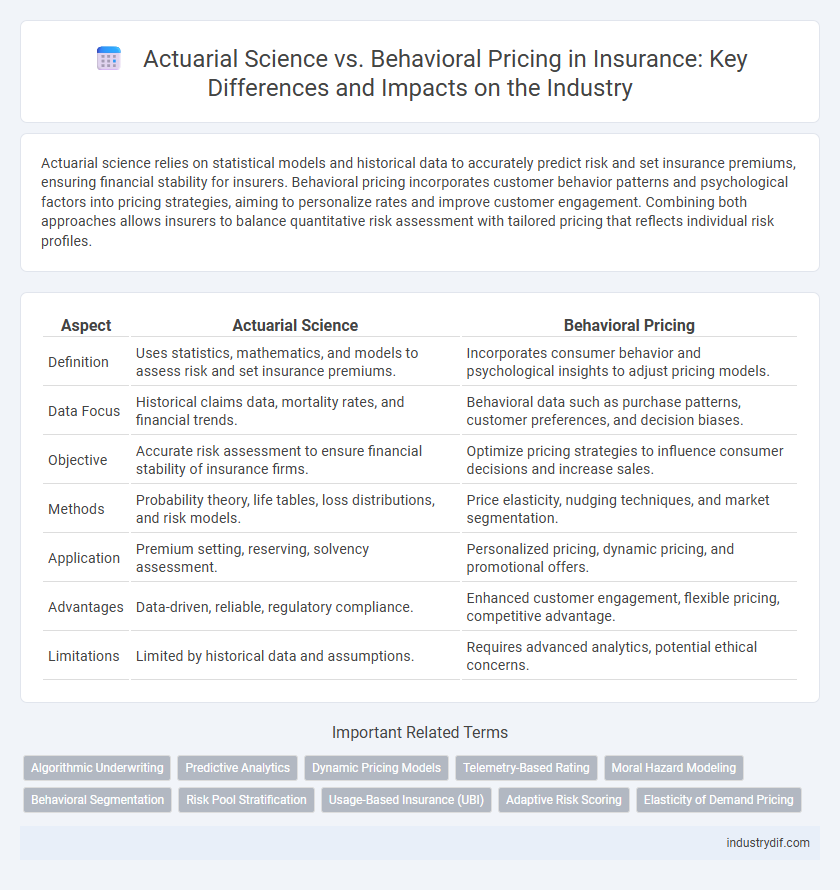

Actuarial science relies on statistical models and historical data to accurately predict risk and set insurance premiums, ensuring financial stability for insurers. Behavioral pricing incorporates customer behavior patterns and psychological factors into pricing strategies, aiming to personalize rates and improve customer engagement. Combining both approaches allows insurers to balance quantitative risk assessment with tailored pricing that reflects individual risk profiles.

Table of Comparison

| Aspect | Actuarial Science | Behavioral Pricing |

|---|---|---|

| Definition | Uses statistics, mathematics, and models to assess risk and set insurance premiums. | Incorporates consumer behavior and psychological insights to adjust pricing models. |

| Data Focus | Historical claims data, mortality rates, and financial trends. | Behavioral data such as purchase patterns, customer preferences, and decision biases. |

| Objective | Accurate risk assessment to ensure financial stability of insurance firms. | Optimize pricing strategies to influence consumer decisions and increase sales. |

| Methods | Probability theory, life tables, loss distributions, and risk models. | Price elasticity, nudging techniques, and market segmentation. |

| Application | Premium setting, reserving, solvency assessment. | Personalized pricing, dynamic pricing, and promotional offers. |

| Advantages | Data-driven, reliable, regulatory compliance. | Enhanced customer engagement, flexible pricing, competitive advantage. |

| Limitations | Limited by historical data and assumptions. | Requires advanced analytics, potential ethical concerns. |

Introduction to Actuarial Science and Behavioral Pricing

Actuarial Science uses mathematical models and statistical techniques to assess risk and determine insurance premiums based on historical data and probability theories. Behavioral Pricing integrates psychological insights and consumer behavior patterns to adjust pricing strategies and optimize customer engagement. Combining both approaches enhances precision in risk evaluation and improves market competitiveness for insurance companies.

