Minimum order quantity (MOQ) sets a fixed threshold for purchase quantities, ensuring consistent order sizes that streamline inventory management and reduce handling costs. Dynamic pricing adjusts prices based on demand, order size, and market conditions, offering flexibility that can incentivize larger purchases and optimize profit margins. Balancing MOQ with dynamic pricing strategies helps wholesalers maximize sales volume while maintaining competitive pricing and profitability.

Table of Comparison

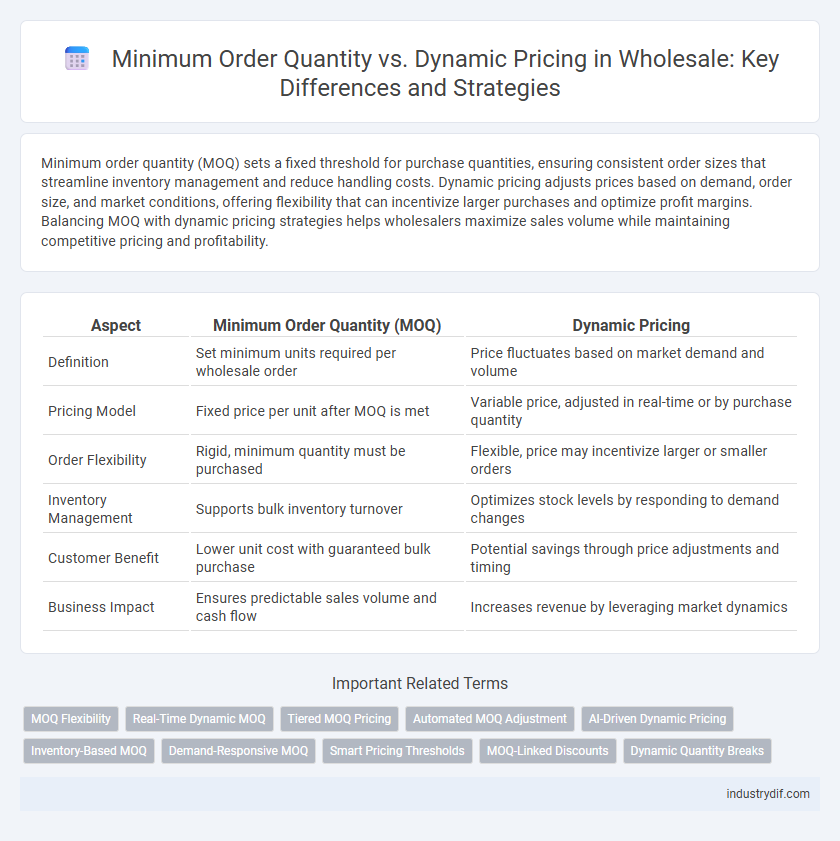

| Aspect | Minimum Order Quantity (MOQ) | Dynamic Pricing |

|---|---|---|

| Definition | Set minimum units required per wholesale order | Price fluctuates based on market demand and volume |

| Pricing Model | Fixed price per unit after MOQ is met | Variable price, adjusted in real-time or by purchase quantity |

| Order Flexibility | Rigid, minimum quantity must be purchased | Flexible, price may incentivize larger or smaller orders |

| Inventory Management | Supports bulk inventory turnover | Optimizes stock levels by responding to demand changes |

| Customer Benefit | Lower unit cost with guaranteed bulk purchase | Potential savings through price adjustments and timing |

| Business Impact | Ensures predictable sales volume and cash flow | Increases revenue by leveraging market dynamics |

Understanding Minimum Order Quantity (MOQ) in Wholesale

Minimum Order Quantity (MOQ) in wholesale represents the smallest number of units a supplier requires buyers to purchase in a single order, ensuring cost efficiency and inventory management. Dynamic pricing adjusts costs based on order volume, demand, and market conditions, but MOQ sets a fixed baseline quantity essential for negotiating pricing tiers. Grasping MOQ helps wholesalers balance bulk purchasing benefits with budget constraints, optimizing supply chain operations.

