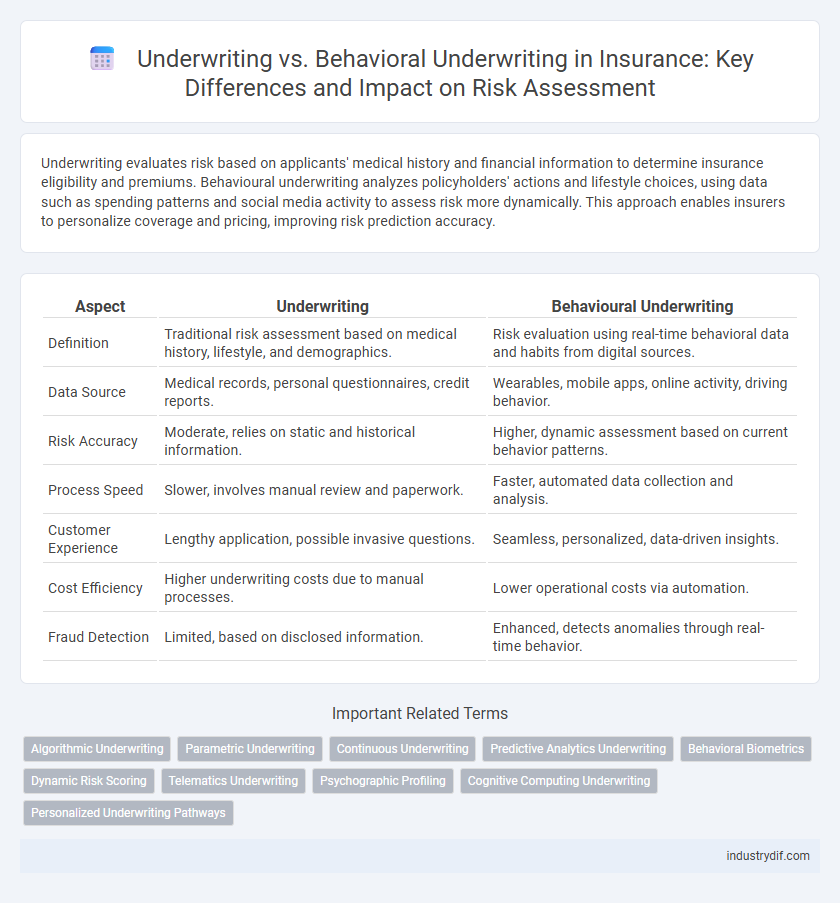

Underwriting evaluates risk based on applicants' medical history and financial information to determine insurance eligibility and premiums. Behavioural underwriting analyzes policyholders' actions and lifestyle choices, using data such as spending patterns and social media activity to assess risk more dynamically. This approach enables insurers to personalize coverage and pricing, improving risk prediction accuracy.

Table of Comparison

| Aspect | Underwriting | Behavioural Underwriting |

|---|---|---|

| Definition | Traditional risk assessment based on medical history, lifestyle, and demographics. | Risk evaluation using real-time behavioral data and habits from digital sources. |

| Data Source | Medical records, personal questionnaires, credit reports. | Wearables, mobile apps, online activity, driving behavior. |

| Risk Accuracy | Moderate, relies on static and historical information. | Higher, dynamic assessment based on current behavior patterns. |

| Process Speed | Slower, involves manual review and paperwork. | Faster, automated data collection and analysis. |

| Customer Experience | Lengthy application, possible invasive questions. | Seamless, personalized, data-driven insights. |

| Cost Efficiency | Higher underwriting costs due to manual processes. | Lower operational costs via automation. |

| Fraud Detection | Limited, based on disclosed information. | Enhanced, detects anomalies through real-time behavior. |

Introduction to Underwriting in Insurance

Underwriting in insurance involves evaluating risks and determining policy terms to ensure balanced risk exposure and profitability for insurers. Traditional underwriting relies on factors like medical history, credit scores, and demographic data to assess applicants. Behavioural underwriting enhances this process by integrating real-time data such as lifestyle habits and telematics, enabling more personalized and accurate risk assessment.

What is Traditional Underwriting?

Traditional underwriting in insurance involves assessing an applicant's risk profile based on objective criteria such as medical history, age, occupation, and lifestyle habits. This process relies heavily on standardized questionnaires, medical exams, and statistical data to evaluate the likelihood of a claim. Traditional underwriting aims to determine policy eligibility and pricing by analyzing quantifiable risk factors rather than real-time behavior.

Key Steps in the Underwriting Process

The underwriting process involves assessing risk through data collection, risk evaluation, and policy pricing to determine insurability and premium rates. Behavioural underwriting incorporates real-time behavior data, such as driving patterns or lifestyle habits, enhancing risk assessment precision. Key steps include gathering applicant information, analyzing risk factors, applying predictive models, and making informed decisions to optimize coverage and profitability.

Defining Behavioural Underwriting

Behavioural underwriting integrates policyholders' real-time data, such as spending habits and lifestyle choices, to assess risk more accurately than traditional underwriting methods. It leverages advanced analytics and machine learning algorithms to evaluate behavioral patterns alongside classic risk factors like age and medical history. This approach enhances predictive accuracy and enables personalized insurance premiums based on individual behavior rather than solely on demographic or static information.

Differences Between Traditional and Behavioural Underwriting

Traditional underwriting relies on static data such as medical history, age, and financial records to assess insurance risk, using standardized criteria and manual evaluations. Behavioural underwriting incorporates real-time data from wearable devices, online activity, and lifestyle habits, enabling dynamic risk assessments based on actual policyholder behavior. This shift leads to more personalized insurance premiums and improved accuracy in risk prediction by analyzing continuous behavioral patterns rather than solely historical information.

