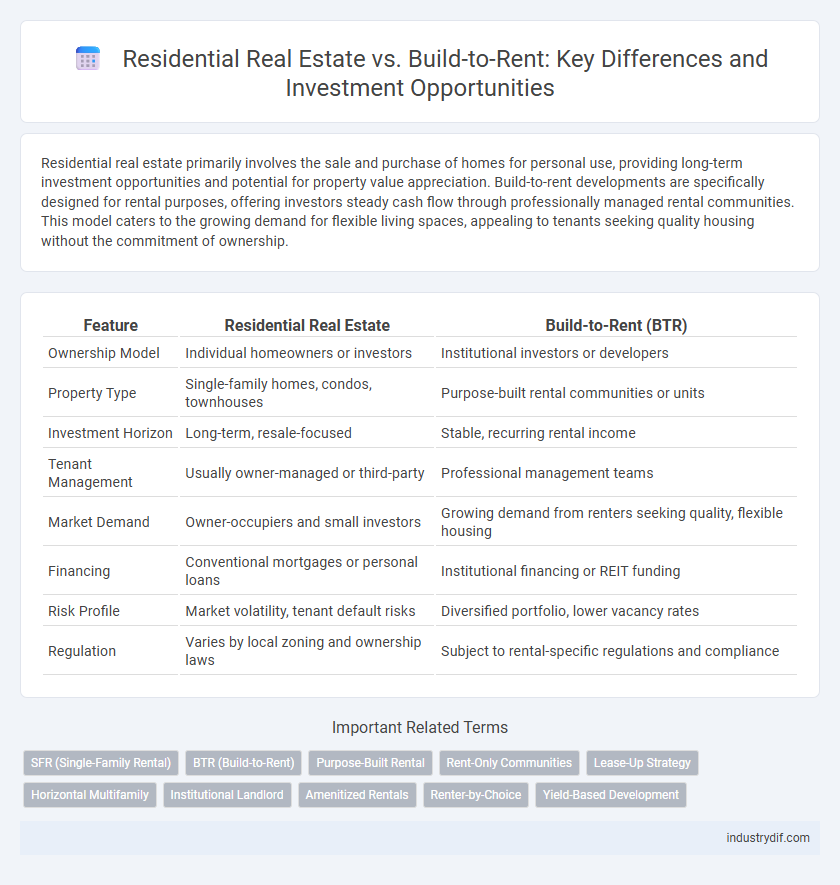

Residential real estate primarily involves the sale and purchase of homes for personal use, providing long-term investment opportunities and potential for property value appreciation. Build-to-rent developments are specifically designed for rental purposes, offering investors steady cash flow through professionally managed rental communities. This model caters to the growing demand for flexible living spaces, appealing to tenants seeking quality housing without the commitment of ownership.

Table of Comparison

| Feature | Residential Real Estate | Build-to-Rent (BTR) |

|---|---|---|

| Ownership Model | Individual homeowners or investors | Institutional investors or developers |

| Property Type | Single-family homes, condos, townhouses | Purpose-built rental communities or units |

| Investment Horizon | Long-term, resale-focused | Stable, recurring rental income |

| Tenant Management | Usually owner-managed or third-party | Professional management teams |

| Market Demand | Owner-occupiers and small investors | Growing demand from renters seeking quality, flexible housing |

| Financing | Conventional mortgages or personal loans | Institutional financing or REIT funding |

| Risk Profile | Market volatility, tenant default risks | Diversified portfolio, lower vacancy rates |

| Regulation | Varies by local zoning and ownership laws | Subject to rental-specific regulations and compliance |

Overview of Residential Real Estate and Build-to-Rent

Residential real estate primarily consists of single-family homes, condominiums, and townhouses designed for individual ownership or rental by families and individuals. Build-to-rent communities are newly developed properties constructed specifically for long-term rental, offering amenities and management services tailored for renters rather than owners. This model addresses growing demand for rental housing, providing streamlined maintenance and community-focused living environments.

Investment Models: Ownership vs. Leasing

Residential real estate investment predominantly involves ownership, allowing investors to benefit from property appreciation and rental income over time. In contrast, the build-to-rent model emphasizes leasing, where developers retain ownership and generate steady cash flow by renting multiple units to tenants. This shift from ownership to leasing in build-to-rent offers scalable, predictable income streams, appealing to institutional investors seeking long-term rental yield stability.

Market Trends and Growth Prospects

Residential real estate continues to dominate market share with steady demand driven by homeownership aspirations, while build-to-rent (BTR) developments exhibit rapid growth fueled by shifting demographics and rental preference trends. The BTR sector benefits from institutional investment influx and urbanization patterns, emphasizing community-centric designs that appeal to young professionals and families. Market forecasts predict BTR growth outpacing traditional residential sales due to affordability challenges and increasing demand for flexible, long-term rental solutions.

Target Demographics and Tenant Profiles

Residential real estate primarily targets owner-occupiers and long-term homeowners seeking stability and investment value, often appealing to families, retirees, and individuals prioritizing community and asset appreciation. Build-to-rent properties focus on renters valuing flexibility, contemporary amenities, and managed living environments, attracting younger professionals, transient workers, and small households who prefer leasing over ownership. Tenant profiles for build-to-rent typically include tech-savvy individuals and dual-income renters seeking convenience and urban proximity without the commitment of homeownership.

Financial Returns and Risk Factors

Residential real estate investments typically offer stable cash flow and long-term appreciation, with risks tied to market fluctuations and tenant turnover. Build-to-rent properties generate higher initial yields due to professional management and scalable operations but face risks related to construction delays, higher capital requirements, and market saturation. Analyzing cap rates, vacancy rates, and maintenance costs is crucial for comparing financial returns and risk profiles between these asset classes.

