A real estate portfolio consists of physical properties such as residential, commercial, and industrial buildings that generate income and appreciate over time. Digital real estate refers to virtual properties like websites, domain names, and online platforms that hold value and can generate revenue through advertising, e-commerce, or leasing. Comparing both, traditional real estate offers tangible assets with long-term stability, while digital real estate provides scalable opportunities in the rapidly evolving digital economy.

Table of Comparison

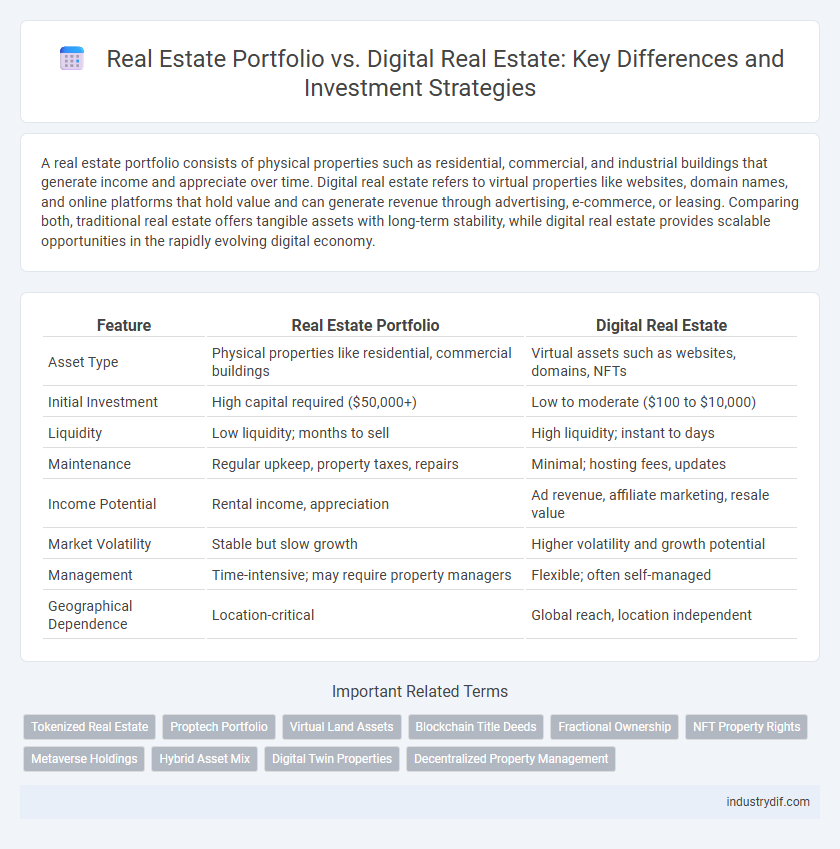

| Feature | Real Estate Portfolio | Digital Real Estate |

|---|---|---|

| Asset Type | Physical properties like residential, commercial buildings | Virtual assets such as websites, domains, NFTs |

| Initial Investment | High capital required ($50,000+) | Low to moderate ($100 to $10,000) |

| Liquidity | Low liquidity; months to sell | High liquidity; instant to days |

| Maintenance | Regular upkeep, property taxes, repairs | Minimal; hosting fees, updates |

| Income Potential | Rental income, appreciation | Ad revenue, affiliate marketing, resale value |

| Market Volatility | Stable but slow growth | Higher volatility and growth potential |

| Management | Time-intensive; may require property managers | Flexible; often self-managed |

| Geographical Dependence | Location-critical | Global reach, location independent |

Defining Traditional Real Estate Portfolios

Traditional real estate portfolios consist of physical properties such as residential homes, commercial buildings, and land holdings, acquired for income generation and capital appreciation. These portfolios rely on tangible assets that require property management, maintenance, and direct market involvement. Unlike digital real estate, traditional portfolios involve higher upfront costs, longer liquidity timelines, and location-dependent value fluctuations.

