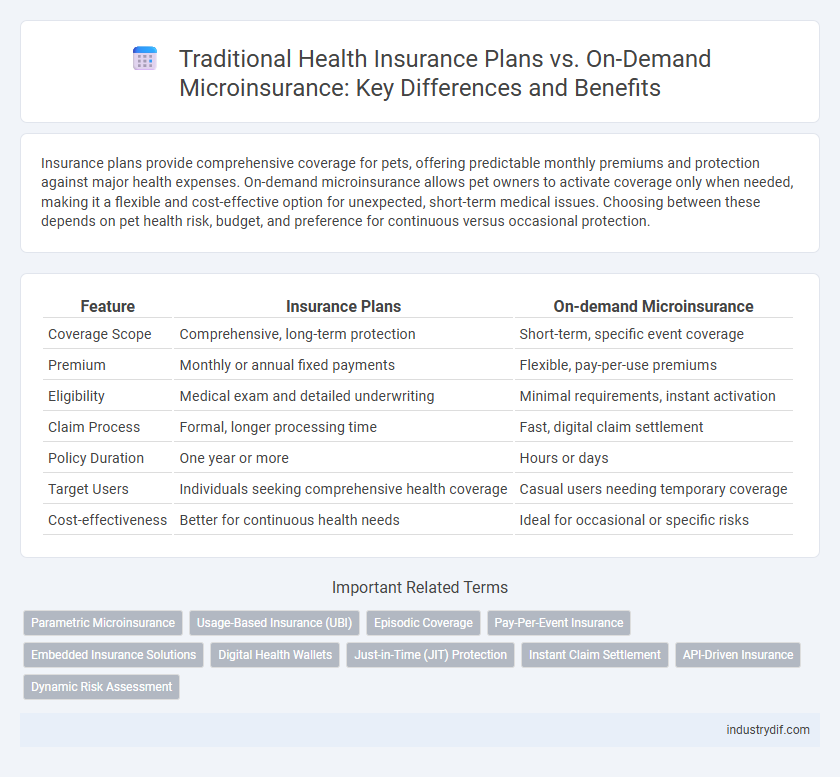

Insurance plans provide comprehensive coverage for pets, offering predictable monthly premiums and protection against major health expenses. On-demand microinsurance allows pet owners to activate coverage only when needed, making it a flexible and cost-effective option for unexpected, short-term medical issues. Choosing between these depends on pet health risk, budget, and preference for continuous versus occasional protection.

Table of Comparison

| Feature | Insurance Plans | On-demand Microinsurance |

|---|---|---|

| Coverage Scope | Comprehensive, long-term protection | Short-term, specific event coverage |

| Premium | Monthly or annual fixed payments | Flexible, pay-per-use premiums |

| Eligibility | Medical exam and detailed underwriting | Minimal requirements, instant activation |

| Claim Process | Formal, longer processing time | Fast, digital claim settlement |

| Policy Duration | One year or more | Hours or days |

| Target Users | Individuals seeking comprehensive health coverage | Casual users needing temporary coverage |

| Cost-effectiveness | Better for continuous health needs | Ideal for occasional or specific risks |

Understanding Traditional Insurance Plans

Traditional insurance plans provide comprehensive coverage through fixed premiums and long-term contracts, often covering a wide range of health services including hospitalization, surgeries, and chronic condition management. These plans require thorough underwriting and typically involve deductibles, co-payments, and annual limits, making them suitable for individuals seeking extensive and predictable healthcare protection. However, the rigidity and higher cost of traditional insurance can limit accessibility for low-income populations or those needing flexible, short-term coverage options.

What is On-Demand Microinsurance?

On-demand microinsurance offers flexible, short-term coverage tailored to specific needs, activating instantly via digital platforms. Unlike traditional insurance plans with fixed premiums and long-term commitments, this microinsurance caters to emerging risks with affordable, pay-per-use policies. It provides accessible protection for individuals seeking immediate, low-cost solutions for events like travel delays, gadget damage, or short-term health coverage.

Coverage Scope: Broad Policies vs Flexible Options

Traditional insurance plans offer broad coverage policies designed to protect against a wide range of health risks, often requiring long-term commitments and higher premiums. On-demand microinsurance provides flexible options tailored to specific, short-term health needs, allowing consumers to activate coverage only when necessary. This approach enhances accessibility and cost-efficiency for individuals seeking targeted protection without the burden of comprehensive policy obligations.

Cost Comparison: Premiums, Payments, and Affordability

Traditional insurance plans generally require higher premiums and fixed payment schedules, making them less flexible and often less affordable for low-income individuals. On-demand microinsurance offers lower premiums and pay-as-you-go payment models, enhancing accessibility and cost efficiency for users with fluctuating financial situations. This cost structure allows microinsurance to cater better to emerging markets and gig economy workers seeking affordable health coverage.

Accessibility: Application and Enrollment Processes

Traditional insurance plans often require lengthy application procedures, extensive paperwork, and strict eligibility criteria that limit accessibility for many individuals. On-demand microinsurance offers streamlined enrollment processes with minimal documentation and instant activation, making it highly accessible to underserved populations. Mobile platforms and digital interfaces further enhance accessibility by enabling users to apply and enroll anytime, anywhere, without the need for physical presence.

