Traditional mortgage processes often involve extensive paperwork, in-person visits, and longer approval times, which can delay property acquisition. Digital mortgages streamline lending through online applications, automated verification, and faster decision-making, enhancing convenience and efficiency for both borrowers and lenders. Embracing digital mortgages can significantly reduce closing times and improve the overall customer experience in real estate transactions.

Table of Comparison

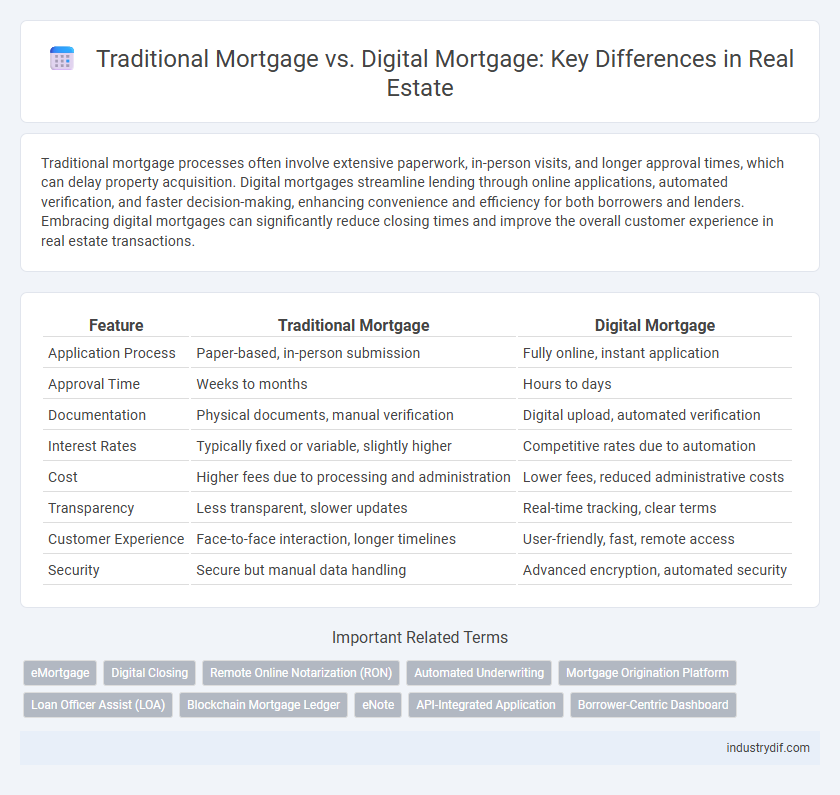

| Feature | Traditional Mortgage | Digital Mortgage |

|---|---|---|

| Application Process | Paper-based, in-person submission | Fully online, instant application |

| Approval Time | Weeks to months | Hours to days |

| Documentation | Physical documents, manual verification | Digital upload, automated verification |

| Interest Rates | Typically fixed or variable, slightly higher | Competitive rates due to automation |

| Cost | Higher fees due to processing and administration | Lower fees, reduced administrative costs |

| Transparency | Less transparent, slower updates | Real-time tracking, clear terms |

| Customer Experience | Face-to-face interaction, longer timelines | User-friendly, fast, remote access |

| Security | Secure but manual data handling | Advanced encryption, automated security |

Understanding Traditional Mortgages

Traditional mortgages involve a lengthy approval process requiring extensive paperwork, credit checks, and in-person meetings with lenders, which can extend the timeline for loan approval. These mortgages are typically serviced by banks or credit unions and adhere to strict underwriting criteria, including income verification and property appraisal. Understanding these conventional lending practices helps borrowers recognize the time and documentation commitments needed before securing home financing.

What Is a Digital Mortgage?

A digital mortgage streamlines the home loan process by leveraging online platforms to automate application, approval, and document submission, significantly reducing paperwork and processing time compared to traditional mortgages. Digital mortgages use advanced technologies such as e-signatures, automated underwriting, and real-time data verification, enhancing transparency and borrower convenience. This innovation provides faster approval rates and improved accuracy, making home financing more accessible and efficient for buyers and lenders alike.

Application Process: Paperwork vs. Paperless

Traditional mortgage applications require extensive paperwork, including physical documents that must be printed, signed, and submitted in person or via mail, leading to longer processing times and increased risks of document loss. Digital mortgages utilize online platforms that streamline the application process with electronic signatures, automated document verification, and real-time status updates, significantly reducing the time and effort needed to complete the loan approval. The paperless approach enhances efficiency, lowers administrative costs, and improves borrower experience through faster turnaround and greater transparency.

Speed and Efficiency Compared

Traditional mortgages typically require lengthy paperwork, face-to-face meetings, and slower approval processes that can extend closing times by weeks. Digital mortgages utilize automated systems, e-signatures, and online document uploads, significantly reducing processing time and enabling approvals within days. This enhanced speed and efficiency make digital mortgages increasingly preferred by buyers seeking swift and streamlined home financing.

Accessibility and Convenience

Traditional mortgages often require extensive paperwork, multiple in-person visits, and longer approval times, making the process less accessible for many borrowers. Digital mortgages streamline application procedures through online platforms, enabling faster approvals and reducing the need for physical documentation, significantly enhancing convenience. Accessibility increases as digital solutions cater to remote applicants and provide 24/7 access to mortgage services, overcoming geographic and time constraints inherent to traditional methods.

