Mortgage brokers connect borrowers with traditional lenders, offering personalized advice and access to a range of mortgage products, often requiring extensive paperwork and longer approval times. Blockchain mortgage facilitators streamline the process by utilizing decentralized technology to verify identities, secure transactions, and automate approvals, resulting in faster, more transparent, and lower-cost lending experiences. This technological advancement enhances security and reduces fraud risks, positioning blockchain facilitators as a disruptive force in the real estate financing market.

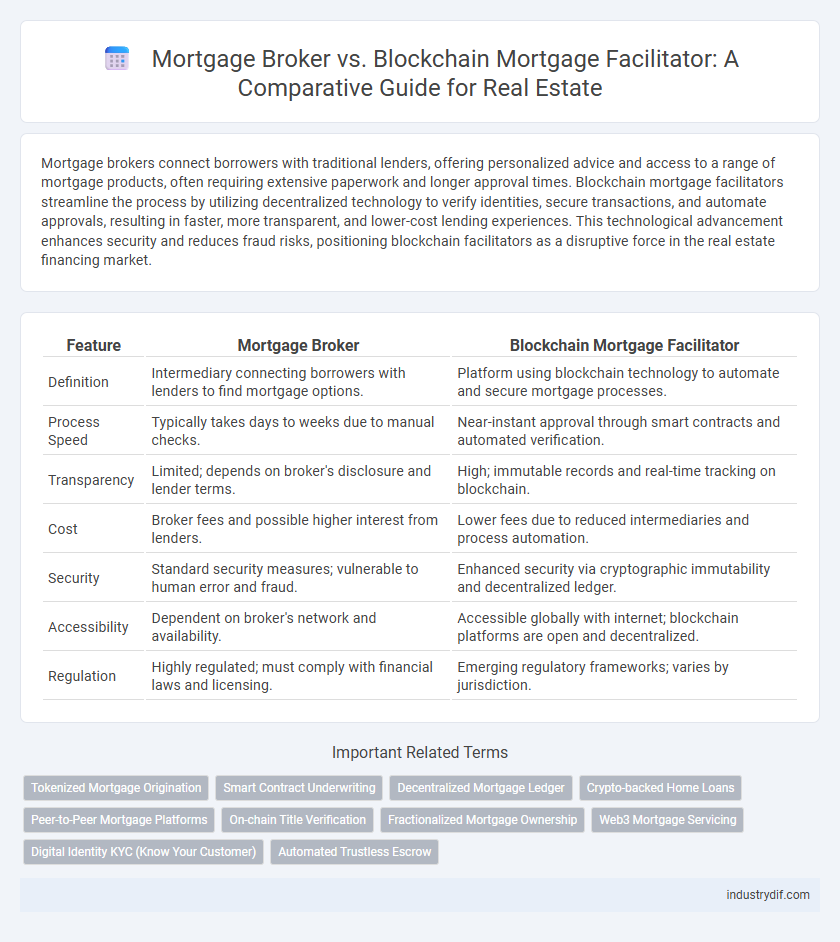

Table of Comparison

| Feature | Mortgage Broker | Blockchain Mortgage Facilitator |

|---|---|---|

| Definition | Intermediary connecting borrowers with lenders to find mortgage options. | Platform using blockchain technology to automate and secure mortgage processes. |

| Process Speed | Typically takes days to weeks due to manual checks. | Near-instant approval through smart contracts and automated verification. |

| Transparency | Limited; depends on broker's disclosure and lender terms. | High; immutable records and real-time tracking on blockchain. |

| Cost | Broker fees and possible higher interest from lenders. | Lower fees due to reduced intermediaries and process automation. |

| Security | Standard security measures; vulnerable to human error and fraud. | Enhanced security via cryptographic immutability and decentralized ledger. |

| Accessibility | Dependent on broker's network and availability. | Accessible globally with internet; blockchain platforms are open and decentralized. |

| Regulation | Highly regulated; must comply with financial laws and licensing. | Emerging regulatory frameworks; varies by jurisdiction. |

Understanding the Roles: Mortgage Broker vs. Blockchain Mortgage Facilitator

A mortgage broker acts as an intermediary between borrowers and traditional lenders, helping clients secure loans by comparing various mortgage products and negotiating terms. In contrast, a blockchain mortgage facilitator leverages decentralized ledger technology to streamline mortgage processes, increase transparency, and reduce reliance on intermediaries through smart contracts and digital asset verification. Understanding these roles highlights the shift from conventional loan origination methods to innovative, technology-driven mortgage solutions in real estate financing.