Understanding Digital Real Estate Assets

Digital real estate assets encompass virtual properties such as domain names, websites, and virtual land within metaverse platforms, offering unique opportunities for investment beyond traditional physical real estate portfolios. Unlike traditional real estate, digital assets provide scalability, liquidity, and global accessibility, allowing investors to diversify their portfolios with non-tangible but highly valuable digital properties. Understanding the valuation, market dynamics, and revenue potential of digital real estate is crucial for maximizing returns in this emerging sector.

Key Differences Between Physical and Digital Property

Physical real estate involves tangible assets such as land and buildings that require maintenance, taxes, and can appreciate based on location and market trends. Digital real estate consists of virtual properties like websites, domain names, and virtual land in metaverses, which rely on internet traffic, digital content, and platform value for revenue generation. Key differences include liquidity, management complexity, regulatory frameworks, and the nature of asset appreciation driven by physical factors versus digital engagement metrics.

Investment Strategies for Real Estate Portfolios

Real estate portfolios involve tangible assets such as residential, commercial, and industrial properties, offering long-term value appreciation and rental income stability. Investment strategies for these portfolios focus on diversification across property types and geographic locations to mitigate risks and maximize returns. Digital real estate, including domain names and virtual properties in metaverse platforms, requires strategies centered on market trends, digital asset liquidity, and technology adoption to capitalize on emerging virtual economies.

Monetization Models in Digital Real Estate

Digital real estate monetization models primarily include advertising revenue from website traffic, affiliate marketing commissions, and subscription services for premium content access. Unlike traditional real estate portfolios that generate income through rent or property appreciation, digital real estate leverages scalable, low-overhead income streams such as sponsored content and data monetization. Platforms with high user engagement and targeted demographics further enhance revenue potential through programmatic advertising and native ads.

Asset Valuation: Brick-and-Mortar vs. Online

Brick-and-mortar real estate assets derive their valuation primarily from physical location, square footage, and market demand, often influenced by economic trends and zoning laws. Digital real estate valuation hinges on website traffic, domain authority, and monetization potential, with fluctuations driven by algorithm changes and online engagement metrics. While traditional properties offer tangible collateral, digital assets provide scalable opportunities with lower entry costs and rapid asset appreciation.

Risk Factors in Physical vs. Digital Real Estate

Physical real estate carries risks such as property damage, market volatility, and high maintenance costs, along with regulatory complexities and illiquidity. Digital real estate faces cybersecurity threats, platform dependence, and rapid technological obsolescence, creating unique vulnerabilities in asset stability and value retention. Understanding these contrasting risk factors is essential for diversifying investment strategies between tangible properties and virtual assets.

Diversification Benefits: Mixing Physical and Digital Assets

Combining a real estate portfolio with digital real estate assets enhances diversification by balancing tangible property investments with virtual properties like domain names, NFTs, or metaverse land. Physical real estate offers stability through rental income and appreciation, while digital assets provide high-growth potential and liquidity in emerging markets. This strategic blend minimizes risk exposure and capitalizes on both traditional and innovative real estate opportunities.

Market Trends Influencing Real and Digital Estate

The real estate market is increasingly influenced by technological advancements and shifting consumer behaviors, driving the growth of digital real estate alongside traditional real estate portfolios. Investors are diversifying their assets by incorporating virtual properties, such as domain names and virtual land in metaverse platforms, reflecting a broader market trend towards digital asset integration. Market data shows a rising interest in digital real estate, with global virtual property investments expected to reach billions, highlighting the importance of adapting portfolio strategies to leverage both physical and digital real estate opportunities.

Future Outlook: The Convergence of Real Estate and Digital Spaces

The future outlook of real estate highlights the convergence of traditional physical properties with digital real estate, where virtual assets like metaverse land and NFTs gain significant investment traction. Real estate portfolios increasingly integrate digital spaces to diversify risk and capitalize on emerging technologies driving value in virtual environments. This hybrid approach transforms asset management strategies, blending tangible property ownership with dynamic digital real estate markets to optimize returns and future-proof investments.

