Real Estate Investment Trusts (REITs) offer investors access to diversified real estate portfolios with liquidity similar to stocks, providing steady income through dividends. Tokenized real estate enables fractional ownership using blockchain technology, allowing for lower entry costs, enhanced transparency, and faster transactions. Comparing both, tokenized real estate presents innovative opportunities for decentralization and global access, while REITs maintain regulatory stability and widespread market acceptance.

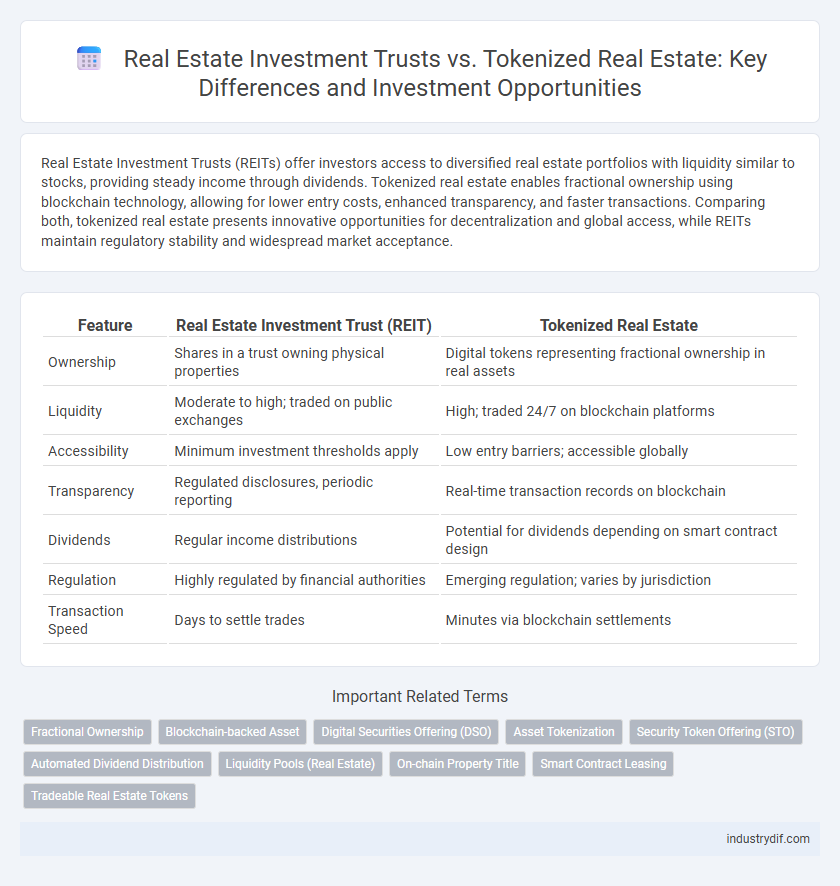

Table of Comparison

| Feature | Real Estate Investment Trust (REIT) | Tokenized Real Estate |

|---|---|---|

| Ownership | Shares in a trust owning physical properties | Digital tokens representing fractional ownership in real assets |

| Liquidity | Moderate to high; traded on public exchanges | High; traded 24/7 on blockchain platforms |

| Accessibility | Minimum investment thresholds apply | Low entry barriers; accessible globally |

| Transparency | Regulated disclosures, periodic reporting | Real-time transaction records on blockchain |

| Dividends | Regular income distributions | Potential for dividends depending on smart contract design |

| Regulation | Highly regulated by financial authorities | Emerging regulation; varies by jurisdiction |

| Transaction Speed | Days to settle trades | Minutes via blockchain settlements |

Overview of Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across various sectors such as commercial, residential, and industrial properties. REITs allow investors to gain exposure to real estate markets without direct ownership, offering liquidity through publicly traded shares and regular dividend income. Regulated under the Investment Company Act of 1940, REITs must distribute at least 90% of taxable income to shareholders, making them a popular vehicle for income-focused investment.

What is Tokenized Real Estate?

