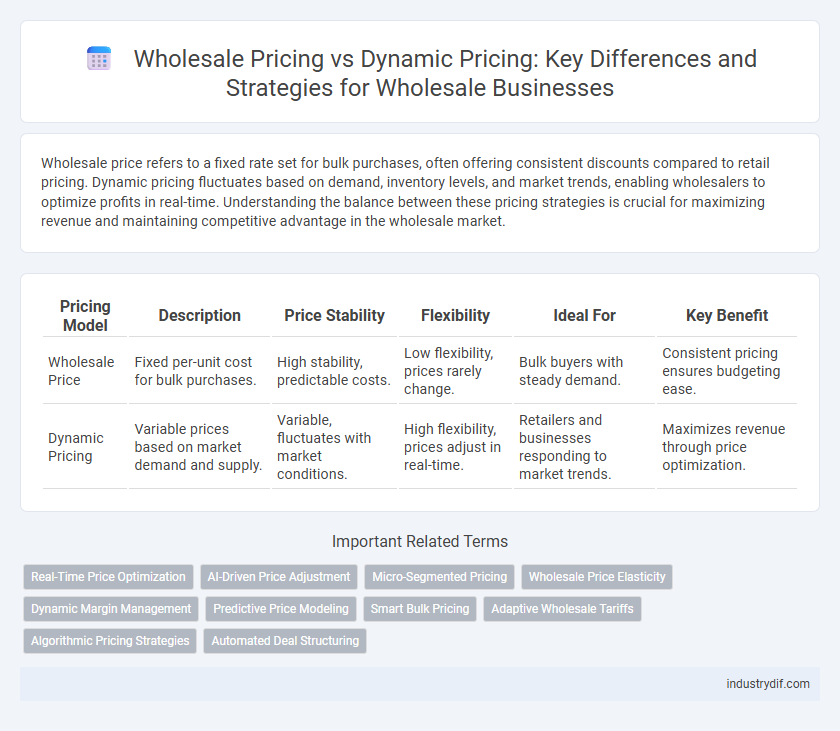

Wholesale price refers to a fixed rate set for bulk purchases, often offering consistent discounts compared to retail pricing. Dynamic pricing fluctuates based on demand, inventory levels, and market trends, enabling wholesalers to optimize profits in real-time. Understanding the balance between these pricing strategies is crucial for maximizing revenue and maintaining competitive advantage in the wholesale market.

Table of Comparison

| Pricing Model | Description | Price Stability | Flexibility | Ideal For | Key Benefit |

|---|---|---|---|---|---|

| Wholesale Price | Fixed per-unit cost for bulk purchases. | High stability, predictable costs. | Low flexibility, prices rarely change. | Bulk buyers with steady demand. | Consistent pricing ensures budgeting ease. |

| Dynamic Pricing | Variable prices based on market demand and supply. | Variable, fluctuates with market conditions. | High flexibility, prices adjust in real-time. | Retailers and businesses responding to market trends. | Maximizes revenue through price optimization. |

Understanding Wholesale Pricing: Definition and Key Concepts

Wholesale pricing refers to the fixed cost at which products are sold in bulk to retailers or businesses before reaching the consumer market, often characterized by volume discounts and standard price lists. Dynamic pricing involves adjusting wholesale prices in real-time based on market demand, inventory levels, and competitor pricing to maximize profitability. Understanding wholesale pricing requires grasping key concepts such as cost-based pricing, minimum order quantities, and margin management to optimize supply chain efficiency.

What Is Dynamic Pricing? An Industry Overview

Dynamic pricing is a real-time pricing strategy where wholesale prices fluctuate based on market demand, competitor pricing, and inventory levels, significantly differing from fixed wholesale prices. This approach utilizes advanced algorithms and data analytics to optimize revenue and respond swiftly to market changes, increasing profitability for wholesalers. Industries such as retail, manufacturing, and distribution extensively implement dynamic pricing to maintain competitive advantage and manage supply chain efficiency.

