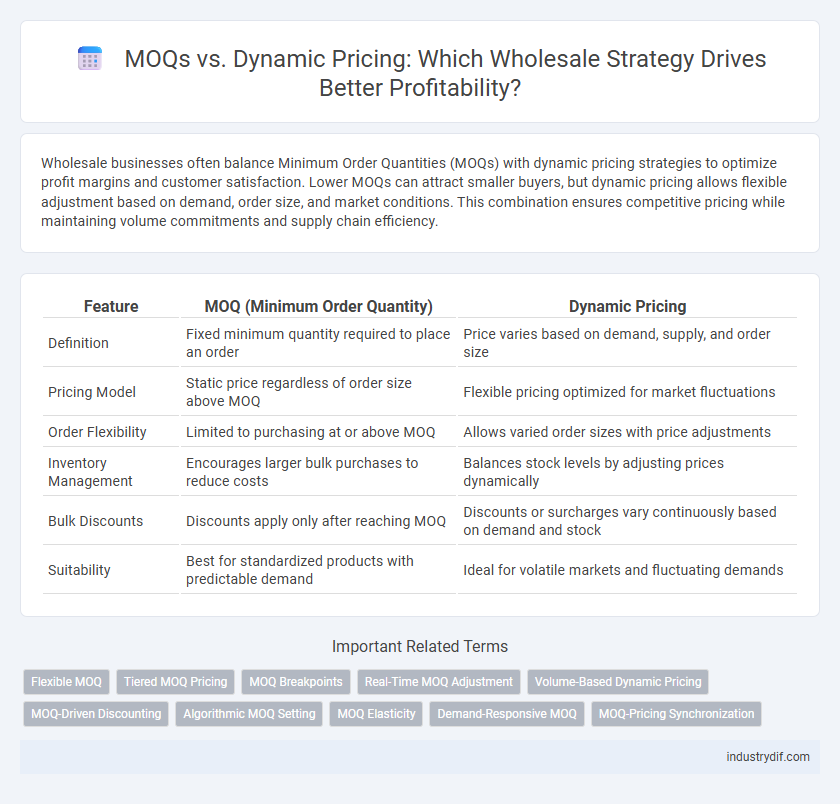

Wholesale businesses often balance Minimum Order Quantities (MOQs) with dynamic pricing strategies to optimize profit margins and customer satisfaction. Lower MOQs can attract smaller buyers, but dynamic pricing allows flexible adjustment based on demand, order size, and market conditions. This combination ensures competitive pricing while maintaining volume commitments and supply chain efficiency.

Table of Comparison

| Feature | MOQ (Minimum Order Quantity) | Dynamic Pricing |

|---|---|---|

| Definition | Fixed minimum quantity required to place an order | Price varies based on demand, supply, and order size |

| Pricing Model | Static price regardless of order size above MOQ | Flexible pricing optimized for market fluctuations |

| Order Flexibility | Limited to purchasing at or above MOQ | Allows varied order sizes with price adjustments |

| Inventory Management | Encourages larger bulk purchases to reduce costs | Balances stock levels by adjusting prices dynamically |

| Bulk Discounts | Discounts apply only after reaching MOQ | Discounts or surcharges vary continuously based on demand and stock |

| Suitability | Best for standardized products with predictable demand | Ideal for volatile markets and fluctuating demands |

Understanding MOQs in Wholesale

Minimum Order Quantities (MOQs) in wholesale define the smallest batch of products a buyer must purchase, ensuring suppliers maintain production efficiency and cost-effectiveness. MOQs directly impact inventory management, cash flow, and pricing strategies, influencing the overall profitability for both wholesalers and retailers. Understanding MOQs is critical when comparing traditional fixed pricing models to dynamic pricing, which adjusts costs based on demand, supply, and order size.

What Is Dynamic Pricing in Wholesale?

Dynamic pricing in wholesale refers to a flexible pricing strategy where product prices fluctuate based on factors such as demand, inventory levels, and competitor pricing. Unlike fixed Minimum Order Quantities (MOQs), dynamic pricing allows wholesalers to adjust prices in real-time to optimize sales and profit margins. This approach enhances market responsiveness and enables tailored pricing that reflects current market conditions.

Key Differences: MOQs vs Dynamic Pricing

Minimum Order Quantities (MOQs) require buyers to purchase a set number of units, guaranteeing volume sales and reducing per-unit costs for wholesalers. Dynamic pricing adjusts product prices based on real-time market demand, inventory levels, or competitor pricing, offering flexibility but potentially increasing price variability. MOQs emphasize consistent bulk buying to optimize production efficiency, while dynamic pricing focuses on maximizing revenue through responsive price changes.

Advantages of Minimum Order Quantities

Minimum Order Quantities (MOQs) ensure consistent inventory turnover and reduce storage costs for wholesalers, fostering more predictable cash flow management. MOQs also optimize production efficiency by encouraging larger batch manufacturing, which often leads to lower per-unit costs and improved supplier relationships. Enforcing MOQs minimizes order fragmentation, streamlining logistics and reducing administrative overhead for both suppliers and buyers.

Benefits of Dynamic Pricing Strategies

Dynamic pricing strategies in wholesale enable businesses to adjust prices in real time based on demand, inventory levels, and market trends, improving sales velocity and maximizing revenue. Unlike fixed MOQs (Minimum Order Quantities) that can limit customer flexibility, dynamic pricing attracts a broader range of buyers by offering tailored discounts and incentives. This approach enhances competitive edge, increases order frequency, and optimizes inventory management for wholesalers.