Tokenized real estate represents real estate assets through blockchain-based digital tokens, enabling fractional ownership and increased liquidity compared to traditional Real Estate Investment Trusts (REITs). These tokens allow investors to buy, sell, and trade real estate shares seamlessly on secure, decentralized platforms, reducing barriers such as high entry costs and limited market access. By leveraging blockchain technology, tokenized real estate enhances transparency, expedites transactions, and broadens investor participation beyond what conventional REIT structures typically offer.

Key Differences Between REITs and Tokenized Real Estate

Real Estate Investment Trusts (REITs) provide investors with regulated, publicly traded shares representing ownership in diversified real estate portfolios, offering liquidity and dividend income. Tokenized real estate leverages blockchain technology to fractionalize property ownership into digital tokens, enabling direct transactions, enhanced transparency, and lower entry barriers for investors. Unlike REITs, tokenized real estate allows peer-to-peer trading on decentralized platforms, bypassing traditional intermediaries and regulatory constraints.

Accessibility and Liquidity Comparison

Real Estate Investment Trusts (REITs) offer easier market access through traditional financial platforms and provide daily liquidity via stock exchanges, making them suitable for investors seeking convenience and established structures. Tokenized real estate leverages blockchain technology to enable fractional ownership, lowering barriers for smaller investors and facilitating 24/7 trading on digital marketplaces, which can enhance liquidity compared to conventional real estate assets. While REITs benefit from regulatory oversight and stable liquidity, tokenized real estate promises increased accessibility and potentially higher liquidity through decentralized platforms, though it remains subject to evolving regulations and market acceptance.

Regulatory Frameworks: REITs vs Tokenization

Real Estate Investment Trusts (REITs) operate under well-established regulatory frameworks governed by securities laws such as the SEC in the United States, ensuring investor protection, reporting requirements, and liquidity standards. Tokenized real estate leverages blockchain technology but faces evolving and fragmented regulatory landscapes, with varying compliance demands across jurisdictions related to digital assets and securities regulations. Regulatory clarity for tokenization is still developing, posing challenges for standardization and investor confidence compared to the mature oversight present for traditional REITs.

Investment Returns and Risk Profiles

Real Estate Investment Trusts (REITs) typically offer stable dividend yields with moderate risk due to diversified property portfolios managed by professionals. Tokenized real estate presents higher potential returns through fractional ownership and increased liquidity but carries elevated risks linked to market volatility and regulatory uncertainties. Investors must weigh the consistent income and lower volatility of REITs against the innovative growth opportunities and risks inherent in digital real estate tokens.

Fractional Ownership Explained

Real Estate Investment Trusts (REITs) offer investors fractional ownership by pooling funds to invest in diverse property portfolios, providing liquidity and professional management. Tokenized real estate leverages blockchain technology to enable direct fractional ownership of specific properties, enhancing transparency and reducing entry barriers. Both models democratize real estate investment, but tokenization allows for faster transactions and more precise asset division.

Technology’s Role in Tokenized Real Estate

Tokenized real estate leverages blockchain technology to enable fractional ownership, increasing liquidity and accessibility compared to traditional Real Estate Investment Trusts (REITs). Smart contracts automate transactions, reduce intermediaries, and enhance transparency, providing real-time asset data and secure record-keeping. This technological innovation democratizes real estate investment, allowing smaller investors to participate with lower capital requirements and quicker settlement times.

Tax Implications for Investors

Real Estate Investment Trusts (REITs) typically offer investors pass-through taxation, meaning income is taxed at the investor's individual rate without corporate tax layers, whereas tokenized real estate investments may involve complex tax treatments depending on jurisdiction and the underlying asset structure. Investors in REITs benefit from predictable dividend taxation, often at qualified dividend rates, while tokenized real estate tokens can trigger capital gains tax upon transfer or sale, with potential additional tax reporting requirements. Understanding the distinct tax implications, including entity-level taxes, withholding taxes, and the nature of income recognition, is crucial for optimizing returns in either investment vehicle.

Future Trends in Real Estate Investment

Real Estate Investment Trusts (REITs) continue to offer traditional investors diversified portfolios with liquidity and professional management, while tokenized real estate introduces blockchain technology for fractional ownership and increased accessibility. Future trends highlight a growing shift towards tokenization, enabling seamless cross-border transactions, enhanced transparency, and reduced entry barriers for smaller investors. This evolution is set to democratize real estate investment, combining the stability of REITs with the innovation of decentralized finance (DeFi) platforms.

