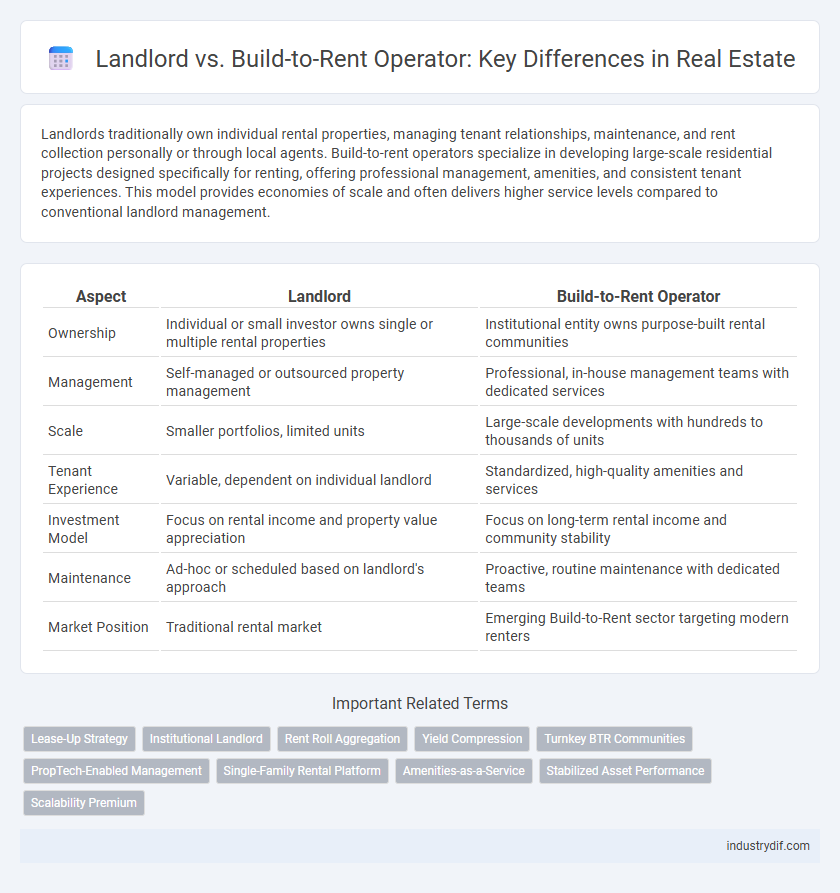

Landlords traditionally own individual rental properties, managing tenant relationships, maintenance, and rent collection personally or through local agents. Build-to-rent operators specialize in developing large-scale residential projects designed specifically for renting, offering professional management, amenities, and consistent tenant experiences. This model provides economies of scale and often delivers higher service levels compared to conventional landlord management.

Table of Comparison

| Aspect | Landlord | Build-to-Rent Operator |

|---|---|---|

| Ownership | Individual or small investor owns single or multiple rental properties | Institutional entity owns purpose-built rental communities |

| Management | Self-managed or outsourced property management | Professional, in-house management teams with dedicated services |

| Scale | Smaller portfolios, limited units | Large-scale developments with hundreds to thousands of units |

| Tenant Experience | Variable, dependent on individual landlord | Standardized, high-quality amenities and services |

| Investment Model | Focus on rental income and property value appreciation | Focus on long-term rental income and community stability |

| Maintenance | Ad-hoc or scheduled based on landlord's approach | Proactive, routine maintenance with dedicated teams |

| Market Position | Traditional rental market | Emerging Build-to-Rent sector targeting modern renters |

Definition of Landlord and Build-to-Rent Operator

A landlord is an individual or entity that owns residential or commercial property and leases it to tenants, typically responsible for property maintenance and rent collection. A build-to-rent operator, by contrast, specializes in developing and managing purpose-built residential communities designed exclusively for renting, often offering professional management and enhanced tenant amenities. This distinction influences investment strategies and tenant experiences within the real estate rental market.

