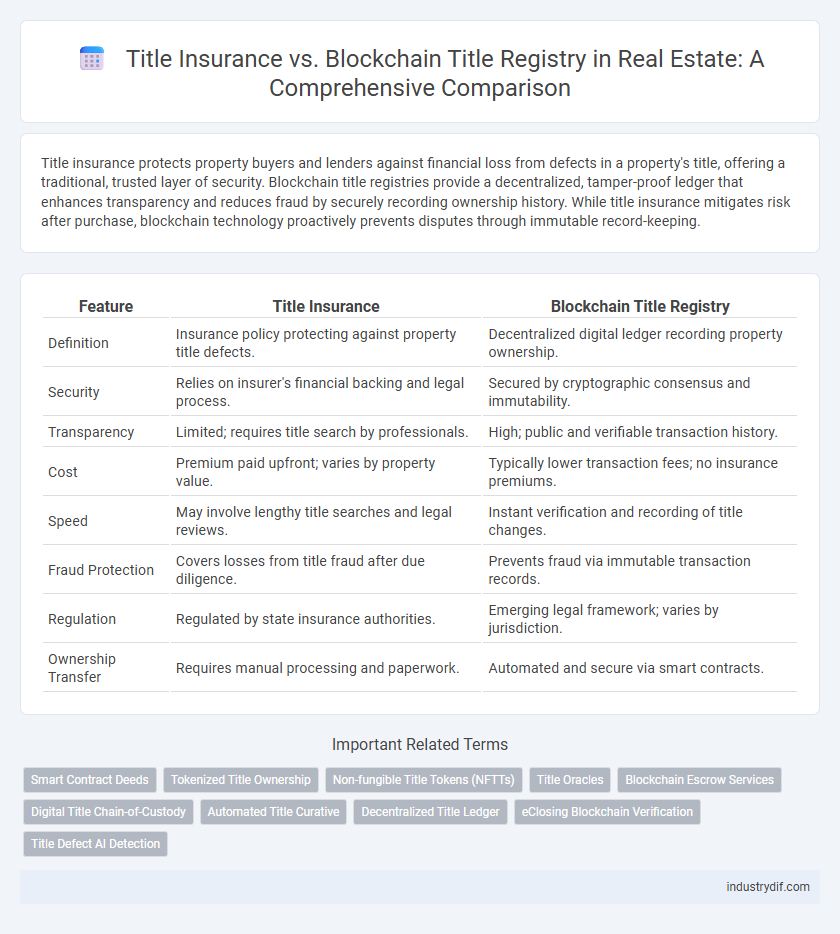

Title insurance protects property buyers and lenders against financial loss from defects in a property's title, offering a traditional, trusted layer of security. Blockchain title registries provide a decentralized, tamper-proof ledger that enhances transparency and reduces fraud by securely recording ownership history. While title insurance mitigates risk after purchase, blockchain technology proactively prevents disputes through immutable record-keeping.

Table of Comparison

| Feature | Title Insurance | Blockchain Title Registry |

|---|---|---|

| Definition | Insurance policy protecting against property title defects. | Decentralized digital ledger recording property ownership. |

| Security | Relies on insurer's financial backing and legal process. | Secured by cryptographic consensus and immutability. |

| Transparency | Limited; requires title search by professionals. | High; public and verifiable transaction history. |

| Cost | Premium paid upfront; varies by property value. | Typically lower transaction fees; no insurance premiums. |

| Speed | May involve lengthy title searches and legal reviews. | Instant verification and recording of title changes. |

| Fraud Protection | Covers losses from title fraud after due diligence. | Prevents fraud via immutable transaction records. |

| Regulation | Regulated by state insurance authorities. | Emerging legal framework; varies by jurisdiction. |

| Ownership Transfer | Requires manual processing and paperwork. | Automated and secure via smart contracts. |

Introduction to Title Insurance and Blockchain Title Registry

Title insurance protects property buyers and lenders from financial loss due to defects in a property's title, such as liens or ownership disputes, by providing coverage and legal defense. Blockchain title registry utilizes decentralized ledger technology to create a transparent, immutable record of property ownership, reducing fraud and simplifying title transfer processes. Both systems aim to secure real estate transactions, but blockchain offers a novel approach to record-keeping by enabling real-time updates and enhanced security.