Core Differences Between Wholesale Price and Dynamic Pricing

Wholesale price is a fixed cost set by suppliers for bulk purchasing, providing consistent pricing across orders and long-term contracts. Dynamic pricing fluctuates based on real-time market demand, inventory levels, and competitor pricing, allowing for flexible adjustments to optimize sales and profits. Core differences lie in the stability and predictability of wholesale pricing versus the adaptive, data-driven nature of dynamic pricing models.

How Wholesale Pricing Works in B2B Transactions

Wholesale pricing in B2B transactions involves offering products at a lower cost per unit due to bulk purchasing agreements, which helps businesses reduce per-item expenses and improve profit margins. These fixed wholesale prices are typically set based on volume discounts, negotiated agreements, and long-term partnerships between suppliers and buyers. Unlike dynamic pricing, wholesale pricing remains stable regardless of market fluctuations, ensuring predictable costs for retailers and distributors.

The Role of Technology in Enabling Dynamic Pricing

Technology plays a pivotal role in enabling dynamic pricing by leveraging real-time data analytics and AI algorithms to adjust wholesale prices based on market demand, inventory levels, and competitor pricing. Advanced software platforms integrate with ERP and CRM systems, allowing wholesalers to implement flexible pricing strategies that maximize profit margins and improve supply chain efficiency. Machine learning models continuously refine pricing decisions, helping businesses respond swiftly to market fluctuations and customer purchasing behavior.

Advantages and Drawbacks of Traditional Wholesale Pricing

Traditional wholesale pricing offers straightforward pricing structures that provide predictability and ease of budgeting for both suppliers and buyers. This method simplifies inventory management and fosters long-term relationships through consistent price points, yet it lacks flexibility to respond to market fluctuations and demand changes. The primary drawback is missed opportunities for maximizing revenue, as fixed prices cannot adjust dynamically to competition, seasonality, or consumer behavior shifts.

Benefits and Challenges of Adopting Dynamic Pricing Models

Dynamic pricing in wholesale enables businesses to adjust prices based on real-time market demand, inventory levels, and competitor activity, driving increased revenue and enhanced inventory management. However, implementing dynamic pricing models requires sophisticated data analytics infrastructure and can lead to buyer distrust if price fluctuations appear unpredictable or unfair. Balancing responsiveness to market conditions with transparency is essential to maximize benefits and mitigate challenges in wholesale pricing strategies.

Wholesale Price vs Dynamic Pricing: Impact on Profit Margins

Wholesale price offers consistent profit margins by setting fixed rates for bulk purchases, ensuring predictable revenue streams. Dynamic pricing adjusts prices in real-time based on demand fluctuations, maximizing short-term profits but introducing variability in margins. Businesses leveraging dynamic pricing may experience higher profit margins during peak demand but risk lower margins when market conditions soften.

Industry Case Studies: Wholesale vs Dynamic Pricing Strategies

Industry case studies reveal that wholesale pricing often provides stability and simplified bulk purchasing agreements, benefiting manufacturers and large retailers alike. Dynamic pricing strategies leverage real-time market data and demand fluctuations, enabling wholesalers like Amazon Business and Alibaba to optimize profits through adaptive pricing models. Companies integrating dynamic pricing report increased revenue growth and better inventory turnover, contrasting with traditional wholesale pricing which prioritizes volume discounts and long-term contracts.

Choosing the Best Pricing Model for Your Wholesale Business

Wholesale price offers predictable, fixed rates that simplify budgeting and inventory management for bulk buyers, enhancing pricing transparency and long-term contracts. Dynamic pricing adapts in real-time to market demand, competition, and customer behavior, maximizing profit margins and clearing inventory efficiently during fluctuating market conditions. Selecting the optimal pricing model depends on your business goals, customer expectations, and market volatility, with some wholesalers successfully integrating both strategies to balance stability and responsiveness.

