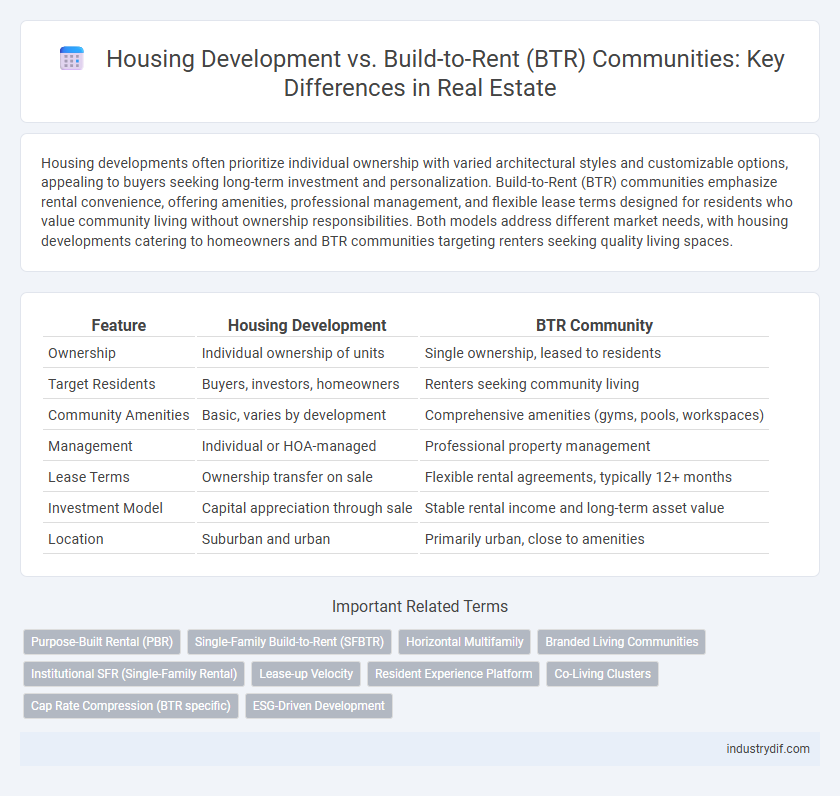

Housing developments often prioritize individual ownership with varied architectural styles and customizable options, appealing to buyers seeking long-term investment and personalization. Build-to-Rent (BTR) communities emphasize rental convenience, offering amenities, professional management, and flexible lease terms designed for residents who value community living without ownership responsibilities. Both models address different market needs, with housing developments catering to homeowners and BTR communities targeting renters seeking quality living spaces.

Table of Comparison

| Feature | Housing Development | BTR Community |

|---|---|---|

| Ownership | Individual ownership of units | Single ownership, leased to residents |

| Target Residents | Buyers, investors, homeowners | Renters seeking community living |

| Community Amenities | Basic, varies by development | Comprehensive amenities (gyms, pools, workspaces) |

| Management | Individual or HOA-managed | Professional property management |

| Lease Terms | Ownership transfer on sale | Flexible rental agreements, typically 12+ months |

| Investment Model | Capital appreciation through sale | Stable rental income and long-term asset value |

| Location | Suburban and urban | Primarily urban, close to amenities |

Defining Housing Development and BTR Community

Housing development refers to the process of constructing residential properties, including single-family homes, townhouses, and apartments, aimed at sale or lease to individual owners or investors. Build-to-Rent (BTR) communities are purpose-built residential properties designed specifically for rental, featuring professional management and shared amenities to enhance tenant experience and long-term occupancy. Unlike traditional housing developments, BTR communities focus on rental markets with a cohesive community environment rather than individual homeownership.

Key Structural Differences

Housing developments typically consist of individual homes or townhouses sold to private owners, emphasizing ownership and customization. Build-to-Rent (BTR) communities are purpose-built rental properties designed for long-term leasing, featuring amenities and management tailored to tenant convenience. Key structural differences include ownership models, with housing developments favoring private ownership versus communal rental management in BTR communities, impacting maintenance responsibilities and community engagement.

Ownership and Investment Models

Housing developments typically offer traditional ownership models where buyers purchase individual units for personal use or resale, emphasizing long-term capital appreciation. Build-to-Rent (BTR) communities focus on institutional investment, maintaining rental ownership through single entities that manage and lease properties collectively, prioritizing consistent rental income. Investors seeking stable returns often prefer BTR communities, while individual buyers favor housing developments for property ownership and potential equity growth.

Resident Demographics Comparison

Housing developments typically attract a diverse range of residents including families, retirees, and first-time homeowners seeking long-term equity. Build-to-Rent (BTR) communities primarily appeal to young professionals and transient populations valuing flexibility and amenity-rich living without homeownership commitments. Demographic studies reveal BTR residents generally have higher mobility rates and prefer urban proximity, while traditional housing developments see more stable, multi-generational occupancy.

Design and Amenities Focus

Housing developments often emphasize traditional residential layouts with individual homes or townhouses, prioritizing private space and architectural variety. BTR (Build-to-Rent) communities concentrate on cohesive design that fosters connectivity and convenience, featuring shared amenities such as fitness centers, coworking spaces, and communal lounges. This approach enhances resident experience by blending modern living with social engagement within purpose-built environments.

Financial Implications for Stakeholders

Housing development often requires significant upfront capital investment, impacting developers with higher financial risk and longer return timelines. Build-to-Rent (BTR) communities offer investors steady, predictable cash flow through rental income, enhancing portfolio diversification and reducing exposure to market volatility. Tenants in BTR schemes benefit from professionally managed properties with consistent maintenance, potentially leading to higher satisfaction and reduced turnover costs for stakeholders.