What Is Dynamic Pricing in Wholesale Markets?

Dynamic pricing in wholesale markets refers to adjusting product prices in real-time based on factors such as demand fluctuations, inventory levels, and competitor pricing. Unlike fixed minimum order quantities that set a static purchase threshold, dynamic pricing enables wholesalers to optimize revenue and manage supply chain efficiency by tailoring prices to current market conditions. This strategy enhances flexibility for both suppliers and buyers, facilitating better inventory turnover and increased sales volume.

Key Differences: MOQ vs. Dynamic Pricing

Minimum Order Quantity (MOQ) defines the smallest number of units a buyer must purchase to complete a wholesale transaction, establishing a fixed threshold for order size. Dynamic pricing adjusts the cost per unit based on real-time factors such as demand, supply fluctuations, and customer buying behavior, offering price flexibility. While MOQ focuses on quantity commitment, dynamic pricing emphasizes price variability to optimize sales and inventory management.

Advantages of Minimum Order Quantity for Wholesalers

Minimum Order Quantity (MOQ) offers wholesalers predictable revenue streams and streamlined inventory management by ensuring bulk purchases that reduce handling costs. Setting MOQs strengthens supplier relationships through consistent order volumes, enabling better negotiation leverage and improved production planning. This approach minimizes stock obsolescence and enhances cash flow stability, key advantages in wholesale business operations.

Benefits of Implementing Dynamic Pricing Strategies

Implementing dynamic pricing strategies in wholesale allows businesses to adjust prices based on real-time market demand, inventory levels, and competitor pricing, enhancing profitability and sales efficiency. This approach reduces the constraints of minimum order quantities by enabling flexible pricing that encourages smaller, more frequent purchases and attracts a broader customer base. Dynamic pricing improves cash flow management and inventory turnover, providing wholesalers with a competitive edge in fluctuating market conditions.

Challenges and Pitfalls: MOQ and Dynamic Pricing

Minimum Order Quantity (MOQ) often restricts purchase flexibility, causing inventory surplus and increased holding costs for buyers unable to meet set thresholds. Dynamic pricing, while responsive to market demand, can create price unpredictability and complicate budgeting for wholesale customers. Balancing MOQ with dynamic pricing requires strategic alignment to avoid alienating buyers and maintaining competitive market positioning.

Choosing Between MOQ and Dynamic Pricing Models

Choosing between Minimum Order Quantity (MOQ) and Dynamic Pricing models depends on the wholesale business strategy and customer demand patterns. MOQ ensures inventory control and cost efficiency by setting a fixed quantity threshold, while Dynamic Pricing adjusts prices based on real-time demand, inventory levels, and market trends to maximize revenue. Evaluating product turnover rates, customer purchasing behavior, and supply chain flexibility helps wholesalers select the optimal pricing approach for profitability and competitive advantage.

Impact on Wholesale Buyer Relationships

Minimum Order Quantity (MOQ) policies often create barriers for wholesale buyers by requiring high upfront commitments, which can limit flexibility and strain buyer-seller relationships. Dynamic pricing models offer tailored discounts based on order volume and market demand, fostering stronger partnerships through personalized pricing strategies. Wholesale buyers tend to prefer dynamic pricing due to its adaptability, improving satisfaction and encouraging long-term collaboration.

Technology’s Role in MOQ and Dynamic Pricing Optimization

Advanced technology enables precise Minimum Order Quantity (MOQ) calculations by analyzing real-time sales data, inventory levels, and demand forecasts. Dynamic pricing algorithms adjust wholesale prices automatically based on market fluctuations, competitor pricing, and buyer behavior patterns. Integration of AI-driven tools optimizes both MOQ and dynamic pricing strategies, enhancing profitability and operational efficiency in wholesale business models.

