Long-term rentals provide stable income and reduce tenant turnover, making them ideal for investors seeking consistent cash flow and lower management demands. Short-term rentals often yield higher monthly revenue but require more frequent tenant turnover and ongoing maintenance, appealing to those willing to manage a dynamic rental business. Evaluating local market trends, property location, and personal management capacity is crucial when choosing between long-term and short-term rental strategies.

Table of Comparison

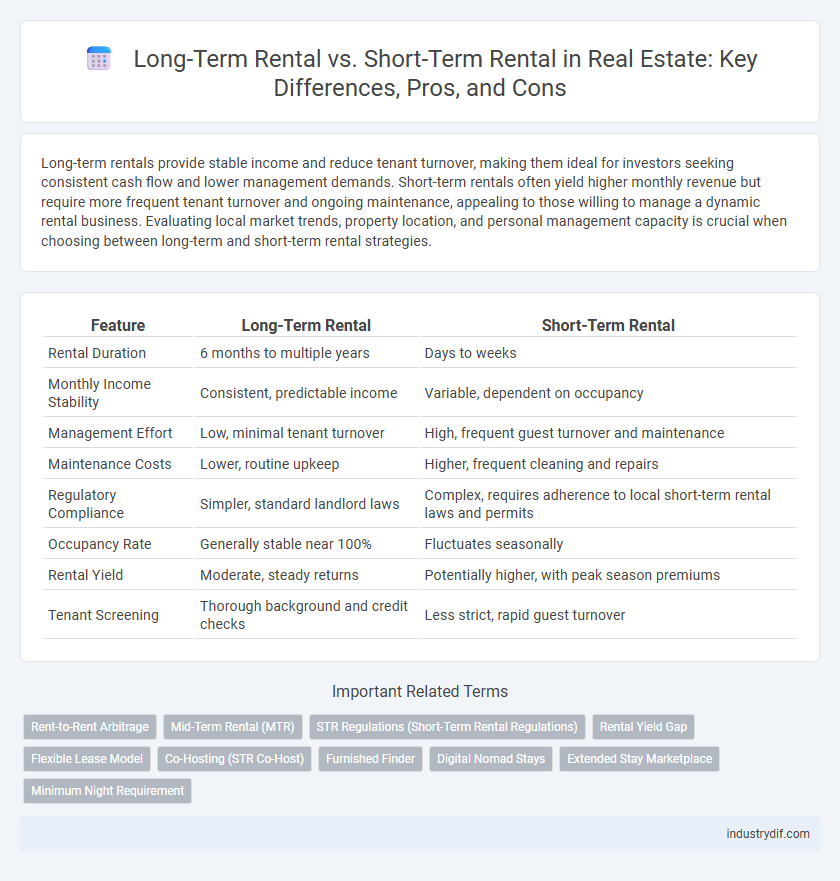

| Feature | Long-Term Rental | Short-Term Rental |

|---|---|---|

| Rental Duration | 6 months to multiple years | Days to weeks |

| Monthly Income Stability | Consistent, predictable income | Variable, dependent on occupancy |

| Management Effort | Low, minimal tenant turnover | High, frequent guest turnover and maintenance |

| Maintenance Costs | Lower, routine upkeep | Higher, frequent cleaning and repairs |

| Regulatory Compliance | Simpler, standard landlord laws | Complex, requires adherence to local short-term rental laws and permits |

| Occupancy Rate | Generally stable near 100% | Fluctuates seasonally |

| Rental Yield | Moderate, steady returns | Potentially higher, with peak season premiums |

| Tenant Screening | Thorough background and credit checks | Less strict, rapid guest turnover |

Understanding Long-Term Rental Properties

Long-term rental properties typically offer stable monthly income and lower vacancy rates, making them a reliable investment for consistent cash flow. These properties often attract tenants seeking leases of six months or more, reducing turnover costs and maintenance expenses compared to short-term rentals. Investors prioritize location, property condition, and local rental market trends to maximize occupancy and rental yields in long-term leasing scenarios.

What Defines Short-Term Rentals?

Short-term rentals are defined as property leases typically lasting fewer than 30 days, often catering to tourists and business travelers seeking flexible accommodation options. These rentals include vacation homes, Airbnb listings, and serviced apartments, offering amenities and locations that prioritize convenience and temporary stays. Regulatory frameworks often distinguish short-term rentals from long-term leases due to their transient nature and impact on local housing markets.

Key Differences Between Long-Term and Short-Term Rentals

Long-term rentals typically involve lease agreements lasting six months to a year or more, offering stable monthly income and reduced tenant turnover, making them suitable for investors seeking consistent cash flow. Short-term rentals, often booked for days or weeks via platforms like Airbnb, generate higher per-night revenue but require frequent management, marketing efforts, and adherence to local regulations. Understanding the distinct financial profiles, maintenance demands, and legal implications of each rental type is essential for optimizing real estate investment strategies.

Profitability Comparison: Long-Term vs Short-Term Rental

Long-term rentals typically generate steady monthly income with lower vacancy rates, making them reliable for consistent cash flow and reduced management costs. Short-term rentals often yield higher per-night rates and increased profitability during peak seasons but require more frequent maintenance, marketing efforts, and variable occupancy. Investors should weigh steady revenue against potential for higher returns and increased operational demands when comparing long-term versus short-term rental strategies.

Rental Demand Trends in Today’s Market

Long-term rental demand remains strong due to housing stability and affordability preferences, especially in urban and suburban areas with growing populations. Short-term rentals experience fluctuating demand driven by tourism trends, local events, and travel restrictions, with peak seasons significantly boosting occupancy rates. Real estate investors prioritize market analysis of demographic shifts and regulatory environments to optimize rental income strategies.