Related Important Terms

Real-Time Price Optimization

Real-time price optimization leverages dynamic pricing algorithms to adjust wholesale prices instantly based on market demand, inventory levels, and competitor pricing, ensuring maximum profitability and competitiveness. Unlike static wholesale pricing, dynamic pricing enhances responsiveness to market fluctuations, enabling businesses to capitalize on emerging trends and optimize revenue efficiently.

AI-Driven Price Adjustment

AI-driven price adjustment in wholesale leverages machine learning algorithms to analyze market demand, competitor prices, and inventory levels, enabling real-time dynamic pricing that maximizes profit margins while maintaining competitive positioning. Unlike static wholesale pricing, dynamic pricing adapts to fluctuating market conditions, ensuring wholesalers optimize revenue and minimize overstock or stockouts through precise, data-driven strategies.

Micro-Segmented Pricing

Wholesale price strategies traditionally rely on fixed rates determined by volume and client categories, whereas dynamic pricing leverages real-time market data and customer behavior to adjust prices continuously. Micro-segmented pricing enhances dynamic pricing by tailoring wholesale prices at a granular level, optimizing profitability and competitive advantage through precise demand forecasting and customer-specific value assessment.

Wholesale Price Elasticity

Wholesale price elasticity measures the sensitivity of demand to changes in wholesale prices, crucial for optimizing profit margins in bulk transactions. Dynamic pricing adjusts wholesale prices in real-time based on market conditions and demand fluctuations, enhancing responsiveness but requiring accurate elasticity data to prevent revenue loss.

Dynamic Margin Management

Dynamic pricing leverages real-time market data and demand fluctuations to optimize profit margins, contrasting static wholesale pricing that often ignores rapid changes. Implementing dynamic margin management enables wholesalers to adjust prices strategically, maximizing revenue while maintaining competitive advantage in volatile markets.

Predictive Price Modeling

Predictive price modeling in wholesale leverages historical sales data and market trends to forecast optimal pricing strategies, enhancing profit margins and inventory turnover. Dynamic pricing adjusts wholesale prices in real-time based on demand fluctuations, competitor pricing, and seasonal factors, but predictive models provide a more data-driven approach to anticipate market changes effectively.

Smart Bulk Pricing

Smart bulk pricing in wholesale leverages dynamic pricing algorithms to adjust rates based on order quantities, market demand, and inventory levels, optimizing profit margins while ensuring competitive pricing. This approach outperforms static wholesale prices by providing tailored discounts that encourage larger purchases and enhance supply chain efficiency.

Adaptive Wholesale Tariffs

Adaptive wholesale tariffs leverage dynamic pricing algorithms to adjust prices based on real-time market demand, inventory levels, and buyer behavior, enabling wholesalers to maximize profit margins while maintaining competitive advantage. Unlike static wholesale prices, these adaptive models respond swiftly to fluctuations, optimizing revenue streams and improving supply chain efficiency in high-volume transactions.

Algorithmic Pricing Strategies

Wholesale pricing relies on static, volume-based discounts that ensure predictable cost structures for bulk buyers, while dynamic pricing leverages algorithmic pricing strategies to adjust prices in real-time based on supply, demand, and competitor behavior. Algorithmic pricing in wholesale uses machine learning models to optimize margins, minimize inventory risks, and respond swiftly to market fluctuations, enhancing profitability beyond traditional fixed-price frameworks.

Automated Deal Structuring

Wholesale price models traditionally rely on fixed rates set for bulk purchases, whereas dynamic pricing leverages automated deal structuring algorithms to adjust prices in real-time based on demand, inventory levels, and customer segmentation. Automated deal structuring enhances efficiency by using AI-driven data analysis to optimize margins and tailor offers, driving higher sales volumes and increased profitability in wholesale markets.

Wholesale Price vs Dynamic Pricing Infographic

industrydif.com

industrydif.com