Role of Data Analytics in Behavioural Underwriting

Data analytics transforms behavioural underwriting by enabling insurers to assess risk more accurately through real-time tracking of policyholders' activities, such as driving patterns or health habits. Advanced algorithms analyze vast datasets from wearable devices, telematics, and social media to predict future claims, enhancing personalized pricing models. This approach improves risk segmentation and fraud detection, leading to more efficient underwriting processes and better customer outcomes.

Benefits of Behavioural Underwriting for Insurers

Behavioural underwriting leverages real-time data and predictive analytics to assess risk more accurately than traditional underwriting methods. It enables insurers to price policies more precisely, reducing loss ratios and improving profitability. This approach also enhances customer engagement by offering personalized premiums based on actual behavior patterns.

Impact on Policyholders and Premium Rates

Traditional underwriting evaluates policyholders based on static factors such as age, medical history, and lifestyle, which often results in premium rates reflecting generalized risk categories. Behavioural underwriting incorporates real-time data from wearables and smart devices to assess individual health behaviors, enabling more personalized risk analysis and potentially lower premiums for healthier policyholders. This approach encourages proactive wellness, leading to improved health outcomes and more equitable premium rates aligned closely with actual risk.

Challenges and Ethical Considerations

Traditional underwriting relies on historical data and risk assessment models, often facing challenges related to data accuracy and bias, which can lead to unfair premium pricing. Behavioural underwriting incorporates real-time behavioural data to refine risk evaluation but raises ethical concerns about privacy, informed consent, and potential discrimination. Insurers must balance predictive accuracy with transparency and fairness to maintain trust and compliance in evolving regulatory environments.

Future Trends in Insurance Underwriting

Future trends in insurance underwriting emphasize the integration of behavioural underwriting techniques, leveraging real-time data from wearables and IoT devices to provide personalized risk assessments. Advances in artificial intelligence and machine learning enable insurers to analyze vast behavioural datasets, improving accuracy in predicting policyholder risk and enhancing premium pricing models. This shift from traditional underwriting to behaviour-driven models supports proactive risk management and fosters more dynamic policy adjustments tailored to individual behaviours.

Related Important Terms

Algorithmic Underwriting

Algorithmic underwriting leverages advanced data analytics and machine learning models to assess risk more accurately than traditional underwriting by analyzing extensive behavioral data such as spending patterns, social media activity, and online behavior. This approach enhances predictive accuracy and efficiency, allowing insurers to tailor policies and premiums based on real-time behavioral insights rather than solely relying on historical medical records and demographic information.

Parametric Underwriting

Parametric underwriting leverages predefined parameters and real-time data triggers to assess risk and automate decision-making, contrasting traditional risk evaluation in behavioral underwriting that relies on historical behavioral data and subjective analysis. This approach enhances accuracy and efficiency in insurance underwriting by using measurable event-based criteria, such as weather patterns or sensor outputs, to determine payouts without extensive claims investigation.

Continuous Underwriting

Continuous underwriting leverages real-time data and AI-driven analytics to assess risk dynamically, improving accuracy over traditional underwriting models that rely on static, one-time evaluations. This approach enables insurers to adjust premiums and coverage based on ongoing behavioral insights, enhancing risk management and customer personalization.

Predictive Analytics Underwriting

Predictive analytics underwriting leverages big data and machine learning algorithms to assess risk more accurately than traditional underwriting methods by analyzing behavioral patterns and historical data. This advanced approach enhances risk prediction, enabling insurers to customize policies and premiums effectively while reducing claim defaults.

Behavioral Biometrics

Behavioral underwriting integrates behavioral biometrics--such as keystroke dynamics, mouse movements, and touchscreen gestures--to assess risk more accurately than traditional underwriting methods relying solely on demographic and financial data. This advanced approach enhances fraud detection and personalizes insurance premiums by analyzing unique behavioral patterns, improving underwriting precision and customer experience.

Dynamic Risk Scoring

Dynamic risk scoring in behavioural underwriting leverages real-time data and analytics to assess policyholders' risk more accurately than traditional underwriting, which relies on static information and historical data. This approach enhances risk prediction by monitoring ongoing behaviour and lifestyle changes, enabling insurers to adjust premiums and coverage dynamically.

Telematics Underwriting

Telematics underwriting leverages real-time driving data from GPS devices and sensors to assess risk more accurately than traditional behavioral underwriting, which relies on historical data and self-reported information. This data-driven approach enables insurers to personalize premiums based on actual driving behaviors, enhancing risk prediction and promoting safer driving habits.

Psychographic Profiling

Traditional underwriting assesses insurance risk based on quantitative data such as age, medical history, and financial status, while behavioural underwriting integrates psychographic profiling to evaluate personality traits, lifestyle choices, and behavioural patterns that influence risk. Psychographic profiling enhances risk prediction accuracy by capturing cognitive biases, attitudes, and mental health factors that traditional metrics may overlook, enabling more personalized insurance pricing and risk management.

Cognitive Computing Underwriting

Cognitive computing underwriting leverages advanced AI algorithms to analyze vast datasets, improving risk assessment beyond traditional underwriting by incorporating behavioral patterns and real-time data. This approach enhances precision in policy pricing and fraud detection while adapting dynamically to individual customer behaviors and market trends.

Personalized Underwriting Pathways

Traditional underwriting assesses risk using static criteria such as medical history and demographics, while behavioural underwriting integrates real-time data from policyholder activities to create personalized underwriting pathways that enhance accuracy and efficiency. Leveraging wearable technology and AI-driven analytics, personalized underwriting pathways enable insurers to tailor coverage and pricing dynamically, improving risk prediction and customer engagement.

Underwriting vs Behavioural Underwriting Infographic

industrydif.com

industrydif.com