Related Important Terms

Fractional Ownership

Real Estate Investment Trusts (REITs) offer fractional ownership through pooled investments in large property portfolios, providing liquidity and professional management but often with limited direct control for investors. Tokenized real estate leverages blockchain technology to enable true fractional ownership with greater transparency, faster transactions, and potentially lower entry barriers by dividing properties into digital tokens.

Blockchain-backed Asset

Blockchain-backed assets in real estate investment offer enhanced transparency, liquidity, and fractional ownership through tokenized real estate, contrasting with traditional Real Estate Investment Trusts (REITs) that rely on conventional shareholding structures and are often limited by market hours and regulatory constraints. Tokenized assets leverage decentralized ledger technology to enable 24/7 trading and reduce entry barriers, positioning blockchain as a transformative force in real estate asset management and investment diversification.

Digital Securities Offering (DSO)

Real Estate Investment Trusts (REITs) have traditionally provided investors access to real estate portfolios through publicly traded shares, while Tokenized Real Estate leverages blockchain technology via Digital Securities Offerings (DSO) to fractionalize and digitize property ownership. DSOs enable enhanced liquidity, transparency, and global accessibility by issuing compliant digital tokens that represent fractional real estate assets, transforming investment models beyond conventional REIT structures.

Asset Tokenization

Real Estate Investment Trusts (REITs) provide traditional access to diversified property portfolios, while tokenized real estate leverages blockchain technology to enable fractional ownership and enhanced liquidity through asset tokenization. This digital transformation allows investors to trade real estate tokens on secondary markets, reducing entry barriers and increasing market efficiency.

Security Token Offering (STO)

Security Token Offerings (STO) enable tokenized real estate investments by digitizing property assets on blockchain, providing increased liquidity, transparency, and fractional ownership compared to traditional Real Estate Investment Trusts (REITs). STOs comply with regulatory frameworks, offering enhanced investor protection and streamlined access to diverse real estate portfolios globally.

Automated Dividend Distribution

Real Estate Investment Trusts (REITs) typically distribute dividends on a quarterly basis through traditional channels, often involving manual processing and delays. Tokenized real estate leverages blockchain technology for automated, transparent dividend distribution, enabling real-time payments directly to investors' digital wallets without intermediary delays.

Liquidity Pools (Real Estate)

Liquidity pools in Real Estate Investment Trusts (REITs) provide traditional investors with access to diversified portfolios of properties, offering relatively stable dividend yields and market liquidity through publicly traded shares. Tokenized real estate leverages blockchain technology to create fractional ownership via liquidity pools, enhancing transaction speed, reducing entry barriers, and enabling 24/7 trading with increased transparency and lower fees.

On-chain Property Title

Real Estate Investment Trusts (REITs) offer traditional ownership structures with regulated property titles held off-chain, whereas tokenized real estate leverages blockchain technology to provide transparent, immutable on-chain property titles, enhancing security and ease of transfer. On-chain property titles reduce fraud risks and enable fractional ownership through smart contracts, revolutionizing liquidity and accessibility in real estate investments.

Smart Contract Leasing

Smart contract leasing in tokenized real estate automates rental agreements, ensuring transparent, secure, and instantaneous execution of lease terms without intermediaries, enhancing efficiency over traditional Real Estate Investment Trusts (REITs) that rely on manual processing. This blockchain-driven approach reduces administrative costs and minimizes disputes by embedding conditions and payments directly into the property tokens.

Tradeable Real Estate Tokens

Tradeable real estate tokens offer enhanced liquidity and fractional ownership compared to traditional Real Estate Investment Trusts (REITs), enabling investors to buy, sell, and trade property shares on blockchain platforms instantly. These digital assets reduce barriers to entry, increase transparency through smart contracts, and facilitate global access to real estate markets without conventional intermediaries.

Real Estate Investment Trust vs Tokenized Real Estate Infographic

industrydif.com

industrydif.com