Ownership Structures in Residential Real Estate

Landlords typically own individual residential properties or smaller portfolios, managing rental units directly or through property managers, with ownership often tied to personal or corporate entities. Build-to-rent operators, on the other hand, focus on large-scale developments designed specifically for rental, leveraging institutional ownership structures such as real estate investment trusts (REITs) or private equity funds to optimize long-term asset management. These differing ownership models impact financing strategies, risk distribution, and operational scalability within the residential real estate market.

Property Management Approaches

Landlords typically manage properties individually, focusing on tenant selection, rent collection, and maintenance on a case-by-case basis. Build-to-rent operators implement scalable property management systems designed to optimize occupancy rates, streamline maintenance requests, and enhance resident experiences across entire portfolios. Technology-driven platforms and dedicated in-house teams enable build-to-rent operators to deliver more consistent and efficient property management compared to traditional landlords.

Investment Strategy Comparison

Landlord investment strategies typically focus on acquiring individual rental properties or small portfolios with steady cash flow and long-term capital appreciation. Build-to-rent operators prioritize large-scale developments designed specifically for rental income, leveraging economies of scale and operational efficiencies to enhance returns. Institutional investors favor build-to-rent models for predictable yields and reduced vacancy risks, while traditional landlords often seek higher control with localized management.

Tenant Experience and Services

Build-to-rent operators enhance tenant experience by offering professionally managed amenities, consistent maintenance, and community engagement programs, fostering long-term residency. Unlike traditional landlords, these operators streamline digital rent payments, maintenance requests, and communication, ensuring faster response times and improved tenant satisfaction. Emphasis on modern living standards and integrated services differentiates build-to-rent from conventional landlord models, providing tenants with superior convenience and lifestyle benefits.

Legal and Regulatory Considerations

Landlords are often subject to traditional tenancy laws that govern lease agreements, eviction processes, and tenant rights, which vary significantly by jurisdiction. Build-to-rent operators must navigate complex regulatory frameworks that include zoning laws, property licensing, and compliance with mandatory affordable housing provisions. Legal considerations also extend to ongoing maintenance standards and data protection regulations related to tenant information management.

Scalability and Portfolio Growth

Build-to-rent operators achieve rapid scalability by developing large-scale residential communities designed specifically for rental, enabling streamlined management and consistent tenant experiences. Unlike traditional landlords who typically manage smaller, disparate properties, build-to-rent models leverage institutional funding to accelerate portfolio growth and operational efficiency. This strategic approach allows build-to-rent operators to optimize asset performance and capitalize on economies of scale in maintenance, marketing, and tenant retention.

Risk Management and Return Profiles

Landlords typically face higher market volatility and tenant turnover risks, impacting rental income stability, whereas build-to-rent operators benefit from economies of scale and professional management that mitigate these risks. Build-to-rent models often provide more predictable, long-term cash flows due to diversified tenant bases and integrated maintenance services, enhancing risk-adjusted returns. Landlords may achieve higher returns through property appreciation but encounter greater exposure to localized market fluctuations and vacancy periods.

Technology Adoption in Operations

Build-to-rent operators leverage advanced technology platforms for property management, tenant screening, and maintenance tracking, driving efficiency and enhancing resident experience. Traditional landlords often rely on manual processes or basic software, which can limit scalability and responsiveness in managing multiple units. Integration of IoT devices, smart home systems, and data analytics is more prevalent in build-to-rent models, enabling predictive maintenance and optimized energy use to reduce operational costs.

Market Trends Influencing Landlords and BTR Operators

Market trends reveal a growing preference for build-to-rent (BTR) operators driven by increasing demand for professionally managed rental communities and enhanced tenant amenities. Landlords face pressure to adapt as institutional investment in BTR developments rises, influencing rental yield expectations and property management standards. Shifts in urbanization, demographic changes, and rental market regulation further shape strategies for both traditional landlords and BTR operators.

