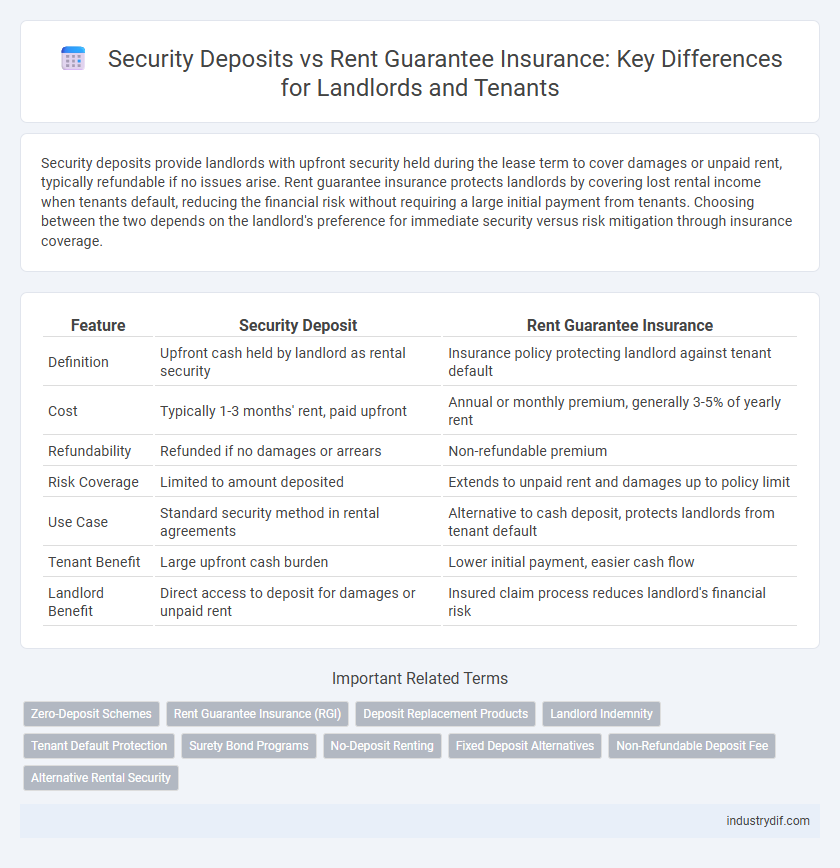

Security deposits provide landlords with upfront security held during the lease term to cover damages or unpaid rent, typically refundable if no issues arise. Rent guarantee insurance protects landlords by covering lost rental income when tenants default, reducing the financial risk without requiring a large initial payment from tenants. Choosing between the two depends on the landlord's preference for immediate security versus risk mitigation through insurance coverage.

Table of Comparison

| Feature | Security Deposit | Rent Guarantee Insurance |

|---|---|---|

| Definition | Upfront cash held by landlord as rental security | Insurance policy protecting landlord against tenant default |

| Cost | Typically 1-3 months' rent, paid upfront | Annual or monthly premium, generally 3-5% of yearly rent |

| Refundability | Refunded if no damages or arrears | Non-refundable premium |

| Risk Coverage | Limited to amount deposited | Extends to unpaid rent and damages up to policy limit |

| Use Case | Standard security method in rental agreements | Alternative to cash deposit, protects landlords from tenant default |

| Tenant Benefit | Large upfront cash burden | Lower initial payment, easier cash flow |

| Landlord Benefit | Direct access to deposit for damages or unpaid rent | Insured claim process reduces landlord's financial risk |

Understanding Security Deposits in Rental Agreements

Security deposits in rental agreements serve as a financial safeguard for landlords, typically amounting to one to two months' rent, held to cover damages or unpaid rent during tenancy. Unlike rent guarantee insurance, which provides landlords with a guarantee of rent payments in case of tenant default, security deposits are collected upfront and returned if the property is undamaged and rent obligations are met. Thorough understanding of security deposit terms, including conditions for deductions and legal limits, is essential for both tenants and landlords to prevent disputes and ensure compliance with local rental laws.