Key Differences in Mortgage Origination Processes

Mortgage brokers traditionally act as intermediaries between borrowers and lenders, gathering credit information, assessing eligibility, and facilitating loan applications through established financial institutions. Blockchain mortgage facilitators leverage decentralized ledger technology to automate verification, reduce paperwork, and enhance transparency by recording all transactions securely and immutably on a blockchain. Key differences include increased efficiency, faster processing times, and reduced reliance on intermediaries in blockchain-enabled mortgage origination compared to conventional broker-led methods.

Technology Integration: Traditional vs. Blockchain Solutions

Mortgage brokers rely on established digital platforms for loan processing, verification, and communication, streamlining traditional workflows through centralized technology systems. Blockchain mortgage facilitators leverage decentralized ledger technology to enhance transparency, security, and automation via smart contracts, reducing processing time and minimizing fraud risks. Integration of blockchain solutions disrupts conventional mortgage practices by enabling peer-to-peer transactions and immutable record-keeping, offering a more efficient and trustworthy alternative to the traditional mortgage pipeline.

Transaction Speed and Efficiency Comparisons

Mortgage brokers typically involve slower transaction speeds due to manual documentation and third-party verifications, which can extend loan approval times to several weeks. Blockchain mortgage facilitators utilize smart contracts and decentralized ledger technology to automate verification processes, significantly accelerating transactions to near real-time settlement. This enhanced efficiency reduces costs and minimizes the risk of errors, transforming traditional mortgage workflows into seamless digital experiences.

Transparency and Security in Mortgage Transactions

Mortgage brokers traditionally act as intermediaries, offering personalized guidance but relying on centralized systems that can obscure transaction transparency. Blockchain mortgage facilitators use decentralized ledgers, ensuring immutable records and real-time visibility, which dramatically enhances transparency and security in mortgage processes. Smart contracts on blockchain platforms automate verification and approvals, reducing fraud risk and increasing trust among all parties involved.

Regulatory Compliance and Industry Standards

Mortgage brokers operate under strict regulatory frameworks such as the Real Estate Settlement Procedures Act (RESPA) and maintain compliance with local and federal lending standards to ensure borrower protection and transparency. Blockchain mortgage facilitators leverage decentralized ledger technology to provide immutable transaction records, enhancing transparency and security while navigating emerging regulatory landscapes that are still evolving to address digital asset compliance and data privacy. Both entities must adhere to anti-money laundering (AML) laws and know-your-customer (KYC) protocols, but blockchain facilitators face unique challenges in aligning with traditional financial regulations due to the novel nature of their technology.

Client Experience: Personalization vs. Automation

Mortgage brokers offer personalized client experiences by tailoring loan options to individual financial profiles and providing direct human guidance throughout the mortgage process. Blockchain mortgage facilitators utilize automation to streamline approvals, reduce paperwork, and enhance transaction transparency through smart contracts. This shift from personalization to automation improves efficiency but may reduce personalized interactions that some clients value in complex financial decisions.

Cost Structure: Fees and Savings Analysis

Mortgage brokers typically charge upfront fees and commissions, which can range from 0.5% to 2% of the loan amount, impacting overall borrowing costs. Blockchain mortgage facilitators reduce expenses by leveraging decentralized technology, minimizing intermediaries, and automating processes, resulting in lower fees and faster transactions. Cost savings through blockchain can include reduced administrative fees, decreased underwriting costs, and elimination of third-party charges, enhancing affordability for borrowers.

Challenges Facing Blockchain Adoption in Mortgages

Blockchain mortgage facilitators face significant challenges in adoption, including regulatory uncertainty and integration with existing financial systems. Mortgage brokers benefit from established networks and compliance frameworks, while blockchain platforms struggle with scalability and consumer trust issues. Overcoming legal hurdles and ensuring data privacy remain critical obstacles for blockchain technology to disrupt traditional mortgage processes.