Related Important Terms

Tokenized Real Estate

Tokenized real estate transforms traditional real estate portfolios by enabling fractional ownership through blockchain technology, increasing liquidity and accessibility for investors. This innovative digital real estate market allows seamless transfer of asset shares, enhanced transparency, and global reach, outperforming conventional property holdings in diversification and scalability.

Proptech Portfolio

A Proptech portfolio integrates traditional real estate assets with innovative digital real estate platforms, leveraging technology to enhance asset management, tenant engagement, and market analytics. This hybrid approach maximizes returns by combining physical property investments with scalable digital solutions such as virtual tours, smart contracts, and AI-driven property valuation.

Virtual Land Assets

Real estate portfolios traditionally comprise physical properties such as residential, commercial, and industrial assets that generate income through leasing or appreciation. Digital real estate, specifically virtual land assets in metaverses and blockchain platforms, offers new investment opportunities by enabling ownership, development, and monetization of virtual spaces through NFTs and digital marketplaces.

Blockchain Title Deeds

Real estate portfolios traditionally consist of physical properties held for investment, while digital real estate encompasses virtual assets and blockchain title deeds that provide secure, transparent ownership records through decentralized ledgers. Blockchain title deeds enhance real estate portfolios by reducing fraud, streamlining transactions, and enabling fractional ownership, transforming asset management in both physical and digital markets.

Fractional Ownership

Fractional ownership in real estate portfolios allows investors to acquire partial shares of physical properties, diversifying risk and enhancing liquidity compared to traditional full ownership models. Digital real estate platforms extend this concept by enabling fractional investments in virtual assets, such as metaverse properties, offering novel opportunities for portfolio expansion and passive income generation.

NFT Property Rights

Real estate portfolios traditionally consist of physical properties generating rental income and capital appreciation, while digital real estate, through NFT property rights, enables ownership, trading, and monetization of virtual land within metaverse platforms. NFT-based property rights offer immutable proof of ownership, fractional investment opportunities, and enhanced liquidity in comparison to conventional real estate assets.

Metaverse Holdings

Real estate portfolios traditionally consist of physical properties such as residential, commercial, and industrial assets, generating income through rent and capital appreciation; in contrast, digital real estate within Metaverse holdings involves acquiring virtual land and assets on platforms like Decentraland and The Sandbox, offering opportunities for immersive marketing, virtual events, and speculative investment. Metaverse digital real estate holds potential for higher liquidity and global reach, driven by blockchain technology and NFT ownership, which redefine property rights and monetization strategies in the evolving digital economy.

Hybrid Asset Mix

A hybrid asset mix combines traditional real estate properties such as commercial and residential buildings with digital real estate assets including domain names, virtual land, and online businesses, offering diversified income streams and risk mitigation. This integrated approach enhances portfolio resilience by balancing tangible property appreciation with the high liquidity and scalability of digital assets.

Digital Twin Properties

Digital Twin Properties revolutionize real estate portfolios by creating precise virtual replicas of physical assets, enabling real-time monitoring, predictive maintenance, and enhanced decision-making. Integrating digital twins into real estate investments optimizes asset management, reduces operational costs, and unlocks new revenue streams through virtual leasing and remote property evaluations.

Decentralized Property Management

Decentralized property management leverages blockchain technology to enhance transparency, security, and efficiency in digital real estate portfolios by enabling peer-to-peer transactions and automated smart contracts. Unlike traditional real estate portfolios reliant on centralized intermediaries, digital real estate benefits from immutable records and decentralized governance, reducing costs and increasing accessibility for global investors.

Real estate portfolio vs Digital real estate Infographic

industrydif.com

industrydif.com