What is Rent Guarantee Insurance?

Rent guarantee insurance protects landlords by covering rental payments if tenants default, ensuring steady income during lease terms. Unlike security deposits, which are upfront funds held as collateral, rent guarantee insurance involves a policy purchased to mitigate financial risks from non-payment. This insurance often covers legal fees related to tenant eviction and provides landlords with extended financial security beyond traditional deposits.

Key Differences Between Security Deposit and Rent Guarantee Insurance

Security deposits are upfront payments made by tenants to landlords as financial protection against property damage or unpaid rent, typically refunded if no issues arise. Rent guarantee insurance, however, is a policy landlords purchase to cover lost rental income due to tenant default, removing the need for holding large deposits. Unlike security deposits, rent guarantee insurance spreads risk through premiums, offering landlords more predictable financial security without tenant-held funds.

Pros and Cons of Security Deposits for Landlords and Tenants

Security deposits provide landlords with immediate financial protection against tenant damage or unpaid rent but require tenants to tie up a significant amount of money upfront, reducing their cash flow. While security deposits are refundable if no damages occur, disputes over deductions can lead to lengthy conflicts and delays in tenant repayment. This method relies on landlords' proper management and tenants' trust, often causing friction compared to alternative options like rent guarantee insurance.

Advantages and Disadvantages of Rent Guarantee Insurance

Rent Guarantee Insurance offers landlords financial protection against tenant payment defaults, ensuring steady rental income without requiring a large upfront security deposit. It reduces the risk of prolonged eviction processes and legal costs associated with non-payment, while often covering additional tenant damages and arrears. However, premiums and coverage conditions can vary, potentially leading to higher long-term costs compared to traditional security deposits, and some policies may have claim limitations or exclusions.

Cost Comparison: Security Deposit vs. Rent Guarantee Insurance

Security deposits typically require tenants to pay an upfront lump sum equal to one to three months' rent, which landlords hold as collateral against damages or missed payments. Rent guarantee insurance, by contrast, involves a monthly premium often ranging from 1% to 3% of the monthly rent, providing landlords with coverage against tenant default without requiring a large upfront amount. This cost structure makes rent guarantee insurance a more cash-flow-friendly option for tenants, while landlords benefit from consistent protection throughout the lease term.

Legal Considerations for Security Deposits and Rent Guarantee Insurance

Security deposits are legally regulated, often requiring landlords to hold funds in separate accounts and return them within a specified timeframe after tenancy ends, subject to deductions for damages. Rent guarantee insurance, governed by contract law, provides landlords a financial safeguard against tenant default without the need for upfront cash but must comply with insurance and consumer protection laws. Understanding jurisdiction-specific legal frameworks is crucial for landlords to ensure compliance and protect their rights in both security deposits and rent guarantee insurance agreements.

Impact on Tenant Accessibility and Affordability

Security deposits often require tenants to provide a substantial upfront sum, which can limit accessibility for low-income renters and reduce overall affordability. Rent guarantee insurance shifts the financial risk from tenants to insurers, allowing tenants to avoid large initial payments and facilitating easier access to rental properties. This insurance option promotes greater affordability and expands housing opportunities by lowering entry barriers for renters.

How Claims Work: Security Deposit vs Rent Guarantee Insurance

Security deposits provide landlords with upfront funds that can be claimed against damages or unpaid rent after the tenant vacates, requiring documentation and inspection to process claims. Rent guarantee insurance offers a streamlined claims process where landlords receive timely compensation for missed rent payments through the insurer, often without the need for extensive proof of damages or tenant fault. Both methods protect landlords financially, but rent guarantee insurance typically enables faster recovery of losses compared to the security deposit claim process.

