Risk assessment traditionally relies on historical data, demographic factors, and credit scores to determine insurance premiums and coverage eligibility. Telematics-based risk scoring enhances this process by using real-time driving behavior data collected through devices or apps, providing a more personalized and accurate profile of risk. Insurers leveraging telematics benefit from improved loss prediction, incentivizing safer driving habits and potentially lowering premiums for responsible drivers.

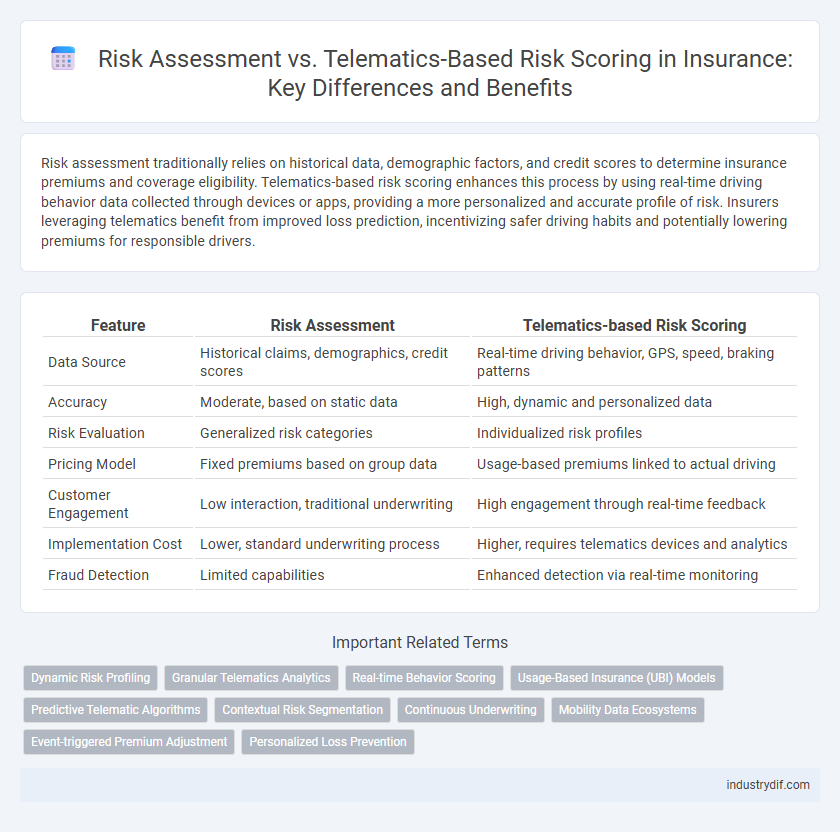

Table of Comparison

| Feature | Risk Assessment | Telematics-based Risk Scoring |

|---|---|---|

| Data Source | Historical claims, demographics, credit scores | Real-time driving behavior, GPS, speed, braking patterns |

| Accuracy | Moderate, based on static data | High, dynamic and personalized data |

| Risk Evaluation | Generalized risk categories | Individualized risk profiles |

| Pricing Model | Fixed premiums based on group data | Usage-based premiums linked to actual driving |

| Customer Engagement | Low interaction, traditional underwriting | High engagement through real-time feedback |

| Implementation Cost | Lower, standard underwriting process | Higher, requires telematics devices and analytics |

| Fraud Detection | Limited capabilities | Enhanced detection via real-time monitoring |

Introduction to Risk Assessment in Insurance

Risk assessment in insurance involves evaluating the likelihood and potential severity of claims to determine appropriate coverage and premiums. Traditional risk assessment relies on historical data, policyholder information, and actuarial models to estimate risk exposure accurately. Telematics-based risk scoring enhances this process by incorporating real-time driving behavior and vehicle data, offering a more dynamic and personalized risk profile.

