Escrow services provide a trusted third party to hold funds securely during a real estate transaction, ensuring both buyer and seller meet agreed conditions. Smart contracts automate property transfers by executing predefined rules on a blockchain, reducing the need for intermediaries and minimizing fraud risks. Comparing escrow and smart contracts reveals a shift towards digital trust mechanisms that enhance transparency and efficiency in real estate deals.

Table of Comparison

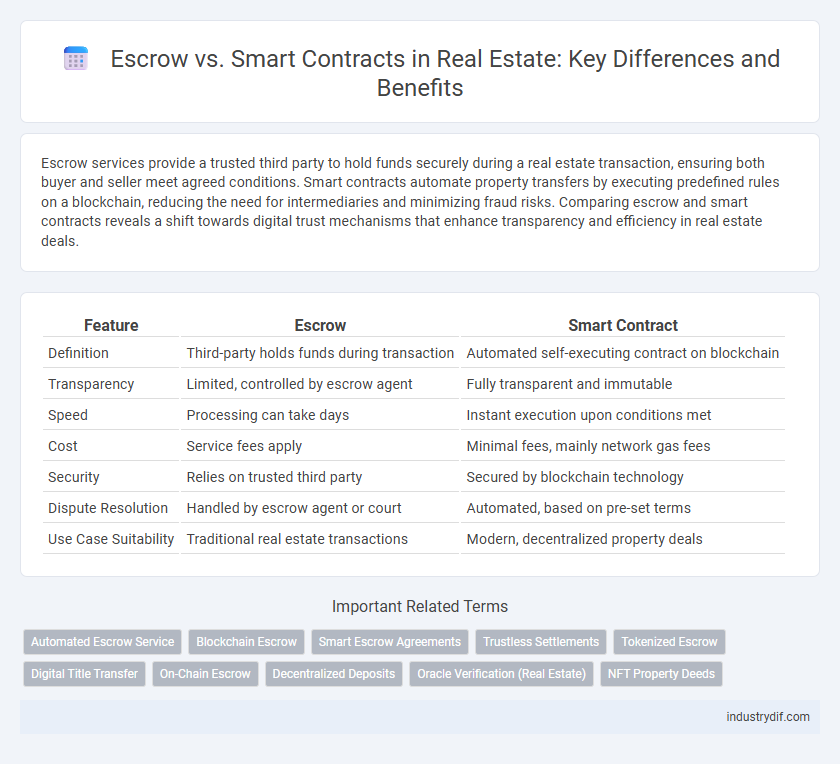

| Feature | Escrow | Smart Contract |

|---|---|---|

| Definition | Third-party holds funds during transaction | Automated self-executing contract on blockchain |

| Transparency | Limited, controlled by escrow agent | Fully transparent and immutable |

| Speed | Processing can take days | Instant execution upon conditions met |

| Cost | Service fees apply | Minimal fees, mainly network gas fees |

| Security | Relies on trusted third party | Secured by blockchain technology |

| Dispute Resolution | Handled by escrow agent or court | Automated, based on pre-set terms |

| Use Case Suitability | Traditional real estate transactions | Modern, decentralized property deals |

Understanding Escrow in Real Estate Transactions

Escrow in real estate transactions involves a neutral third party holding funds and documents until all conditions of the sale are met, ensuring security and trust between buyer and seller. This process protects both parties by verifying that contingencies like inspections, financing, and title clearance are satisfied before the property ownership transfers. Unlike smart contracts that automate conditions through blockchain technology, escrow relies on traditional legal frameworks and human oversight to manage transaction complexities.

What Are Smart Contracts?

Smart contracts are self-executing agreements coded on blockchain platforms that automatically enforce and verify contract terms without intermediaries, enhancing transparency and reducing fraud risks in real estate transactions. These digital contracts streamline processes such as property transfers, automatically releasing funds once predefined conditions are met. By leveraging smart contracts, buyers and sellers benefit from faster closings, lower costs, and increased security compared to traditional escrow services.

Key Differences Between Escrow and Smart Contracts

Escrow involves a neutral third party holding funds or assets during a real estate transaction to ensure both buyer and seller meet agreed conditions, while smart contracts automate agreements through blockchain technology without intermediaries. Escrow services typically require manual intervention and verification, whereas smart contracts execute automatically when pre-defined criteria are met, increasing efficiency and reducing the risk of human error. Security in escrow depends on trusted mediators, whereas smart contracts rely on cryptographic protocols and decentralized validation for enhanced transparency.

Pros and Cons of Escrow in Property Deals

Escrow in property deals offers security by holding funds and documents in a neutral third-party account until all contract conditions are met, reducing the risk of fraud. It provides a clear, regulated process governed by established legal frameworks but can involve higher fees and longer transaction times compared to automated alternatives. Escrow's reliance on intermediaries may result in less transparency and slower dispute resolution than blockchain-based smart contracts.

Advantages of Smart Contracts in Real Estate

Smart contracts in real estate streamline transactions by automating contract execution and reducing the need for intermediaries, which lowers costs and minimizes delays. They ensure transparency and security through blockchain technology, enabling tamper-proof recording of property transfers and payment schedules. The increased efficiency and trustworthiness of smart contracts accelerate closing times and enhance the overall buyer and seller experience.