Future Trends: Evolving Wholesale Pricing Strategies

Future trends in wholesale pricing strategies emphasize the shift from rigid Minimum Order Quantity (MOQ) models to more flexible dynamic pricing systems that respond to real-time market demand and inventory levels. Advanced AI algorithms enable wholesalers to optimize prices dynamically, balancing customer acquisition with profitability while minimizing excess stock. This evolution fosters more personalized buyer experiences and enhanced supply chain efficiency in a competitive global marketplace.

Related Important Terms

MOQ Flexibility

Minimum Order Quantity (MOQ) flexibility enhances buyer convenience by allowing smaller, customizable purchase volumes that align with dynamic pricing models, optimizing cost efficiency and inventory management. Adapting MOQs to fluctuating demand supports scalable wholesale strategies, increasing supplier competitiveness and customer satisfaction through tailored pricing tiers.

Real-Time Dynamic MOQ

Real-time dynamic Minimum Order Quantity (MOQ) adjusts order thresholds based on current demand, inventory levels, and market trends, optimizing wholesale pricing strategies for maximum profitability. Integrating dynamic pricing with fluctuating MOQs enhances flexibility, reduces stock risks, and aligns supply with real-time buyer behavior.

Tiered MOQ Pricing

Tiered MOQ pricing strategically sets different minimum order quantities to unlock progressively lower prices, incentivizing bulk purchases and optimizing revenue in wholesale. This dynamic approach balances inventory management with customer demand, enhancing profitability by aligning order size with cost savings.

Automated MOQ Adjustment

Automated Minimum Order Quantity (MOQ) adjustment leverages dynamic pricing algorithms to optimize order sizes based on real-time demand, inventory levels, and customer purchasing behavior. This strategic integration enhances supply chain efficiency, reduces excess stock, and maximizes profit margins by aligning MOQ thresholds with fluctuating market conditions.

AI-Driven Dynamic Pricing

AI-driven dynamic pricing optimizes wholesale strategies by adjusting prices in real-time based on demand, inventory levels, and competitor pricing, reducing the constraints imposed by traditional Minimum Order Quantity (MOQ) models. This approach enhances profitability and flexibility, enabling wholesalers to cater to diverse customer needs without rigid order size requirements.

Inventory-Based MOQ

Inventory-based Minimum Order Quantity (MOQ) adjusts order size requirements according to current stock levels, enabling wholesalers to optimize inventory turnover and reduce holding costs. Dynamic pricing works in tandem by fluctuating prices based on demand and inventory, encouraging larger orders when stock is high and balancing sales velocity with supply constraints.

Demand-Responsive MOQ

Demand-responsive Minimum Order Quantity (MOQ) adjusts purchase requirements based on real-time demand patterns, enabling wholesalers to optimize inventory turnover and reduce holding costs. Dynamic pricing complements this by varying prices according to order volume and market demand, driving sales efficiency and enhancing competitive advantage.

Smart Pricing Thresholds

Smart pricing thresholds optimize wholesale strategies by balancing minimum order quantities (MOQ) with dynamic pricing models, enabling suppliers to maximize profit margins while accommodating buyer flexibility. Leveraging data analytics to adjust prices dynamically based on order volume and market demand reduces inventory risks and enhances competitive positioning in bulk sales.

MOQ-Linked Discounts

Minimum Order Quantity (MOQ)-linked discounts incentivize bulk purchases by offering tiered price reductions based on the order size, effectively reducing the unit cost as buyers meet higher MOQ thresholds. This pricing strategy optimizes inventory turnover and enhances supplier profitability by aligning dynamic pricing models with specific MOQ benchmarks.

Dynamic Quantity Breaks

Dynamic quantity breaks in wholesale enable flexible pricing tiers based on order size, encouraging larger purchases without rigid minimum order quantities. This strategy optimizes revenue by adjusting discounts dynamically, aligning with customer demand and inventory levels for better profit margins.

Minimum Order Quantity vs Dynamic Pricing Infographic

industrydif.com

industrydif.com