Related Important Terms

Lease-Up Strategy

Landlords traditionally rely on local market knowledge and personalized tenant relationships to drive lease-up velocity, while build-to-rent operators employ data-driven marketing campaigns and comprehensive amenity packages to attract renters at scale. Leveraging advanced analytics and digital leasing tools, build-to-rent companies optimize pricing and tenant engagement, resulting in faster lease-up periods and reduced vacancies compared to conventional landlord approaches.

Institutional Landlord

Institutional landlords own large portfolios of rental properties and prioritize long-term asset management, stability, and consistent income streams, often leveraging economies of scale and professional management teams. Build-to-rent operators specialize in developing communities specifically designed for rental, focusing on modern amenities and tenant experience to attract long-term renters and maximize property value.

Rent Roll Aggregation

Rent roll aggregation enables build-to-rent operators to consolidate multiple tenant leases into a unified income stream, optimizing cash flow management and investment performance. Unlike traditional landlords who manage rent rolls on an individual property basis, build-to-rent operators leverage aggregated data to enhance portfolio scalability and predictability.

Yield Compression

Yield compression in real estate often affects landlords and build-to-rent operators differently due to varied risk profiles and investment scales, with landlords experiencing tighter yields on individual properties while build-to-rent operators benefit from portfolio diversification and operational efficiencies that mitigate compression impacts. This dynamic drives landlords to seek higher rent growth or value-add strategies, whereas build-to-rent operators focus on long-term income stability and economies of scale to sustain yield optimization.

Turnkey BTR Communities

Turnkey Build-to-Rent (BTR) communities offer landlords a streamlined investment model by providing fully developed, managed rental properties that reduce operational burdens and enhance tenant retention through modern amenities and professional services. Unlike traditional landlords, BTR operators leverage scalable infrastructure and data-driven management, leading to optimized rental yields and consistent cash flow in growing real estate markets.

PropTech-Enabled Management

PropTech-enabled management allows Build-to-Rent operators to utilize advanced digital platforms for streamlined tenant communication, automated maintenance tracking, and data-driven property performance analytics, enhancing operational efficiency compared to traditional landlords. These technologies facilitate scalable, responsive management models that optimize occupancy rates and tenant satisfaction in purpose-built rental communities.

Single-Family Rental Platform

Landlord ownership typically involves managing a limited portfolio of single-family rental homes with direct tenant interaction, whereas build-to-rent operators leverage large-scale Single-Family Rental Platforms to optimize property management through data-driven technology and streamlined leasing processes. Build-to-rent companies focus on scalability, operational efficiency, and tenant experience enhancements, differentiating themselves from traditional landlords by integrating automated maintenance, predictive analytics, and centralized rent collection.

Amenities-as-a-Service

Build-to-rent operators enhance tenant satisfaction by integrating Amenities-as-a-Service models, offering scalable access to shared facilities like fitness centers, co-working spaces, and smart home technologies, which traditional landlords often lack. This service-driven approach increases property value and occupancy rates by creating a seamless, convenience-focused living experience tailored to modern renters.

Stabilized Asset Performance

Landlords typically rely on traditional leasing models that can lead to variable stabilized asset performance due to tenant turnover and inconsistent rental income. In contrast, build-to-rent operators optimize stabilized asset performance through purpose-built properties designed for long-term rentals, ensuring steady cash flow and higher occupancy rates.

Scalability Premium

Build-to-rent operators command a scalability premium by managing large, purpose-built portfolios designed for rental efficiency and streamlined operations, enabling cost savings and consistent tenant experiences at scale. Traditional landlords often lack this advantage due to fragmented property ownership, leading to higher per-unit management costs and limited ability to optimize rent pricing and maintenance strategies.

Landlord vs Build-to-rent operator Infographic

industrydif.com

industrydif.com