Claims Process: Speed and Simplicity

Insurance plans typically involve lengthy claims processes requiring extensive documentation and approvals, often delaying payouts. On-demand microinsurance leverages digital platforms and automated verification to streamline claims, ensuring faster settlements and reduced administrative burdens. Faster claims processing enhances customer satisfaction and supports timely access to healthcare benefits.

Personalization: Customizing Your Health Coverage

Insurance plans traditionally offer standardized health coverage with limited flexibility, often leading to overpaying for unnecessary benefits or gaps in essential care. On-demand microinsurance enables personalized health coverage by allowing individuals to select specific benefits and coverage periods tailored to their unique health needs and budget. This customization increases cost-efficiency and ensures that policyholders receive targeted protection aligned with their personal health risks and lifestyle.

Regulatory Considerations in Health Microinsurance

Regulatory considerations in health microinsurance require adherence to tailored frameworks that balance consumer protection with flexible product design, ensuring accessibility for low-income populations. Insurance regulators often mandate solvency margins, transparency in policy terms, and claims processing standards to maintain market stability and trust. On-demand microinsurance must comply with these standards while leveraging digital distribution to meet regulatory requirements efficiently.

Consumer Trust and Data Security

Traditional insurance plans often face challenges with consumer trust due to complex policies and opaque data handling practices, whereas on-demand microinsurance prioritizes transparency and immediate coverage, fostering higher trust levels. Enhanced data security measures, including blockchain and encrypted customer portals, underpin on-demand microinsurance by protecting sensitive personal and health information in real time. This shift towards flexible, secure insurance options aligns with growing consumer demand for privacy and trustworthiness in health-related financial services.

Future Trends in Health Insurance Models

Future trends in health insurance models indicate a shift from traditional insurance plans toward more flexible on-demand microinsurance solutions that cater to personalized coverage needs. Advances in digital health technologies and real-time data analytics enable insurers to offer microinsurance products that are affordable, adaptive, and accessible for short-term or specific health events. This trend emphasizes seamless integration with healthcare providers, enhancing preventive care and optimizing risk management through finely tuned insurance models.

Related Important Terms

Parametric Microinsurance

Parametric microinsurance offers a streamlined alternative to traditional insurance plans by providing predetermined payouts based on specific triggers, such as weather events or health thresholds, enhancing accessibility and speed for underserved populations. This model reduces claim processing time and administrative costs, making it particularly effective for health-related contingencies in regions with limited healthcare infrastructure.

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) leverages telematics and real-time health data to offer personalized premiums and tailored coverage, making it more adaptable compared to traditional insurance plans with fixed rates. On-demand microinsurance enhances flexibility by allowing policyholders to activate coverage only when needed, reducing costs and improving accessibility for short-term health risks.

Episodic Coverage

Insurance plans provide comprehensive, long-term protection with fixed premiums, whereas on-demand microinsurance offers flexible, episodic coverage tailored for specific events or short durations, ideal for users seeking cost-effective and targeted risk management. Episodic coverage enables immediate activation and expiration aligned with specific needs, reducing unnecessary expenses and enhancing accessibility for underserved populations.

Pay-Per-Event Insurance

Pay-per-event insurance offers consumers flexible, cost-effective coverage by charging premiums only when specific health events occur, contrasting traditional insurance plans that require regular monthly payments regardless of usage. This on-demand microinsurance model enhances accessibility for individuals with sporadic healthcare needs, reducing financial barriers and aligning costs directly with actual risk exposure.

Embedded Insurance Solutions

Embedded insurance solutions integrate health coverage seamlessly within everyday products and services, offering a convenient alternative to traditional insurance plans by providing on-demand microinsurance tailored to individual needs. This approach increases accessibility and affordability, enhancing risk protection through real-time, context-aware health insurance options embedded directly into digital platforms and healthcare services.

Digital Health Wallets

Digital Health Wallets integrate both traditional insurance plans and on-demand microinsurance, offering users seamless access to personalized health coverage and real-time claim processing through mobile platforms. By leveraging blockchain technology, these wallets ensure secure, transparent transactions and enable flexible insurance options tailored to individual health needs.

Just-in-Time (JIT) Protection

Insurance plans offer comprehensive coverage with scheduled premiums and fixed terms, whereas on-demand microinsurance provides Just-in-Time (JIT) protection by allowing users to activate coverage only when needed, reducing costs and improving accessibility. This JIT model leverages digital platforms and real-time data to deliver personalized health risk management, making it ideal for unpredictable or short-term healthcare needs.

Instant Claim Settlement

Insurance plans often involve lengthy claim processing times, causing delays in financial support during medical emergencies. On-demand microinsurance leverages digital platforms to enable instant claim settlement, ensuring timely access to funds and enhanced convenience for policyholders.

API-Driven Insurance

API-driven insurance enables seamless integration between traditional insurance plans and on-demand microinsurance, offering flexible, real-time coverage tailored to individual health needs. This technology reduces administrative costs and accelerates claim processing, enhancing user experience and accessibility in health insurance services.

Dynamic Risk Assessment

Dynamic risk assessment in insurance plans leverages real-time data analytics and behavioral insights to personalize coverage and premiums, enhancing risk prediction accuracy. On-demand microinsurance utilizes this adaptive model to offer flexible, short-term protection tailored to evolving individual risks, improving affordability and responsiveness in health coverage.

Insurance Plans vs On-demand Microinsurance Infographic

industrydif.com

industrydif.com