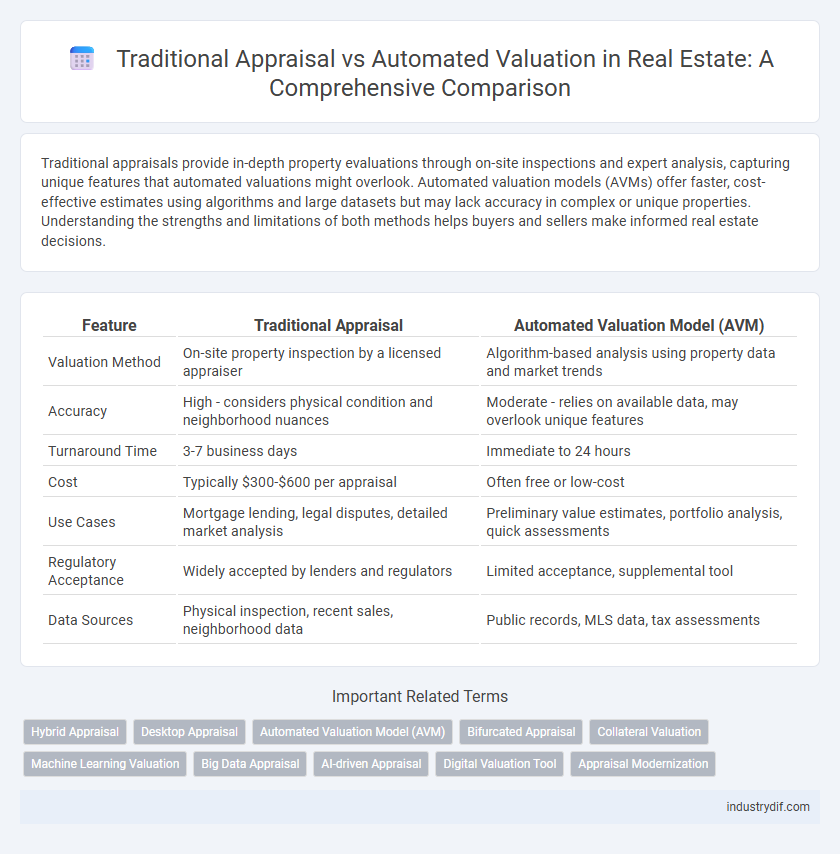

Traditional appraisals provide in-depth property evaluations through on-site inspections and expert analysis, capturing unique features that automated valuations might overlook. Automated valuation models (AVMs) offer faster, cost-effective estimates using algorithms and large datasets but may lack accuracy in complex or unique properties. Understanding the strengths and limitations of both methods helps buyers and sellers make informed real estate decisions.

Table of Comparison

| Feature | Traditional Appraisal | Automated Valuation Model (AVM) |

|---|---|---|

| Valuation Method | On-site property inspection by a licensed appraiser | Algorithm-based analysis using property data and market trends |

| Accuracy | High - considers physical condition and neighborhood nuances | Moderate - relies on available data, may overlook unique features |

| Turnaround Time | 3-7 business days | Immediate to 24 hours |

| Cost | Typically $300-$600 per appraisal | Often free or low-cost |

| Use Cases | Mortgage lending, legal disputes, detailed market analysis | Preliminary value estimates, portfolio analysis, quick assessments |

| Regulatory Acceptance | Widely accepted by lenders and regulators | Limited acceptance, supplemental tool |

| Data Sources | Physical inspection, recent sales, neighborhood data | Public records, MLS data, tax assessments |

Definition of Traditional Appraisal

Traditional appraisal involves a licensed appraiser conducting an in-depth property inspection and analyzing comparable sales, market trends, and property conditions to determine accurate market value. This method relies on expert judgment, on-site evaluations, and detailed reports to capture unique property features and local market nuances. It remains the industry standard for mortgage lending, legal disputes, and high-value transactions due to its thoroughness and reliability.

Overview of Automated Valuation Models (AVMs)

Automated Valuation Models (AVMs) utilize sophisticated algorithms and extensive real estate data, such as recent sales, property characteristics, and market trends, to generate property valuations quickly and consistently. Unlike traditional appraisals, which rely on subjective expert analysis and physical inspections, AVMs provide scalable and cost-effective estimates, enhancing efficiency in property assessment processes. Key AVM types include statistical models, machine learning techniques, and hybrid approaches that integrate multiple data sources for improved accuracy.

Key Differences Between Traditional and Automated Valuations

Traditional appraisals rely on licensed appraisers conducting in-depth property inspections and local market analysis to determine value, offering personalized insights and adjustments for unique property features. Automated valuations use algorithms and big data, including recent sales, tax records, and market trends, to provide rapid property value estimates without physical inspections. The key difference lies in accuracy and customization, where traditional appraisals excel in subjectivity and nuanced analysis, while automated valuations prioritize speed, efficiency, and scalability.

Accuracy and Reliability Comparison

Traditional appraisals rely on certified appraisers conducting on-site inspections and considering unique property features, resulting in highly accurate and reliable valuations. Automated valuation models (AVMs) use algorithms analyzing large datasets such as recent sales, tax assessments, and market trends, offering faster but sometimes less precise estimates. While AVMs provide scalability and speed, traditional appraisals remain the gold standard in accuracy and reliability, especially for complex or unique real estate transactions.

Time and Cost Efficiency

Traditional real estate appraisals typically require several days and incur higher costs due to on-site inspections and expert analysis. Automated valuation models (AVMs) deliver property estimates within minutes using advanced algorithms and vast data sets, significantly reducing both time and expenses. The increased efficiency of AVMs benefits buyers, sellers, and lenders by providing quick, cost-effective property valuations without sacrificing accuracy.

