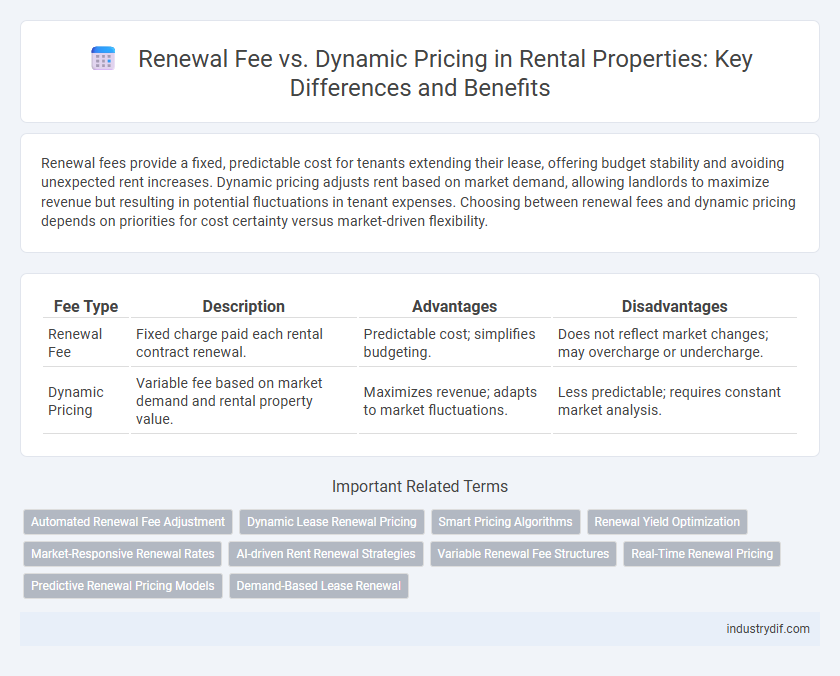

Renewal fees provide a fixed, predictable cost for tenants extending their lease, offering budget stability and avoiding unexpected rent increases. Dynamic pricing adjusts rent based on market demand, allowing landlords to maximize revenue but resulting in potential fluctuations in tenant expenses. Choosing between renewal fees and dynamic pricing depends on priorities for cost certainty versus market-driven flexibility.

Table of Comparison

| Fee Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Renewal Fee | Fixed charge paid each rental contract renewal. | Predictable cost; simplifies budgeting. | Does not reflect market changes; may overcharge or undercharge. |

| Dynamic Pricing | Variable fee based on market demand and rental property value. | Maximizes revenue; adapts to market fluctuations. | Less predictable; requires constant market analysis. |

Understanding Renewal Fees in Rental Agreements

Renewal fees in rental agreements are fixed charges landlords impose when tenants extend their lease beyond the original term, typically covering administrative costs and market adjustments. Unlike dynamic pricing, which fluctuates based on real-time market demand and availability, renewal fees provide predictable costs for tenants renewing their contracts. Understanding renewal fees helps tenants anticipate expenses and negotiate terms effectively during lease extensions.

What is Dynamic Pricing in the Rental Industry?

Dynamic pricing in the rental industry refers to the strategy of adjusting rental rates based on real-time market demand, seasonality, and local events to maximize revenue. Unlike a fixed renewal fee, dynamic pricing allows landlords to optimize prices continuously by analyzing factors such as occupancy rates, competitor pricing, and user behavior patterns. This approach enhances profitability by aligning rental costs with current market trends rather than relying on static fees.

Key Differences Between Renewal Fees and Dynamic Pricing

Renewal fees in rental agreements are fixed charges applied at the end of a lease term to extend the lease, providing predictable costs for tenants. Dynamic pricing adjusts rent based on real-time market demand, vacancy rates, and seasonal trends, allowing landlords to maximize revenue. Key differences include predictability and flexibility: renewal fees offer stability while dynamic pricing introduces variability that reflects current market conditions.

Impact of Renewal Fees on Tenant Retention

Renewal fees often discourage tenants from extending their leases, leading to higher turnover rates and increased vacancy periods for landlords. Dynamic pricing models adjust rent based on market demand, potentially reducing the need for separate renewal fees by aligning costs with tenant willingness to pay. By minimizing upfront renewal costs through dynamic pricing strategies, landlords can enhance tenant retention and ensure more stable occupancy rates.

How Dynamic Pricing Influences Rental Revenue

Dynamic pricing adjusts rental rates in real-time based on market demand, occupancy levels, and competitor pricing, significantly increasing potential rental revenue compared to static renewal fees. This strategy maximizes income during high-demand periods by capturing premium prices, while optimizing occupancy during low-demand times with adjusted rates. By leveraging data-driven algorithms, dynamic pricing enhances profitability and provides landlords with greater financial flexibility than fixed renewal fees.

Pros and Cons of Renewal Fees for Landlords and Tenants

Renewal fees provide landlords with predictable additional income and help cover administrative costs, but tenants may view these fees as an unfair extra expense, potentially impacting tenant retention. Unlike dynamic pricing, which adjusts rent based on market demand and can optimize revenue, renewal fees are fixed and may discourage lease renewals if perceived as excessive. Tenants benefit from stability in renewal fees, while landlords risk alienating renters by not adopting flexible pricing strategies that reflect current market conditions.