Interest Rates and Fee Structures

Traditional mortgages typically feature fixed or variable interest rates influenced by credit scores, with standardized fee structures including origination, appraisal, and closing fees. Digital mortgages often offer competitive or lower interest rates due to streamlined underwriting processes and reduced operational costs, resulting in minimized or transparent fee structures. Borrowers benefit from faster approval timelines and potential savings through automated documentation and reduced reliance on third-party intermediaries.

Security and Data Protection

Traditional mortgages rely on manual processing and physical documentation, increasing the risk of data breaches and unauthorized access. Digital mortgages employ advanced encryption, multi-factor authentication, and blockchain technology to ensure robust security and protect sensitive financial information. Enhanced cybersecurity measures in digital mortgage platforms reduce the likelihood of identity theft and fraud during loan origination and approval.

Customer Experience and Support

Traditional mortgage processes often involve lengthy paperwork and in-person meetings, leading to slower approvals and limited real-time support. Digital mortgages streamline applications through user-friendly online platforms, providing faster approvals, 24/7 customer support, and automated updates throughout the loan lifecycle. Enhanced transparency and convenience in digital mortgages significantly improve customer satisfaction compared to conventional methods.

Approval Times and Turnaround

Traditional mortgage approval times typically range from 30 to 45 days due to extensive paperwork and manual verification processes. Digital mortgages leverage automated data analysis and e-signatures, reducing turnaround times to as little as 7 to 10 days. Faster approvals in digital mortgages enhance buyer experience and accelerate property transactions.

Future Trends in Mortgage Technology

Digital mortgages are revolutionizing the industry by leveraging AI, blockchain, and automated underwriting systems to streamline loan approval processes and enhance security. Traditional mortgages, while reliable, face challenges adapting to consumer demands for speed and transparency in a digital-first economy. Future trends indicate a shift towards fully integrated online platforms that minimize paperwork, reduce closing times, and offer personalized loan options through advanced data analytics.

Related Important Terms

eMortgage

Digital mortgages streamline the home financing process by enabling electronic document signing, faster approval times, and automated underwriting, significantly reducing the delays and paperwork associated with traditional mortgages. eMortgages ensure secure digital storage, compliance with legal standards like the ESIGN Act, and seamless integration with loan origination systems, enhancing efficiency and borrower convenience compared to conventional paper-based loans.

Digital Closing

Digital mortgage streamlines the closing process by enabling electronic document signing, remote identity verification, and automated compliance checks, resulting in faster transaction times and reduced paperwork compared to traditional mortgage closings. This digital closing ecosystem enhances borrower convenience, minimizes errors, and accelerates loan funding, driving efficiency throughout the real estate transaction lifecycle.

Remote Online Notarization (RON)

Remote Online Notarization (RON) significantly enhances digital mortgage processes by enabling secure, real-time, and remote notarization of loan documents, reducing the time and geographic barriers inherent in traditional mortgage closings. While traditional mortgages rely on in-person notarization, RON streamlines compliance and accelerates transaction efficiency, making digital mortgages more accessible and convenient for borrowers and lenders alike.

Automated Underwriting

Automated underwriting in digital mortgages leverages advanced algorithms and real-time data analysis to accelerate loan approval processes, reducing human error and increasing efficiency compared to traditional mortgage underwriting methods. This technology enhances risk assessment accuracy and provides faster, more transparent decisions for borrowers and lenders in the real estate market.

Mortgage Origination Platform

Traditional mortgage origination platforms rely heavily on manual processes, paperwork, and in-person interactions, resulting in longer approval times and increased costs for lenders and borrowers. Digital mortgage platforms automate document verification, enable remote application submissions, and utilize AI-driven credit assessments, significantly accelerating approval timelines and reducing operational expenses.

Loan Officer Assist (LOA)

Loan Officer Assist (LOA) streamlines the digital mortgage process by automating document collection and verification, reducing errors and accelerating loan approvals compared to traditional mortgage methods. This technology enhances efficiency for loan officers by providing real-time status updates and data-driven insights, improving borrower experience and closing speed in the competitive real estate market.

Blockchain Mortgage Ledger

A Blockchain Mortgage Ledger enhances transparency and security in digital mortgages by providing an immutable, decentralized record of loan transactions, reducing fraud risk and streamlining verification processes. Unlike traditional mortgages relying on paper-based systems, blockchain technology accelerates loan approval and closing times through automated smart contracts and real-time data updates.

eNote

Traditional mortgages rely on paper-based processes requiring physical signatures and in-person closings, which often lead to longer processing times and higher administrative costs. Digital mortgages utilize eNotes, enabling fully electronic promissory notes that streamline loan origination, increase security through encryption, and accelerate closing timelines by allowing remote execution and instant validation.

API-Integrated Application

API-integrated applications streamline mortgage processing by enabling seamless data exchange between lenders, borrowers, and third-party services, significantly reducing approval times for both traditional and digital mortgages. While traditional mortgages often rely on manual data entry and paperwork, digital mortgages leverage API integrations to automate credit checks, income verification, and property appraisals, enhancing efficiency and accuracy throughout the lending lifecycle.

Borrower-Centric Dashboard

A borrower-centric dashboard in digital mortgages offers real-time loan status updates, personalized payment tracking, and streamlined document submission, significantly enhancing user experience compared to traditional mortgage processes. This technology-driven interface empowers borrowers with greater transparency and control, reducing processing times and minimizing errors common in conventional mortgage transactions.

Traditional mortgage vs Digital mortgage Infographic

industrydif.com

industrydif.com