Mortgage processes traditionally rely on banks and legal institutions to verify ownership and secure loans, often resulting in lengthy paperwork and potential errors. Blockchain title systems offer an immutable, decentralized ledger that enhances transparency and reduces fraud by securely recording property ownership. This innovative technology can streamline transactions, minimize costs, and accelerate the transfer of real estate titles compared to conventional mortgage methods.

Table of Comparison

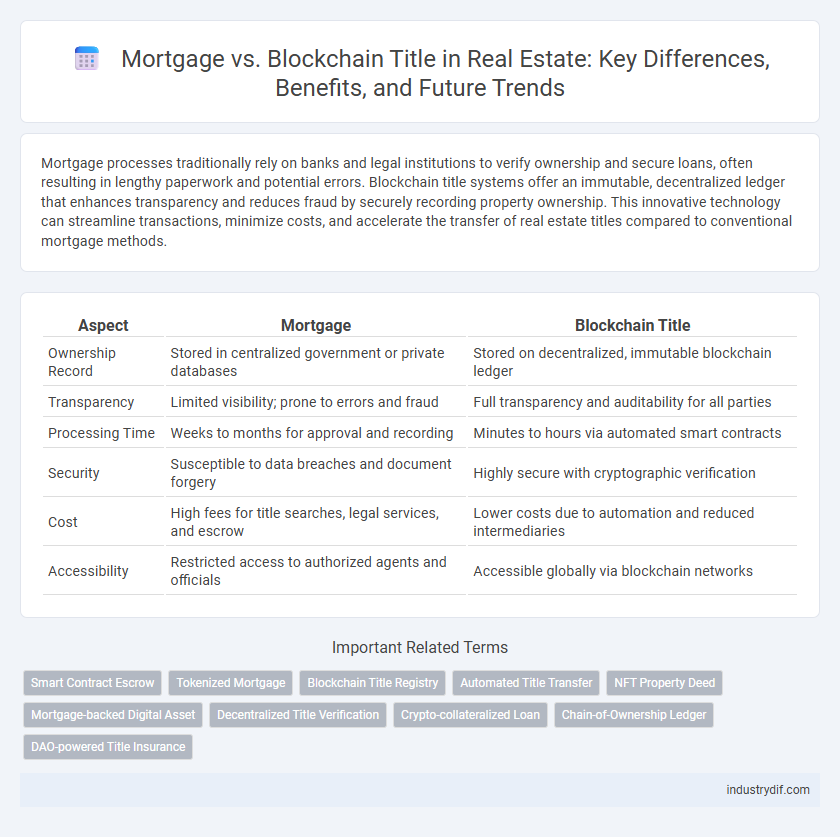

| Aspect | Mortgage | Blockchain Title |

|---|---|---|

| Ownership Record | Stored in centralized government or private databases | Stored on decentralized, immutable blockchain ledger |

| Transparency | Limited visibility; prone to errors and fraud | Full transparency and auditability for all parties |

| Processing Time | Weeks to months for approval and recording | Minutes to hours via automated smart contracts |

| Security | Susceptible to data breaches and document forgery | Highly secure with cryptographic verification |

| Cost | High fees for title searches, legal services, and escrow | Lower costs due to automation and reduced intermediaries |

| Accessibility | Restricted access to authorized agents and officials | Accessible globally via blockchain networks |

Introduction: Comparing Traditional Mortgages and Blockchain Title Solutions

Traditional mortgages rely on centralized financial institutions for loan approval, processing, and title management, often resulting in lengthy paperwork and higher costs. Blockchain title solutions use decentralized ledger technology to provide transparent, secure, and tamper-proof property records, reducing fraud and accelerating transactions. This comparison highlights how blockchain can streamline title verification, cut expenses, and enhance trust compared to conventional mortgage processes.

What is a Mortgage in Real Estate?

A mortgage in real estate is a loan secured by the property that allows buyers to purchase homes without paying the full price upfront. The borrower agrees to repay the loan over time with interest, using the property as collateral. Mortgages involve lenders, borrowers, interest rates, repayment terms, and legal documentation to formalize ownership and debt obligations.

Understanding Blockchain Title Technology

Blockchain title technology revolutionizes property ownership verification by securely recording and storing real estate titles on a decentralized ledger, reducing fraud and errors common in traditional mortgage title processes. Unlike conventional mortgage title systems that rely on intermediaries and paper documentation, blockchain offers transparent, immutable records that enhance trust and efficiency for buyers, sellers, and lenders. This technology streamlines title transfers and lowers costs by eliminating redundant checks and accelerating settlement times.

Key Differences Between Mortgage and Blockchain Title Processes

Mortgage title processes rely on centralized entities such as banks and title companies to verify ownership and facilitate property transactions, leading to longer processing times and higher fees. Blockchain title systems use decentralized ledgers to record and verify property ownership, providing greater transparency, reduced fraud risks, and faster transaction settlements. The key difference lies in the traditional reliance on intermediaries for mortgages versus the trustless, automated verification enabled by blockchain technology.

Benefits of Using Blockchain for Property Titles

Blockchain technology enhances property title management by providing a secure, immutable ledger that reduces fraud and streamlines verification processes. This increased transparency and efficiency lower costs and accelerate transactions compared to traditional mortgage title systems. The decentralized nature of blockchain enables real-time updates and easy access to property records for all relevant parties.