Choosing the Right Option: Factors for Landlords and Tenants

Security deposits provide landlords with immediate funds to cover damages or unpaid rent but may strain tenants financially upfront. Rent guarantee insurance offers landlords protection against rent default without requiring tenants to pay a large sum initially, improving tenant accessibility. Factors such as upfront costs, risk tolerance, tenant financial stability, and legal regulations influence the decision between security deposits and rent guarantee insurance for landlords and tenants.

Related Important Terms

Zero-Deposit Schemes

Zero-deposit schemes provide tenants with an alternative to traditional security deposits by using rent guarantee insurance, which covers landlords against potential damages or unpaid rent without requiring upfront cash. This approach enhances tenant affordability and flexibility while safeguarding landlords financially through insurance-backed guarantees.

Rent Guarantee Insurance (RGI)

Rent Guarantee Insurance (RGI) offers landlords protection against tenant default by covering missed rent payments, providing a more flexible alternative to traditional security deposits that are often limited to one or two months' rent. Unlike security deposits, RGI enhances cash flow stability and reduces the financial risk associated with long-term tenant non-payment, making it a preferred choice for property investors.

Deposit Replacement Products

Security deposit replacement products, such as rent guarantee insurance, reduce upfront costs for tenants by substituting traditional cash deposits with insurance policies covering potential damages and unpaid rent. These innovative solutions enhance rental affordability while providing landlords financial protection and faster claim processing compared to conventional security deposits.

Landlord Indemnity

Security deposits provide landlords with upfront financial security by holding tenant funds against potential damages or unpaid rent, while rent guarantee insurance offers indemnity by covering lost rental income through an insurance policy, minimizing landlord financial risk. Rent guarantee insurance typically extends broader protection, including legal expenses and occupancy risks, creating a more comprehensive indemnity framework beyond the refundable security deposit.

Tenant Default Protection

Security deposit provides landlords with upfront funds to cover tenant default risks, but rent guarantee insurance offers comprehensive tenant default protection by securing monthly rent payments for an agreed period. Rent guarantee insurance minimizes financial losses and legal disputes, enhancing landlord security beyond traditional security deposits.

Surety Bond Programs

Security deposit requirements can be reduced or replaced by rent guarantee insurance, which provides landlords with surety bond programs that secure rent payments and mitigate tenant default risks. Surety bond programs offer a reliable, insurance-backed alternative to traditional cash deposits, enhancing financial protection while improving tenant accessibility to rental units.

No-Deposit Renting

No-deposit renting eliminates upfront security deposits by utilizing rent guarantee insurance, which protects landlords against tenant default while offering tenants a more accessible move-in option. Rent guarantee insurance reduces financial barriers and enhances rental market flexibility compared to traditional security deposits.

Fixed Deposit Alternatives

Security deposit and rent guarantee insurance serve as financial safeguards for landlords, with security deposits requiring upfront cash typically equivalent to one or two months' rent, while rent guarantee insurance acts as a cost-effective alternative that eliminates the need for large fixed deposits. Rent guarantee insurance provides landlords with consistent rent protection without tying tenants' funds in a locked deposit, optimizing cash flow and reducing move-in costs.

Non-Refundable Deposit Fee

Security deposits require tenants to provide a refundable sum held against damages or unpaid rent, whereas rent guarantee insurance involves a non-refundable premium paid by landlords or tenants to secure rent payments without the need for upfront cash. The non-refundable deposit fee in rent guarantee insurance offers landlords financial protection without tying up tenant funds, contrasting with traditional refundable security deposits.

Alternative Rental Security

Security Deposit typically requires a lump sum payment upfront to cover potential damages or unpaid rent, whereas Rent Guarantee Insurance offers landlords protection against tenant default without necessitating a large initial deposit. Rent Guarantee Insurance serves as a cost-effective alternative rental security, improving tenant affordability while ensuring landlords receive compensation for missed payments or property damage.

Security Deposit vs Rent Guarantee Insurance Infographic

industrydif.com

industrydif.com