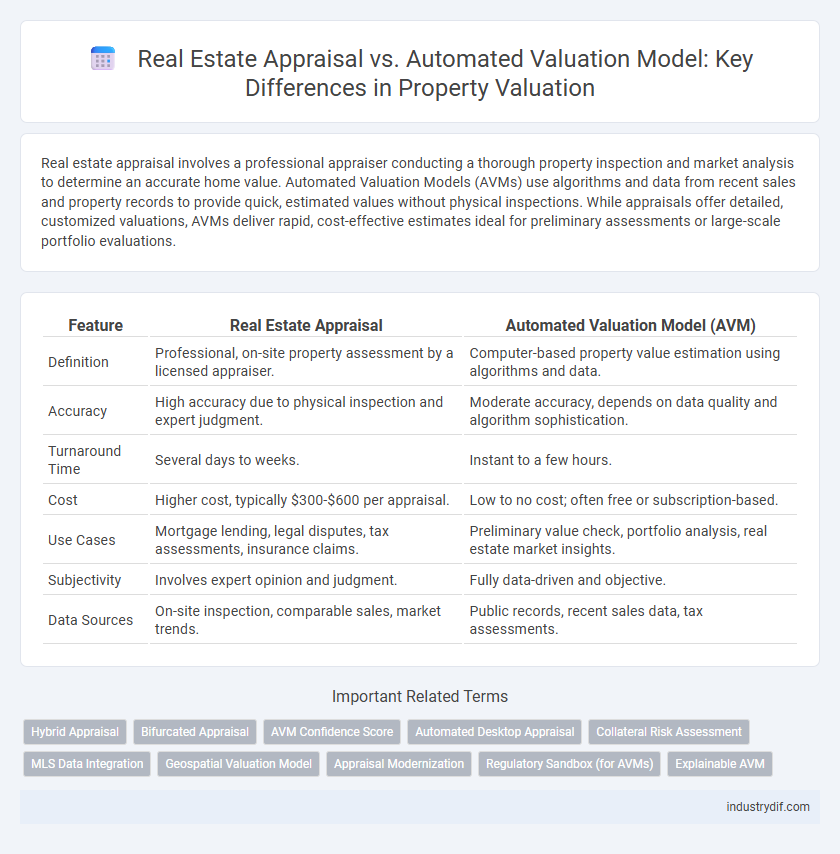

Real estate appraisal involves a professional appraiser conducting a thorough property inspection and market analysis to determine an accurate home value. Automated Valuation Models (AVMs) use algorithms and data from recent sales and property records to provide quick, estimated values without physical inspections. While appraisals offer detailed, customized valuations, AVMs deliver rapid, cost-effective estimates ideal for preliminary assessments or large-scale portfolio evaluations.

Table of Comparison

| Feature | Real Estate Appraisal | Automated Valuation Model (AVM) |

|---|---|---|

| Definition | Professional, on-site property assessment by a licensed appraiser. | Computer-based property value estimation using algorithms and data. |

| Accuracy | High accuracy due to physical inspection and expert judgment. | Moderate accuracy, depends on data quality and algorithm sophistication. |

| Turnaround Time | Several days to weeks. | Instant to a few hours. |

| Cost | Higher cost, typically $300-$600 per appraisal. | Low to no cost; often free or subscription-based. |

| Use Cases | Mortgage lending, legal disputes, tax assessments, insurance claims. | Preliminary value check, portfolio analysis, real estate market insights. |

| Subjectivity | Involves expert opinion and judgment. | Fully data-driven and objective. |

| Data Sources | On-site inspection, comparable sales, market trends. | Public records, recent sales data, tax assessments. |

Understanding Real Estate Appraisal

Real estate appraisal involves a licensed professional conducting a detailed inspection and analysis of a property to determine its market value based on factors like location, condition, and comparable sales. This method provides an expert, tailored valuation report that considers unique property characteristics, legal aspects, and market trends. Unlike automated valuation models (AVMs) that use algorithms and data aggregation, appraisals deliver more precise and reliable values essential for financing, taxation, and investment decisions.