The Benefits and Challenges of Implementing Dynamic Pricing

Dynamic pricing in rental markets maximizes revenue by adjusting rates based on demand, occupancy, and market trends, outperforming static renewal fees that can limit income potential. Implementing dynamic pricing enhances competitiveness and attracts price-sensitive tenants but requires advanced data analytics and real-time market monitoring. Challenges include potential tenant dissatisfaction due to price fluctuations and the complexity of integrating automated pricing algorithms with existing property management systems.

Renewal Fee Strategies vs. Dynamic Pricing Models

Renewal fee strategies provide predictable income by setting fixed costs for lease extensions, enhancing tenant retention through stability and clear expectations. Dynamic pricing models adjust rental rates based on market demand, occupancy rates, and seasonal factors, maximizing revenue potential in fluctuating markets. Balancing renewal fees and dynamic pricing allows landlords to optimize profitability while maintaining tenant satisfaction and lease continuity.

Legal Considerations for Renewal Fees and Dynamic Pricing

Legal considerations for renewal fees and dynamic pricing in rental agreements center on compliance with local landlord-tenant laws and regulations that often limit excessive or non-transparent fee structures. Renewal fees must be clearly disclosed, reasonable, and not used as punitive measures, while dynamic pricing models must avoid discriminatory practices and ensure price fluctuations are justifiable by market conditions. Landlords should document all fees and pricing adjustments to mitigate potential legal disputes and adhere to fair housing laws.

Choosing the Right Pricing Approach for Rental Properties

Choosing between a renewal fee and dynamic pricing depends on the rental market's volatility and tenant retention goals. Renewal fees provide predictable income and encourage long-term leases, while dynamic pricing adjusts rent based on real-time demand and market trends, maximizing revenue potential. Landlords should analyze local market data, vacancy rates, and tenant profiles to determine the optimal pricing strategy for each rental property.

Related Important Terms

Automated Renewal Fee Adjustment

Automated renewal fee adjustment streamlines rental lease extensions by dynamically aligning fees with current market rates, ensuring optimal pricing without manual intervention. This system leverages real-time data to balance renter retention and revenue maximization, outperforming traditional static renewal fees.

Dynamic Lease Renewal Pricing

Dynamic lease renewal pricing leverages real-time market data and tenant behavior analytics to adjust renewal offers, maximizing landlord revenue while enhancing tenant retention. This approach outperforms flat renewal fees by aligning lease terms with current demand and competitive rental rates.

Smart Pricing Algorithms

Smart pricing algorithms enable rental platforms to optimize renewal fees by analyzing market demand, competitor rates, and tenant behavior in real-time. This dynamic pricing approach maximizes revenue while maintaining competitive and fair renewal fees, outperforming traditional fixed-price models.

Renewal Yield Optimization

Renewal fee strategies provide stable income streams by locking in tenant retention costs, while dynamic pricing models leverage real-time market data to maximize rental revenue through optimized renewal yields. Balancing renewal fees with dynamic pricing enables landlords to enhance tenant lifetime value and drive higher return on investment in competitive rental markets.

Market-Responsive Renewal Rates

Market-responsive renewal rates leverage dynamic pricing strategies to adjust rental fees based on current demand, occupancy rates, and competitor pricing, ensuring landlords maximize revenue while retaining tenants. Renewal fees set as static premiums often fail to capture real-time market fluctuations, making dynamic approaches more effective for balancing profitability and tenant satisfaction.

AI-driven Rent Renewal Strategies

AI-driven rent renewal strategies utilize data analytics and machine learning to optimize renewal fees by predicting tenant behavior and local market trends, outperforming traditional dynamic pricing models. These strategies enhance revenue management by balancing tenant retention with maximizing rental income through personalized pricing adjustments.

Variable Renewal Fee Structures

Variable renewal fee structures in rental agreements introduce flexibility by adjusting fees based on market demand, tenant history, or property conditions rather than a fixed rate. This dynamic pricing approach helps landlords optimize revenue and tenant retention, balancing profitability with competitive positioning in fluctuating rental markets.

Real-Time Renewal Pricing

Real-time renewal pricing leverages dynamic pricing algorithms to adjust renewal fees based on current market demand, occupancy rates, and tenant behavior, optimizing revenue for property owners. This approach contrasts with fixed renewal fees by offering flexible pricing that can increase profitability and improve tenant retention through market-responsive adjustments.

Predictive Renewal Pricing Models

Predictive renewal pricing models leverage historical tenant data and market trends to forecast optimal renewal fees, balancing landlord revenue goals and tenant retention rates. Unlike static renewal fees, these models integrate dynamic pricing elements to adjust fees in real-time based on demand, occupancy rates, and competitor pricing, maximizing rental income while minimizing vacancy risks.

Demand-Based Lease Renewal

Demand-based lease renewal utilizes dynamic pricing models to adjust renewal fees according to current market demand and rental property occupancy rates. This approach optimizes revenue by increasing renewal fees during high-demand periods and offering competitive rates when demand is lower.

Renewal fee vs Dynamic pricing Infographic

industrydif.com

industrydif.com