Traditional mortgages require borrowers to secure full financing for a property, often involving lengthy approval processes and substantial monthly payments. Fractional ownership allows multiple investors to share the costs and benefits of a real estate asset, reducing individual financial burdens and increasing accessibility. This model offers flexibility in property use and can diversify investment portfolios while minimizing risks associated with sole ownership.

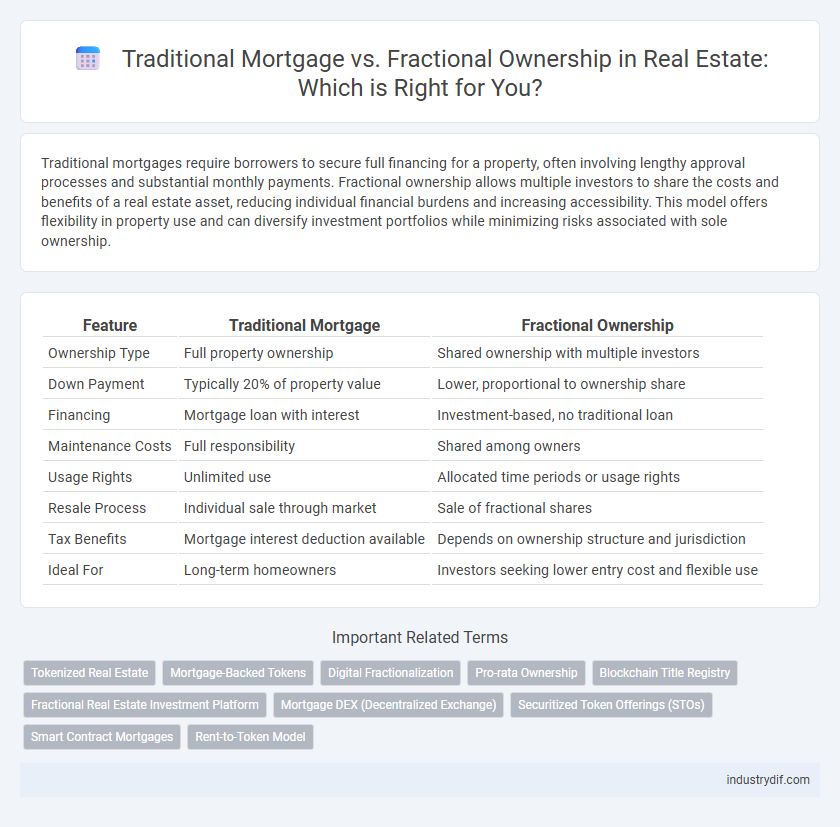

Table of Comparison

| Feature | Traditional Mortgage | Fractional Ownership |

|---|---|---|

| Ownership Type | Full property ownership | Shared ownership with multiple investors |

| Down Payment | Typically 20% of property value | Lower, proportional to ownership share |

| Financing | Mortgage loan with interest | Investment-based, no traditional loan |

| Maintenance Costs | Full responsibility | Shared among owners |

| Usage Rights | Unlimited use | Allocated time periods or usage rights |

| Resale Process | Individual sale through market | Sale of fractional shares |

| Tax Benefits | Mortgage interest deduction available | Depends on ownership structure and jurisdiction |

| Ideal For | Long-term homeowners | Investors seeking lower entry cost and flexible use |

Understanding Traditional Mortgages in Real Estate

Traditional mortgages in real estate involve a borrower obtaining a loan from a financial institution to purchase an entire property, with the property itself serving as collateral. These loans typically require a substantial down payment, fixed or variable interest rates, and a repayment term ranging from 15 to 30 years. Understanding the obligations tied to traditional mortgages, such as monthly payments, interest accumulation, and credit score impact, is essential for effective financial planning and property ownership.

What is Fractional Ownership?

Fractional ownership in real estate allows multiple investors to collectively purchase and share equity in a single property, reducing individual financial burden while granting access to high-value assets. Unlike traditional mortgages where a single buyer assumes full loan responsibility, fractional ownership divides costs, responsibilities, and usage rights among co-owners. This model offers flexibility, lower entry costs, and potential rental income from shared properties such as vacation homes or commercial real estate.

Key Differences Between Traditional Mortgage and Fractional Ownership

Traditional mortgages require full property ownership with a single borrower responsible for the entire loan amount, often involving fixed interest rates and long-term commitments. Fractional ownership divides the property into shares, allowing multiple investors to co-own and share costs, risks, and benefits proportionally. Unlike traditional mortgages, fractional ownership reduces individual financial burden and increases liquidity by enabling buy-in and sell-out flexibility.

Eligibility and Qualification Requirements

Traditional mortgage eligibility requires a stable income, a good credit score typically above 620, and a debt-to-income ratio below 43%. Fractional ownership often involves less stringent credit checks, focusing instead on the buyer's ability to pay a share of the property cost and associated fees. While traditional mortgages demand proof of employment and extensive documentation, fractional ownership prioritizes investor suitability and financial liquidity over credit history.

Initial Investment and Upfront Costs

Traditional mortgages typically require a significant down payment ranging from 10% to 20% of the property's purchase price, along with closing costs that can add 2% to 5% of the loan amount. Fractional ownership drastically reduces initial investment by allowing buyers to purchase a share of the property, splitting upfront costs such as maintenance fees and taxes proportionally among owners. This model lowers the financial barrier to entry, making real estate investment more accessible compared to the higher upfront expenses associated with traditional mortgages.