What is an Automated Valuation Model (AVM)?

An Automated Valuation Model (AVM) is a technology-driven tool that uses mathematical algorithms, property data, and market trends to estimate real estate property values quickly and efficiently. Unlike traditional real estate appraisals conducted by licensed appraisers involving physical inspections, AVMs provide instant valuations based on large datasets including recent sales, tax assessments, and geospatial information. AVMs are widely used by lenders, real estate agents, and financial institutions for preliminary property assessments, risk management, and faster loan processing.

Key Differences Between Appraisal and AVM

Real estate appraisal involves a licensed professional conducting an in-depth, on-site evaluation of a property's condition, comparable sales, and market trends to determine an accurate value. Automated Valuation Models (AVMs) rely on algorithms and large datasets, including recent sales, tax records, and property details, to generate instant property valuations without a physical inspection. Appraisals provide personalized, detail-oriented insight and legal credibility, whereas AVMs offer speed, cost-efficiency, and scalability but may lack precision in unique or rapidly changing markets.

How Real Estate Appraisals Work

Real estate appraisals involve a licensed appraiser conducting a detailed property inspection, evaluating factors such as location, structural condition, and recent sales of comparable homes to determine the accurate market value. This process includes on-site visits, analysis of local market trends, and consideration of unique property features that automated valuation models (AVMs) often overlook. Appraisals provide a thorough, personalized valuation essential for mortgage approvals, legal matters, and investment decisions, contrasting with the algorithm-driven estimates of AVMs.

The Technology Behind Automated Valuation Models

Automated Valuation Models (AVMs) leverage advanced machine learning algorithms and vast datasets, such as recent sales, tax assessments, and market trends, to generate rapid property value estimates. These models integrate geospatial analytics and historical transaction data to enhance accuracy and adapt to market fluctuations in real time. Unlike traditional real estate appraisals, AVMs provide scalable and cost-effective valuations by harnessing big data and artificial intelligence technologies.

Accuracy: Appraisal vs. AVM

Real estate appraisal offers precise property value assessments by incorporating physical inspections and local market nuances, resulting in higher accuracy for unique or complex properties. Automated Valuation Models (AVMs) rely on algorithms and large datasets, providing rapid estimates but often lacking the detailed context essential for exact valuations. While AVMs excel in volume processing and consistency, traditional appraisals deliver superior accuracy in scenarios requiring in-depth analysis and professional judgment.

Speed and Efficiency Comparison

Real estate appraisal offers detailed property valuations conducted by certified appraisers, providing high accuracy but requiring several days to complete. Automated Valuation Models (AVMs) deliver instant property value estimates using algorithms and extensive data sets, greatly enhancing speed and operational efficiency. While AVMs prioritize rapid results for large-scale evaluations, appraisals are preferred for precision in complex property assessments.

Cost Analysis: Manual Appraisal vs. AVM

Manual real estate appraisals generally incur higher costs due to the need for licensed professionals conducting on-site property inspections and detailed market analysis. Automated Valuation Models (AVMs), leveraging algorithms and large data sets, offer a more cost-effective alternative by providing instant property value estimates without physical inspections. While AVMs reduce expenses significantly, they may sacrifice accuracy in unique or complex property evaluations compared to the comprehensive insights from manual appraisals.

Best Use Cases for Each Valuation Method

Real estate appraisal provides detailed, site-specific analysis ideal for high-value or complex properties requiring expert judgment and local market insights. Automated valuation models (AVMs) offer rapid, cost-effective estimates suitable for mass appraisal, portfolio management, and routine lending decisions across standardized residential markets. Leveraging appraisals for nuanced valuation ensures accuracy while AVMs enable scalability and efficiency in volume-driven scenarios.