Traditional Risk Assessment Methods

Traditional risk assessment methods in insurance rely heavily on historical data and demographic factors such as age, gender, occupation, and credit score to evaluate potential risk levels. These approaches use actuarial tables and statistical models to predict the likelihood of claims, often resulting in generalized risk categories that may lack individual precision. Unlike telematics-based risk scoring, traditional methods do not capture real-time behavioral data, limiting their ability to tailor premiums based on actual policyholder driving habits or usage patterns.

What is Telematics-based Risk Scoring?

Telematics-based risk scoring utilizes data collected from in-vehicle devices or smartphone apps to monitor driving behavior, such as speed, braking patterns, and mileage. This method enables insurers to assess risk more accurately by analyzing real-time, personalized driving data rather than relying solely on traditional factors like age or credit history. By leveraging telematics technology, insurance companies can offer customized premiums and incentivize safer driving habits.

Key Differences: Risk Assessment vs Telematics

Risk assessment in insurance traditionally relies on historical data, demographic information, and credit scores to determine a policyholder's risk profile, while telematics-based risk scoring leverages real-time driving behavior data collected via GPS devices and onboard diagnostics. Telematics provides dynamic, personalized insights such as speed patterns, braking habits, and mileage, enabling more accurate and individualized premium calculations compared to conventional risk assessments. The integration of telematics allows insurers to shift from static, generalized risk models to continuous, behavior-driven scoring, improving risk prediction and incentivizing safer driving practices.

Data Sources: Underwriting and Telematics Devices

Risk assessment relies on traditional underwriting data sources such as credit scores, claims history, and demographic information to evaluate insurance risk. Telematics-based risk scoring leverages real-time data collected from telematics devices--including GPS, accelerometers, and vehicle diagnostics--to monitor driving behavior and provide dynamic risk profiles. The integration of telematics data enables insurers to enhance risk precision by continuously updating scores based on actual usage patterns and driving habits.

Impact on Premium Pricing

Risk assessment traditionally relies on historical data, demographics, and generalized risk factors to determine premium pricing, often leading to broader risk pools and less personalized rates. Telematics-based risk scoring uses real-time driving behavior data, such as speed, braking patterns, and mileage, enabling insurers to offer more accurate, individualized premiums. This shift reduces adverse selection, encourages safer driving habits, and leads to dynamic pricing models reflecting actual risk exposure.

Accuracy and Predictive Power

Risk assessment traditionally relies on historical data and statistical models to evaluate insurance risk, often leading to generalized and less personalized results. Telematics-based risk scoring enhances accuracy by using real-time driving behavior data such as speed, braking patterns, and mileage to create individualized risk profiles. This approach significantly improves predictive power, enabling insurers to better predict future claims and tailor premiums accordingly.

Benefits for Insurers and Policyholders

Risk assessment traditionally relies on historical data and statistical models to evaluate insurance risk, offering insurers a broad understanding of potential claim frequencies and severities. Telematics-based risk scoring enhances this approach by providing real-time, individualized driving behavior data, enabling insurers to price policies more accurately and incentivize safer driving habits. Policyholders benefit from personalized premiums and increased control over insurance costs, while insurers experience reduced claim rates and improved risk management precision.

Challenges and Limitations

Traditional risk assessment methods rely heavily on historical data and generic risk factors, often leading to less precise individual risk profiling. Telematics-based risk scoring faces challenges such as data privacy concerns, varying data quality, and the complexity of accurately interpreting driving behavior in diverse conditions. Both approaches struggle with integrating real-time data seamlessly and addressing customer skepticism regarding data usage.

The Future of Risk Scoring in Insurance

Telematics-based risk scoring enhances traditional risk assessment by utilizing real-time data from connected devices, providing insurers with dynamic and personalized risk profiles. Advanced analytics and machine learning algorithms process driving behavior, location, and vehicle usage patterns, enabling more accurate premium pricing and proactive risk mitigation. The future of risk scoring in insurance hinges on integrating telematics with AI-driven insights to foster precision underwriting and improved customer engagement.