Traditional Title Insurance: Process and Limitations

Traditional title insurance involves a thorough title search conducted by a title company to identify any liens, encumbrances, or ownership disputes before issuance. Despite offering protection against past title defects, the process can be time-consuming, costly, and prone to errors due to reliance on manual record-keeping. Limitations include delays in property closings, incomplete historical records, and potential gaps in coverage that may expose buyers to legal risks.

Understanding Blockchain Title Registry Technology

Blockchain title registry technology utilizes decentralized digital ledgers to record and verify property ownership, enhancing transparency and reducing the risk of fraud compared to traditional title insurance. By securing immutable transaction records through cryptographic hashing, blockchain enables real-time updates and seamless title transfers without reliance on intermediaries. This innovation offers increased efficiency, lower costs, and improved trust in real estate transactions through automated smart contracts and distributed consensus mechanisms.

Risk Mitigation: Title Insurance vs Blockchain Solutions

Title insurance provides financial protection against hidden title defects and fraud by insuring the property buyer from potential losses after the purchase, while blockchain title registries enhance transparency and security by recording immutable, time-stamped property ownership data on a decentralized ledger. Traditional title insurance mitigates risk by transferring potential title disputes to insurers, whereas blockchain solutions aim to prevent disputes altogether through real-time verification and reduced reliance on third parties. Combining both methods can offer comprehensive risk mitigation by leveraging blockchain's tamper-proof records alongside title insurance's financial safeguards.

Speed and Efficiency in Property Transactions

Title insurance provides a traditional layer of protection against title defects but often involves lengthy verification processes that can delay property transactions. Blockchain title registries enable near-instantaneous verification and secure recording of ownership data, significantly reducing the time and administrative costs associated with title transfers. By leveraging decentralized ledgers, blockchain technology streamlines the entire property transaction workflow, enhancing both speed and efficiency compared to conventional title insurance methods.

Cost Comparison: Title Insurance Fees vs Blockchain Costs

Title insurance fees typically range from 0.5% to 1% of the property purchase price, encompassing underwriting, search, and risk coverage costs, which can amount to several thousand dollars in high-value transactions. Blockchain title registry offers a more cost-efficient alternative by reducing intermediaries and automating verification processes, often resulting in significantly lower transaction fees and faster settlement times. While initial setup and technology integration costs exist for blockchain systems, long-term savings and transparency can substantially decrease overall title transfer expenses compared to traditional title insurance.

Transparency and Security in Title Management

Title insurance provides a traditional layer of protection by safeguarding property owners and lenders against title defects and disputes through verified legal ownership records. Blockchain title registries enhance transparency by creating an immutable and decentralized ledger that records every transaction securely, reducing the risk of fraud and hidden liens. The combination of blockchain technology with title management offers superior security and real-time verification, streamlining the title transfer process and increasing trust among stakeholders.

Regulatory Challenges and Industry Adoption

Title insurance faces regulatory complexities due to varied state laws and lengthy claims adjudication processes, hindering rapid industry adoption. Blockchain title registries offer enhanced transparency and immutable records but confront regulatory uncertainties and integration challenges with existing legal frameworks. Industry adoption depends on resolving compliance issues and establishing standardized protocols to ensure security and legal recognition.

Future Trends in Real Estate Title Management

Title insurance remains a critical safeguard against ownership disputes by providing financial protection, but blockchain title registries are emerging as a transformative technology that ensures immutable, transparent, and real-time verification of property records. Future trends in real estate title management are likely to integrate blockchain solutions with traditional title insurance to enhance security, reduce fraud, and streamline transaction processes. Market adoption of blockchain technology is expected to grow, driven by increased regulatory support and the demand for efficient, tamper-proof record keeping in property ownership.