Regulatory and Compliance Factors

Housing developments face stringent zoning laws and building codes that vary widely across jurisdictions, requiring comprehensive approval processes before construction. BTR (Build-to-Rent) communities must also comply with residential leasing regulations and tenant protection laws, which influence design and management practices. Both models demand adherence to safety standards and environmental regulations, but BTR projects often navigate additional complexities related to operational compliance and ongoing property management.

Long-Term Value and Sustainability

Housing developments often prioritize immediate resale value and aesthetic appeal, while BTR (Build-to-Rent) communities focus on long-term tenant retention and sustainable living practices. BTR communities integrate energy-efficient technologies, green spaces, and durable materials, enhancing property value through reduced environmental impact and operational costs over time. These factors contribute to sustained asset appreciation and community resilience, making BTR a strategic investment for future-proof real estate portfolios.

Market Trends and Growth Projections

Housing development continues to expand rapidly with a focus on single-family homes and mixed-use projects, while Build-to-Rent (BTR) communities are gaining momentum as an attractive alternative for long-term rental markets. Market trends indicate a growing demand for BTR developments due to increasing urbanization, shifting demographics, and the preference for flexible living arrangements among millennials and Gen Z renters. Growth projections estimate the BTR sector to outpace traditional housing development, with expected annual growth rates exceeding 10% over the next five years, driven by institutional investment and rising rental affordability concerns.

Choosing the Right Option for Investors

Investors must evaluate yield stability and tenant demand when choosing between traditional housing developments and Build-to-Rent (BTR) communities. BTR offers long-term income with professional management and higher tenant retention, while conventional developments may provide quicker capital gains but face leasing risks. Analyzing market trends, demographic preferences, and regulatory factors ensures selecting the optimal investment vehicle for portfolio diversification and sustainable returns.

Related Important Terms

Purpose-Built Rental (PBR)

Purpose-Built Rental (PBR) communities are designed to offer long-term rental stability and professional management, contrasting with traditional housing developments primarily focused on homeownership and resale value. PBR models prioritize resident amenities, community engagement, and consistent rental income, addressing urban housing demand through dedicated rental infrastructure rather than piecemeal conversions.

Single-Family Build-to-Rent (SFBTR)

Single-Family Build-to-Rent (SFBTR) communities offer renters the privacy and space of standalone homes combined with the management efficiency of build-to-rent models, distinguishing them from traditional housing developments that primarily focus on ownership sales. SFBTR developments strategically target growing demand for suburban rental housing, providing high-quality, professionally maintained properties that appeal to families seeking long-term rental stability without the upfront investment of purchasing a home.

Horizontal Multifamily

Horizontal multifamily housing developments typically offer smaller-scale, clustered residences with shared amenities designed for long-term ownership, whereas Build-to-Rent (BTR) communities focus on professionally managed rental units arranged in horizontal layouts to optimize tenant accessibility and community engagement. Emphasizing flexible living spaces and integrated green areas, BTR horizontal multifamily projects address evolving rental market demands and preferences for suburban environments over traditional housing developments.

Branded Living Communities

Branded Living Communities emphasize curated lifestyles and high-quality amenities that differentiate them from traditional housing developments by integrating hospitality-driven services and design. These BTR (Build-to-Rent) communities prioritize long-term resident engagement, offering consistent management and a sense of belonging that standard housing developments often lack.

Institutional SFR (Single-Family Rental)

Institutional Single-Family Rental (SFR) investments distinguish housing developments from Build-to-Rent (BTR) communities by emphasizing large-scale, professionally managed rental homes that cater to long-term tenants, enhancing stable income streams for investors. BTR communities integrate these SFR properties within planned neighborhoods featuring shared amenities and community-centric designs, driving higher tenant satisfaction and retention rates.

Lease-up Velocity

Housing development projects typically experience slower lease-up velocity due to phased construction and individual unit sales, whereas Build-to-Rent (BTR) communities benefit from faster lease-up rates driven by bulk leasing strategies and turnkey rental availability. Data indicates BTR communities often achieve 90% occupancy within the first six months, outperforming traditional housing developments that may take 12 to 18 months to reach comparable lease-up levels.

Resident Experience Platform

Housing developments often lack integrated Resident Experience Platforms, resulting in fragmented communication and limited access to community services; BTR (Build-to-Rent) communities leverage these platforms to enhance resident engagement, streamline maintenance requests, and foster a connected living environment. Advanced Resident Experience Platforms in BTR properties incorporate smart home technology, real-time community updates, and seamless payment systems, directly improving tenant satisfaction and retention rates.

Co-Living Clusters

Co-living clusters in housing developments offer shared amenities and communal spaces designed to foster social interaction, contrasting with Build-to-Rent (BTR) communities that emphasize long-term private tenancy and full-service management. These co-living setups optimize space efficiency and affordability, appealing to young professionals seeking flexible urban lifestyles within integrated residential environments.

Cap Rate Compression (BTR specific)

Cap rate compression in Build-to-Rent (BTR) communities reflects strong investor demand driven by stable rental income and operational efficiencies, differentiating it from traditional housing developments where cap rates tend to be higher due to sales-based revenue models. This compression signals increased valuations in BTR assets, highlighting a shift towards long-term cash flow-focused real estate investment strategies.

ESG-Driven Development

Housing developments prioritize individual property sales, while BTR (Build to Rent) communities emphasize long-term sustainable living, integrating ESG criteria such as energy efficiency, waste reduction, and social equity into their design. ESG-driven development in BTR communities fosters improved tenant well-being and community resilience, aligning real estate investments with environmental, social, and governance goals.

Housing Development vs BTR Community Infographic

industrydif.com

industrydif.com