Mortgage brokers provide personalized service by connecting borrowers with multiple lenders to find competitive loan options, ensuring tailored mortgage solutions. Fintech lenders leverage technology to offer streamlined, fast approval processes and often lower fees, appealing to tech-savvy borrowers. Choosing between a mortgage broker and a fintech lender depends on the borrower's preference for personalized guidance versus convenience and speed.

Table of Comparison

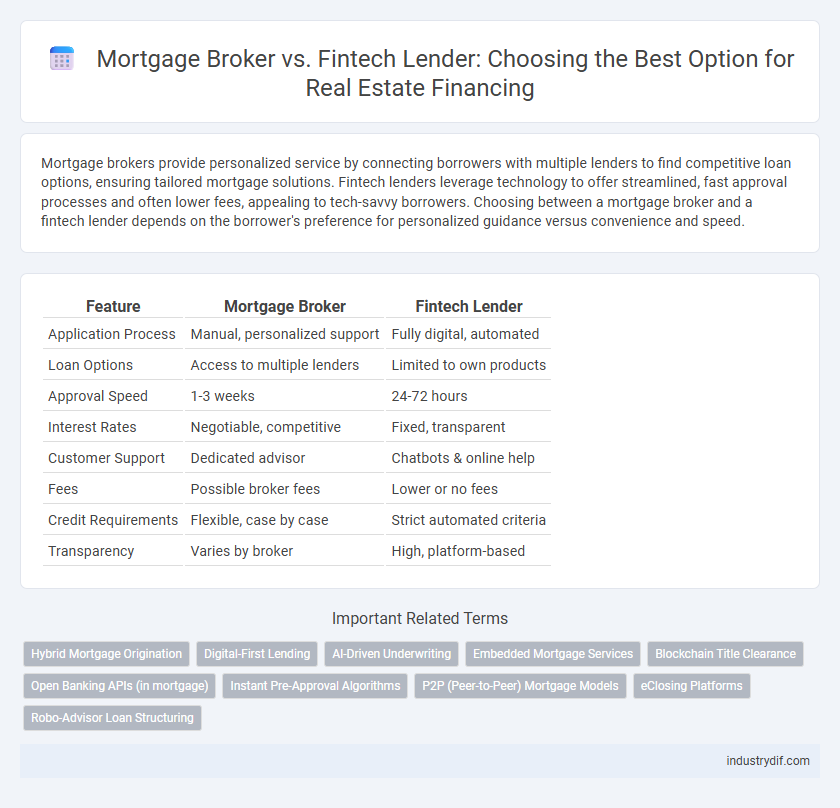

| Feature | Mortgage Broker | Fintech Lender |

|---|---|---|

| Application Process | Manual, personalized support | Fully digital, automated |

| Loan Options | Access to multiple lenders | Limited to own products |

| Approval Speed | 1-3 weeks | 24-72 hours |

| Interest Rates | Negotiable, competitive | Fixed, transparent |

| Customer Support | Dedicated advisor | Chatbots & online help |

| Fees | Possible broker fees | Lower or no fees |

| Credit Requirements | Flexible, case by case | Strict automated criteria |

| Transparency | Varies by broker | High, platform-based |

Introduction to Mortgage Brokers and Fintech Lenders

Mortgage brokers act as intermediaries between borrowers and multiple lenders, offering personalized guidance to secure the best mortgage rates and terms available. Fintech lenders use advanced technology and data analytics to streamline the loan application process, providing faster approval times and digital-first customer experiences. Both options cater to different borrower needs, with brokers delivering human expertise and fintech lenders emphasizing speed and convenience.

Defining Mortgage Brokers in Real Estate

Mortgage brokers in real estate act as intermediaries connecting borrowers with multiple lenders to secure the most favorable mortgage terms. They offer personalized guidance, assessing clients' financial situations to find tailored loan options from a broad network of banks and financial institutions. Their expertise in navigating diverse mortgage products provides borrowers with competitive rates and flexible repayment plans.

Understanding the Rise of Fintech Lenders

Fintech lenders have rapidly transformed the mortgage landscape by leveraging advanced algorithms and digital platforms to offer faster loan approvals and competitive rates, challenging traditional mortgage brokers. Their ability to streamline application processes through automation and data analytics meets the increasing demand for convenience and transparency in real estate financing. This shift has empowered borrowers with more options and reshaped lending dynamics in the housing market.

How Mortgage Brokers Work: Process and Benefits

Mortgage brokers act as intermediaries between borrowers and multiple lenders, comparing various loan products to secure the best mortgage rates and terms tailored to the client's financial situation. Their process involves assessing the borrower's creditworthiness, collecting necessary documentation, submitting applications to several lenders, and negotiating on behalf of the borrower to optimize loan approval chances. Benefits of using mortgage brokers include personalized service, access to a wider range of mortgage options, and often lower interest rates compared to direct lenders or fintech platforms.

The Digital Advantage: How Fintech Lenders Operate

Fintech lenders leverage advanced algorithms and AI-driven credit assessments to streamline the mortgage approval process, significantly reducing turnaround times compared to traditional mortgage brokers. Their digital platforms offer real-time application tracking, automated document verification, and instant eligibility checks, enhancing transparency and user experience. This tech-driven approach enables fintech lenders to provide competitive rates and personalized loan options with greater efficiency and scalability.

Comparing Loan Approval Processes: Broker vs Fintech

Mortgage brokers rely on personalized assessments and relationships with multiple lenders to secure loan approvals, often requiring extensive documentation and manual underwriting. Fintech lenders use automated algorithms and digital data verification to streamline loan approval, providing faster decisions with less paperwork. While brokers offer tailored advice and negotiation leverage, fintech lenders prioritize speed and convenience through technology-driven processes.