Security and Trust: Escrow vs Smart Contract

Escrow services enhance security by involving a trusted third party to hold funds until contractual obligations are fulfilled, reducing the risk of fraud in real estate transactions. Smart contracts utilize blockchain technology to automate and enforce agreements transparently, eliminating intermediaries while ensuring tamper-proof execution. While escrow relies on human oversight and regulatory compliance, smart contracts offer increased trust through decentralized verification and immutable transaction records.

Cost Comparison: Escrow Services vs Smart Contract Automation

Escrow services typically charge fees ranging from 1% to 3% of the transaction amount, adding significant costs to real estate deals, while smart contract automation can drastically reduce these expenses by eliminating intermediaries and associated administrative fees. Smart contracts operate on blockchain technology, enabling secure, transparent, and cost-effective transactions with minimal overhead. The reduction in manual processing and enhanced efficiency offered by smart contracts translates to substantial savings for buyers, sellers, and agents involved in the real estate market.

Speed and Efficiency in Closing Deals

Smart contracts accelerate real estate transactions by automating contract execution and fund transfers without intermediaries, significantly reducing closing times. Traditional escrow processes rely on manual verification and third-party involvement, often leading to delays and increased administrative costs. Implementing blockchain-based smart contracts enhances efficiency, ensuring faster, transparent, and secure closings in property deals.

Legal Considerations for Escrow and Smart Contracts

Escrow agreements in real estate provide a legally recognized, third-party service that ensures funds and documents are securely held until all contractual conditions are met, offering statutory protections and dispute resolution frameworks. Smart contracts automate transaction processes through blockchain technology but face evolving legal acceptance and regulatory scrutiny, with uncertainties around enforceability and jurisdiction. Parties must assess compliance with local real estate laws, data privacy regulations, and contract validity when choosing between traditional escrow services and blockchain-based smart contracts.

Future Trends: Blockchain Technology in Real Estate

Blockchain technology is revolutionizing real estate transactions by enhancing transparency and security through smart contracts, which automate escrow processes without intermediaries. Future trends indicate widespread adoption of decentralized platforms, reducing transaction times and costs while minimizing fraud risks. Integration of smart contracts with IoT and AI will further streamline property management and escrow functions, fostering a more efficient real estate ecosystem.

Related Important Terms

Automated Escrow Service

Automated escrow services leverage smart contracts to securely hold and release funds based on predefined conditions in real estate transactions, minimizing the need for intermediaries and reducing transaction times. By using blockchain technology, these smart contracts enhance transparency, prevent fraud, and ensure that all parties meet contractual obligations before funds are disbursed.

Blockchain Escrow

Blockchain escrow leverages smart contract technology to automate and secure real estate transactions by holding funds until predefined conditions are met, reducing the need for traditional intermediaries and minimizing fraud. This method enhances transparency and efficiency by recording all actions on an immutable ledger, ensuring trust between buyers and sellers.

Smart Escrow Agreements

Smart escrow agreements leverage blockchain technology to automate transaction conditions, ensuring secure and transparent real estate deals without the need for traditional intermediaries. These smart contracts reduce risks by releasing funds only when predefined criteria are met, streamlining property transfers and enhancing trust between buyers and sellers.

Trustless Settlements

Escrow services act as trusted third parties to hold funds during real estate transactions, ensuring secure transfers but often requiring manual oversight and higher costs. Smart contracts automate trustless settlements by executing predefined terms on blockchain platforms, reducing the need for intermediaries and increasing transparency and efficiency.

Tokenized Escrow

Tokenized escrow leverages blockchain technology to securely hold and manage funds during real estate transactions, providing transparency and reducing the risk of fraud compared to traditional escrow services. Smart contracts automate the release of funds once predefined conditions are met, streamlining the process and enabling faster, more efficient tokenized real estate deals.

Digital Title Transfer

Escrow services act as a neutral third party holding funds and documents until all conditions of a real estate transaction are met, ensuring secure and traditional digital title transfer. Smart contracts automate the title transfer process through blockchain technology, enabling instant, transparent, and tamper-proof digital title conveyance without intermediaries.

On-Chain Escrow

On-chain escrow leverages blockchain technology to securely hold funds during real estate transactions, ensuring transparency and reducing reliance on traditional intermediaries. Unlike conventional escrow, smart contracts automate fund release based on predefined conditions, minimizing fraud and accelerating deal closure within decentralized platforms.

Decentralized Deposits

Decentralized deposits through smart contracts eliminate intermediaries by automatically enforcing escrow terms on blockchain, ensuring transparent and tamper-proof transactions in real estate. Unlike traditional escrow, smart contracts reduce delays and costs by securely releasing funds only when predefined conditions are met.

Oracle Verification (Real Estate)

Oracle verification in real estate smart contracts automates property transaction validation by securely integrating off-chain data such as title records and ownership details into the blockchain, reducing reliance on traditional escrow services. Unlike escrow that requires manual intervention, oracle-verified smart contracts enhance transparency and speed by triggering contract execution only when verified real-world data conditions are met.

NFT Property Deeds

Escrow services in real estate provide a trusted third party to hold funds and property deeds securely during transactions, ensuring all conditions are met before transfer, while smart contracts automate these processes using blockchain technology for NFT property deeds, enabling transparent, instant, and tamper-proof transfers without intermediaries. NFT property deeds leverage smart contracts to record immutable ownership details on the blockchain, reducing fraud risk and enhancing transaction efficiency compared to traditional escrow methods.

Escrow vs Smart contract Infographic

industrydif.com

industrydif.com