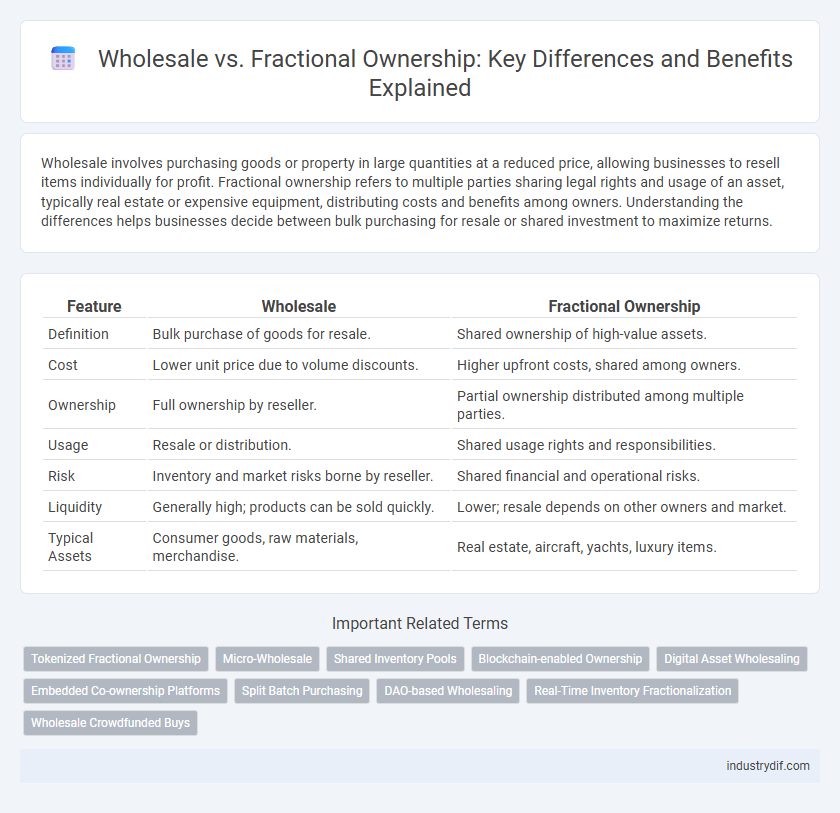

Wholesale involves purchasing goods or property in large quantities at a reduced price, allowing businesses to resell items individually for profit. Fractional ownership refers to multiple parties sharing legal rights and usage of an asset, typically real estate or expensive equipment, distributing costs and benefits among owners. Understanding the differences helps businesses decide between bulk purchasing for resale or shared investment to maximize returns.

Table of Comparison

| Feature | Wholesale | Fractional Ownership |

|---|---|---|

| Definition | Bulk purchase of goods for resale. | Shared ownership of high-value assets. |

| Cost | Lower unit price due to volume discounts. | Higher upfront costs, shared among owners. |

| Ownership | Full ownership by reseller. | Partial ownership distributed among multiple parties. |

| Usage | Resale or distribution. | Shared usage rights and responsibilities. |

| Risk | Inventory and market risks borne by reseller. | Shared financial and operational risks. |

| Liquidity | Generally high; products can be sold quickly. | Lower; resale depends on other owners and market. |

| Typical Assets | Consumer goods, raw materials, merchandise. | Real estate, aircraft, yachts, luxury items. |

Understanding Wholesale Ownership in Business

Wholesale ownership in business involves purchasing large quantities of products directly from manufacturers or distributors at reduced prices to sell them in bulk or retail. This model emphasizes economies of scale, enabling businesses to optimize inventory management, reduce per-unit costs, and increase profit margins. Unlike fractional ownership, wholesale ownership requires full possession and control of the goods, making it essential for companies focusing on supply chain efficiency and market responsiveness.

What Is Fractional Ownership?

Fractional ownership refers to the shared purchase of high-value assets, where multiple individuals collectively own a portion of the asset, such as real estate, aircraft, or luxury yachts. This model allows owners to enjoy usage rights and share maintenance costs proportionally, making it more affordable than outright ownership. Unlike wholesale transactions, which involve bulk purchasing typically for resale, fractional ownership emphasizes shared use and investment in the asset itself.

Key Differences Between Wholesale and Fractional Ownership

Wholesale involves purchasing goods in large quantities at discounted prices for resale, emphasizing bulk transactions and cost efficiency. Fractional ownership allows multiple individuals to share ownership rights of an asset, such as property or equipment, providing usage benefits and shared costs without full ownership. Key differences include the nature of ownership, transaction size, and the end purpose--wholesale targets resale profit, while fractional ownership focuses on shared access and usage.

Pros and Cons of Wholesale Ownership

Wholesale ownership offers the advantage of complete control over the asset, allowing for full decision-making power regarding usage, maintenance, and profit allocation. It typically requires a significant upfront investment and higher risks, but it also enables owners to benefit from the entire financial upside without sharing returns. The lack of shared responsibilities can streamline management but may limit access to diverse expertise and reduce liquidity compared to fractional ownership models.

Advantages and Disadvantages of Fractional Ownership

Fractional ownership offers the advantage of shared costs, reducing individual financial burden while granting access to high-value assets such as real estate or luxury goods. However, disadvantages include potential conflicts among owners regarding usage schedules and decision-making, as well as complexities in resale processes. Compared to wholesale purchasing, fractional ownership requires more coordination and may limit flexibility, but provides an affordable entry point to premium investments.

