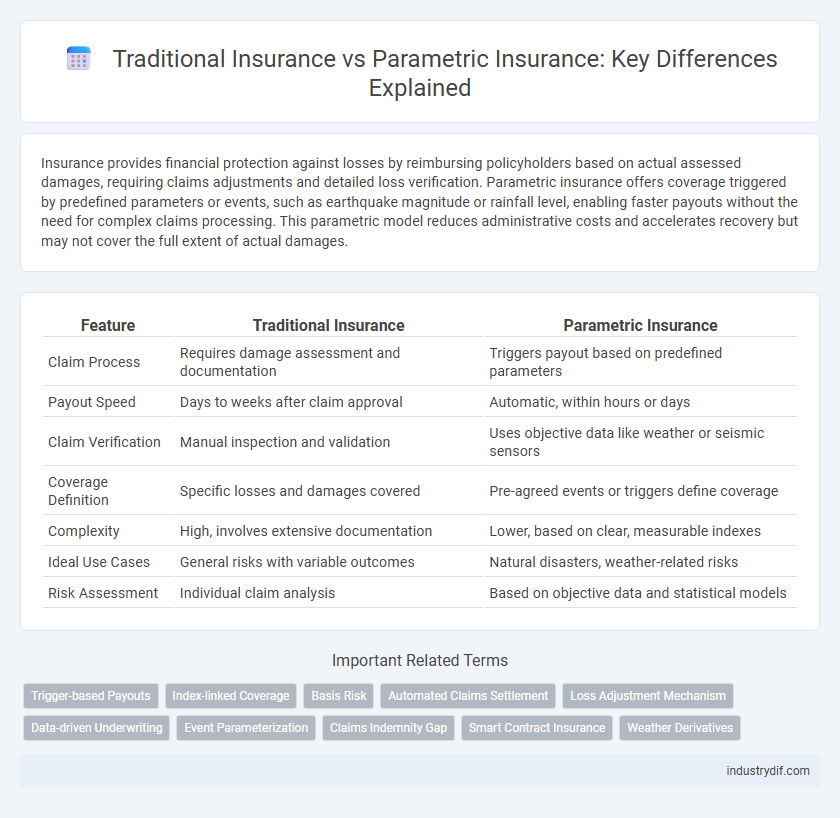

Insurance provides financial protection against losses by reimbursing policyholders based on actual assessed damages, requiring claims adjustments and detailed loss verification. Parametric insurance offers coverage triggered by predefined parameters or events, such as earthquake magnitude or rainfall level, enabling faster payouts without the need for complex claims processing. This parametric model reduces administrative costs and accelerates recovery but may not cover the full extent of actual damages.

Table of Comparison

| Feature | Traditional Insurance | Parametric Insurance |

|---|---|---|

| Claim Process | Requires damage assessment and documentation | Triggers payout based on predefined parameters |

| Payout Speed | Days to weeks after claim approval | Automatic, within hours or days |

| Claim Verification | Manual inspection and validation | Uses objective data like weather or seismic sensors |

| Coverage Definition | Specific losses and damages covered | Pre-agreed events or triggers define coverage |

| Complexity | High, involves extensive documentation | Lower, based on clear, measurable indexes |

| Ideal Use Cases | General risks with variable outcomes | Natural disasters, weather-related risks |

| Risk Assessment | Individual claim analysis | Based on objective data and statistical models |

Definition of Traditional Insurance

Traditional insurance involves a contractual agreement where the insurer compensates the policyholder for covered losses based on assessed damages after a claim is filed. Coverage typically requires loss verification through documentation and claims adjustment processes, which can be time-consuming. This model contrasts with parametric insurance that pays out predefined amounts when specific triggering events occur, without the need for damage assessment.

Overview of Parametric Insurance

Parametric insurance offers coverage based on predefined triggers such as weather indices or seismic activity, providing faster payouts compared to traditional claim-based insurance. This type of insurance reduces claims processing time by using objective data measurements, minimizing disputes and administrative costs. It is particularly effective for managing risks related to natural disasters, ensuring timely financial support for policyholders.

Key Differences Between Insurance and Parametric Insurance

Traditional insurance compensates policyholders based on documented losses after thorough claims assessment, often requiring extensive paperwork and time-consuming processes. Parametric insurance triggers predetermined payouts when specific parameters or indices, such as earthquake magnitude or rainfall levels, are met, eliminating the need for individual loss verification. This key difference leads to faster claims settlement and greater transparency in parametric insurance compared to traditional indemnity insurance models.

Trigger Mechanisms: Indemnity vs. Parametric Triggers

Indemnity insurance relies on loss assessment and verification processes, where claim payments correspond to actual financial damages incurred. Parametric insurance activates payouts based on predefined triggers, such as measurable events like rainfall levels or wind speeds, independent of the policyholder's actual loss. This trigger mechanism allows for faster claims processing and reduced administrative costs compared to traditional indemnity-based insurance models.

Claims Process Comparison

Traditional insurance claims require detailed documentation, loss assessment by adjusters, and often involve prolonged approval times due to manual verification. Parametric insurance simplifies the claims process by triggering payments automatically based on pre-defined parameters, such as earthquake magnitude or rainfall levels, eliminating the need for loss adjustment. This results in faster claims settlement, reduced administrative costs, and increased transparency in claim validation.