Fundamentals of Actuarial Science in Insurance

Actuarial Science in insurance fundamentally involves the application of mathematics, statistics, and financial theory to assess risk and uncertainty in policy pricing and reserving. It focuses on evaluating probabilities of events such as death, illness, or property damage to calculate premiums that ensure financial stability for insurers. This discipline uses mortality tables, loss distributions, and discounting techniques to predict future claims and optimize risk management strategies within insurance portfolios.

Principles of Behavioral Pricing in Insurance

Principles of behavioral pricing in insurance leverage psychological insights to influence consumer decisions by adjusting premiums based on perceived fairness, risk preferences, and decision-making biases. This approach integrates data on customer behavior, such as purchase patterns and responses to pricing changes, to design dynamic pricing strategies that optimize affordability and retention. Unlike traditional actuarial science, which relies primarily on statistical risk assessment, behavioral pricing emphasizes the impact of cognitive factors on consumer willingness to pay and policy uptake.

Key Differences Between Actuarial Science and Behavioral Pricing

Actuarial Science relies on statistical models and historical data to assess risk and set insurance premiums, emphasizing mathematical accuracy and probability. Behavioral Pricing incorporates consumer behavior analysis and psychological factors to predict buying patterns and adjust pricing strategies dynamically. The key difference lies in Actuarial Science's focus on objective risk quantification versus Behavioral Pricing's subjective evaluation of customer decision-making processes.

Data Sources and Analytical Techniques

Actuarial science relies heavily on structured data sources such as historical claims, policyholder demographics, and financial records, utilizing statistical models and predictive analytics to assess risk and set premiums. Behavioral pricing incorporates real-time consumer behavior data, including online browsing patterns, purchase history, and response to marketing stimuli, applying machine learning algorithms and experimental design techniques to tailor pricing strategies. Combining traditional actuarial methods with advanced behavioral analytics enables insurers to enhance risk assessment accuracy and optimize personalized pricing.

Impact on Risk Assessment and Premium Calculation

Actuarial science relies on statistical analysis of historical data to evaluate risk and calculate premiums with high precision, ensuring financial stability for insurers. Behavioral pricing incorporates policyholder behavior patterns and psychological factors, improving risk prediction by identifying potential moral hazard or anti-selection. Combining both methods enhances premium accuracy, optimizing risk assessment and profitability in insurance pricing models.

Consumer Behavior and Pricing Strategies

Actuarial Science leverages statistical models and historical data to quantify risk and set premiums based on probability distributions, ensuring financial stability for insurers. Behavioral Pricing incorporates insights from consumer psychology and decision-making patterns to design pricing strategies that influence perceived value and willingness to pay. Integrating behavioral data with actuarial models enhances pricing accuracy and improves customer segmentation in insurance markets.

Advantages and Limitations of Actuarial Science

Actuarial Science in insurance offers the advantage of precise risk assessment through mathematical models and historical data analysis, enabling accurate premium setting and financial forecasting. However, its limitations include reliance on past trends that may not predict future behavioral changes and insufficient incorporation of consumer psychology, which behavioral pricing addresses by considering how customer behavior impacts risk perception and purchasing decisions. The traditional actuarial approach may overlook dynamic market conditions and behavioral biases, reducing its adaptability in personalized pricing strategies.

Advantages and Limitations of Behavioral Pricing

Behavioral pricing leverages customer data and psychological insights to tailor insurance premiums more accurately, improving risk assessment and enhancing customer engagement. Its main advantage lies in incentivizing safer behavior and increasing market competitiveness through personalized pricing strategies. However, limitations include potential privacy concerns, regulatory challenges, and the risk of reinforcing biases, which may lead to fairness and ethical issues in premium determination.