Investment Potential: Wholesale vs Fractional Ownership

Wholesale offers investors full asset control and higher returns by acquiring properties at below-market prices, enabling complete decision-making power. Fractional ownership divides costs and risks among multiple stakeholders, lowering individual investment but potentially limiting profit margins and exit strategies. Evaluating investment potential depends on the desired level of control, capital availability, and risk tolerance in property ventures.

Legal and Regulatory Considerations

Wholesale transactions generally involve bulk purchases governed by standardized contracts and regulated under commercial laws, ensuring clear ownership transfer and liability terms. Fractional ownership, often structured as a shared equity model, triggers complex legal frameworks including co-ownership agreements, fiduciary duties, and compliance with securities regulations. Navigating these regulatory considerations requires thorough due diligence to mitigate risks related to title disputes, tax implications, and regulatory oversight by agencies such as the SEC or local real estate authorities.

Costs and Financial Structures Compared

Wholesale involves purchasing entire assets at a lower overall cost, allowing for full control and flexibility in financial management, while fractional ownership entails shared investment costs and potential ongoing fees that reduce individual equity stakes. Costs in wholesale transactions are typically upfront and consolidated, whereas fractional ownership spreads expenses over multiple owners, impacting liquidity and decision-making power. Financial structures in wholesale favor singular financing and streamlined asset management, contrasting with fractional models that require coordinated agreements and shared financial responsibilities.

Suitability for Different Buyer Profiles

Wholesale appeals primarily to buyers seeking bulk purchases with reduced costs, ideal for retailers and businesses aiming to resell products quickly in large quantities. Fractional ownership suits individuals or entities interested in shared use and investment in high-value assets, such as real estate or luxury goods, allowing access without full ownership. Buyers focused on operational flexibility or resale volume benefit more from wholesale, while those prioritizing shared cost and usage prefer fractional ownership.

Future Trends in Wholesale and Fractional Ownership

Future trends in wholesale indicate increased integration of digital platforms and AI-driven analytics to optimize supply chain efficiency and reduce costs. Fractional ownership is expected to expand in popularity, leveraging blockchain technology for secure, transparent, and easily transferable ownership shares across real estate and luxury assets. Both models will continue to evolve with sustainability initiatives and personalized customer experiences shaping market demands worldwide.

Related Important Terms

Tokenized Fractional Ownership

Tokenized fractional ownership leverages blockchain technology to enable multiple investors to hold digital shares of high-value wholesale assets, enhancing liquidity and accessibility compared to traditional wholesale models. This innovative approach reduces entry barriers, allowing fractional investors to participate in asset appreciation and income streams without full asset acquisition.

Micro-Wholesale

Micro-wholesale offers smaller quantity transactions compared to traditional wholesale, enabling businesses to access bulk pricing without large inventory commitments. Unlike fractional ownership, which involves shared equity and usage rights, micro-wholesale focuses on streamlined bulk purchasing tailored for smaller retailers or startups seeking efficiency and cost savings.

Shared Inventory Pools

Shared inventory pools in wholesale enable multiple buyers to access large quantities of products at reduced costs, maximizing purchasing power and minimizing individual risk. Fractional ownership, however, typically limits access to shared inventory by dividing ownership in specific assets, reducing flexibility compared to wholesale's extensive, collectively managed stock.

Blockchain-enabled Ownership

Blockchain-enabled ownership in wholesale enhances transparency and security by providing immutable records of transactions, whereas fractional ownership leverages blockchain to enable multiple stakeholders to share asset control and investment risks efficiently. This decentralized ledger technology streamlines bulk asset management, reduces fraud, and facilitates liquidity in wholesale markets through tokenized shares.

Digital Asset Wholesaling

Digital asset wholesaling enables bulk transactions of cryptocurrencies or tokens at negotiated rates, providing liquidity and market access without fractional ownership complexities. Unlike fractional ownership, wholesaling transfers entire asset units, simplifying legal frameworks and streamlining asset distribution in blockchain ecosystems.

Embedded Co-ownership Platforms

Embedded co-ownership platforms streamline wholesale transactions by enabling multiple investors to purchase shares of assets, reducing entry barriers and increasing liquidity. These platforms enhance fractional ownership models by integrating seamless transaction processing, transparent asset management, and automated compliance, optimizing wholesale distribution channels.

Split Batch Purchasing

Split batch purchasing in wholesale allows buyers to acquire large quantities of products at lower costs by dividing orders among multiple parties, optimizing inventory management and cash flow. Fractional ownership, in contrast, involves shared rights and responsibilities of a single asset, with less emphasis on bulk purchasing efficiency and more on collaborative usage.

DAO-based Wholesaling

DAO-based wholesaling leverages decentralized autonomous organizations to streamline bulk transactions, enhancing transparency and reducing intermediaries compared to traditional fractional ownership models. This approach enables collective decision-making and automated smart contracts, optimizing efficiency and trust in the wholesale market.

Real-Time Inventory Fractionalization

Real-time inventory fractionalization enables wholesale businesses to divide large product quantities into smaller, manageable shares, optimizing stock liquidity and increasing sales flexibility. This contrasts with traditional wholesale, where bulk transactions limit market access and slow inventory turnover.

Wholesale Crowdfunded Buys

Wholesale crowdfunded buys enable multiple investors to pool capital for acquiring large-scale real estate assets, maximizing purchasing power and access to premium wholesale deals typically reserved for institutional investors. This approach differs from fractional ownership by emphasizing bulk acquisition at wholesale prices before distributing equity shares, thus optimizing entry cost and mitigating risk across a diversified investor base.

Wholesale vs Fractional Ownership Infographic

industrydif.com

industrydif.com