Impact on Buyer-Supplier Relationships

Minimum Order Quantities (MOQs) establish clear purchasing thresholds that foster predictable inventory management and secure pricing agreements between buyers and suppliers. Dynamic pricing introduces variability based on real-time market conditions, which can enhance flexibility but may lead to uncertainty in budgeting and trust. Balancing MOQs with dynamic pricing strategies strengthens buyer-supplier relationships by combining stability and adaptability in wholesale transactions.

MOQs and Dynamic Pricing: Profitability Insights

Minimum Order Quantities (MOQs) set clear purchase thresholds that help wholesalers manage inventory and production costs effectively, ensuring consistent profitability. Dynamic pricing adjusts product prices in real-time based on demand fluctuations, market trends, and competitor strategies, maximizing revenue potential. Balancing MOQs with dynamic pricing strategies enables wholesalers to optimize profit margins while maintaining competitive market positioning.

Challenges with Traditional MOQs

Traditional Minimum Order Quantities (MOQs) present significant challenges in wholesale, including increased inventory costs, limited flexibility, and cash flow constraints for buyers. Fixed MOQs often lead to excess stock or missed sales opportunities, hindering the ability to respond to fluctuating market demand. Dynamic pricing models offer a solution by enabling variable order sizes and flexible pricing structures that better align with buyer needs and market conditions.

How Dynamic Pricing Drives Market Competitiveness

Dynamic pricing enables wholesalers to adjust prices in real-time based on demand fluctuations, inventory levels, and competitor pricing, fostering greater market competitiveness. Unlike fixed minimum order quantities (MOQs), dynamic pricing allows flexibility for buyers, encouraging smaller or varied order sizes while optimizing profit margins. This pricing strategy enhances responsiveness to market conditions, attracting diverse customers and improving overall sales performance.

Choosing the Right Model: MOQ or Dynamic Pricing

Choosing the right pricing model between Minimum Order Quantities (MOQs) and Dynamic Pricing depends on factors like inventory turnover and customer demand variability. MOQs ensure predictable order volumes and reduce per-unit costs, ideal for stable, high-volume purchases. Dynamic Pricing offers flexibility by adjusting prices based on market trends and demand fluctuations, benefiting businesses with diverse product lines and variable sales cycles.

Related Important Terms

Flexible MOQ

Flexible MOQ (Minimum Order Quantity) enhances wholesale purchasing by allowing buyers to order varied quantities tailored to demand, reducing inventory risks and increasing market responsiveness. Dynamic pricing complements flexible MOQ by adjusting prices based on order volume and market conditions, optimizing profitability and attracting diverse customer segments.

Tiered MOQ Pricing

Tiered MOQ pricing enables wholesalers to offer dynamic pricing structures where unit costs decrease as order quantities increase, optimizing profit margins while accommodating varying client purchasing capacities. This strategy leverages multiple minimum order quantity (MOQ) tiers to stimulate larger orders and improve inventory turnover efficiency.

MOQ Breakpoints

MOQ breakpoints in wholesale establish minimum order quantities that trigger tiered pricing discounts, influencing buyers to increase order volume for better unit prices. Dynamic pricing models adjust rates based on order size and market demand, but MOQ breakpoints remain crucial for securing the most favorable wholesale discounts and inventory management.

Real-Time MOQ Adjustment

Real-time MOQ adjustment enables wholesalers to dynamically modify minimum order quantities based on current market demand, inventory levels, and buyer behavior, optimizing sales and reducing stockouts. Integrating AI-driven pricing models with MOQ flexibility enhances revenue by aligning order thresholds with fluctuating price points and customer purchasing patterns.

Volume-Based Dynamic Pricing

Volume-based dynamic pricing in wholesale adjusts prices according to order quantities, incentivizing larger purchases by reducing unit costs as volume increases. This strategy optimizes supply chain efficiency and maximizes profit margins by aligning pricing with demand fluctuations and customer buying behavior.

MOQ-Driven Discounting

MOQ-driven discounting in wholesale establishes fixed minimum order quantities to unlock tiered price reductions, ensuring predictable volume commitments while incentivizing larger purchases. This approach contrasts with dynamic pricing by providing transparent, stable discounts based on order size rather than fluctuating market factors.

Algorithmic MOQ Setting

Algorithmic MOQ setting leverages dynamic pricing models to optimize minimum order quantities based on customer demand patterns and inventory levels, enhancing wholesale efficiency. This approach balances bulk purchasing incentives with adaptive price adjustments, driving higher revenue and reducing stockouts.

MOQ Elasticity

Minimum Order Quantities (MOQs) directly impact purchasing behavior, with MOQ elasticity measuring how changes in order size requirements influence demand in wholesale markets. Dynamic pricing models leverage MOQ elasticity data to adjust prices based on order volumes, optimizing revenue while maintaining competitive advantages.

Demand-Responsive MOQ

Demand-responsive Minimum Order Quantities (MOQs) adapt dynamically to fluctuating market demand, optimizing inventory turnover and reducing excess stock costs for wholesalers. By integrating dynamic pricing strategies with adjustable MOQs, businesses can better align supply with demand, enhancing profitability and customer satisfaction.

MOQ-Pricing Synchronization

Synchronizing Minimum Order Quantities (MOQs) with dynamic pricing strategies optimizes inventory turnover and maximizes profit margins by aligning order size incentives with fluctuating market demand. Effective MOQ-pricing synchronization enables wholesalers to adjust prices based on order volume thresholds, reducing excess stock and improving cash flow management.

MOQs vs Dynamic Pricing Infographic

industrydif.com

industrydif.com