Legal and Regulatory Considerations

Long-term rentals typically require compliance with local housing regulations, including tenant rights laws and lease duration standards, ensuring greater legal stability for property owners. Short-term rentals must adhere to zoning laws, occupancy limits, and often require specific permits or registration with municipal authorities, which can vary significantly between cities. Non-compliance in short-term rentals may result in fines, license revocation, or legal disputes, making thorough knowledge of local regulations essential for investors.

Maintenance and Operational Requirements

Long-term rentals typically require lower maintenance and operational efforts due to stable tenant occupancy and less frequent turnover. Short-term rentals demand constant cleaning, regular inspections, and rapid repairs to meet guest expectations and comply with hospitality standards. Efficient management of maintenance schedules directly impacts tenant satisfaction and property value in both rental models.

Tenant Screening and Turnover Rates

Long-term rentals typically involve thorough tenant screening processes, including credit checks, employment verification, and rental history assessments, which help reduce the risk of problematic tenants and ensure stable occupancy. In contrast, short-term rentals often have minimal tenant screening due to the transient nature of guests, increasing turnover rates and potential property wear. Higher turnover rates in short-term rentals lead to increased maintenance costs and more frequent vacancy periods, impacting overall profitability compared to long-term leasing arrangements.

Tax Implications and Financial Management

Long-term rentals typically offer more stable, predictable income streams with tax benefits like depreciation deductions and lower turnover costs, which can simplify financial management. Short-term rentals generate higher gross revenue but often incur increased expenses, such as frequent maintenance and platform fees, requiring meticulous bookkeeping and quarterly tax payments, including potential lodging taxes. Understanding the distinct tax implications--such as short-term rental income being treated as active income versus passive income for long-term rentals--is crucial for optimizing profitability and compliance.

Choosing the Right Rental Strategy for Your Investment

Long-term rentals provide consistent monthly income and lower vacancy risks, making them ideal for investors seeking stable cash flow and minimal management. Short-term rentals often generate higher returns per night but require active management, frequent marketing, and are sensitive to seasonal demand fluctuations. Analyzing local market trends, property location, and target tenant profiles helps determine whether long-term or short-term rental strategies maximize investment profitability.

Related Important Terms

Rent-to-Rent Arbitrage

Rent-to-rent arbitrage in real estate involves leasing a property long-term and then subleasing it as short-term rentals to maximize cash flow and capitalize on higher nightly rates. This strategy requires careful market analysis of occupancy rates, local regulations, and operational costs to ensure profitability and compliance.

Mid-Term Rental (MTR)

Mid-Term Rentals (MTR) offer a strategic balance between long-term and short-term rental models by targeting tenants who need accommodations for one to six months, such as remote workers or traveling professionals. This rental type maximizes occupancy rates and income stability while reducing turnover costs and wear compared to short-term rentals, making it an attractive option for real estate investors seeking consistent revenue with moderate management effort.

STR Regulations (Short-Term Rental Regulations)

Short-term rental regulations vary significantly across cities, often including licensing requirements, occupancy limits, and restrictions on rental duration to address community concerns and housing shortages. Long-term rentals typically face fewer regulatory hurdles but may offer lower immediate returns compared to short-term rentals, which are subject to stricter compliance to mitigate impacts on residential neighborhoods.

Rental Yield Gap

Long-term rentals typically offer steady but lower rental yields, averaging around 4-6%, while short-term rentals can generate higher yields of 8-12% due to premium nightly rates and occupancy fluctuations. The rental yield gap is influenced by factors such as location demand, property management costs, and seasonal occupancy variations, making yield optimization dependent on market dynamics and investor risk tolerance.

Flexible Lease Model

A flexible lease model accommodates both long-term rental stability and short-term rental profitability by allowing property owners to adjust lease durations according to market demand and tenant needs. This approach maximizes rental income while maintaining occupancy rates, appealing to a broader range of tenants including corporate clients and vacationers.

Co-Hosting (STR Co-Host)

STR co-hosts enhance property management for short-term rentals by handling guest communication, cleaning coordination, and dynamic pricing optimization, increasing overall rental income. Long-term rentals typically require less day-to-day involvement, making co-host services more valuable and profitable in the short-term rental market.

Furnished Finder

Furnished Finder specializes in long-term rental solutions, offering fully furnished properties ideal for traveling professionals and remote workers seeking stays of 30 days or more. Unlike short-term rental platforms, Furnished Finder emphasizes extended leases that provide stable income for property owners and convenient, home-like accommodations for tenants.

Digital Nomad Stays

Long-term rentals provide stability and cost-efficiency for digital nomads seeking extended stays, often featuring fully furnished apartments with reliable Wi-Fi and local amenities. Short-term rentals cater to flexible, transient digital nomads by offering convenience and diverse locations, though typically at higher nightly rates and with more variable contract terms.

Extended Stay Marketplace

Long-term rentals in the extended stay marketplace provide consistent cash flow and reduced vacancy rates by catering to tenants seeking stability for months or years, while short-term rentals capitalize on higher nightly rates and flexibility but face increased management costs and regulatory challenges. Investors targeting the extended stay sector benefit from hybrid models that balance occupancy levels and premium pricing, optimizing returns through tailored property management strategies.

Minimum Night Requirement

Long-term rentals typically require a minimum stay of 30 days or more, providing stability and consistent income for landlords, whereas short-term rentals often have minimum night requirements ranging from 2 to 7 nights, catering to travelers seeking flexibility. Understanding these minimum night requirements helps investors optimize occupancy rates and comply with local regulations governing rental properties.

Long-Term Rental vs Short-Term Rental Infographic

industrydif.com

industrydif.com