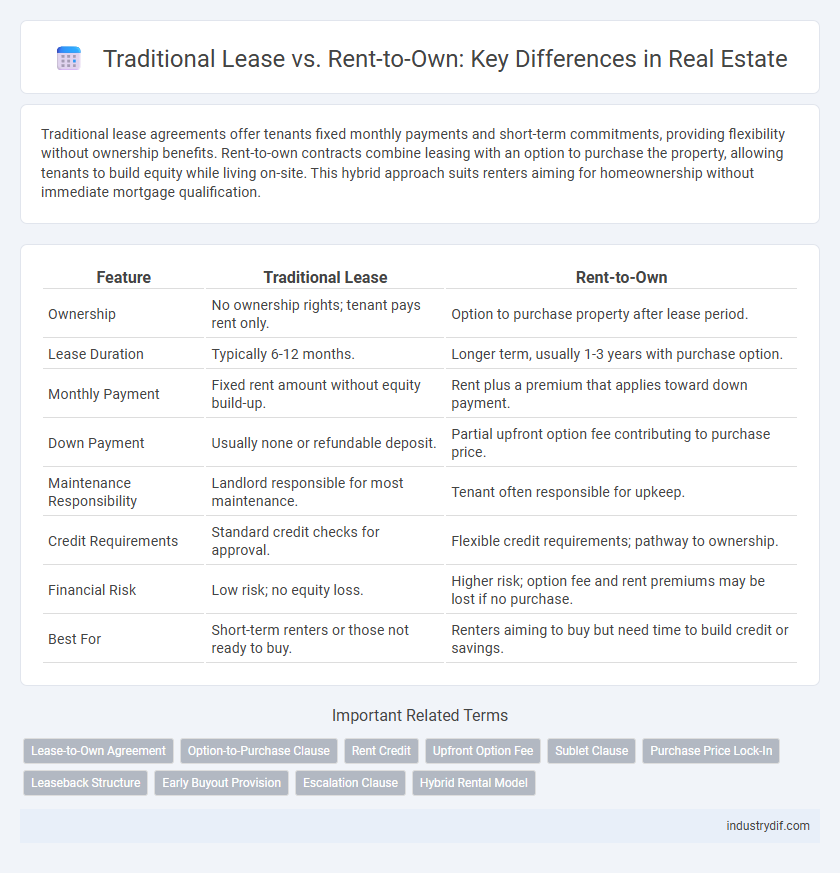

Traditional lease agreements offer tenants fixed monthly payments and short-term commitments, providing flexibility without ownership benefits. Rent-to-own contracts combine leasing with an option to purchase the property, allowing tenants to build equity while living on-site. This hybrid approach suits renters aiming for homeownership without immediate mortgage qualification.

Table of Comparison

| Feature | Traditional Lease | Rent-to-Own |

|---|---|---|

| Ownership | No ownership rights; tenant pays rent only. | Option to purchase property after lease period. |

| Lease Duration | Typically 6-12 months. | Longer term, usually 1-3 years with purchase option. |

| Monthly Payment | Fixed rent amount without equity build-up. | Rent plus a premium that applies toward down payment. |

| Down Payment | Usually none or refundable deposit. | Partial upfront option fee contributing to purchase price. |

| Maintenance Responsibility | Landlord responsible for most maintenance. | Tenant often responsible for upkeep. |

| Credit Requirements | Standard credit checks for approval. | Flexible credit requirements; pathway to ownership. |

| Financial Risk | Low risk; no equity loss. | Higher risk; option fee and rent premiums may be lost if no purchase. |

| Best For | Short-term renters or those not ready to buy. | Renters aiming to buy but need time to build credit or savings. |

Understanding Traditional Lease Agreements

Traditional lease agreements in real estate establish a fixed-term rental contract where tenants pay a specified monthly rent to occupy the property without ownership rights. These leases commonly include clauses on lease duration, security deposits, maintenance responsibilities, and renewal options, clearly defining landlord and tenant obligations. Understanding the binding nature and legal protections embedded in traditional leases is essential for both parties to avoid disputes and ensure compliance.

What Is Rent-to-Own in Real Estate?

Rent-to-own in real estate is a hybrid housing agreement allowing tenants to rent a property with the option to purchase it later, often applying a portion of rent payments toward the home's down payment. This arrangement benefits buyers with limited credit or savings by providing time to build equity while living in the property. Unlike traditional leases, rent-to-own contracts typically include a predetermined purchase price and a lease term that leads to homeownership.

Key Differences Between Leasing and Rent-to-Own

Traditional lease agreements require tenants to pay rent for a fixed term without equity accumulation, while rent-to-own contracts combine rental payments with an option to purchase the property later, often applying a portion of rent towards the down payment. Lease terms typically range from six months to one year with minimal long-term commitment, whereas rent-to-own agreements span multiple years, providing tenants time to build credit and save for homeownership. Maintenance responsibilities in traditional leases usually fall on landlords, whereas rent-to-own tenants may share or assume upkeep costs as part of preparing the property for eventual purchase.

Pros and Cons of Traditional Leasing

Traditional leasing offers the advantage of predictable monthly payments and minimal upfront costs, making it ideal for tenants seeking short-term living arrangements. However, it lacks equity-building opportunities and may include restrictions on customization or early termination penalties. Lease agreements often limit tenant flexibility, creating potential challenges for those desiring future property ownership or adaptable living situations.