Speed of Payouts

Parametric insurance delivers payouts faster by using predefined triggers based on objective data such as weather conditions or seismic activity, eliminating the need for lengthy claims assessments. Traditional insurance requires detailed investigations and adjustment processes, which can delay payments for weeks or months. Swift disbursement in parametric insurance enhances disaster recovery efforts by providing immediate liquidity to policyholders.

Risk Assessment and Underwriting Approaches

Traditional insurance relies on detailed risk assessment and underwriting processes, analyzing historical data and individual policyholder information to price premiums accurately. Parametric insurance, however, uses predefined triggers such as weather metrics or seismic activity thresholds, enabling faster claims processing with reduced ambiguity. This shift from individual risk evaluation to objective parameter monitoring streamlines underwriting but may limit coverage personalization.

Use Cases: When to Choose Each Type

Traditional insurance is ideal for complex risks requiring detailed assessments and personalized coverage, such as property damage or liability claims, where precise loss evaluation is critical. Parametric insurance suits scenarios with clear, measurable triggers like weather events or natural disasters, enabling rapid payouts based on predefined data without the need for extensive claims processing. Businesses facing frequent, data-driven risks benefit from parametric policies, while clients needing comprehensive protection for uncertain or multifaceted risks rely on traditional insurance solutions.

Advantages of Parametric Insurance

Parametric insurance offers faster claim settlements by triggering payouts based on predefined parameters such as weather data, eliminating lengthy loss assessments. It provides greater transparency and predictability for policyholders, reducing disputes and administrative costs. This model enhances risk management by covering risks that traditional insurance often excludes or delays.

Limitations and Challenges of Both Models

Traditional insurance often faces challenges such as lengthy claim processing times, potential disputes over damage assessments, and exposure to moral hazard due to the subjective nature of claims. Parametric insurance, while offering faster payouts through predefined triggers like weather data, can suffer from basis risk where the payout may not fully align with actual losses experienced by the insured. Both models encounter limitations in accurately pricing risk and ensuring customer satisfaction, highlighting the need for hybrid solutions and improved data analytics.

Related Important Terms

Trigger-based Payouts

Parametric insurance offers trigger-based payouts that activate automatically when predefined parameters such as weather conditions or seismic activity thresholds are met, eliminating the need for lengthy claims assessments. This contrasts with traditional insurance, which relies on loss verification and subjective damage appraisals before disbursing funds.

Index-linked Coverage

Parametric insurance provides index-linked coverage by triggering payments based on predefined parameters, such as weather data or seismic activity, rather than actual loss assessments, enabling faster and more transparent claims processing. Traditional insurance relies on loss adjustment and indemnity, often resulting in longer settlement times and higher administrative costs.

Basis Risk

Traditional insurance involves indemnity payments based on actual losses, often leading to disputes and delays, while parametric insurance pays out predetermined amounts when specific triggers, such as weather data or seismic activity, occur, minimizing claim processing time. Basis risk arises in parametric insurance when the trigger event does not perfectly correlate with the insured loss, potentially resulting in under- or over-compensation for policyholders.

Automated Claims Settlement

Parametric insurance enables automated claims settlement by using predetermined triggers such as weather data or seismic activity, eliminating the need for traditional loss assessments. This automation accelerates payouts, reduces operational costs, and enhances transparency compared to conventional indemnity insurance models.

Loss Adjustment Mechanism

Traditional insurance relies on detailed loss adjustment mechanisms involving claim verification and damage assessments to determine payouts, often leading to longer settlement times. Parametric insurance uses predefined triggers based on objective parameters, such as weather indices or seismic activity levels, enabling faster claims processing without extensive loss adjustment.

Data-driven Underwriting

Data-driven underwriting in traditional insurance relies on historical claims and risk assessments, whereas parametric insurance utilizes real-time data triggers like weather indices to automate and expedite claim settlements. This shift enhances transparency, reduces claim processing times, and enables more precise risk pricing by leveraging advanced analytics and IoT sensor data.

Event Parameterization

Traditional insurance relies on claims adjustment and loss assessment, while parametric insurance uses predefined event parameterization, such as wind speed thresholds or rainfall amounts, to trigger automatic payouts. This event-driven approach ensures faster claims processing and reduces the uncertainty associated with damage verification.

Claims Indemnity Gap

Traditional insurance assesses claims based on actual loss documentation, often leading to prolonged claim settlements and potential indemnity gaps due to underreported or disputed damages. Parametric insurance triggers payouts automatically when predefined parameters, such as wind speed or rainfall thresholds, are met, significantly reducing indemnity gaps by providing faster, more predictable claim settlements.

Smart Contract Insurance

Smart contract insurance leverages blockchain technology to automate claims processing by triggering payments through predefined parameters, reducing fraud and administrative costs compared to traditional insurance models. Parametric insurance, a subset of smart contract insurance, pays out based on objective metrics like weather data or seismic readings, providing faster and more transparent compensation without the need for subjective loss assessments.

Weather Derivatives

Parametric insurance uses predefined weather metrics such as rainfall or temperature thresholds to trigger payouts without needing traditional claims assessment, offering faster and more transparent risk transfer compared to conventional insurance. Weather derivatives, as financial instruments linked to weather indices, complement parametric insurance by enabling businesses to hedge against adverse weather conditions through contracts based on measurable weather variables.

Insurance vs Parametric Insurance Infographic

industrydif.com

industrydif.com