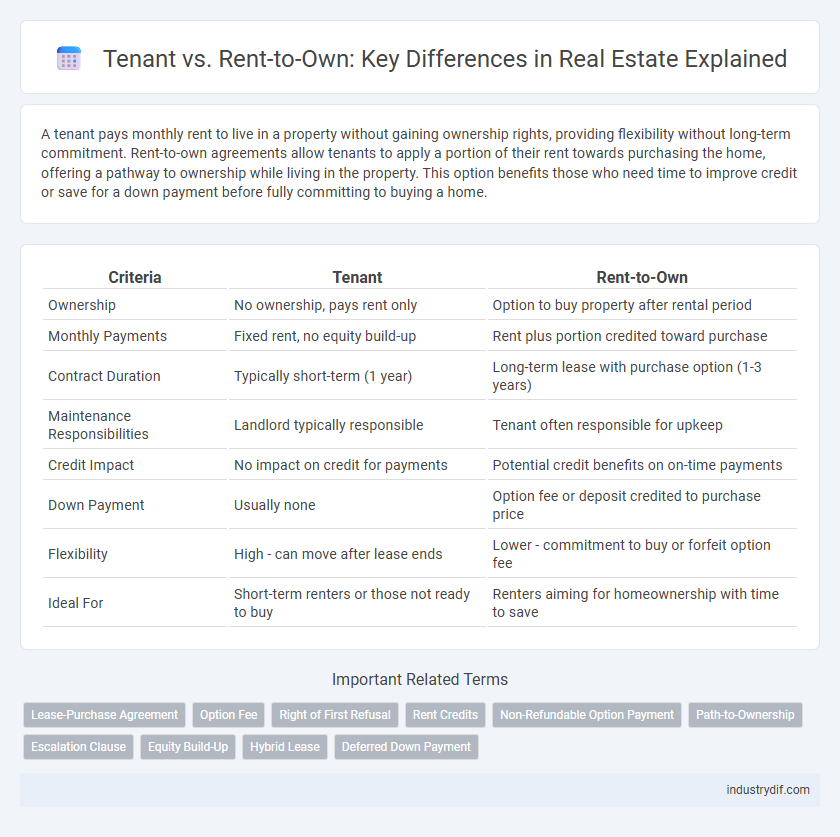

A tenant pays monthly rent to live in a property without gaining ownership rights, providing flexibility without long-term commitment. Rent-to-own agreements allow tenants to apply a portion of their rent towards purchasing the home, offering a pathway to ownership while living in the property. This option benefits those who need time to improve credit or save for a down payment before fully committing to buying a home.

Table of Comparison

| Criteria | Tenant | Rent-to-Own |

|---|---|---|

| Ownership | No ownership, pays rent only | Option to buy property after rental period |

| Monthly Payments | Fixed rent, no equity build-up | Rent plus portion credited toward purchase |

| Contract Duration | Typically short-term (1 year) | Long-term lease with purchase option (1-3 years) |

| Maintenance Responsibilities | Landlord typically responsible | Tenant often responsible for upkeep |

| Credit Impact | No impact on credit for payments | Potential credit benefits on on-time payments |

| Down Payment | Usually none | Option fee or deposit credited to purchase price |

| Flexibility | High - can move after lease ends | Lower - commitment to buy or forfeit option fee |

| Ideal For | Short-term renters or those not ready to buy | Renters aiming for homeownership with time to save |

Understanding Tenant and Rent-to-Own Arrangements

Tenant agreements typically involve paying monthly rent without gaining equity in the property, whereas rent-to-own arrangements allow tenants to apply a portion of their rent toward eventual homeownership. Rent-to-own contracts provide an option to purchase the property at a predetermined price within a set timeframe, offering a pathway to build equity. Understanding the legal terms and financial commitments of each option is crucial for making informed decisions in real estate.

Key Differences Between Renting and Rent-to-Own

Renting a property involves paying monthly rent without ownership benefits, while rent-to-own agreements combine rental payments with a path to purchase, often applying a portion of rent toward the down payment. Renters have less long-term commitment and flexibility but no equity buildup, whereas rent-to-own tenants commit to eventual ownership, risking forfeiture of invested funds if they fail to purchase. Key differences include financial obligations, contract length, and potential to acquire property equity over time.

Financial Implications: Tenant vs Rent-to-Own

Tenants typically pay monthly rent without building equity, resulting in limited long-term financial benefits. Rent-to-own agreements often require higher monthly payments, a portion of which contributes toward a future down payment, enhancing homeownership potential. While tenants face recurring costs with no asset accumulation, rent-to-own can provide a pathway to ownership but may involve higher upfront and ongoing financial commitments.

Legal Considerations in Rent-to-Own Agreements

Rent-to-own agreements require careful legal consideration, including clear contract terms outlining lease payments, option fees, and purchase price to protect both tenants and sellers. These agreements must comply with state-specific regulations on property disclosures, eviction procedures, and default consequences to avoid legal disputes. Understanding tenant rights and obligations, alongside the seller's responsibilities, is crucial for ensuring a legally sound rent-to-own transaction.

Flexibility and Commitment: Comparing Your Options

Tenant agreements typically offer short-term flexibility with month-to-month or yearly leases, allowing renters to relocate with minimal commitment. Rent-to-own contracts involve a longer commitment, combining rental payments with an eventual path to property ownership, making them ideal for tenants seeking stability and home equity building. Understanding these differences helps prospective tenants balance immediate housing needs with long-term investment goals.