Choosing the Right Solution for Real Estate Transactions

Title insurance provides financial protection against defects or disputes in property ownership, ensuring security in real estate transactions by covering legal costs and potential losses. Blockchain title registries offer a decentralized, tamper-proof ledger that enhances transparency and reduces fraud risk, streamlining the verification process. Selecting the right solution depends on the transaction complexity, desired security level, and willingness to adopt emerging technologies for efficient property record management.

Related Important Terms

Smart Contract Deeds

Smart contract deeds leverage blockchain technology to automate and secure the property title transfer process, reducing fraud and ensuring transparent, immutable records compared to traditional title insurance that relies on manual verification and underwriting. Blockchain title registries enhance efficiency by recording transactions on a decentralized ledger, while title insurance provides financial protection against title defects, with smart contracts potentially eliminating the need for intermediaries and decreasing closing times.

Tokenized Title Ownership

Tokenized title ownership on blockchain offers enhanced transparency and security over traditional title insurance by enabling immutable, real-time verification of property records. This decentralized ledger reduces fraud risk and streamlines transactions by allowing direct ownership transfers without intermediaries.

Non-fungible Title Tokens (NFTTs)

Title insurance provides financial protection against property title defects and claims, while blockchain title registries use decentralized ledgers to record ownership transparently and immutably. Non-fungible Title Tokens (NFTTs) represent unique property titles on the blockchain, enabling secure, tamper-proof, and easily transferable proof of ownership without intermediaries.

Title Oracles

Title insurance protects property buyers from financial loss due to title defects by verifying and insuring against title risks, while blockchain title registries use decentralized ledgers to create tamper-proof property records. Title oracles bridge these systems by providing real-time, verifiable data from blockchain registries to insurance providers, enhancing accuracy and trust in property transactions.

Blockchain Escrow Services

Blockchain escrow services enhance real estate transactions by securely holding funds and automating release conditions, reducing fraud risks compared to traditional title insurance. The decentralized ledger ensures transparent title registry management, streamlining ownership verification and minimizing disputes in property transfers.

Digital Title Chain-of-Custody

Title insurance provides financial protection against defects in property ownership by verifying and insuring the chain of title, while blockchain title registries create a transparent, immutable digital title chain-of-custody that enhances security and reduces fraud risks. The decentralized nature of blockchain technology ensures real-time updates and permanent records, streamlining property transactions and minimizing disputes compared to traditional title insurance methods.

Automated Title Curative

Automated title curative solutions leverage blockchain title registries to instantly verify and correct property records, reducing errors and fraud compared to traditional title insurance processes that often involve manual title searches and lengthy claims resolution. Blockchain's transparent, immutable ledger enhances the efficiency and accuracy of title verification, streamlining title curative measures and minimizing the risk of liens or ownership disputes in real estate transactions.

Decentralized Title Ledger

Decentralized title ledgers on blockchain enable secure, transparent, and tamper-proof property records, reducing fraud risks compared to traditional title insurance methods. This technology streamlines real estate transactions by providing real-time verification and immutable ownership history.

eClosing Blockchain Verification

eClosing blockchain verification enhances the title insurance process by providing a tamper-proof, transparent ledger that ensures property ownership authenticity and reduces fraud risk. Unlike traditional title insurance, blockchain title registries enable instant, secure verification of transaction history and ownership records, streamlining real estate closings and boosting trust among buyers and sellers.

Title Defect AI Detection

Title insurance provides financial protection against title defects by covering losses from undiscovered issues, while blockchain title registries use decentralized ledgers to ensure transparency and immutability of property records. AI-powered title defect detection enhances both systems by rapidly identifying anomalies and risks in property histories, reducing fraud and improving accuracy in title verification.

Title Insurance vs Blockchain Title Registry Infographic

industrydif.com

industrydif.com