Future Trends in Property Valuation

Future trends in property valuation emphasize increased integration of artificial intelligence and machine learning within Automated Valuation Models (AVMs), enhancing accuracy and efficiency by analyzing vast datasets in real-time. Despite advancements, traditional real estate appraisals remain crucial for nuanced, location-specific insights that algorithms may overlook, ensuring comprehensive property assessments. Hybrid approaches combining AVM speed with professional appraiser expertise are expected to dominate the market, driven by the demand for reliable and scalable valuation methods.

Related Important Terms

Hybrid Appraisal

Hybrid appraisal combines traditional real estate appraisal's expert analysis with automated valuation model (AVM) data, enhancing accuracy and efficiency in property valuation. This approach leverages human insight alongside algorithmic data processing to deliver more reliable market value estimations for residential and commercial properties.

Bifurcated Appraisal

Bifurcated appraisal separates the appraisal process into two parts: data collection by a field appraiser and valuation analysis by a desk appraiser, enhancing efficiency and consistency in real estate valuation. Unlike Automated Valuation Models (AVMs) that rely solely on algorithm-driven estimates, bifurcated appraisals incorporate human expertise while reducing turnaround time and minimizing bias.

AVM Confidence Score

The Automated Valuation Model (AVM) Confidence Score quantifies the reliability of property value estimates by analyzing data accuracy, market volatility, and recent comparable sales, offering a precise metric for investment decisions. In contrast, traditional real estate appraisals rely on expert judgment and site inspections, which may lack the immediate data-driven confidence assessment provided by AVM scores.

Automated Desktop Appraisal

Automated Desktop Appraisal relies on proprietary algorithms and extensive property databases to generate quick, data-driven property valuations without a physical inspection. This method enhances efficiency and consistency in real estate appraisal while offering real-time market analysis and cost-effective alternatives to traditional appraisals.

Collateral Risk Assessment

Real estate appraisal provides a comprehensive collateral risk assessment through on-site inspections and expert analysis, ensuring accurate property valuation for mortgage lending decisions. Automated Valuation Models (AVMs) use algorithms and large data sets for rapid property valuation but may lack the nuanced judgment necessary to fully assess collateral risk in dynamic market conditions.

MLS Data Integration

Real estate appraisal relies on expert analysis combined with comprehensive MLS data integration to provide accurate property valuations tailored to market trends and unique features. Automated Valuation Models (AVMs) use algorithm-driven MLS data to generate quick estimates, but often lack the nuanced insights that human appraisers provide.

Geospatial Valuation Model

Geospatial Valuation Models in real estate leverage geographic information systems (GIS) and spatial data to enhance appraisal accuracy by analyzing location-specific factors such as proximity to amenities, neighborhood trends, and environmental risks. Unlike traditional real estate appraisals or Automated Valuation Models (AVMs) that rely heavily on comparable sales and statistical algorithms, geospatial models provide deeper insights through detailed mapping and spatial analytics, improving precision in property valuation.

Appraisal Modernization

Real estate appraisal modernization integrates advanced technologies such as artificial intelligence and big data analytics to enhance the accuracy and efficiency of traditional appraisals. This modernization process contrasts with Automated Valuation Models (AVMs) by combining expert human judgment with technological tools to deliver more reliable property valuations in dynamic markets.

Regulatory Sandbox (for AVMs)

Regulatory sandboxes provide a controlled environment for Automated Valuation Models (AVMs) to innovate while ensuring compliance with real estate appraisal standards and consumer protection laws. These sandboxes enable AVM developers to test new algorithms and data sources under regulatory oversight, promoting transparency and accuracy in property valuations.

Explainable AVM

Explainable Automated Valuation Models (AVMs) enhance transparency in real estate appraisal by providing clear, data-driven insights into property value estimates, which traditional appraisals may lack due to subjective factors. These models utilize algorithms and extensive datasets, improving accuracy and enabling stakeholders to understand the rationale behind valuations in residential and commercial real estate markets.

Real Estate Appraisal vs Automated Valuation Model Infographic

industrydif.com

industrydif.com