Future Trends: Integrating Actuarial Science and Behavioral Pricing

Future trends in insurance pricing emphasize the integration of actuarial science with behavioral pricing to enhance risk assessment accuracy and customer segmentation. Advanced predictive analytics and machine learning models leverage traditional actuarial data alongside behavioral insights such as customer decision patterns and psychological factors. This fusion drives more personalized pricing strategies, improving competitive advantage and optimizing loss ratios in highly dynamic insurance markets.

Related Important Terms

Algorithmic Underwriting

Algorithmic underwriting integrates actuarial science's statistical models with behavioral pricing insights to enhance risk assessment accuracy in insurance. By analyzing both quantitative data and consumer behavior patterns, insurers optimize premium pricing and improve underwriting efficiency.

Predictive Analytics

Predictive analytics in actuarial science leverages statistical models and historical data to forecast risks and set premiums based on objective risk assessment. Behavioral pricing integrates customer behavior patterns and psychological factors into predictive models, enabling insurers to tailor pricing dynamically and enhance risk segmentation accuracy.

Dynamic Pricing Models

Dynamic pricing models in insurance leverage actuarial science by utilizing statistical analysis and risk assessment to set premiums that reflect individual risk profiles accurately. Behavioral pricing incorporates consumer behavior data, enabling dynamic adjustments based on real-time actions and decision patterns, thus enhancing personalized pricing strategies.

Telemetry-Based Rating

Telemetry-Based Rating leverages real-time driving data collected through sensors and GPS to enhance actuarial precision in determining insurance premiums. This approach integrates behavioral pricing by analyzing individual risk patterns, enabling insurers to tailor coverage and incentivize safer driving habits more effectively than traditional actuarial models.

Moral Hazard Modeling

Actuarial Science employs statistical models and historical data to assess and predict risks, while Behavioral Pricing integrates psychological factors influencing policyholder decisions, enhancing moral hazard modeling by accounting for risk-taking behaviors. Advanced behavioral models improve insurer strategies to mitigate moral hazard by predicting how incentives and pricing structures impact policyholder conduct.

Behavioral Segmentation

Behavioral segmentation in insurance uses customer actions and preferences to tailor pricing models, enhancing risk assessment beyond traditional actuarial science, which relies heavily on historical data and statistical methods. Integrating behavioral pricing strategies enables insurers to predict policyholder behavior more accurately, optimize premiums, and improve customer retention by aligning rates with individual risk profiles.

Risk Pool Stratification

Actuarial science utilizes statistical models and historical data to stratify risk pools based on quantifiable factors such as age, health status, and claim history, ensuring precise premium pricing. Behavioral pricing incorporates policyholder behavior and decision-making patterns into risk assessment, enhancing risk pool stratification by identifying potential adverse selection and moral hazard beyond traditional actuarial metrics.

Usage-Based Insurance (UBI)

Actuarial Science leverages historical data and statistical models to assess risk and set premiums in Usage-Based Insurance (UBI), while Behavioral Pricing integrates telematics and real-time driving behavior to personalize rates more dynamically. UBI combines these approaches by using actuarial analysis for baseline risk evaluation and behavioral insights to adjust premiums based on actual usage patterns and driver habits.

Adaptive Risk Scoring

Adaptive risk scoring integrates actuarial science's quantitative models with behavioral pricing insights to more accurately assess policyholders' risk profiles. This approach leverages real-time data and behavioral indicators, refining premium calculations beyond traditional statistical methods to optimize insurance pricing strategies.

Elasticity of Demand Pricing

Actuarial Science in insurance relies on statistical models and historical data to assess risk and set prices based on expected losses, while Behavioral Pricing incorporates consumer behavior insights to adjust premiums dynamically, reflecting elasticity of demand more accurately. Elasticity of demand pricing in Behavioral Pricing allows insurers to optimize revenue by identifying price sensitivity among different customer segments, enabling more personalized and competitive premium offerings.

Actuarial Science vs Behavioral Pricing Infographic

industrydif.com

industrydif.com