Buy-to-let investments provide direct ownership of rental properties, generating steady rental income and long-term capital appreciation. Real estate crowdfunding offers a more accessible, diversified approach by pooling funds with other investors to participate in larger commercial or residential projects. Both strategies present unique risk profiles and liquidity considerations tailored to different investor preferences and financial goals.

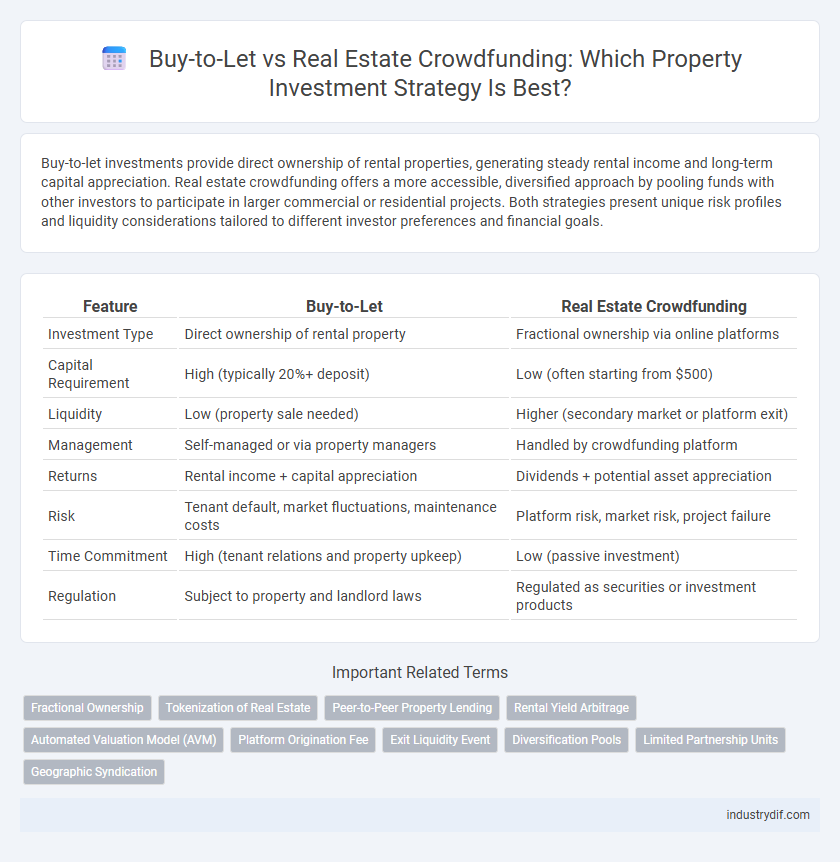

Table of Comparison

| Feature | Buy-to-Let | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Direct ownership of rental property | Fractional ownership via online platforms |

| Capital Requirement | High (typically 20%+ deposit) | Low (often starting from $500) |

| Liquidity | Low (property sale needed) | Higher (secondary market or platform exit) |

| Management | Self-managed or via property managers | Handled by crowdfunding platform |

| Returns | Rental income + capital appreciation | Dividends + potential asset appreciation |

| Risk | Tenant default, market fluctuations, maintenance costs | Platform risk, market risk, project failure |

| Time Commitment | High (tenant relations and property upkeep) | Low (passive investment) |

| Regulation | Subject to property and landlord laws | Regulated as securities or investment products |

Introduction to Buy-to-Let and Real Estate Crowdfunding

Buy-to-let involves purchasing residential properties to rent out, generating steady rental income and potential capital appreciation, with direct ownership and property management responsibilities. Real estate crowdfunding pools funds from multiple investors to finance large-scale property projects or developments, offering diversified exposure and passive investment without direct asset management. Both methods provide pathways to real estate investment but differ in liquidity, risk, and involvement levels.

Key Differences Between Buy-to-Let and Crowdfunding

Buy-to-let involves purchasing a physical property to generate rental income and potential capital appreciation, requiring significant upfront capital and active property management. Real estate crowdfunding enables investors to pool funds online to invest in fractional shares of larger property projects, offering lower entry costs and passive income opportunities. Key differences include control over the asset, liquidity levels, income consistency, and risk exposure, with buy-to-let providing more direct oversight but less liquidity compared to the diversified and accessible nature of crowdfunding platforms.

Investment Process: Buy-to-Let vs Crowdfunding

Buy-to-let investments require property acquisition, tenant management, and ongoing maintenance, often involving significant upfront capital and time commitment. Real estate crowdfunding allows investors to pool funds online, gaining fractional ownership in properties managed by professional teams, reducing hands-on responsibilities. The crowdfunding process is typically faster and more accessible, offering diversified portfolios with lower individual investment amounts compared to traditional buy-to-let ownership.

Entry Barriers and Accessibility

Buy-to-let investments often require substantial capital outlay, including a sizable down payment and high creditworthiness, making entry barriers significant for individual investors. Real estate crowdfunding platforms lower accessibility thresholds by allowing smaller investments and pooled funding, enabling broader participation without traditional mortgage requirements. This democratization of real estate investment expands opportunities to diversify portfolios with reduced initial financial commitment.

Risk Assessment in Buy-to-Let and Crowdfunding

Risk assessment in buy-to-let investments centers on tenant default rates, property market fluctuations, and ongoing maintenance costs, which can impact rental income and capital growth. Real estate crowdfunding diversifies risk across multiple projects and developers, but it exposes investors to platform reliability, project completion risk, and limited liquidity. Evaluating creditworthiness of tenants, location stability, and crowdfunding platform reputation are critical for mitigating financial exposure in both strategies.