Related Important Terms

Dynamic Risk Profiling

Risk assessment traditionally relies on static data such as age, location, and claim history to evaluate insurance risk, whereas telematics-based risk scoring uses real-time driving behavior data to create dynamic risk profiles that adjust continuously. This dynamic risk profiling enhances accuracy in underwriting by reflecting actual driving patterns and enabling personalized premium adjustments.

Granular Telematics Analytics

Granular telematics analytics enable insurers to evaluate driving behavior with precise data on speed, acceleration, and braking patterns, enhancing risk assessment accuracy beyond traditional methods. Integrating telematics-based risk scoring allows for dynamic, personalized premiums that reflect real-time driving habits, improving underwriting decisions and customer retention.

Real-time Behavior Scoring

Risk assessment in insurance traditionally relies on historical data and static factors, whereas telematics-based risk scoring leverages real-time behavior scoring through continuous monitoring of driving patterns, enabling more precise and personalized premium calculations. Real-time data from telematics devices captures metrics like speed, braking intensity, and mileage, offering insurers dynamic insights that enhance risk prediction accuracy and promote safer driving habits.

Usage-Based Insurance (UBI) Models

Risk assessment in traditional insurance relies on demographic and historical data to estimate risk, whereas telematics-based risk scoring leverages real-time driving behavior and vehicle usage data to enhance accuracy. Usage-Based Insurance (UBI) models utilize telematics technology to personalize premiums, reward safe driving, and improve risk prediction by continuously monitoring factors like speed, braking patterns, and mileage.

Predictive Telematic Algorithms

Predictive telematic algorithms analyze real-time driving behavior data such as speed, acceleration, and braking patterns to generate dynamic risk scores, enabling more accurate and personalized insurance premiums. Unlike traditional risk assessment methods that rely on historical data and static profiles, telematics-based risk scoring enhances risk prediction by continuously adapting to driver habits and road conditions.

Contextual Risk Segmentation

Risk assessment traditionally evaluates insurance risk through historical data and broad demographic profiles, while telematics-based risk scoring leverages real-time driving behavior captured via GPS and onboard sensors. This contextual risk segmentation enhances underwriting precision by dynamically differentiating risk levels based on actual driver habits, environmental conditions, and usage patterns.

Continuous Underwriting

Continuous underwriting enhances traditional risk assessment by integrating telematics-based risk scoring, enabling real-time monitoring of driver behavior and dynamic adjustment of insurance premiums. This approach improves accuracy in risk prediction, reduces underwriting cycles, and fosters proactive risk management through data-driven insights.

Mobility Data Ecosystems

Risk assessment in insurance leverages historical claims and demographic data to evaluate policyholder risk, while telematics-based risk scoring utilizes real-time mobility data ecosystems, including GPS tracking, driving behavior, and vehicle sensor inputs, to provide dynamic, individualized risk profiles. Integrating telematics enhances accuracy by capturing actual on-road behaviors, reducing reliance on static data and enabling more precise premium pricing and risk management.

Event-triggered Premium Adjustment

Event-triggered premium adjustment in telematics-based risk scoring allows insurers to dynamically modify premiums based on real-time driving behavior data such as sudden braking, acceleration, or speeding incidents. Traditional risk assessment relies on static historical data and demographic factors, lacking the responsiveness and precision enabled by telematics for individualized premium calculations.

Personalized Loss Prevention

Risk assessment in insurance traditionally relies on historical data and broad risk categories, while telematics-based risk scoring utilizes real-time driving behavior and personalized data to deliver more accurate and individualized loss prevention strategies. By integrating telematics, insurers can tailor premiums and interventions to unique client profiles, enhancing risk mitigation and promoting safer driving habits.

Risk Assessment vs Telematics-based Risk Scoring Infographic

industrydif.com

industrydif.com