Potential Risks of Blockchain in Real Estate Transactions

Blockchain technology in real estate transactions presents potential risks such as data immutability errors, where incorrect information recorded on the ledger cannot be easily corrected, leading to title disputes. Security vulnerabilities in smart contracts may result in unauthorized access or fraud, compromising property ownership integrity. Regulatory uncertainty and lack of standardized legal frameworks pose challenges in ensuring that blockchain-based titles are universally recognized and enforceable.

Efficiency and Cost Analysis: Mortgage vs Blockchain Title

Traditional mortgage title services often involve multiple intermediaries, leading to higher costs and extended closing times, sometimes taking weeks to finalize. Blockchain title systems streamline the ownership verification process through decentralized ledgers, significantly reducing administrative expenses and enabling near-instantaneous title transfers. This efficiency in blockchain technology lowers transaction fees and minimizes fraud risks, making it a cost-effective alternative to conventional mortgage title processes.

Security and Fraud Prevention: Which Is Better?

Blockchain title systems enhance security by leveraging decentralized ledgers that are tamper-resistant, significantly reducing the risk of title fraud compared to traditional mortgage title methods. Mortgage title record-keeping relies on centralized databases vulnerable to hacking, errors, or manipulation, which can lead to fraudulent claims or disputes. The transparency and immutability of blockchain technology ensure accurate, real-time verification of ownership history, making it a robust solution for preventing fraud in real estate transactions.

Legal and Regulatory Considerations in Mortgage and Blockchain Title

Mortgage transactions are governed by well-established legal frameworks involving liens, public recording, and lender protections, whereas blockchain title systems introduce decentralized, tamper-proof ledgers that challenge traditional regulatory oversight and jurisdictional issues. Regulatory authorities are actively developing compliance standards for blockchain property records to ensure transparency, fraud prevention, and secure ownership verification without compromising existing mortgage lender rights. The interplay between mortgage law and blockchain innovations demands updated legal infrastructures that reconcile digital deed authenticity with enforceable creditor claims and real property statutes.

Future Trends: Will Blockchain Replace Traditional Mortgages?

Blockchain technology is poised to revolutionize property transactions by enhancing transparency, reducing fraud, and expediting title transfers, challenging the conventional mortgage process reliant on intermediaries. Smart contracts on blockchain platforms can automate loan agreements and payments, potentially lowering costs and increasing efficiency compared to traditional mortgage systems. As regulatory frameworks evolve, blockchain-based title management could become a mainstream alternative, transforming real estate financing and ownership verification in the near future.

Related Important Terms

Smart Contract Escrow

Smart contract escrow in blockchain title systems automates property transaction processes by securely holding and releasing funds only when all contractual conditions are met, reducing fraud risks and increasing transparency. Compared to traditional mortgage escrow accounts managed by banks, blockchain offers faster settlement times, lower transaction fees, and immutable record-keeping for enhanced trust and efficiency.

Tokenized Mortgage

Tokenized mortgages leverage blockchain technology to enhance transparency and liquidity in real estate financing by converting mortgage assets into tradable digital tokens. This innovation streamlines title verification, reduces fraud, and enables fractional ownership, transforming traditional mortgage processes.

Blockchain Title Registry

Blockchain Title Registry enhances real estate transactions by providing a secure, transparent, and tamper-proof record of property ownership, reducing fraud and eliminating lengthy title searches. Unlike traditional mortgages reliant on centralized databases, blockchain technology enables instant verification and streamlined transfer of titles, revolutionizing property registration efficiency.

Automated Title Transfer

Blockchain title systems enable automated title transfers by securely recording property ownership changes on a decentralized ledger, reducing the need for manual processing and minimizing title fraud risks. Traditional mortgage title transfers rely heavily on intermediaries and extensive paperwork, leading to longer processing times and higher costs compared to blockchain's efficient automation.

NFT Property Deed

NFT property deeds leverage blockchain technology to provide secure, immutable records that minimize fraud and streamline the transfer process compared to traditional mortgage title systems. Unlike conventional methods, these decentralized digital assets enable transparent ownership verification and faster transaction settlements in real estate.

Mortgage-backed Digital Asset

Mortgage-backed digital assets leverage blockchain technology to enhance transparency, reduce fraud, and streamline property title transfers by tokenizing mortgage portfolios. This innovation transforms traditional mortgage-backed securities into programmable, liquid assets on decentralized ledgers, increasing efficiency and investor accessibility in real estate finance.

Decentralized Title Verification

Decentralized title verification using blockchain technology ensures secure, transparent, and tamper-proof property records, reducing risks of fraud compared to traditional mortgage title processes. This innovation streamlines title transfer by eliminating intermediaries and providing real-time access to verified ownership data.

Crypto-collateralized Loan

Crypto-collateralized loans leverage blockchain technology to streamline mortgage processes by enabling decentralized, transparent title verification and reducing reliance on traditional credit assessments. This integration enhances liquidity and security for real estate transactions, positioning blockchain-based titles as a transformative alternative to conventional mortgage frameworks.

Chain-of-Ownership Ledger

A blockchain title leverages a decentralized, immutable chain-of-ownership ledger that enhances transparency and security compared to traditional mortgage title systems prone to fraud and errors. Real estate transactions benefit from faster verification processes and reduced costs by using blockchain technology to maintain a tamper-proof record of property ownership history.

DAO-powered Title Insurance

DAO-powered title insurance leverages blockchain technology to enhance transparency and reduce fraud in real estate transactions by securely recording property titles on a decentralized ledger. This approach contrasts with traditional mortgage processes by enabling faster title verification and lowering costs through automated smart contracts within a decentralized autonomous organization framework.

Mortgage vs Blockchain Title Infographic

industrydif.com

industrydif.com