Ownership Structure and Legal Implications

Traditional mortgage ownership involves a single borrower holding full legal title and responsibility for the property's mortgage debt, ensuring clear control but also sole liability. Fractional ownership divides the property title among multiple investors, each holding a percentage share, which requires detailed legal agreements to manage usage rights, maintenance responsibilities, and decision-making processes. Legal implications for fractional ownership often include complex contract enforcement and potential challenges in resale or dispute resolution, contrasting with the more straightforward foreclosure and lien procedures in traditional mortgages.

Flexibility and Liquidity Comparison

Traditional mortgages require long-term financial commitment with fixed repayment schedules, limiting flexibility for homeowners who need to adjust their payment plans or sell quickly. Fractional ownership offers enhanced liquidity by allowing investors to buy and sell shares of a property without the need for full divestment, providing more adaptable exit strategies. This model also enables shared costs and benefits, making it a more flexible option for those seeking partial real estate investment without the constraints of conventional mortgage obligations.

Risks and Rewards: Traditional vs Fractional Models

Traditional mortgage loans offer full property ownership with long-term equity growth but entail higher financial risk due to credit requirements and full responsibility for maintenance. Fractional ownership reduces upfront costs and diversifies investment risk by sharing property use and expenses among multiple owners, though it limits control and potential profits. Evaluating liquidity, market volatility, and individual financial stability is crucial when choosing between the stability of traditional mortgages and the flexibility of fractional models.

Assessing Market Trends in Property Financing

Traditional mortgage financing remains dominant due to established lending criteria and long-term fixed interest rates, appealing to buyers seeking full property control. Fractional ownership gains traction in urban and vacation markets by lowering entry costs and enabling shared equity among multiple investors. Market trends indicate increasing interest in fractional models driven by rising property prices and demand for diversified investment opportunities in real estate.

Choosing the Right Real Estate Investment Approach

Traditional mortgages involve full property ownership with long-term loans, providing complete control but requiring significant upfront capital and creditworthiness. Fractional ownership allows multiple investors to share property equity, lowering entry costs and diversifying risk but limiting individual control and decision-making authority. Selecting the right investment approach depends on financial goals, risk tolerance, and desired involvement in property management.

Related Important Terms

Tokenized Real Estate

Tokenized real estate transforms traditional mortgage limitations by enabling fractional ownership through blockchain, allowing investors to purchase digital shares of a property rather than securing full loans. This method increases liquidity, reduces entry barriers, and enhances transparency in the real estate market compared to conventional mortgage financing.

Mortgage-Backed Tokens

Mortgage-Backed Tokens represent a blockchain-based innovation enabling fractional ownership of real estate assets, offering liquidity and lower entry barriers compared to traditional mortgages that require full loan approval and long-term repayment commitments. This tokenization enhances transparency and accessibility by allowing investors to buy and sell portions of mortgage loans, revolutionizing how property equity is bought and managed in the real estate market.

Digital Fractionalization

Digital fractionalization revolutionizes real estate investment by enabling multiple investors to own digital shares of a single property, lowering entry barriers compared to traditional mortgages that require full loan approval and long-term financial commitment. This blockchain-based approach enhances liquidity and transparency, offering a flexible alternative to conventional mortgage structures with increased accessibility for diverse investors.

Pro-rata Ownership

Pro-rata ownership in fractional ownership allows investors to hold a proportional equity stake in a property, sharing both benefits and risks according to their investment size, unlike traditional mortgages where a single borrower holds full ownership and debt responsibility. This structure enables diversified investment with potentially lower capital requirements, while traditional mortgages demand full repayment and ownership control from one party.

Blockchain Title Registry

Traditional mortgage systems rely on centralized title registries, which can be slow and prone to errors or fraud, while fractional ownership enabled by blockchain title registries offers transparent, immutable records and faster verification processes. Blockchain technology enhances real estate transactions by securely tokenizing property shares, allowing multiple investors to hold verifiable ownership stakes without the complexities of conventional mortgage lending.

Fractional Real Estate Investment Platform

Fractional real estate investment platforms enable multiple investors to buy shares of high-value properties, reducing entry costs and diversifying portfolios compared to traditional mortgages that require full property purchase and financing. These platforms leverage blockchain technology for transparent transactions and liquidity, offering an innovative alternative to conventional homeownership models.

Mortgage DEX (Decentralized Exchange)

Mortgage DEX revolutionizes real estate financing by enabling decentralized, blockchain-based mortgage transactions that increase transparency and reduce intermediaries, contrasting with traditional mortgage systems that rely on centralized institutions and rigid approval processes. Fractional ownership through Mortgage DEX allows investors to purchase and trade property shares efficiently, enhancing liquidity and democratizing access to real estate investments compared to conventional single-owner mortgage models.

Securitized Token Offerings (STOs)

Traditional mortgages involve borrowing funds from financial institutions with set interest rates and repayment schedules, whereas fractional ownership through Securitized Token Offerings (STOs) enables investors to purchase tokenized shares of real estate assets, enhancing liquidity and accessibility. STOs leverage blockchain technology to securely tokenize properties, allowing fractional investors to trade their digital shares on secondary markets, thus democratizing real estate investment and reducing entry barriers compared to conventional mortgage financing.

Smart Contract Mortgages

Smart contract mortgages leverage blockchain technology to automate loan agreements, reducing costs and enhancing transparency compared to traditional mortgage processes. Fractional ownership combined with smart contracts enables investors to securely acquire and trade property shares, democratizing real estate investment and increasing liquidity.

Rent-to-Token Model

The Rent-to-Token model combines traditional mortgage benefits with fractional ownership, allowing investors to acquire real estate tokens that represent partial property shares while paying rent instead of a full mortgage. This innovative approach enhances liquidity, lowers entry barriers, and offers flexible exit options compared to traditional mortgage financing.

Traditional Mortgage vs Fractional Ownership Infographic

industrydif.com

industrydif.com