Property Management Differences

Residential real estate typically involves individual homeowners managing their properties or hiring third-party property managers, focusing on long-term tenant relationships and maintenance responsiveness. Build-to-rent developments centralize property management under professional companies, ensuring standardized services, consistent tenant screening, and streamlined maintenance across multiple units. This centralized approach in build-to-rent reduces vacancy rates and enhances operational efficiency compared to traditional residential property management.

Legal and Regulatory Considerations

Residential real estate transactions require compliance with zoning laws, fair housing regulations, and standard landlord-tenant statutes that protect individual homeowners and renters. Build-to-rent developments face additional legal scrutiny, including more complex lease agreements, multi-unit compliance, and adherence to local government policies promoting long-term rental affordability and property management standards. Regulatory considerations for build-to-rent also involve community impact assessments and obligations for ongoing maintenance, differentiating them significantly from traditional single-family residential real estate legal frameworks.

Construction and Design Standards

Residential real estate typically involves custom construction tailored to individual buyers' preferences, emphasizing traditional architectural design, personalized layouts, and quality materials that enhance long-term property value. Build-to-rent developments prioritize standardized construction methods and efficient design to maximize rental yield, often featuring modern amenities, durable finishes, and community-centric layouts that appeal to long-term tenants. Both sectors adhere to local building codes and sustainability standards, but build-to-rent projects frequently incorporate scalable construction technologies and modular design to reduce costs and accelerate development timelines.

Technology and Innovation in Residential Sectors

Technology in residential real estate is transforming traditional homebuying and property management through smart home systems, AI-driven market analytics, and virtual reality tours, enhancing buyer experiences and operational efficiency. Build-to-rent communities leverage innovation by integrating IoT-enabled appliances, app-based amenities management, and data-driven maintenance to improve tenant satisfaction and reduce operational costs. These technological advancements position build-to-rent developments and residential real estate as competitive markets adapting to evolving consumer demands and digital trends.

Future Outlook: Residential Real Estate vs Build-to-Rent

The future outlook for residential real estate indicates sustained demand driven by population growth and urbanization, while build-to-rent (BTR) developments are expected to expand rapidly due to shifting lifestyle preferences and increased institutional investment. Analysts project the build-to-rent sector to capture a growing market share by offering professionally managed, flexible rental options that appeal to younger demographics and transient workers. Technological integration and sustainability initiatives within BTR projects further enhance their appeal compared to traditional homeownership models.

Related Important Terms

SFR (Single-Family Rental)

Single-Family Rental (SFR) properties in residential real estate offer individualized homeownership appeal, while Build-to-Rent (BTR) developments provide purpose-built communities designed for streamlined property management and tenant experience. SFR investments emphasize long-term appreciation and neighborhood integration, contrasting with BTR's scalable rental income models and institutional ownership strategies.

BTR (Build-to-Rent)

Build-to-Rent (BTR) developments offer professionally managed, purpose-built rental homes designed to meet the growing demand for flexible, high-quality living spaces. Unlike traditional residential real estate sales, BTR communities provide long-term rental stability, enhanced amenities, and modern layouts tailored to urban renters and families seeking convenience and lifestyle-focused housing.

Purpose-Built Rental

Purpose-built rental properties in the build-to-rent sector are designed specifically to meet the needs of long-term tenants, offering consistent rental income streams and professional management. Unlike traditional residential real estate, these developments prioritize community amenities, durable materials, and flexible lease terms to enhance tenant retention and investment stability.

Rent-Only Communities

Rent-only communities in residential real estate offer tenants flexibility without long-term ownership commitments, contrasting with build-to-rent developments that provide professionally managed, purpose-built rental homes designed for long-term tenancy. These build-to-rent properties typically feature modern amenities, consistent maintenance, and community-focused living, appealing to renters seeking stability and convenience.

Lease-Up Strategy

Residential real estate lease-up strategies prioritize tenant retention and community appeal through targeted marketing and flexible lease terms, maximizing occupancy rates. Build-to-Rent developments focus on scalable lease-up plans using technology-driven tenant screening and standardized processes to accelerate occupancy and optimize long-term cash flow.

Horizontal Multifamily

Horizontal multifamily properties in residential real estate typically involve subdivided housing units such as townhomes and duplexes, offering homebuyers ownership opportunities and neighborhood integration. Build-to-rent developments focus on professionally managed, single-family-style homes designed for long-term rentals, catering to renters seeking community amenities and maintenance-free living.

Institutional Landlord

Institutional landlords increasingly favor build-to-rent developments for steady, long-term cash flow and reduced tenant turnover compared to traditional residential real estate sales. These large-scale rental communities offer scalable asset management advantages and predictable income streams, aligning with institutional investment strategies.

Amenitized Rentals

Amenitized rentals in build-to-rent communities often feature tailored amenities such as on-site fitness centers, co-working spaces, and enhanced security systems, designed to attract long-term tenants seeking convenience and lifestyle integration. In contrast, traditional residential real estate may lack these specialized features, typically offering standard amenities that prioritize ownership over rental experience.

Renter-by-Choice

Renter-by-choice individuals increasingly prefer Build-to-Rent properties due to purpose-built amenities, flexible lease terms, and professional management, contrasting with traditional residential real estate that often attracts long-term homeowners. This shift emphasizes the demand for convenience, community features, and maintenance-free living, differentiating Build-to-Rent as a strategic asset class in urban rental markets.

Yield-Based Development

Yield-based development in residential real estate prioritizes maximizing rental income through strategic property positioning and tenant demand analysis. Build-to-rent projects enhance yield by delivering purpose-built rental communities with scalable management efficiencies and steady cash flow streams.

Residential Real Estate vs Build-to-Rent Infographic

industrydif.com

industrydif.com