Future Trends: Evolution of Mortgage Facilitation

Mortgage brokers are evolving by integrating blockchain technology to enhance transparency, reduce processing times, and increase security in loan origination. Blockchain mortgage facilitators leverage decentralized ledgers to streamline property title verification and automate smart contracts, minimizing human error and fraud. Future trends indicate a shift towards fully digitized, trustless mortgage platforms that democratize access to home financing and revolutionize the traditional mortgage ecosystem.

Related Important Terms

Tokenized Mortgage Origination

Tokenized mortgage origination through blockchain mortgage facilitators streamlines the loan approval process by automating verification and ensuring transparent, immutable records, contrasting with traditional mortgage brokers who rely on manual procedures and centralized systems. This innovative approach reduces costs, accelerates transaction times, and enhances security by leveraging smart contracts and decentralized ledgers.

Smart Contract Underwriting

Smart contract underwriting in blockchain mortgage facilitation automates loan approval by securely executing contract terms on a decentralized ledger, significantly reducing processing time and human error compared to traditional mortgage brokers. This innovation enhances transparency, streamlines verification of borrower credentials, and enforces compliance through coded rules, revolutionizing mortgage transactions.

Decentralized Mortgage Ledger

A mortgage broker acts as an intermediary between borrowers and lenders, streamlining loan applications through centralized databases, while a blockchain mortgage facilitator leverages a decentralized mortgage ledger to enhance transparency, reduce fraud, and accelerate transaction times. The decentralized mortgage ledger enables secure, immutable records of property titles and loan agreements, minimizing reliance on traditional third parties and lowering costs in real estate financing.

Crypto-backed Home Loans

Mortgage brokers traditionalize home loan processes by connecting borrowers with lenders, ensuring competitive interest rates and personalized financial advice, while blockchain mortgage facilitators leverage decentralized ledgers to enable transparent, faster, and secure Crypto-backed Home Loans. Crypto-backed Home Loans utilize digital assets as collateral, reducing reliance on conventional credit checks and offering innovative, borderless financing options in the real estate market.

Peer-to-Peer Mortgage Platforms

Peer-to-peer mortgage platforms leverage blockchain technology to enable direct transactions between borrowers and lenders, reducing reliance on traditional mortgage brokers and lowering transaction costs. This decentralized approach enhances transparency, accelerates loan processing times, and provides greater access to financing options for both parties in the real estate market.

On-chain Title Verification

Mortgage brokers rely on traditional title verification methods that involve extensive paperwork and third-party validation, often causing delays in the loan approval process. Blockchain mortgage facilitators leverage on-chain title verification to provide transparent, tamper-proof property records, significantly reducing fraud risks and accelerating transaction speed in real estate financing.

Fractionalized Mortgage Ownership

Mortgage brokers traditionally connect borrowers with lenders, managing loan applications and securing favorable terms, while blockchain mortgage facilitators use decentralized ledgers to enable fractionalized mortgage ownership, allowing multiple investors to share equity and reduce individual risk. Fractionalized mortgage ownership on blockchain platforms increases liquidity and transparency, transforming real estate investment by enabling smaller, more accessible stakes in property loans.

Web3 Mortgage Servicing

Web3 mortgage servicing leverages blockchain technology to enhance transparency, security, and efficiency in mortgage transactions, contrasting traditional mortgage brokers who rely on centralized platforms and manual processes. By automating verification, record-keeping, and payment settlements through smart contracts, blockchain mortgage facilitators reduce costs and improve trust among borrowers and lenders.

Digital Identity KYC (Know Your Customer)

Mortgage brokers rely on traditional KYC processes involving physical document verification and manual identity checks, which can be time-consuming and prone to errors. Blockchain mortgage facilitators leverage decentralized digital identity solutions, enabling secure, tamper-proof KYC verification that accelerates approval times and enhances data privacy in real estate financing.

Automated Trustless Escrow

Mortgage brokers serve as intermediaries connecting borrowers with lenders, manually managing trust and escrow processes, while blockchain mortgage facilitators utilize automated trustless escrow systems powered by smart contracts to enhance transparency, reduce fraud, and accelerate transaction settlements. This decentralized approach eliminates reliance on third parties, ensuring secure, immutable recording of funds and ownership transfers within the property sale lifecycle.

Mortgage broker vs Blockchain mortgage facilitator Infographic

industrydif.com

industrydif.com