Human Expertise vs Algorithm-Based Analysis

Traditional appraisals rely on human expertise, leveraging local market knowledge and professional judgment to assess property value with nuanced understanding of unique characteristics. Automated valuation models use algorithm-based analysis, processing vast datasets and comparable sales to provide rapid, consistent estimates but may lack insight into local market trends or property specifics. Combining human expertise with advanced algorithms offers a balanced approach, enhancing accuracy and reliability in real estate valuation.

Common Use Cases for Each Valuation Method

Traditional appraisals are predominantly used for mortgage lending, legal disputes, and complex property evaluations where detailed inspection and expert judgment are essential. Automated valuation models (AVMs) serve efficiently in quick property estimates for refinancing, portfolio management, and market trend analysis by leveraging large datasets and algorithms. Both methods complement each other in real estate transactions, balancing accuracy and speed depending on the intended use and regulatory requirements.

Limitations and Challenges of Traditional Appraisals

Traditional appraisals face limitations such as subjective judgment, time-consuming processes, and higher costs compared to automated valuations. Appraisers may encounter challenges with inconsistent data quality and difficulty in accurately assessing unique property features. These factors can result in appraisal delays and variability in valuation accuracy.

Limitations and Challenges of Automated Valuation

Automated valuation models (AVMs) often face limitations in accurately assessing unique or complex properties due to reliance on standardized data and algorithms. These systems may struggle with incomplete or outdated data, leading to valuation inaccuracies and reduced reliability in rapidly changing markets. Unlike traditional appraisals, AVMs lack the nuanced judgment of professional appraisers who incorporate local market trends and property-specific conditions.

Future Trends in Property Valuation Methods

Future trends in property valuation methods emphasize increased reliance on automated valuation models (AVMs), driven by advances in artificial intelligence and big data analytics that enhance accuracy and efficiency. Traditional appraisals remain essential for complex or unique properties but face integration pressures as hybrid models combining expert insight with algorithmic data gain prominence. Emerging technologies like machine learning and geospatial analysis are revolutionizing market forecasting, leading to dynamic, real-time property valuations that better reflect fluctuating market conditions.

Related Important Terms

Hybrid Appraisal

Hybrid appraisal combines the accuracy of traditional appraisal methods with the efficiency of automated valuation models (AVMs), leveraging both appraiser expertise and advanced algorithms to deliver faster, more reliable property assessments. This approach enhances valuation precision by integrating comprehensive market data, property characteristics, and real-time analytics, optimizing decision-making in real estate transactions.

Desktop Appraisal

Desktop appraisal leverages automated valuation models (AVMs) to estimate property value using algorithms and aggregated data, offering faster and cost-effective assessments compared to traditional appraisals that rely on in-person inspections by licensed appraisers. While desktop appraisals enhance efficiency in real estate transactions, they may lack the nuanced insights provided by comprehensive physical evaluations in complex or unique properties.

Automated Valuation Model (AVM)

Automated Valuation Models (AVMs) leverage advanced algorithms and extensive data sets, including recent sales, property characteristics, and market trends, to estimate property values quickly and accurately without the need for physical inspections. AVMs offer real estate professionals and buyers a cost-effective and efficient alternative to traditional appraisals, providing instant valuations that support informed decision-making in dynamic markets.

Bifurcated Appraisal

Bifurcated appraisal divides the traditional real estate valuation process by separating the property inspection from the appraisal report preparation, enhancing efficiency and reducing costs. Automated valuation models (AVMs) complement this approach by using algorithms and extensive datasets to provide quick property value estimates, streamlining decision-making for buyers, sellers, and lenders.

Collateral Valuation

Traditional appraisal relies on in-person inspections and expert judgment to assess property value, ensuring detailed collateral valuation accuracy. Automated valuation models (AVMs) use big data algorithms and recent sales metrics to provide rapid, scalable collateral valuations but may lack property-specific nuances captured by traditional methods.

Machine Learning Valuation

Machine Learning Valuation (MLV) in real estate leverages advanced algorithms to analyze vast datasets, providing highly accurate property valuations faster than traditional appraisals that rely on manual inspections and comparable sales. MLV continuously improves valuation precision by integrating real-time market trends, property features, and transactional data, streamlining decision-making for buyers, sellers, and lenders.

Big Data Appraisal

Big Data Appraisal leverages vast datasets and advanced algorithms to provide more accurate and timely property valuations compared to traditional appraisals, which rely heavily on manual inspections and limited comparable sales data. By integrating real-time market trends, socioeconomic factors, and historical property records, automated valuations enhance predictive accuracy and reduce human bias, transforming the real estate appraisal landscape.

AI-driven Appraisal

AI-driven appraisal leverages machine learning algorithms to analyze vast datasets, providing real-time property valuations with enhanced accuracy and reduced human bias compared to traditional appraisals. This technology integrates historical sales data, local market trends, and property features to deliver efficient, scalable, and cost-effective valuation solutions in the real estate industry.

Digital Valuation Tool

Digital Valuation Tools leverage machine learning algorithms and extensive data sets to provide instant property value estimates, enhancing accuracy and efficiency compared to traditional appraisals that rely on manual inspections and subjective assessments. These automated valuations integrate market trends, neighborhood analytics, and comparable sales data, streamlining real estate transactions and enabling faster decision-making for buyers, sellers, and lenders.

Appraisal Modernization

Traditional appraisal relies on in-person inspections and expert judgment, leading to longer turnaround times and potential subjectivity. Automated valuation models leverage big data and machine learning algorithms to provide faster, more consistent property valuations, driving appraisal modernization and enhancing accuracy in real estate markets.

Traditional appraisal vs Automated valuation Infographic

industrydif.com

industrydif.com