Returns and Profitability Comparison

Buy-to-let investments typically offer steady rental income and potential property appreciation, resulting in moderate but reliable returns. Real estate crowdfunding provides access to diversified projects with lower entry costs, often yielding higher short-term profits through interest payments or equity stakes. While buy-to-let demands active management and higher upfront capital, crowdfunding pools resources, reducing risk but possibly sacrificing long-term property value growth.

Legal and Regulatory Considerations

Buy-to-let investments require compliance with landlord licensing laws, tenancy deposit protection schemes, and local housing regulations, ensuring legal accountability for property management. Real estate crowdfunding operates under financial regulations such as securities laws and crowdfunding-specific rules enforced by authorities like the SEC or FCA, requiring transparency and investor protection measures. Understanding these legal frameworks is crucial to mitigate risks and ensure lawful participation in either investment strategy.

Tax Implications for Both Investment Types

Buy-to-let investments typically involve more complex tax implications, including rental income tax, capital gains tax on property sales, and allowable expenses such as mortgage interest relief. Real estate crowdfunding often offers simplified tax treatment, with investors taxed on dividends and capital gains from fund shares rather than direct property income. Understanding tax deductions, reporting requirements, and potential tax-efficient structures is crucial for optimizing returns in both buy-to-let and crowdfunding investments.

Liquidity and Exit Strategies

Buy-to-let investments offer limited liquidity due to long-term property holding periods and the time required to find buyers or tenants, making exit strategies slower and more complex. Real estate crowdfunding provides enhanced liquidity by enabling investors to buy and sell shares on digital platforms, often with predefined exit windows or secondary markets. This flexibility allows quicker capital access, though secondary market availability and platform rules can impact actual exit timing.

Choosing the Right Real Estate Investment Approach

Buy-to-let investments offer direct ownership and control over rental properties, generating consistent rental income and potential capital appreciation. Real estate crowdfunding enables investors to diversify across multiple properties with lower capital requirements and reduced management responsibilities. Evaluating factors such as risk tolerance, investment horizon, and desired level of involvement is essential when choosing between buy-to-let and crowdfunding approaches.

Related Important Terms

Fractional Ownership

Buy-to-let investment offers direct property ownership and rental income control, while real estate crowdfunding enables fractional ownership by pooling funds from multiple investors to acquire high-value assets with lower capital requirements. Fractional ownership in crowdfunding platforms diversifies risk and provides liquidity options typically absent in traditional buy-to-let investments.

Tokenization of Real Estate

Tokenization of real estate transforms traditional buy-to-let investments by enabling fractional ownership through blockchain technology, increasing liquidity and lowering entry barriers for investors. Real estate crowdfunding platforms leverage tokenization to offer diversified property portfolios, enhancing transparency and accessibility compared to conventional buy-to-let models.

Peer-to-Peer Property Lending

Buy-to-let investment involves purchasing a property to generate rental income, offering direct control over the asset and potential capital appreciation. Peer-to-Peer Property Lending through real estate crowdfunding enables investors to fund property projects with lower capital requirements, diversifying risk across multiple developments while earning fixed interest returns.

Rental Yield Arbitrage

Buy-to-let investments typically offer rental yields ranging from 3% to 7%, depending on location and property type, while real estate crowdfunding platforms can provide diversified exposure with potentially higher yield arbitrage opportunities due to pooled capital and varied project risk profiles. Rental yield arbitrage occurs when investors leverage rental income streams from buy-to-let properties against crowdfunding returns, optimizing cash flow and maximizing overall portfolio profitability in the real estate sector.

Automated Valuation Model (AVM)

Buy-to-let properties provide direct ownership with control over asset management and rental income, while real estate crowdfunding leverages Automated Valuation Models (AVMs) to provide real-time property valuation and risk assessment for diversified investment portfolios. AVMs enhance crowdfunding platforms by using machine learning algorithms and extensive market data to deliver precise, scalable valuations, which are less accessible in traditional buy-to-let investments.

Platform Origination Fee

Buy-to-let investments typically involve platform origination fees ranging from 1% to 3% of the property's purchase price, while real estate crowdfunding platforms often charge lower origination fees, commonly between 0.5% and 2%. These fees impact overall returns, making crowdfunding a more cost-efficient option for investors seeking lower upfront costs.

Exit Liquidity Event

Buy-to-let properties offer greater control over exit timing through property sales or lease transfers, typically resulting in higher liquidity risk due to longer sale processes. Real estate crowdfunding provides more frequent exit opportunities and potential secondary markets, enhancing exit liquidity event flexibility but often with lower asset control.

Diversification Pools

Buy-to-let properties offer direct ownership but typically require significant capital and concentrate risk within a limited number of assets. Real estate crowdfunding platforms enable investors to access diversified pools of properties across various locations and asset types, reducing risk through broader portfolio distribution and lower individual investment thresholds.

Limited Partnership Units

Limited Partnership Units in buy-to-let investments offer direct property ownership and control, often requiring substantial capital and active management, whereas real estate crowdfunding provides fractional ownership with lower entry costs and passive income streams through pooled investments in diversified property portfolios. Investors seeking liquidity and reduced responsibilities may prefer crowdfunding, while those valuing asset control and tax benefits might lean toward buy-to-let Limited Partnership structures.

Geographic Syndication

Buy-to-let investments involve direct ownership of rental properties, allowing investors to control specific geographic locations and benefit from localized market appreciation and rental yields. Real estate crowdfunding facilitates geographic syndication by pooling funds from multiple investors to invest in diverse properties across various regions, providing broader market exposure and risk diversification.

Buy-to-let vs Real estate crowdfunding Infographic

industrydif.com

industrydif.com