Customer Experience: Human Touch vs Digital Convenience

Mortgage brokers offer personalized guidance and tailored loan options through direct human interaction, enhancing trust and clarity in complex real estate transactions. Fintech lenders leverage advanced algorithms and digital platforms to provide quick approvals, streamlined processes, and 24/7 accessibility, prioritizing convenience and speed. Customers seeking customized advice often prefer brokers, while tech-savvy borrowers value the efficiency and transparency of fintech lenders.

Fees and Transparency in Mortgage Lending

Mortgage brokers typically charge origination fees ranging from 0.5% to 1% of the loan amount, with some additional fees for application and processing, while fintech lenders often offer lower upfront costs and streamlined fee structures due to automated systems. Transparency in mortgage lending varies, as brokers provide personalized explanations but may have hidden markups, whereas fintech platforms display clearer fee schedules and real-time rate comparisons on digital interfaces. Borrowers seeking cost-effective and transparent mortgage solutions increasingly prefer fintech lenders for their straightforward fee models and instant access to loan terms.

Suitability: Which Option Fits Different Buyer Profiles?

Mortgage brokers offer personalized guidance, making them ideal for buyers with complex financial situations or those seeking tailored loan options from multiple lenders. Fintech lenders provide fast, streamlined processes and competitive rates, appealing to tech-savvy buyers prioritizing convenience and speed. First-time homebuyers or those with excellent credit may benefit most from fintech solutions, while borrowers needing flexible underwriting criteria often find mortgage brokers more suitable.

Future Trends: The Evolving Landscape of Mortgage Lending

Mortgage brokers are leveraging personalized client relationships and expert market knowledge to navigate complex loan options, while fintech lenders utilize AI-driven algorithms and instant approval processes to enhance accessibility and speed. Emerging trends indicate increasing integration of blockchain technology for transparent transactions and the rise of digital mortgage platforms that prioritize user experience and automation. This evolving landscape suggests a hybrid future where traditional expertise and innovative technology converge to streamline mortgage lending.

Related Important Terms

Hybrid Mortgage Origination

Hybrid mortgage origination combines the personalized guidance of mortgage brokers with the efficiency and technology-driven processes of fintech lenders, streamlining loan applications while maintaining tailored financial advice. This approach leverages advanced algorithms and direct lender access to offer competitive rates and faster approvals, enhancing borrower experience in the real estate financing market.

Digital-First Lending

Digital-first lending transforms the mortgage process by enabling mortgage brokers to leverage advanced algorithms and AI-driven platforms for faster, more personalized loan approvals compared to traditional methods. Fintech lenders streamline borrower experiences through fully digital applications, real-time credit assessments, and automated underwriting, increasing efficiency and accessibility in home financing.

AI-Driven Underwriting

AI-driven underwriting in mortgage brokers leverages advanced algorithms to assess borrower risk using traditional financial data combined with personal credit histories, enhancing accuracy and speed. Fintech lenders utilize AI to analyze broader data sets, including alternative credit information and behavioral patterns, enabling more inclusive and efficient loan approvals in real estate financing.

Embedded Mortgage Services

Embedded mortgage services streamline the homebuying process by integrating loan options directly within real estate platforms, offering greater convenience compared to traditional mortgage brokers who require separate interactions. Fintech lenders leverage advanced algorithms and digital tools to provide instant mortgage approvals and personalized rates embedded seamlessly into property search experiences.

Blockchain Title Clearance

Blockchain title clearance enhances transparency and security by providing an immutable ledger for property records, reducing fraud risks compared to traditional methods used by mortgage brokers. Fintech lenders leveraging blockchain technology streamline title verification and clearance processes, offering faster, more reliable mortgage approvals than conventional brokers reliant on manual title searches.

Open Banking APIs (in mortgage)

Mortgage brokers leverage Open Banking APIs to aggregate financial data, enabling personalized mortgage offers based on a comprehensive view of borrowers' financial profiles; fintech lenders use these APIs to automate credit assessments and streamline loan approvals with real-time data access. Integration of Open Banking APIs enhances transparency and efficiency in mortgage processing, benefiting both traditional brokers and innovative fintech lenders by reducing manual verification and accelerating decision-making.

Instant Pre-Approval Algorithms

Mortgage brokers leverage personal expertise and established lender networks to customize loan options, while fintech lenders utilize instant pre-approval algorithms powered by AI and big data to rapidly assess creditworthiness and automate approvals. These algorithms analyze vast financial datasets in real-time, enabling fintech platforms to provide borrowers with immediate pre-approval decisions and increase transaction speed in competitive real estate markets.

P2P (Peer-to-Peer) Mortgage Models

P2P mortgage models offered by fintech lenders leverage technology to directly connect borrowers with individual investors, reducing intermediaries and often lowering interest rates compared to traditional mortgage brokers. These platforms provide greater transparency, faster approval processes, and customizable loan options, appealing to tech-savvy homebuyers seeking flexible financing solutions in real estate.

eClosing Platforms

Mortgage brokers traditionally facilitate loans through various lenders, often relying on manual or semi-digital processes, whereas fintech lenders leverage advanced eClosing platforms to expedite and streamline mortgage transactions with enhanced automation and real-time data integration. EClosing platforms reduce paperwork, minimize errors, and improve borrower experience by enabling secure digital signatures and seamless communication between all parties in the mortgage process.

Robo-Advisor Loan Structuring

Mortgage brokers provide personalized loan structuring by analyzing borrowers' financial situations and negotiating with multiple lenders to find optimal mortgage terms. Fintech lenders utilize robo-advisor algorithms to streamline loan approvals and offer data-driven, automated mortgage solutions with faster processing times.

Mortgage Broker vs Fintech Lender Infographic

industrydif.com

industrydif.com