversified equity through shares, whereas fractional ownership entails active participation and property-specific equity.

Investment Structure: REITs vs. Fractional Ownership

Real Estate Investment Trusts (REITs) offer investors a diversified portfolio of properties managed by professional teams, allowing indirect ownership and liquidity through publicly traded shares. Fractional ownership involves direct equity in specific properties, granting investors hands-on control and potential tax benefits but with less liquidity and higher entry barriers. Understanding these differences in investment structure is crucial for aligning risk tolerance, investment goals, and desired management involvement.

Accessibility and Minimum Investment Requirements

Real Estate Investment Trusts (REITs) offer high accessibility with relatively low minimum investments, often starting at $500, allowing individual investors to diversify their portfolios without managing physical properties. Fractional ownership requires a higher minimum investment, typically ranging from $10,000 to $50,000, limiting accessibility to more affluent investors who prefer direct property equity. Both investment types provide entry into real estate markets, but REITs prioritize liquidity and lower financial barriers, whereas fractional ownership emphasizes tangible asset control with greater capital commitment.

Liquidity Comparison: REITs Versus Fractional Real Estate

Real Estate Investment Trusts (REITs) offer high liquidity as they are traded on public stock exchanges, allowing investors to buy and sell shares quickly with minimal transaction costs. Fractional ownership, while providing direct property stakes, generally involves less liquidity due to longer transaction processes and limited secondary markets for reselling shares. This liquidity gap makes REITs more suitable for investors seeking flexible, quick access to their real estate investments.

Risk and Return Profiles in REITs and Fractional Ownership

Real Estate Investment Trusts (REITs) offer diversified exposure to income-generating properties with relatively lower risk due to professional management and liquidity in public markets, making returns more stable but generally moderate. Fractional ownership involves direct investment in specific properties, which presents higher risk from market volatility, property management issues, and illiquidity, but also the potential for higher returns through property appreciation and rental income. Investors prioritizing steady cash flow and lower risk typically favor REITs, while those seeking greater control and potential upside may prefer fractional ownership despite increased risk exposure.

Taxation Differences in REITs and Fractional Real Estate

Real Estate Investment Trusts (REITs) typically offer tax advantages such as dividends taxed at individual income tax rates but allow deductions for depreciation, reducing taxable income. Fractional ownership involves direct property investment, where owners face property taxes, mortgage interest deductions, and potential capital gains taxes upon sale. Understanding the distinct tax treatments of REIT dividends versus direct fractional ownership income is crucial for optimizing real estate investment strategies.

Ownership Rights and Control Aspects

Real Estate Investment Trusts (REITs) offer investors shares in a professionally managed portfolio of properties with limited control and no direct ownership rights, whereas fractional ownership grants investors a tangible stake and usage rights in specific properties with greater decision-making influence. REIT shareholders receive dividends but cannot directly manage or alter property operations, while fractional owners participate in property decisions proportional to their equity share. Control in REITs lies primarily with trustees and management teams, contrasting with fractional ownership where control is distributed among co-owners, providing more personalized asset involvement.

Which Option Suits Different Investor Profiles?

Real Estate Investment Trusts (REITs) offer liquidity and diversification, making them ideal for investors seeking passive income with low capital commitment and minimal management responsibilities. Fractional ownership appeals to those wanting direct property control and potential tax benefits, suitable for investors comfortable with hands-on management and higher initial investment. Assessing risk tolerance, investment horizon, and desired involvement helps determine whether REITs or fractional ownership align best with an individual's financial goals.

Related Important Terms

Digital REITs

Digital Real Estate Investment Trusts (Digital REITs) offer a streamlined, liquid alternative to traditional fractional ownership by tokenizing property assets on blockchain platforms, enabling investors to buy and trade shares with lower entry costs and enhanced transparency. Unlike fractional ownership, which often involves direct property management responsibilities, Digital REITs provide professional asset management and diversified portfolios, reducing risk while maintaining accessibility for smaller investors.

Tokenized Real Estate

Tokenized real estate leverages blockchain technology to enhance liquidity and transparency, enabling investors to buy and trade fractional shares seamlessly through digital tokens. Unlike traditional Real Estate Investment Trusts (REITs), tokenized fractional ownership offers direct asset control and reduced entry barriers, optimizing portfolio diversification and accessibility.

Micro-Investment Platforms

Micro-investment platforms in real estate enable investors to access diversified portfolios through Real Estate Investment Trusts (REITs), offering liquidity and professional management without the need for large capital. Fractional ownership provides direct equity stakes in specific properties, appealing to investors seeking tangible asset control but often with less liquidity and higher entry costs.

Decentralized REITs (DeREITs)

Decentralized Real Estate Investment Trusts (DeREITs) leverage blockchain technology to offer transparent, secure, and fractionalized property investments, providing liquidity and democratized access compared to traditional REITs. Fractional ownership enables investors to purchase specific shares of a property directly, but DeREITs enhance this model by automating transactions and governance through smart contracts, reducing intermediaries and operational costs.

Blockchain Fractionalization

Blockchain fractionalization in real estate enables investors to acquire tokenized shares of properties through Real Estate Investment Trusts (REITs) or fractional ownership platforms, enhancing liquidity and transparency. This technology reduces barriers to entry by allowing smaller, verifiable investments with real-time tracking on decentralized ledgers, distinguishing it from traditional REITs that often involve larger capital commitments and less direct asset control.

Equity Crowdfunding

Equity crowdfunding in real estate offers a democratized investment model, enabling investors to purchase shares in properties through Real Estate Investment Trusts (REITs) or fractional ownership platforms. Unlike REITs, which are publicly traded or private companies pooling investor capital into diversified portfolios, fractional ownership allows direct property equity stakes, providing investors with tangible asset control and potential rental income streams.

Staked Property Shares

Staked property shares offer a hybrid investment model combining the liquidity of Real Estate Investment Trusts (REITs) with the tangible asset benefits of fractional ownership, allowing investors to trade digital shares backed by physical real estate. This blockchain-based approach enhances transparency, lowers entry barriers, and provides fractional owners with verifiable proof of property stake, differentiating it from traditional REIT structures.

Secondary Market Liquidity

Real Estate Investment Trusts (REITs) offer higher secondary market liquidity through publicly traded shares allowing investors to quickly buy and sell, while fractional ownership typically involves private transactions with limited secondary market options and longer holding periods. Liquidity in REITs is enhanced by stock exchange listings and regulatory oversight, whereas fractional ownership depends on platform-specific resale policies and buyer availability, often restricting rapid asset liquidation.

Proptech Syndication

Real Estate Investment Trusts (REITs) offer investors diversified property portfolios with liquidity similar to stocks, while fractional ownership involves investing directly in individual properties, often facilitated by Proptech syndication platforms that streamline collective funding and management. Proptech syndication enhances transparency, automates transaction processes, and provides real-time data analytics, making fractional ownership more accessible and efficient compared to traditional REIT investments.

Smart Contract Ownership

Smart contract ownership in Real Estate Investment Trusts (REITs) enables transparent, automated dividend distribution and property management through blockchain technology, reducing intermediaries and enhancing security. Fractional ownership leverages smart contracts to streamline asset transfers and enforce ownership rights among multiple investors, offering increased liquidity and flexibility compared to traditional REIT models.

Real Estate Investment Trust vs Fractional Ownership Infographic

industrydif.com

industrydif.com