Maintenance Responsibilities: Who Pays for What?

In a tenant agreement, landlords typically cover major maintenance and repairs, while tenants handle minor upkeep such as cleaning and small fixes. Rent-to-own contracts often shift more maintenance responsibilities to the tenant, reflecting their future ownership stake, including costs for repairs and property improvements. Understanding these distinctions is crucial for budgeting and ensuring clear expectations regarding who pays for property maintenance.

Credit Impact: Renting vs Rent-to-Own

Renting typically has a neutral or minimal impact on credit scores since monthly rent payments are not usually reported to credit bureaus. Rent-to-own agreements can positively influence credit if structured to report timely payments, helping build credit history over time. Potential homeowners should verify if the rent-to-own contract includes credit reporting to maximize credit benefits while preparing for future mortgage applications.

Path to Homeownership: How Rent-to-Own Works

Rent-to-own agreements provide tenants with a unique pathway to homeownership by allowing a portion of monthly rent payments to be applied toward the eventual purchase of the property. This model benefits individuals who may not have immediate access to traditional mortgage financing, enabling them to build equity over time while living in the home. Clear contract terms outline the purchase price, lease duration, and rent credits, ensuring transparency and a structured transition from renting to owning.

Risks and Benefits for Landlords and Tenants

Tenant agreements provide landlords with steady rental income and lower risk of property damage, while tenants enjoy predictable monthly payments and flexibility without long-term commitment. Rent-to-own contracts offer landlords potential higher returns and eventual full-sale profits but involve risks of tenant default and delayed sale completion; tenants benefit by building equity and locking in purchase prices, yet face the risk of losing invested option fees if unable to buy. Both arrangements require careful vetting, clear contract terms, and understanding of financial and legal obligations to optimize benefits and minimize risks for landlords and tenants.

Making the Right Choice: Tenant or Rent-to-Own

Choosing between being a tenant or opting for a rent-to-own agreement depends on your long-term housing goals and financial stability. Tenants benefit from lower upfront costs and flexibility without the commitment of ownership, while rent-to-own agreements allow a portion of rent payments to build equity toward purchasing the property. Assessing credit scores, income consistency, and future market conditions is crucial to making the right decision in real estate investments.

Related Important Terms

Lease-Purchase Agreement

A Lease-Purchase Agreement combines elements of renting and buying, allowing tenants to lease a property with the option to purchase it later, often applying a portion of rent towards the down payment. This arrangement benefits tenants seeking homeownership without immediate full financing while providing sellers a committed buyer and steady rental income.

Option Fee

The option fee in a rent-to-own agreement typically ranges from 1% to 5% of the property's purchase price and grants tenants the exclusive right to buy the home within a specified period. Unlike traditional tenants who pay only monthly rent, rent-to-own tenants invest this non-refundable option fee, which is often credited toward the down payment or purchase price upon closing.

Right of First Refusal

The Right of First Refusal in tenant agreements allows tenants to purchase the property before the owner sells to another party, providing priority access to ownership opportunities. Rent-to-own contracts formalize this right, combining lease payments with a future purchase option that secures tenant investment in the property's equity.

Rent Credits

Rent-to-own agreements allow tenants to accumulate rent credits, which are portions of monthly rent payments applied towards the eventual purchase price of the property, providing a pathway to homeownership. Unlike traditional renting where payments do not contribute to equity, rent credits in rent-to-own contracts build financial investment and increase the buyer's down payment over time.

Non-Refundable Option Payment

In rent-to-own agreements, the non-refundable option payment secures the tenant's right to purchase the property at a later date, distinguishing it from standard rental deposits which are typically refundable. This option payment is credited toward the purchase price if the tenant exercises the buy option, offering investment potential absent in traditional tenancy.

Path-to-Ownership

Rent-to-own agreements provide tenants with a structured path-to-ownership by allowing a portion of monthly rent to be credited towards the eventual purchase price, offering a flexible alternative to conventional renting. This model helps tenants build equity and credit while securing the option to buy the property, bridging the gap between renting and homeownership.

Escalation Clause

An escalation clause in a tenant lease typically allows rent increases based on market conditions or inflation, providing landlords flexibility during the lease term. In rent-to-own agreements, escalation clauses often adjust rent credits or purchase prices, ensuring fair value adjustments while guiding the tenant's path to homeownership.

Equity Build-Up

Rent-to-own arrangements enable tenants to build equity gradually by applying a portion of their monthly payments toward the eventual purchase price, contrasting with traditional renting where monthly payments contribute solely to occupancy without equity accumulation. This equity build-up in rent-to-own agreements offers tenants a financial advantage by turning rent into an investment, potentially easing the transition to homeownership.

Hybrid Lease

A hybrid lease combines traditional tenant leasing with rent-to-own options, allowing tenants to accumulate equity while paying rent. This model benefits renters seeking homeownership flexibility and landlords aiming to reduce vacancy rates and secure long-term tenants.

Deferred Down Payment

Deferred down payment in rent-to-own agreements allows tenants to apply a portion of their monthly rent toward the future purchase price, contrasting with traditional renting where no equity is built. This structure benefits tenants seeking homeownership by reducing upfront costs and gradually accumulating investment toward a property purchase.

Tenant vs Rent-to-Own Infographic

industrydif.com

industrydif.com