Advantages and Disadvantages of Rent-to-Own

Rent-to-own agreements offer potential homeowners the advantage of building equity during the rental period while locking in a purchase price, which can be beneficial in rising markets. However, the disadvantages include typically higher monthly payments and the risk of forfeiting option fees if the tenant is unable to complete the purchase. This model provides flexibility for buyers with credit challenges but requires careful contract review to avoid financial loss.

Financial Implications: Lease vs Rent-to-Own

Traditional leases typically require lower upfront costs and fixed monthly payments, providing predictable expenses without equity accumulation. Rent-to-own agreements involve higher monthly payments with a portion credited toward eventual property ownership, increasing long-term financial commitment and potential investment return. Understanding the differences in initial payments, monthly costs, and equity-building potential helps investors and tenants make informed decisions aligned with their financial goals.

Who Benefits Most from Traditional Leasing?

Traditional leasing primarily benefits tenants seeking short-term housing flexibility without long-term financial commitments or property maintenance responsibilities. Landlords gain consistent rental income and retain full control over the property, making it ideal for those preferring predictable cash flow and easier property management. This lease structure suits individuals prioritizing mobility and landlords aiming for stable, low-risk investments in real estate.

Is Rent-to-Own Right for You?

Rent-to-own agreements offer a unique pathway to homeownership by combining rental payments with the option to purchase, making them ideal for individuals with imperfect credit or limited savings for a down payment. In contrast to traditional leases, rent-to-own contracts build equity over time, providing tenants the advantage of locking in purchase prices amid fluctuating markets. Carefully evaluating your financial stability, long-term housing goals, and the specific terms of the rent-to-own contract ensures this approach aligns with your path to property ownership.

Legal Considerations in Both Agreements

Traditional lease agreements clearly define tenant rights, landlord obligations, and fixed rental terms, with legal protections primarily centered on property maintenance and eviction rules. Rent-to-own contracts incorporate not only rental terms but also future purchase options, requiring detailed clauses on purchase price, credit application, and maintenance responsibilities to avoid disputes. Legal scrutiny in rent-to-own agreements often involves ensuring compliance with consumer protection laws and clear resolution processes for default or contract termination.

Choosing the Best Option for Your Housing Needs

Traditional lease agreements provide renters with flexibility and lower upfront costs, making them ideal for short-term housing or uncertain financial situations. Rent-to-own contracts offer a pathway to homeownership by allowing tenants to apply a portion of their rent toward purchasing the property, benefiting those seeking long-term investment and credit improvement. Evaluating factors such as financial stability, market conditions, and future housing goals is essential when choosing between these real estate options.

Related Important Terms

Lease-to-Own Agreement

A lease-to-own agreement combines traditional leasing with an option to purchase the property, allowing tenants to apply rent payments toward the eventual home purchase. This arrangement benefits renters seeking homeownership by building equity while living in the property, offering flexibility and investment potential absent in standard leases.

Option-to-Purchase Clause

The Option-to-Purchase clause in rent-to-own agreements provides tenants with the exclusive right to buy the property at a predetermined price within a specific time frame, contrasting with traditional leases that do not offer purchase options. This clause benefits renters by locking in purchase terms while allowing them to build equity through rent credits, making it a strategic tool for those aiming to transition from renting to homeownership.

Rent Credit

Rent-to-own agreements typically apply a portion of monthly rent payments, known as rent credits, toward the eventual down payment or purchase price of the property, accelerating equity build-up for tenants. Traditional leases do not offer rent credits, meaning tenants' payments do not contribute to ownership but solely cover temporary occupancy costs.

Upfront Option Fee

The upfront option fee in a rent-to-own agreement typically ranges from 1% to 5% of the home's purchase price and secures the tenant's right to buy the property later, often credited toward the down payment. In contrast, traditional leases usually require only a security deposit and first month's rent, with no option fee or future purchase commitment.

Sublet Clause

The sublet clause in traditional lease agreements typically restricts tenants from renting out the property without landlord approval, limiting flexibility for lessees. Rent-to-own contracts often provide clearer terms on subletting, enabling tenants to generate income while building equity toward homeownership.

Purchase Price Lock-In

A traditional lease requires tenants to pay rent without equity buildup, while a rent-to-own agreement locks in the purchase price upfront, allowing tenants to apply a portion of rent towards the home's eventual purchase. This price lock-in protects buyers from market fluctuations and provides a clear path to ownership.

Leaseback Structure

In a leaseback structure, property owners sell their real estate asset and simultaneously lease it back from the buyer, ensuring continued occupancy and generating immediate capital. This contrasts with traditional rent-to-own agreements where tenants gradually acquire ownership through rental payments over time, blending leasing flexibility with eventual property acquisition.

Early Buyout Provision

The Early Buyout Provision in rent-to-own agreements allows tenants to purchase the property before the lease term ends, often applying a portion of rent payments towards the home's equity, unlike traditional leases that typically require a separate down payment at purchase. This provision offers greater flexibility and potential financial benefits to tenants seeking homeownership without immediate full mortgage approval.

Escalation Clause

An escalation clause in traditional leases allows periodic rent increases based on market conditions or inflation, ensuring landlords adjust income without renegotiating terms. Rent-to-own agreements may incorporate escalation clauses tied to future purchase price adjustments, balancing tenant's equity buildup with market value changes.

Hybrid Rental Model

The hybrid rental model combines elements of traditional lease agreements and rent-to-own contracts, allowing tenants to apply a portion of their monthly rent toward eventual property ownership while enjoying the flexibility of a standard lease. This approach benefits renters seeking homeownership with reduced upfront costs and provides landlords with steady rental income plus the potential for a sale.

Traditional Lease vs Rent-to-Own Infographic

industrydif.com

industrydif.com